Nj Property Tax

Welcome to a comprehensive exploration of the New Jersey Property Tax system, a critical aspect of homeownership in the Garden State. This intricate system is a key revenue generator for local governments, impacting every resident and business in the state. As one of the highest property tax burdens in the nation, understanding this system is crucial for both current and prospective residents, offering insights into the costs and benefits of living in New Jersey.

We'll delve into the mechanics of how property taxes are calculated, the factors influencing these rates, and the various strategies employed by homeowners to manage these expenses. Additionally, we'll examine the role of property taxes in funding essential public services and explore the avenues available for taxpayers to dispute their assessments.

Understanding the New Jersey Property Tax System

The New Jersey property tax system is a complex mechanism that underpins the state's fiscal landscape. Every year, property owners in the state are required to pay a portion of their property's value as a tax, which forms a substantial part of their local government's revenue stream. This tax funds a wide array of services, from education and public safety to infrastructure maintenance and local administration.

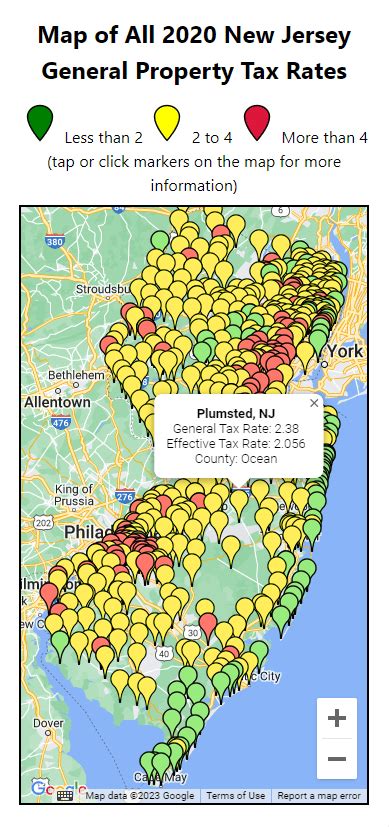

The property tax rate in New Jersey is expressed as a millage rate, which is the amount of tax paid per $1,000 of assessed property value. This rate can vary significantly from one municipality to another, influenced by the specific costs and needs of each local government. For instance, a municipality with a high-quality school district might have a higher tax rate to support its education system.

The taxable value of a property is determined through a process known as property assessment. This assessment is conducted by the local tax assessor's office, which appraises the property's market value and assigns a taxable value. The taxable value can be lower than the market value due to various exemptions and abatements.

The Property Assessment Process

Property assessment in New Jersey is a detailed process designed to ensure fairness and accuracy. Assessors use a combination of sales comparison, cost approach, and income approach to value properties. The sales comparison approach compares the property to recent sales of similar properties in the area. The cost approach estimates the cost to replace the property, while the income approach calculates the property's value based on its potential rental income.

Once the assessor determines the property's value, it's multiplied by the assessment ratio to arrive at the taxable value. The assessment ratio is typically 100%, but it can be lower in certain cases, such as for senior citizens or veterans who qualify for exemptions.

For example, if a property is valued at $500,000 and the assessment ratio is 100%, the taxable value would be $500,000. If the assessment ratio is 80%, the taxable value would be $400,000.

| Assessment Ratio | Taxable Value |

|---|---|

| 100% | $500,000 |

| 80% | $400,000 |

Factors Influencing Property Tax Rates

Several factors contribute to the variation in property tax rates across New Jersey. One of the primary factors is the cost of providing local services. Municipalities with a higher demand for services, such as those with large populations or extensive infrastructure, often have higher tax rates to support these services.

The budgetary needs of the local government also play a significant role. If a municipality has undertaken large-scale projects or faces financial challenges, it might increase tax rates to balance its budget. Conversely, a municipality with a strong financial position might have lower rates.

Additionally, the tax base, which is the total value of all taxable property in a municipality, influences tax rates. A larger tax base can lead to lower tax rates, as the tax burden is spread across more properties. Conversely, a smaller tax base might result in higher rates.

Impact of Property Characteristics

The characteristics of a property itself can also affect its tax rate. For instance, property improvements can lead to a higher assessment and, subsequently, a higher tax bill. This includes additions to the property, such as an extension or a new garage, as well as upgrades like a renovated kitchen or a new roof.

The location of the property can also influence its tax rate. Properties in desirable neighborhoods or those with access to amenities like parks, schools, or public transportation might be subject to higher taxes. This is because these amenities enhance the property's value and can attract a premium.

Furthermore, the size and type of the property can impact its tax rate. Larger properties, such as estates or commercial buildings, often have higher assessments due to their increased value. Similarly, specialized properties like historic homes or waterfront properties might be subject to higher assessments due to their unique features.

Managing Property Taxes: Strategies for Homeowners

Given the significant financial burden that property taxes can impose, homeowners in New Jersey often seek strategies to manage these expenses. One common approach is to appeal the property assessment, arguing that the assessed value is higher than the property's actual market value. This can be particularly effective if the assessment is based on outdated or inaccurate information.

Another strategy is to take advantage of tax exemptions and abatements. New Jersey offers a range of exemptions, such as the Senior Citizen/Disabled Resident Property Tax Relief program, which can significantly reduce the taxable value of a property. Additionally, certain improvements, like installing solar panels, can qualify for tax abatements, lowering the property's tax liability.

Homeowners can also strategically time property improvements to minimize their tax impact. For instance, if a homeowner knows that their property is due for reassessment in the following year, they might postpone non-essential improvements until after the reassessment to avoid an immediate tax increase.

The Role of Property Tax in Funding Public Services

Property taxes are a vital source of revenue for local governments in New Jersey, funding a wide range of public services. These taxes contribute to the maintenance and improvement of infrastructure, such as roads, bridges, and public transportation systems. They also support the operations of local police and fire departments, ensuring public safety.

A significant portion of property taxes goes towards funding public education. This includes the salaries of teachers and school staff, as well as the maintenance and operation of school facilities. Additionally, property taxes support extracurricular activities, special education programs, and other educational initiatives.

Furthermore, property taxes fund local government administration, including the salaries of municipal employees, such as clerks, treasurers, and assessors. They also cover the costs of local elections, town hall operations, and other administrative functions.

Disputing Property Assessments: The Appeal Process

Homeowners who believe their property assessment is inaccurate or unfair have the right to appeal the assessment. The appeal process in New Jersey is designed to provide a fair and transparent review of property assessments, ensuring that taxpayers are not overburdened.

The appeal process typically involves several steps. First, the homeowner must file an appeal with the county tax board within a specified timeframe, usually 45 days after receiving the assessment notice. The appeal should include specific reasons why the assessment is believed to be incorrect, along with any supporting evidence.

The county tax board will then schedule a hearing, where the homeowner can present their case. This hearing provides an opportunity for the homeowner to argue their case, often with the assistance of a tax attorney or assessor. The board will consider the evidence presented and make a decision, which can be either an adjustment to the assessment or a confirmation of the original assessment.

If the homeowner is dissatisfied with the county tax board's decision, they can appeal to the Tax Court of New Jersey, an independent judicial body. The Tax Court reviews the case and can make a final decision, which is binding on both the taxpayer and the local government.

Tips for a Successful Appeal

To increase the chances of a successful appeal, homeowners should gather comprehensive evidence to support their case. This can include recent sales data of similar properties in the area, appraisals, and any other documentation that demonstrates the property's actual market value. It's also beneficial to seek professional advice from a tax attorney or assessor who has experience with property tax appeals.

Additionally, homeowners should be aware of the appeal process timeline and deadlines. Late filings can result in the appeal being dismissed, so it's crucial to act promptly after receiving the assessment notice.

| Step | Description |

|---|---|

| File Appeal | Submit an appeal to the county tax board within the specified timeframe. |

| Hearing | Present your case at a scheduled hearing before the county tax board. |

| Decision | The board will issue a decision, either adjusting the assessment or confirming it. |

| Appeal to Tax Court | If dissatisfied, appeal to the Tax Court of New Jersey for a final decision. |

Conclusion

The New Jersey property tax system is a complex but crucial component of the state's financial landscape. It is a significant expense for homeowners, but it also plays a vital role in funding essential public services. Understanding this system, from the assessment process to the appeal procedures, empowers homeowners to navigate this system effectively and manage their property tax burden.

By staying informed and proactive, homeowners can ensure that their property taxes are fair and accurate, contributing to the continued development and improvement of their communities.

How are property taxes calculated in New Jersey?

+Property taxes in New Jersey are calculated based on the property’s taxable value, which is determined by multiplying the property’s assessed value by the assessment ratio. The taxable value is then multiplied by the millage rate to arrive at the tax amount. The millage rate is set by the local government and varies depending on the municipality.

Can I appeal my property assessment in New Jersey?

+Yes, if you believe your property assessment is incorrect or unfair, you have the right to appeal. The appeal process involves filing an appeal with the county tax board, presenting your case at a hearing, and potentially appealing to the Tax Court of New Jersey if you’re dissatisfied with the initial decision.

What factors influence property tax rates in New Jersey?

+Several factors influence property tax rates, including the cost of providing local services, the budgetary needs of the local government, and the tax base. Property characteristics such as improvements, location, and size can also impact tax rates.

How do property taxes fund public services in New Jersey?

+Property taxes fund a wide range of public services in New Jersey, including infrastructure maintenance, public safety, and local government administration. A significant portion of property taxes also goes towards funding public education, supporting teachers, school facilities, and educational programs.

Are there any exemptions or abatements available to reduce property taxes in New Jersey?

+Yes, New Jersey offers various exemptions and abatements to reduce property taxes. These include the Senior Citizen/Disabled Resident Property Tax Relief program and abatements for certain property improvements, such as installing solar panels. Homeowners can also strategically time property improvements to minimize their tax impact.