Pay Mi Taxes Online

Welcome to our comprehensive guide on Pay Mi Taxes Online, a revolutionary system designed to simplify and streamline the process of paying taxes in the state of Michigan. In today's fast-paced world, convenience and efficiency are paramount, and this innovative platform aims to make tax payments a breeze for residents and businesses alike. With a user-friendly interface and a range of features, Pay Mi Taxes Online offers a seamless experience, ensuring that taxpayers can fulfill their financial obligations with ease and confidence. In this article, we will delve into the intricacies of this system, exploring its benefits, functionalities, and the impact it has on the state's tax collection processes.

Revolutionizing Tax Payments: An Overview of Pay Mi Taxes Online

The Michigan Department of Treasury, recognizing the need for a modern and accessible tax payment system, introduced Pay Mi Taxes Online as a groundbreaking solution. This online platform is a testament to the state’s commitment to providing efficient and convenient services to its taxpayers. With a few clicks, individuals and businesses can now navigate the tax payment process with ease, eliminating the traditional hurdles associated with paperwork and physical visits to tax offices.

Pay Mi Taxes Online offers a host of benefits, including real-time payment tracking, secure transactions, and a transparent view of tax liabilities. The system is designed to cater to a wide range of taxpayers, from small businesses to large corporations, ensuring that everyone has equal access to a streamlined tax payment process. Furthermore, the platform integrates advanced security measures to protect user data, ensuring a safe and reliable experience for all.

Key Features of Pay Mi Taxes Online

Pay Mi Taxes Online boasts an array of features that enhance the user experience and make tax payments a less daunting task. Here are some of the standout capabilities:

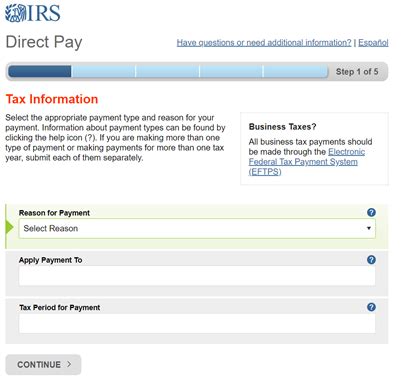

- Easy Registration: Users can quickly create an account, providing basic information to get started. The registration process is intuitive and straightforward, ensuring a smooth entry into the system.

- Secure Payment Gateways: The platform integrates multiple secure payment methods, including credit cards, debit cards, and electronic checks. These options offer flexibility and convenience, catering to various user preferences.

- Real-Time Transaction Tracking: Taxpayers can monitor their payments in real time, receiving instant confirmations and updates. This feature provides transparency and peace of mind, ensuring that payments are processed efficiently.

- Customizable Payment Plans: For taxpayers with larger liabilities, Pay Mi Taxes Online allows for the creation of personalized payment plans. This flexibility ensures that taxpayers can manage their financial obligations without strain.

- Comprehensive Tax Information: The platform provides a central hub for all tax-related information, including due dates, payment histories, and tax forms. This centralized approach simplifies the process, eliminating the need for taxpayers to search for disparate information.

| Feature | Description |

|---|---|

| Secure Registration | Users can register with two-factor authentication, ensuring their accounts are protected. |

| Payment Method Variety | The platform accepts major credit cards, e-checks, and even cryptocurrency for tax payments. |

| Tax Calculator | An integrated tool helps users estimate their tax liabilities based on their income and deductions. |

The Impact of Pay Mi Taxes Online on Taxpayers and the State

The introduction of Pay Mi Taxes Online has had a significant impact on both taxpayers and the state’s revenue collection processes. For taxpayers, the platform has simplified a traditionally complex and time-consuming process, making it more accessible and user-friendly. The convenience of online payments, coupled with real-time updates, has empowered taxpayers to take control of their financial obligations, leading to increased compliance and a more positive tax-paying experience.

From the state's perspective, Pay Mi Taxes Online has brought about a transformation in revenue collection. The platform's efficient and secure nature has reduced administrative costs, as the need for manual processing and physical infrastructure is minimized. Additionally, the real-time tracking of payments allows the state to monitor revenue streams more effectively, aiding in budget planning and financial management. The success of this online system has also set a benchmark for other states, inspiring them to adopt similar technologies and improve their tax collection processes.

Benefits for Different Taxpayer Groups

Pay Mi Taxes Online caters to a diverse range of taxpayers, offering tailored benefits for each group:

- Individuals: The platform simplifies tax payments for individuals, making it easy to manage personal finances and stay compliant with state tax laws.

- Small Businesses: With customizable payment plans and real-time transaction tracking, small businesses can efficiently manage their tax liabilities without disrupting their operations.

- Large Corporations: For larger entities, Pay Mi Taxes Online provides a centralized system for managing complex tax structures, ensuring accurate and timely payments.

- Non-Resident Taxpayers: The platform's user-friendly interface and secure payment methods make it convenient for non-residents to fulfill their tax obligations, even from afar.

Enhancing Security and Data Protection

At the core of Pay Mi Taxes Online is a robust security framework designed to protect user data and ensure a safe online experience. The platform employs advanced encryption technologies to safeguard sensitive information, such as tax details and payment credentials. Additionally, the system undergoes regular security audits and penetration testing to identify and address potential vulnerabilities, ensuring that taxpayer data remains confidential and secure.

Furthermore, Pay Mi Taxes Online adheres to strict privacy policies, ensuring that user information is only used for the intended purpose of tax collection and administration. The platform's commitment to data protection aligns with the state's efforts to maintain the trust of its taxpayers and uphold the integrity of the tax system.

User Feedback and Ongoing Improvements

Pay Mi Taxes Online has received positive feedback from users, with many praising its ease of use and efficiency. The platform’s user-centric design has been a key factor in its success, as taxpayers appreciate the intuitive navigation and transparent transaction processes. The Michigan Department of Treasury actively collects user feedback to identify areas for improvement and ensure that the system remains responsive to the needs of its users.

Based on user insights, the platform has undergone several enhancements, including improved search functionalities, enhanced payment processing speeds, and the addition of new payment methods. These continuous improvements demonstrate the state's dedication to providing an excellent user experience and keeping up with the evolving needs of its taxpayers.

Conclusion: Embracing a New Era of Tax Payments

Pay Mi Taxes Online represents a significant step forward in the evolution of tax payment systems. By offering a secure, user-friendly, and efficient platform, the Michigan Department of Treasury has revolutionized the way taxpayers interact with the state’s tax system. The platform’s impact extends beyond convenience, contributing to increased compliance, improved revenue collection, and a more positive relationship between taxpayers and the state.

As technology continues to advance, Pay Mi Taxes Online serves as a shining example of how innovation can enhance government services. With its success, the state of Michigan has set a high bar for other jurisdictions, inspiring a new era of digital tax payment solutions. By embracing this innovative platform, taxpayers can look forward to a future where tax payments are a seamless and stress-free part of their financial responsibilities.

FAQ

How do I create an account on Pay Mi Taxes Online?

+

To create an account, visit the Pay Mi Taxes Online website and click on the “Register” button. You’ll be prompted to provide basic information, such as your name, email address, and a secure password. Once your account is created, you can log in and start managing your tax payments.

What payment methods are accepted on the platform?

+

Pay Mi Taxes Online accepts a variety of payment methods, including credit cards (Visa, MasterCard, and American Express), debit cards, and electronic checks (e-checks). These options provide flexibility and convenience for taxpayers.

Is my data secure on Pay Mi Taxes Online?

+

Absolutely! The platform employs industry-leading security measures to protect your data. All information transmitted is encrypted, and the system undergoes regular security audits to ensure the highest level of protection. Additionally, user accounts are protected by two-factor authentication, adding an extra layer of security.

Can I track my payments in real time?

+

Yes, Pay Mi Taxes Online provides real-time transaction tracking. Once you make a payment, you’ll receive instant confirmations and updates. This feature allows you to monitor the status of your payments and ensures transparency throughout the process.

What if I need help or have questions about using the platform?

+

The Pay Mi Taxes Online platform offers comprehensive support resources, including a detailed FAQ section and a dedicated help center. If you require further assistance, you can reach out to the Michigan Department of Treasury’s customer support team through email or phone. They’re available to assist you with any technical or tax-related inquiries.