Legal And Tax

The realm of legal and tax matters is an intricate and vital component of modern society, affecting individuals, businesses, and governments alike. It encompasses a wide range of regulations, policies, and practices that govern how we interact with each other and the world around us. From contracts and business agreements to tax obligations and compliance, the legal and tax landscape shapes our economic activities and ensures a fair and orderly system.

This article aims to provide an in-depth exploration of the legal and tax ecosystem, shedding light on its complexities and offering valuable insights for those navigating this intricate field. By delving into specific topics, real-world examples, and practical strategies, we aim to empower readers with the knowledge needed to make informed decisions and stay compliant with the ever-evolving legal and tax landscape.

Navigating the Legal Landscape: A Comprehensive Guide

The legal landscape is a complex network of laws, regulations, and legal principles that govern various aspects of our lives. Understanding this landscape is crucial for individuals and businesses to operate within the boundaries of the law and avoid potential legal pitfalls.

Key Legal Concepts and Principles

At the core of the legal system are fundamental concepts and principles that guide the interpretation and application of laws. These include the rule of law, due process, and the separation of powers, which ensure fairness, transparency, and accountability in the legal process.

Additionally, legal systems are built upon specific principles such as contract law, property law, and tort law. Contract law, for instance, governs agreements between parties, ensuring that promises made are kept and obligations are fulfilled. Property law defines the rights and responsibilities associated with owning and using property, while tort law addresses civil wrongs and provides remedies for harm caused by negligent or intentional acts.

Contract Law: Drafting and Enforcing Agreements

Contracts are the backbone of many business transactions and personal relationships. Understanding contract law is essential to ensure that agreements are legally binding and enforceable. Key considerations when drafting a contract include defining the scope and terms of the agreement, clearly identifying the parties involved, and specifying the obligations and rights of each party.

In the event of a breach of contract, legal remedies may be sought. These can include monetary damages, specific performance (forcing the breaching party to fulfill their obligations), or even termination of the contract. The legal process for enforcing contracts varies by jurisdiction, and it's crucial to seek legal advice to navigate these complexities effectively.

Intellectual Property: Protecting Creative Works

In today’s knowledge-based economy, intellectual property (IP) rights are of paramount importance. IP law protects the rights of creators, inventors, and businesses by granting them exclusive rights to their inventions, designs, artistic works, and brands.

The main categories of IP include patents, trademarks, copyrights, and trade secrets. Patents protect inventions and grant the inventor exclusive rights to their innovation for a limited period. Trademarks safeguard brand names, logos, and symbols, ensuring that consumers can easily identify and associate products or services with a particular brand. Copyrights protect original literary, artistic, and musical works, while trade secrets protect valuable business information that provides a competitive advantage.

Navigating the IP landscape requires a deep understanding of the relevant laws and regulations. For instance, obtaining a patent involves a rigorous application process and a thorough examination by patent offices. Similarly, registering trademarks and copyrights requires adherence to specific procedures and timelines to ensure legal protection.

| Intellectual Property Type | Description |

|---|---|

| Patents | Exclusive rights for inventions, typically granted for 20 years. |

| Trademarks | Protection for brand names, logos, and symbols. |

| Copyrights | Rights for literary, artistic, and musical works, typically lasting for the author's lifetime plus 70 years. |

| Trade Secrets | Protection for valuable business information, providing an ongoing competitive advantage. |

Employment Law: Navigating Employee Rights and Obligations

Employment law governs the rights and responsibilities of employers and employees in the workplace. It covers a wide range of issues, including hiring and firing practices, wage and hour regulations, discrimination and harassment prevention, and employee benefits.

Employers must ensure compliance with various employment laws, such as the Fair Labor Standards Act (FLSA) in the United States, which sets minimum wage and overtime pay standards. Additionally, anti-discrimination laws, such as the Civil Rights Act of 1964, protect employees from unfair treatment based on factors like race, gender, religion, and age.

Understanding employment law is essential for both employers and employees. Employers must create a fair and inclusive work environment, while employees should be aware of their rights and the legal avenues available to address any workplace issues.

Unraveling the Tax Maze: Strategies for Compliance and Optimization

Taxation is an integral part of any functioning economy, providing governments with the revenue needed to fund public services and infrastructure. However, navigating the tax system can be complex and daunting, especially for individuals and businesses.

Understanding the Basics of Taxation

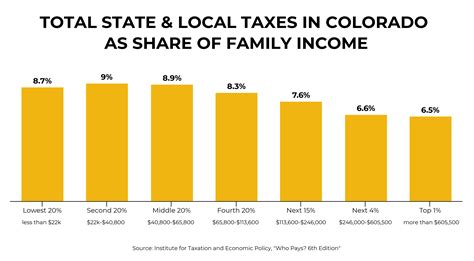

Taxation involves the imposition of charges on income, property, goods, and services by governments to generate revenue. There are various types of taxes, including income tax, corporate tax, sales tax, and property tax, each with its own set of rules and regulations.

Income tax, for instance, is levied on an individual's or business's earnings, with rates varying based on income levels and jurisdictions. Corporate tax, on the other hand, is applied to the profits of corporations, often at a higher rate than individual income tax. Sales tax is added to the price of goods and services at the point of sale, while property tax is assessed on the value of real estate and other tangible assets.

Tax Compliance: Meeting Your Obligations

Tax compliance is a critical aspect of doing business and managing personal finances. It involves understanding and adhering to tax laws, regulations, and deadlines to ensure timely and accurate reporting of tax obligations.

For businesses, tax compliance includes registering for the appropriate tax identifiers, collecting and remitting sales tax, and filing annual tax returns. Individuals, too, must comply with tax laws by accurately reporting their income, claiming eligible deductions and credits, and paying their taxes on time.

Non-compliance with tax laws can result in penalties, interest charges, and even legal consequences. Therefore, it's essential to stay informed about tax regulations and seek professional advice when needed.

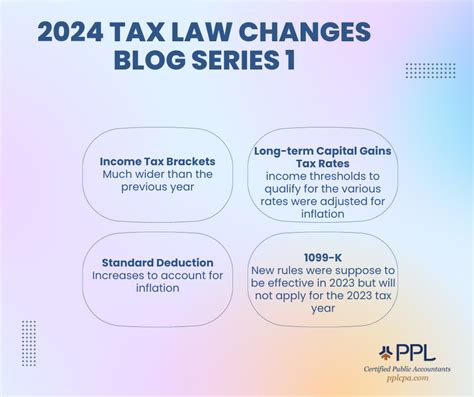

Tax Planning and Optimization Strategies

While tax compliance is non-negotiable, there are strategies individuals and businesses can employ to optimize their tax positions and reduce their tax liabilities legally and ethically.

Tax planning involves structuring financial affairs to minimize tax obligations while remaining compliant with the law. This can include taking advantage of tax deductions and credits, investing in tax-efficient vehicles, and considering tax-effective business structures.

For instance, businesses can optimize their tax positions by strategically timing income and expenses, utilizing tax-deductible business expenses, and exploring tax-advantaged investment opportunities. Individuals, too, can benefit from tax planning by maximizing deductions, contributing to retirement accounts, and taking advantage of tax-efficient investment strategies.

It's important to note that tax optimization strategies should always be within the bounds of the law and ethical guidelines. Engaging in tax avoidance or evasion can have severe legal and financial consequences.

Legal and Tax Challenges in the Digital Age

The rapid advancement of technology and the digital transformation of economies have brought about unique legal and tax challenges. The rise of e-commerce, digital services, and remote work has blurred jurisdictional boundaries, making it increasingly complex to determine tax obligations and legal responsibilities.

International Tax Considerations

With the global nature of business and the ease of cross-border transactions, international tax considerations have become more prominent. Companies operating in multiple countries must navigate a complex web of tax treaties, transfer pricing regulations, and country-specific tax laws.

Transfer pricing, for instance, refers to the prices charged for goods and services between related companies in different countries. It's a critical aspect of international tax planning, as it can significantly impact a company's tax obligations and exposure to double taxation.

To address these challenges, governments and international organizations have been working on initiatives like the Base Erosion and Profit Shifting (BEPS) project, aimed at combating tax avoidance and ensuring a fair distribution of tax obligations among countries.

Digital Services and the Evolution of Taxation

The rise of digital services and the gig economy has presented new challenges for tax authorities. Traditional tax systems often struggle to capture the value created by digital businesses, leading to concerns about tax evasion and revenue loss.

To address this, governments are exploring new tax models, such as digital services taxes, which aim to tax the revenues generated by digital companies within a country, regardless of their physical presence. These taxes are designed to ensure that digital businesses contribute fairly to the jurisdictions where they operate.

However, the introduction of such taxes has sparked debates and discussions, with some arguing that they may hinder innovation and impose an unfair burden on digital businesses.

Data Privacy and Cybersecurity in the Legal Landscape

The digital age has also brought about a heightened focus on data privacy and cybersecurity. With the vast amount of personal and sensitive data being collected and stored online, ensuring the security and privacy of this data has become a legal and ethical imperative.

Data privacy laws, such as the General Data Protection Regulation (GDPR) in the European Union, set strict standards for how personal data can be collected, processed, and stored. Businesses must comply with these regulations to avoid hefty fines and protect the privacy rights of their customers.

Cybersecurity, too, has become a critical legal and business concern. With the increasing frequency and sophistication of cyberattacks, businesses must implement robust cybersecurity measures to protect their digital assets and sensitive information.

Conclusion: Embracing Legal and Tax Expertise

The legal and tax landscape is a complex and ever-evolving field that requires expertise and a deep understanding of the intricacies involved. From drafting contracts and protecting intellectual property to navigating tax compliance and optimization strategies, staying informed and seeking professional advice is essential.

As individuals and businesses continue to face new challenges in the digital age, staying proactive and adaptable is key. By embracing legal and tax expertise, we can ensure that our activities are conducted within the boundaries of the law and that our tax obligations are met while maximizing opportunities for optimization.

Whether it's staying updated with the latest legal and tax developments, seeking guidance from legal and tax professionals, or implementing robust compliance systems, a proactive approach to legal and tax matters can help mitigate risks and ensure long-term success.

Frequently Asked Questions

How often should I seek legal advice for my business?

+Seeking regular legal advice is crucial for businesses to stay compliant and informed. Consider consulting a legal professional at least once a year to review your business practices and ensure they align with the latest legal developments. Additionally, seek immediate legal advice when facing any significant changes or challenges, such as expansion, mergers, or legal disputes.

What are some common tax deductions for small businesses?

+Small businesses can take advantage of various tax deductions, including expenses for business-related travel, meals, and entertainment. Other common deductions include office rent, utilities, insurance, and professional services. It’s essential to consult a tax professional to ensure you’re maximizing your deductions while remaining compliant with tax laws.

How can I protect my intellectual property online?

+Protecting your intellectual property online requires a multi-faceted approach. First, ensure you have registered your trademarks, copyrights, and patents with the appropriate authorities. Implement robust cybersecurity measures to protect your digital assets and data. Additionally, regularly monitor online platforms and social media for any unauthorized use of your intellectual property and take prompt action if necessary.

What are the consequences of tax evasion?

+Tax evasion, the intentional failure to pay taxes owed, can have severe consequences. Penalties for tax evasion can include hefty fines, interest charges, and even criminal prosecution. In some cases, individuals or businesses found guilty of tax evasion may face imprisonment. It’s crucial to prioritize tax compliance and seek professional advice to avoid such penalties.