Colorado Sales Tax

Welcome to a comprehensive guide on the Colorado Sales Tax, a critical component of the state's revenue system and an essential aspect of financial planning for businesses and individuals alike. This article will delve into the intricacies of Colorado's sales tax, providing a detailed analysis of its structure, rates, exemptions, and the impact it has on various industries and consumers.

Understanding the Colorado Sales Tax System

Colorado’s sales tax system is a complex yet vital mechanism that generates revenue for the state and local governments. It is a consumption tax, levied on the sale of goods and certain services, with the primary aim of funding public services and infrastructure.

Taxable Entities and Registration

Any business engaged in selling tangible personal property or providing taxable services in Colorado is generally required to register with the Colorado Department of Revenue and collect sales tax. This includes retailers, wholesalers, and service providers. The registration process involves obtaining a Sales Tax License, which is valid for a specific period, usually renewable annually.

| Registration Process | Online |

|---|---|

| Businesses can register online through the Colorado Online Registration System, a user-friendly platform that guides registrants through the process. | ✔ |

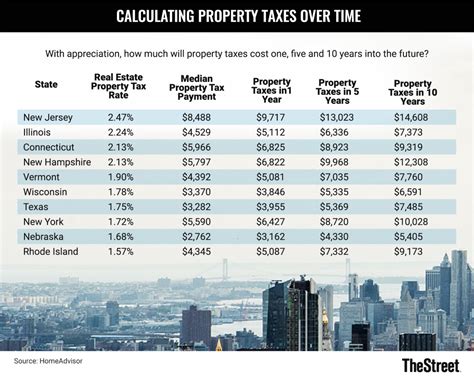

Sales Tax Rates

The sales tax in Colorado operates on a multi-level system, with rates varying based on the type of product or service and the location of the transaction. The state sales tax rate is 2.9%, and this is combined with local sales tax rates, which can range from 0% to 7.45%, depending on the jurisdiction.

Here's a breakdown of the tax rates:

| Type | State Rate | Maximum Local Rate | Total Possible Rate |

|---|---|---|---|

| General Sales Tax | 2.9% | 4.55% | 7.45% |

| Food and Beverage | 2.9% | 3.5% | 6.4% |

| Hotel/Lodging Tax | 2.9% | 12% | 14.9% |

These rates are subject to change, so it's essential for businesses and consumers to stay updated with the latest information.

Taxable and Exempt Items

Understanding what is taxable and what is exempt under Colorado’s sales tax law is crucial for compliance and accurate tax collection.

Taxable Items

In general, most tangible personal property and certain services are subject to sales tax in Colorado. This includes items such as:

- Clothing and footwear

- Electronics

- Furniture

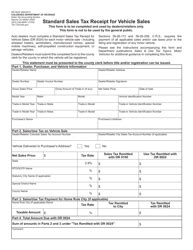

- Vehicles (cars, motorcycles, etc.)

- Building materials

- Restaurants and prepared food

- Many types of services, including repair, installation, and professional services

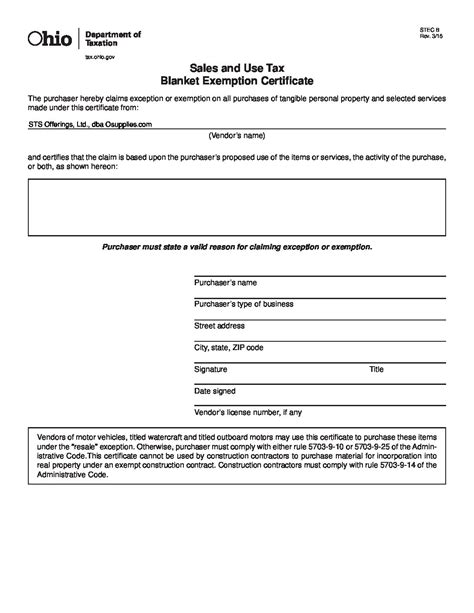

Exempt Items

There are specific items and services that are exempt from sales tax in Colorado. These exemptions can be based on the nature of the product, the intended use, or the status of the purchaser. Here are some common examples:

- Prescription Drugs: Sales of prescription drugs are exempt from state and local sales tax.

- Groceries: Most unprepared food items, including produce, dairy, and bakery goods, are exempt from sales tax.

- Residential Utilities: Services such as electricity, gas, and water are exempt when provided to residential customers.

- Agricultural Supplies: Sales of certain agricultural supplies, like seeds and fertilizers, are exempt when purchased for use in agricultural production.

- Government Purchases: Sales to state and local governments are generally exempt from sales tax.

Sales Tax Collection and Remittance

Businesses registered to collect sales tax in Colorado are responsible for calculating the appropriate tax on each taxable transaction, remitting the collected tax to the state, and filing regular sales tax returns.

Sales Tax Calculation

Calculating the sales tax involves multiplying the taxable sale amount by the applicable tax rate. For example, if a product is sold for 100 and the total sales tax rate is 7.45%, the sales tax due on that transaction would be 7.45.

Sales Tax Filing and Remittance

Sales tax returns in Colorado are typically due monthly, quarterly, or annually, depending on the business’s sales volume and other factors. The return must be filed electronically through the Colorado Online Tax System, and the tax remitted by the due date to avoid penalties and interest.

Record-Keeping and Audits

Businesses must maintain accurate records of all sales transactions, including the tax collected, for at least four years. This information may be requested during a sales tax audit, which is conducted by the Colorado Department of Revenue to ensure compliance with sales tax laws.

Impact on Businesses and Consumers

The Colorado sales tax system has a significant impact on both businesses and consumers, influencing purchasing decisions, pricing strategies, and the overall economic landscape of the state.

Business Implications

For businesses, especially those operating in multiple jurisdictions, navigating Colorado’s sales tax system can be complex. It requires careful planning and accurate tax calculation to ensure compliance and avoid penalties. Additionally, businesses may need to consider the impact of sales tax on their pricing strategies, as it can affect their competitive position in the market.

Consumer Perspective

Consumers in Colorado play a vital role in the sales tax system, as they are ultimately responsible for paying the tax on their purchases. While sales tax can be a significant cost, particularly for larger purchases, it is important to note that it funds essential public services and infrastructure, benefiting the community as a whole.

Future Implications and Potential Changes

As Colorado’s economy and population continue to grow and evolve, the sales tax system may undergo changes to adapt to new circumstances and ensure its continued effectiveness.

Potential Tax Rate Adjustments

Sales tax rates are often a topic of discussion and debate, and there may be proposals to adjust rates to meet changing fiscal needs or address specific community concerns. For instance, increasing the sales tax rate could provide additional revenue for critical services, while a decrease could stimulate economic growth by reducing the tax burden on consumers and businesses.

Expansion of Taxable Items

The list of taxable items can also evolve over time. As technology advances and consumer behavior changes, new products and services may be introduced to the taxable base. For example, the rise of e-commerce and digital services has led to discussions about taxing these transactions, which were previously difficult to capture.

Streamlining the System

Efforts to streamline the sales tax system, such as simplifying registration and filing processes or harmonizing tax rates across jurisdictions, could be implemented to reduce administrative burdens on businesses and improve compliance.

Conclusion

Colorado’s sales tax system is a dynamic and essential component of the state’s fiscal framework, impacting businesses, consumers, and the overall economy. Understanding the intricacies of this system is vital for compliance, strategic planning, and contributing to the vibrant economic landscape of Colorado.

FAQ

How often do businesses need to file sales tax returns in Colorado?

+The frequency of filing sales tax returns in Colorado depends on the business’s sales volume and other factors. Generally, businesses with higher sales volumes are required to file more frequently, typically monthly or quarterly. Businesses with lower sales volumes may be able to file annually.

Are there any special considerations for online retailers in Colorado?

+Yes, online retailers operating in Colorado or selling to customers in the state must register for a Sales Tax License and collect sales tax on taxable sales. This includes out-of-state businesses that have a significant economic presence in Colorado or make sales to Colorado residents.

What happens if a business fails to collect or remit sales tax in Colorado?

+Businesses that fail to collect or remit sales tax as required by law may face penalties and interest charges. In severe cases, the Colorado Department of Revenue may pursue legal action to enforce compliance.

Are there any incentives or programs to encourage sales tax compliance in Colorado?

+Yes, the Colorado Department of Revenue offers various resources and programs to support businesses in understanding and complying with sales tax laws. These include workshops, online guides, and a dedicated Sales Tax Compliance Assistance Program to help businesses navigate the system.

How can businesses stay updated with changes to Colorado’s sales tax laws and rates?

+Businesses can stay informed by regularly checking the Colorado Department of Revenue’s website for updates and subscribing to their email notifications. Additionally, staying engaged with industry associations and tax professionals can provide valuable insights and timely updates on sales tax changes.