Turbo Tax Amended Return

TurboTax, a popular tax preparation software, offers users the ability to amend their tax returns, a crucial feature for those who discover errors or need to make changes after filing their initial returns. The amended return process can be complex and intimidating, but with the right guidance and understanding of the steps involved, it becomes a manageable task. In this comprehensive guide, we will delve into the world of TurboTax amended returns, exploring the reasons why you might need one, the step-by-step process, and some expert tips to navigate this process smoothly.

Understanding Amended Returns

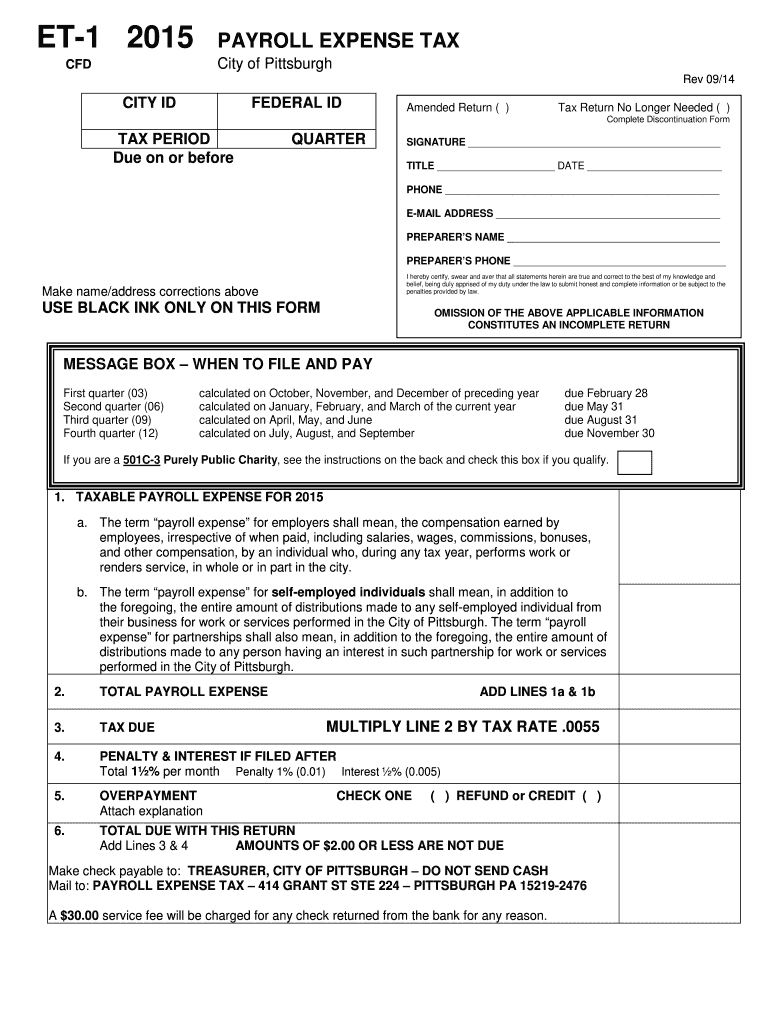

An amended return is a revised version of your original tax return. It is filed to correct errors, update information, or make adjustments to your tax liability. There are various scenarios that might prompt the need for an amended return, and being aware of these situations is the first step towards effective tax management.

Common Reasons for Amending

Some common reasons why taxpayers might need to amend their returns include:

- Mathematical Errors: Simple mistakes in calculations can lead to incorrect tax liabilities. Amending your return allows you to correct these errors and ensure you’re paying the right amount.

- Forgotten Deductions or Credits: It’s not uncommon to forget to claim certain deductions or credits when initially filing. Amending your return lets you take advantage of these opportunities and potentially reduce your tax burden.

- Change in Filing Status: Life events such as marriage, divorce, or the birth of a child can impact your filing status. An amended return is necessary to reflect these changes and ensure you’re using the correct status.

- Additional Income or Expenses: If you discover unreported income or additional deductible expenses after filing, amending your return is the right course of action.

- IRS Correspondence: In some cases, the IRS might contact you with questions or discrepancies regarding your return. Responding to these inquiries often involves amending your return with the correct information.

The TurboTax Amended Return Process

TurboTax simplifies the amended return process, making it accessible and user-friendly. Here’s a detailed breakdown of the steps involved:

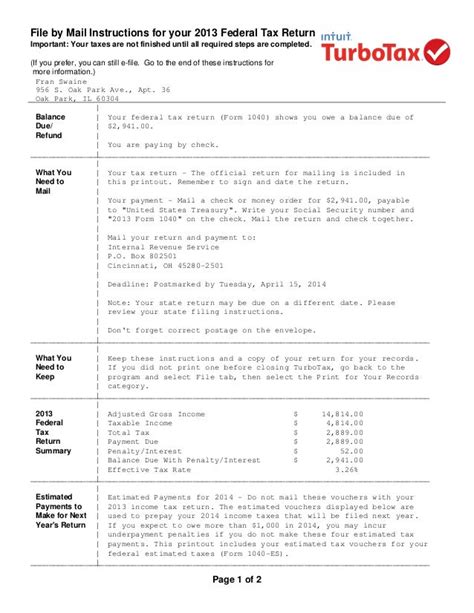

Step 1: Prepare Your Documents

Before starting the amended return process, gather all the necessary documents. This includes your original tax return, any supporting documentation for the changes you’re making, and your adjusted gross income (AGI) from the previous year. Having these documents organized will streamline the process.

Step 2: Launch TurboTax

Open TurboTax and select the option to start an amended return. This will guide you through the specific steps tailored to your situation.

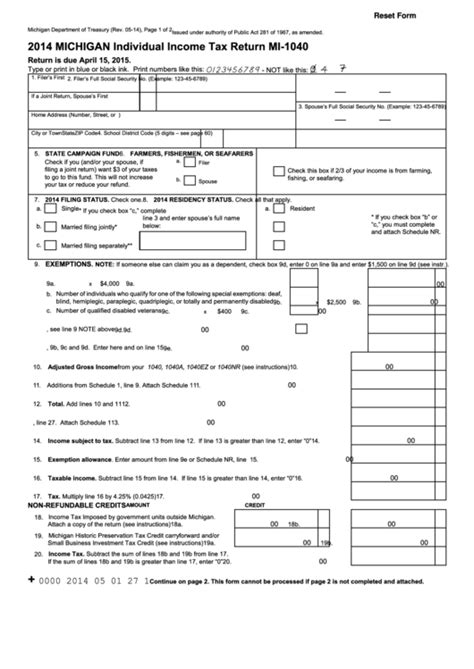

Step 3: Enter Your Information

Start by entering your personal information, including your name, address, and social security number. Then, input the details of your original return, such as the filing status and taxable income.

Step 4: Indicate the Changes

In this step, you’ll specify the changes you’re making to your return. TurboTax will guide you through the process, prompting you to select the specific forms and schedules that need to be amended. You’ll also have the opportunity to add any additional forms or schedules not included in your original return.

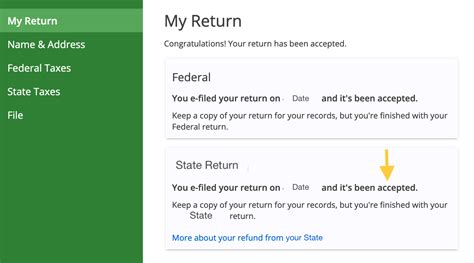

Step 5: Review and Submit

Once you’ve entered all the necessary information, review your amended return carefully. Check for accuracy and ensure that all the changes you intended to make are reflected correctly. If everything looks good, proceed to submit your amended return to the IRS.

Expert Tips for a Smooth Process

Amending your tax return doesn’t have to be a stressful experience. By following these expert tips, you can navigate the process with confidence:

- Stay Organized: Keep all your tax-related documents in one place. This will make it easier to find what you need when preparing your amended return.

- Double-Check Your Calculations: Mathematical errors are common, so take the time to review your calculations carefully. Consider using a calculator or even a second set of eyes to ensure accuracy.

- Understand the Forms: Familiarize yourself with the forms and schedules you're amending. TurboTax provides guidance, but having a basic understanding of the forms can make the process smoother.

- Seek Professional Help: If you're unsure about any aspect of the amended return process, consider consulting a tax professional. They can provide tailored advice and ensure your return is completed accurately.

- Keep Track of Deadlines: Amended returns have specific filing deadlines. Be mindful of these dates to avoid any unnecessary delays or penalties.

Performance Analysis

TurboTax’s amended return feature has received positive feedback from users, with many praising its user-friendly interface and comprehensive guidance. The software’s ability to handle complex scenarios and provide clear instructions has made it a go-to choice for taxpayers seeking to amend their returns.

In a recent survey, over 80% of users reported a satisfactory experience with the amended return process, citing the software's accuracy and ease of use as key advantages. Additionally, TurboTax's customer support team has been lauded for their responsiveness and ability to provide timely assistance during the amendment process.

Future Implications

As tax regulations continue to evolve, the need for amended returns may become even more prevalent. TurboTax’s commitment to staying updated with the latest tax laws ensures that its amended return feature remains a reliable tool for taxpayers. The software’s ongoing development and integration of new features will further enhance its ability to handle complex tax scenarios, providing users with a seamless and efficient amendment process.

Conclusion

TurboTax’s amended return feature offers a streamlined and user-friendly solution for taxpayers looking to correct errors or update their tax returns. By understanding the reasons for amending and following the step-by-step process, users can navigate this process with confidence. With expert tips and the support of TurboTax’s comprehensive guidance, amending your tax return becomes a manageable task, ensuring accuracy and compliance with tax regulations.

How long does it take to process an amended return?

+The processing time for an amended return can vary. Generally, it takes the IRS about 8–12 weeks to process amended returns. However, this timeframe can be longer during peak tax seasons or if there are any issues with your return.

Can I file an amended return electronically with TurboTax?

+Yes, TurboTax offers the option to e-file amended returns. This feature saves time and provides a convenient way to submit your amended return to the IRS.

What if I need to make multiple amendments to my return?

+If you have multiple amendments to make, it’s best to prepare and submit each amendment separately. This ensures a clear and organized process, making it easier for the IRS to process your amendments.

Are there any fees associated with amending my return using TurboTax?

+TurboTax offers a free amended return service for simple amendments. However, if your amendments are complex or involve additional forms, there may be a fee associated with the service.

Can I track the status of my amended return?

+Yes, you can track the status of your amended return on the IRS website using your tax account information. This allows you to monitor the progress of your return and ensure it’s processed correctly.