Property Tax Rebate In Pennsylvania

The topic of property tax rebates is of significant interest to homeowners and property owners in Pennsylvania, as it directly impacts their financial obligations and planning. Pennsylvania, known for its diverse tax landscape, offers various programs and initiatives to provide relief to its residents. This article aims to delve into the specifics of the property tax rebate system in the state, exploring its mechanisms, eligibility criteria, and the potential benefits it holds for property owners.

Understanding the Property Tax Landscape in Pennsylvania

Pennsylvania’s property tax system is a complex web of local, county, and state-level taxes, with rates varying widely across the state. These taxes are primarily used to fund local services such as schools, emergency services, and infrastructure development. The average effective property tax rate in Pennsylvania is 1.45%, which is slightly lower than the national average. However, this average rate masks the significant variations that exist between different counties and municipalities.

For instance, in Allegheny County, which includes the city of Pittsburgh, the median property tax rate is 2.08%, one of the highest in the state. On the other hand, counties like Wayne and Forest have much lower rates, at 0.84% and 0.79% respectively. These variations can have a substantial impact on a homeowner's financial obligations, making the availability of tax relief measures like rebates all the more crucial.

The Pennsylvania Property Tax/Rent Rebate Program: An Overview

One of the most significant tax relief initiatives in Pennsylvania is the Property Tax/Rent Rebate Program, administered by the Department of Revenue. This program offers rebates to eligible Pennsylvania residents for property taxes paid on their primary homes, as well as rent payments. The program is designed to provide financial relief to older adults, individuals with disabilities, and low- to moderate-income homeowners and renters.

The rebate amount is calculated based on the total property taxes or rent paid, and the program has certain eligibility criteria. For the 2022 tax year, the maximum standard rebate was set at $650, while the maximum rebate for homeowners with disabilities or homeowners age 65 and older was $1,300. The program's popularity is evident in the fact that it has distributed over $1 billion in rebates since its inception.

Eligibility Criteria

The eligibility criteria for the Property Tax/Rent Rebate Program are stringent and vary based on factors such as age, income, and property tax or rent payments. To be eligible for the standard rebate, applicants must meet the following criteria:

- Be a Pennsylvania resident for the entire tax year.

- Have a total income of $35,000 or less if filing singly, or $40,000 or less if married, widowed, or divorced.

- Have paid property taxes or rent on a permanent home or residence in Pennsylvania during the tax year.

- Not be a dependent on another person's tax return.

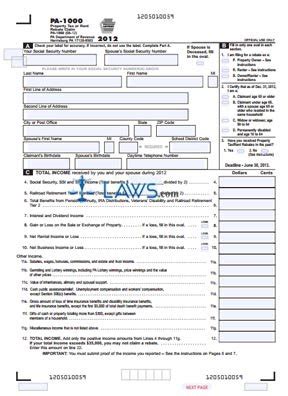

Additionally, applicants must provide proof of their income and property tax or rent payments. The application process involves filling out a detailed form and providing supporting documentation, which can be submitted online or by mail.

Application Process and Timeline

The application process for the Property Tax/Rent Rebate Program is straightforward, but it does require attention to detail. The Department of Revenue provides a step-by-step guide on its website, along with the necessary forms. Applicants can choose to apply online, by mail, or by visiting a local tax center.

The application timeline is critical, as late applications may result in reduced rebates or even ineligibility. For the 2022 tax year, the application period opened on January 1, 2023, and the deadline for applications was December 31, 2023. It's important for applicants to stay updated on the application timeline to ensure they don't miss out on potential rebates.

| Property Tax/Rent Rebate Program Statistics (2022 Tax Year) |

|---|

| Maximum Standard Rebate: $650 |

| Maximum Rebate for Homeowners with Disabilities or Age 65+: $1,300 |

| Total Rebates Distributed: Over $1 billion since inception |

The Impact of Property Tax Rebates on Pennsylvania Residents

The Property Tax/Rent Rebate Program has had a significant impact on the lives of Pennsylvania residents, especially those on fixed incomes or with limited financial means. For many, the rebate can make a substantial difference in their ability to afford their homes and maintain their standard of living. Here are some real-world examples of how the program has benefited Pennsylvanians:

- Mrs. Johnson, a retiree living in Philadelphia, was able to use her rebate to pay for much-needed home repairs, ensuring her safety and comfort in her own home.

- Mr. Williams, a disabled veteran living in Pittsburgh, relied on his rebate to cover the cost of medications and medical equipment, improving his quality of life.

- The Smith family, struggling with rising living costs in suburban Pennsylvania, used their rebate to pay off a portion of their credit card debt, reducing their financial burden.

Exploring Other Property Tax Relief Measures in Pennsylvania

While the Property Tax/Rent Rebate Program is one of the most well-known tax relief initiatives, Pennsylvania offers several other programs to assist homeowners and renters. These programs are designed to address specific needs and circumstances, providing a comprehensive approach to tax relief.

Homestead and Farmstead Exclusion Programs

The Homestead Exclusion Program provides a property tax reduction for eligible homeowners based on their income and property value. The program is particularly beneficial for low- and moderate-income homeowners, as it can significantly reduce their property tax burden. Similarly, the Farmstead Exclusion Program offers a property tax reduction for eligible agricultural properties, helping to preserve Pennsylvania’s rich agricultural heritage.

Tax Abatement Programs

Pennsylvania also offers tax abatement programs that provide temporary relief from property taxes for specific types of properties or developments. These programs are often used to encourage economic growth and development, especially in urban areas. For instance, the Keystone Opportunity Improvement Zones (KOIZ) program offers a 100% property tax abatement for eligible businesses and developments.

Tax Forgiveness Programs

In certain circumstances, Pennsylvania provides tax forgiveness to homeowners who may be facing financial hardship or other challenges. For example, the Act 50 program offers property tax relief to eligible homeowners who are at least 65 years old, have a household income of $35,000 or less, and have lived in their home for at least 10 years. This program can provide a full or partial property tax forgiveness, depending on the individual’s circumstances.

The Future of Property Tax Rebates in Pennsylvania

The future of property tax rebates in Pennsylvania is intertwined with the state’s commitment to supporting its residents and promoting economic growth. As the state continues to evolve, the demand for tax relief measures is likely to remain high, especially with rising living costs and a changing economic landscape.

The Property Tax/Rent Rebate Program has proven to be a successful initiative, and it is expected to continue to provide financial relief to eligible Pennsylvanians. However, the program's effectiveness may be influenced by future legislative decisions, economic trends, and the state's overall financial health. It is essential for the program to remain adaptable and responsive to the changing needs of Pennsylvania's residents.

Additionally, there is a growing emphasis on the development of new tax relief initiatives that target specific needs, such as the rising cost of living and the increasing demand for affordable housing. These initiatives could include expanded rebate programs, targeted tax breaks for certain demographics, or incentives for energy-efficient home improvements. The future of property tax rebates in Pennsylvania is thus a dynamic and evolving landscape, offering both challenges and opportunities for the state's policymakers and residents.

What is the average property tax rate in Pennsylvania?

+The average effective property tax rate in Pennsylvania is 1.45%.

How do I apply for the Property Tax/Rent Rebate Program in Pennsylvania?

+You can apply online, by mail, or by visiting a local tax center. The application process involves filling out a detailed form and providing supporting documentation.

What are some other property tax relief programs in Pennsylvania?

+Pennsylvania offers programs like the Homestead Exclusion Program, Farmstead Exclusion Program, Tax Abatement Programs, and Tax Forgiveness Programs.