City Of Danbury Tax Collector

The City of Danbury, located in Fairfield County, Connecticut, is renowned for its vibrant community spirit, thriving businesses, and a local government that actively promotes economic growth and development. One of the key departments within the city's administration is the Tax Collector's Office, which plays a pivotal role in ensuring the smooth operation of the city's financial infrastructure.

This article aims to delve into the workings of the City of Danbury Tax Collector's Office, exploring its functions, services, and impact on the community. By understanding the inner workings of this essential department, residents and businesses alike can gain valuable insights into the financial management of their city.

An Overview of the Tax Collector's Role in Danbury

The Tax Collector's Office in Danbury is responsible for the collection and management of various taxes and fees imposed by the city government. These taxes contribute significantly to the city's revenue, which is then utilized for crucial public services and infrastructure development. The office's primary goal is to ensure efficient and transparent tax collection processes, fostering a positive relationship between the city and its taxpayers.

At the helm of this department is the appointed Tax Collector, who oversees a dedicated team of professionals. Together, they strive to provide accurate and timely services, ensuring that taxpayers receive the support and guidance they need to fulfill their financial obligations to the city.

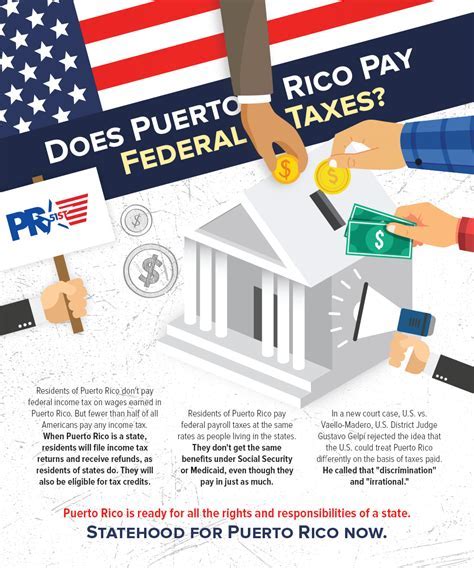

The Tax Collector's Office handles a diverse range of tax types, including property taxes, business taxes, motor vehicle taxes, and various fees associated with city services. Each of these tax categories plays a vital role in funding the city's operations and development initiatives.

Property Taxes: The Backbone of Danbury's Revenue

Property taxes are a significant source of revenue for the City of Danbury, accounting for a substantial portion of the city's annual budget. These taxes are imposed on both residential and commercial properties within the city limits, with rates determined by the assessed value of the property.

The Tax Collector's Office is responsible for assessing property values, sending out tax bills, and collecting the corresponding taxes. This process is meticulous and involves a team of skilled assessors who ensure that property values are accurately determined. The office also provides taxpayers with detailed information about their tax obligations, including due dates, payment options, and any applicable discounts or exemptions.

To make tax payments more accessible, the Tax Collector's Office offers various payment methods, including online payments, direct debit, and traditional in-person payments at the office. This flexibility ensures that taxpayers can choose the most convenient option for their financial needs.

| Property Tax Statistics for Danbury | Fiscal Year 2023 |

|---|---|

| Total Assessed Property Value | $6.2 billion |

| Average Residential Property Tax | $4,800 |

| Number of Property Tax Payments Received | 30,000 |

The efficient management of property taxes not only ensures the city's financial stability but also contributes to the overall prosperity of Danbury's residents and businesses. It allows for the development and maintenance of essential services such as education, public safety, and infrastructure projects.

Business Taxes: Supporting Danbury's Economic Growth

The City of Danbury is committed to fostering a business-friendly environment, and the Tax Collector's Office plays a crucial role in this endeavor. The office collects various business taxes, including sales taxes, business occupation taxes, and fees for specific permits and licenses.

For businesses operating within Danbury, the Tax Collector's Office provides comprehensive guidance on tax obligations. This includes issuing tax registration certificates, providing tax rate information, and offering support for online tax filing. The office also works closely with the city's economic development initiatives, ensuring that businesses receive the necessary resources and incentives to thrive.

One of the key focuses of the Tax Collector's Office is to simplify the tax process for businesses. They offer user-friendly online portals for tax registration, payment, and filing, making it easier for businesses to manage their tax obligations. This digital approach not only saves time for businesses but also reduces the administrative burden on the office itself.

| Business Tax Statistics for Danbury | Fiscal Year 2023 |

|---|---|

| Number of Registered Businesses | 5,200 |

| Total Business Tax Revenue | $12.5 million |

| Average Sales Tax Rate | 6.35% |

By efficiently collecting business taxes, the Tax Collector's Office ensures that Danbury's economic growth is supported and sustained. The revenue generated from these taxes is reinvested into the community, fostering a thriving business ecosystem and creating opportunities for all.

The Impact of the Tax Collector's Office on Community Development

The work of the Tax Collector's Office extends beyond tax collection; it significantly impacts the overall development and well-being of the Danbury community.

Firstly, the office's efficient tax collection processes ensure that the city has a stable and predictable revenue stream. This stability is crucial for long-term planning and the implementation of strategic initiatives. Whether it's investing in education, improving public infrastructure, or enhancing public safety, a reliable revenue source is essential.

Secondly, the Tax Collector's Office actively engages with taxpayers, providing them with the information and support they need to navigate the tax system. This engagement fosters a sense of community and transparency, building trust between the city and its residents and businesses.

Furthermore, the office's commitment to fairness and equity ensures that tax obligations are distributed equitably among taxpayers. This approach promotes social cohesion and ensures that the burden of taxation is shared justly.

The Tax Collector's Office also collaborates with other city departments and community organizations to identify areas where tax revenue can be utilized most effectively. This collaborative approach ensures that resources are allocated to projects and services that have the most significant impact on the community's quality of life.

Community Initiatives Supported by Tax Revenue

A portion of the tax revenue collected by the Tax Collector's Office is directed towards community initiatives and projects. These initiatives aim to enhance the lives of Danbury residents and contribute to the city's overall prosperity.

One such initiative is the Danbury Downtown Revitalization Project, which aims to transform the city's downtown area into a vibrant, pedestrian-friendly hub. The project includes infrastructure upgrades, aesthetic improvements, and the development of public spaces, all funded in part by tax revenue.

Another notable initiative is the Danbury Education Fund, which provides financial support to local schools and educational programs. This fund helps bridge the gap in educational resources, ensuring that all students have access to quality education regardless of their background.

Additionally, tax revenue is allocated to community programs focused on youth development, senior services, and cultural initiatives. These programs enrich the lives of Danbury residents, fostering a sense of community and belonging.

| Community Initiatives Supported by Tax Revenue | Funding Amount (Fiscal Year 2023) |

|---|---|

| Danbury Downtown Revitalization Project | $3.2 million |

| Danbury Education Fund | $2.1 million |

| Youth Development Programs | $1.5 million |

| Senior Services | $800,000 |

| Cultural Initiatives | $600,000 |

Through these initiatives, the Tax Collector's Office demonstrates its commitment to the community's well-being and development. The office's efforts ensure that tax revenue is not only collected efficiently but also reinvested in ways that benefit the entire Danbury community.

Conclusion: A Vital Component of Danbury's Administration

The City of Danbury's Tax Collector's Office is a crucial pillar of the city's administration, playing a multifaceted role in the city's financial management and community development. From efficient tax collection to supporting community initiatives, the office's impact is far-reaching.

By understanding the work of the Tax Collector's Office, residents and businesses can appreciate the vital services it provides and the positive impact it has on their daily lives. The office's dedication to transparency, fairness, and community engagement ensures that Danbury remains a thriving and prosperous city for all its residents.

Frequently Asked Questions

How can I pay my property taxes in Danbury?

+

You can pay your property taxes in Danbury through various methods, including online payments via the city’s website, direct debit, and in-person payments at the Tax Collector’s Office. The office accepts checks, money orders, and cash payments. For more information, visit the official website of the City of Danbury.

Are there any tax incentives for businesses in Danbury?

+

Yes, the City of Danbury offers several tax incentives to attract and support businesses. These incentives include tax abatements, tax credits, and reduced tax rates for specific industries. To learn more about these incentives, businesses can reach out to the Danbury Economic Development Office or consult the city’s official website.

What happens if I miss a tax payment deadline in Danbury?

+

Missing a tax payment deadline in Danbury can result in late fees and penalties. It’s important to stay informed about tax due dates and make timely payments to avoid additional costs. If you anticipate difficulties with a payment, it’s advisable to contact the Tax Collector’s Office to discuss potential payment plans or arrangements.

How often does the Tax Collector’s Office reassess property values in Danbury?

+

The Tax Collector’s Office in Danbury typically conducts a comprehensive reassessment of property values every five years. However, there may be instances where reassessments are conducted more frequently, especially if there are significant changes in the real estate market or specific developments in a property’s neighborhood. Property owners can expect to receive notice of any reassessment and have the opportunity to appeal the assessed value if they disagree.

Can I pay my taxes in installments in Danbury?

+

Yes, the Tax Collector’s Office in Danbury offers the option of paying taxes in installments for certain types of taxes, such as property taxes. This arrangement allows taxpayers to spread out their payments over a specified period, making it more manageable. To explore this option, taxpayers should contact the office directly to discuss their eligibility and the available payment plans.