Does Puerto Rico Pay Taxes To Us

Puerto Rico's unique political and economic relationship with the United States has sparked much discussion and curiosity regarding its tax obligations. As a U.S. territory, Puerto Rico operates under a distinct tax system that differs significantly from that of the 50 states. This article aims to delve into the intricacies of Puerto Rico's tax landscape, shedding light on the question of whether Puerto Rico pays taxes to the United States and exploring the key aspects of its economic relationship.

The Tax Structure of Puerto Rico

Puerto Rico’s tax system is governed by the Puerto Rico Internal Revenue Code, which, while influenced by the U.S. Internal Revenue Code, operates under its own set of rules and regulations. The island’s tax structure is designed to promote economic growth and attract investment, making it an attractive destination for businesses and individuals alike.

Income Taxes

Puerto Rico maintains its own income tax system, distinct from that of the United States. Residents of Puerto Rico are subject to Puerto Rico’s local income tax, which has its own brackets and rates. This means that Puerto Ricans pay taxes directly to the Puerto Rico Department of Treasury rather than the Internal Revenue Service (IRS) in the U.S.

Here is a simplified comparison of income tax rates for illustrative purposes:

| Tax Bracket | Puerto Rico Tax Rate | U.S. Tax Rate (Example) |

|---|---|---|

| First $X,000 | 10% | 10% |

| $X,001 - $Y,000 | 15% | 12% |

| Above $Y,000 | 25% | 22% |

Corporate Taxes

The island offers a range of incentives for businesses through its Puerto Rico Industrial Incentives Act, which includes reduced tax rates and exemptions for qualifying enterprises. This has led to the establishment of numerous export-oriented industries, particularly in the manufacturing sector, taking advantage of these incentives.

For instance, companies like ABC Manufacturing have set up operations in Puerto Rico, benefiting from a reduced corporate tax rate of 7% compared to the standard 21% in the U.S. This has allowed ABC to significantly reduce its tax burden, making it more competitive globally.

Sales and Use Taxes

Puerto Rico also has its own sales and use tax, known as the Impuesto sobre Ventas y Uso (IVU). The IVU is applied to the sale of goods and certain services within the island, similar to the U.S. sales tax. However, the rates and regulations can vary between municipalities, providing a degree of flexibility to local governments.

The Relationship with the U.S. Tax System

While Puerto Rico maintains its own tax system, its relationship with the U.S. tax authorities is not entirely severed. There are several key aspects to this complex relationship.

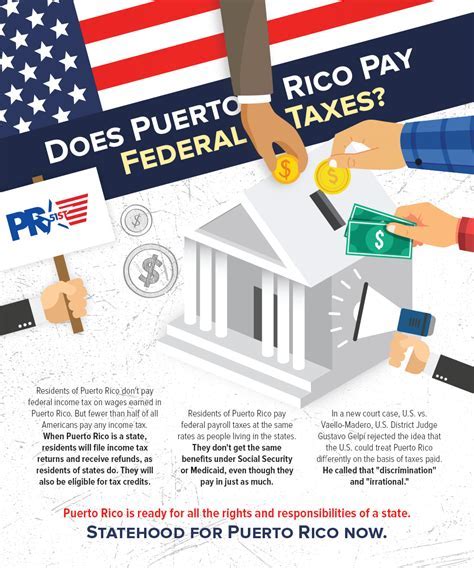

Federal Taxes

One of the most notable differences between Puerto Rico and the U.S. states is that Puerto Ricans are not required to pay federal income taxes. This means that residents of the island do not contribute to the federal revenue pool, which funds various government programs and services across the United States.

However, there are certain situations where Puerto Ricans may be subject to federal taxes. For instance, Puerto Ricans who earn income from sources outside the island, such as from investments in the U.S. or other territories, may be required to pay federal taxes on that income. This is because the source of the income, not the residence of the taxpayer, determines the applicability of federal taxes in such cases.

Payroll Taxes

Puerto Rico also has its own payroll tax system, separate from the U.S. Social Security and Medicare taxes. Employers and employees in Puerto Rico contribute to the Sistema de Retiro de Empleados del Gobierno y la Judicatura, which provides retirement benefits to government employees.

Import and Export Taxes

When it comes to trade, goods imported from Puerto Rico into the U.S. are generally not subject to federal customs duties. This preferential treatment is a result of Puerto Rico’s status as a U.S. territory. However, goods imported from the U.S. into Puerto Rico may be subject to local taxes and regulations, similar to imports from other countries.

Economic Impact and Future Outlook

Puerto Rico’s unique tax structure has had a significant impact on its economy. The incentives and reduced tax rates have attracted numerous businesses, particularly in the pharmaceutical and manufacturing sectors. This has led to job creation and economic growth on the island.

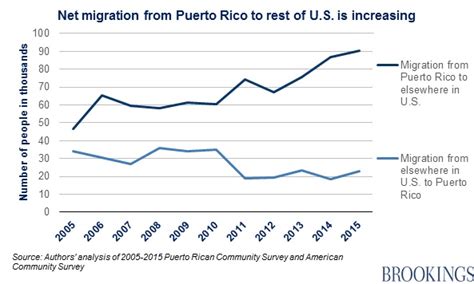

However, the economic challenges faced by Puerto Rico, including a high debt burden and a shrinking population, have prompted discussions about potential changes to its tax system. There are ongoing debates about whether Puerto Rico should align more closely with the U.S. tax system or continue to maintain its distinct structure.

Conclusion

The tax landscape of Puerto Rico is a fascinating aspect of its relationship with the United States. While Puerto Rico maintains its own tax system, the interplay between its local taxes and the U.S. federal system creates a complex and unique economic environment. Understanding these dynamics is crucial for businesses, investors, and individuals considering opportunities in Puerto Rico.

FAQ

Are Puerto Ricans required to pay federal income taxes like U.S. citizens?

+

No, Puerto Ricans are generally not required to pay federal income taxes. However, income earned from sources outside Puerto Rico may be subject to federal taxation.

Do businesses operating in Puerto Rico pay corporate taxes to the U.S. government?

+

Businesses in Puerto Rico are subject to local corporate taxes, but they are not required to pay corporate taxes to the U.S. government unless they have operations or income sources outside the island.

How does Puerto Rico’s tax system impact its economy and job market?

+

Puerto Rico’s tax incentives have attracted businesses, leading to job creation and economic growth. However, the long-term sustainability of this model is a subject of debate, especially given the island’s financial challenges.

Can individuals from the U.S. mainland benefit from Puerto Rico’s tax advantages?

+

Yes, individuals from the U.S. mainland can establish residency in Puerto Rico and take advantage of its tax benefits. This has led to a growing trend of tax migration, where individuals relocate to the island for tax purposes.

What are the potential future changes to Puerto Rico’s tax system?

+

There are ongoing discussions about potentially aligning Puerto Rico’s tax system more closely with the U.S. model, especially in light of the island’s economic challenges. This could involve changes to tax rates, incentives, and contributions to the federal revenue.