Shelby County Tn Property Tax

Understanding property taxes is an essential aspect of homeownership, and in Shelby County, Tennessee, this topic becomes particularly relevant for both new and established residents. Property taxes in Shelby County, like in many other jurisdictions, are a significant source of revenue for local governments and are used to fund vital community services and infrastructure. This article aims to delve into the specifics of Shelby County property taxes, providing a comprehensive guide for homeowners and prospective buyers.

The Basics of Shelby County Property Taxes

In Shelby County, property taxes are assessed annually based on the appraised value of the property. The tax is calculated by multiplying the appraised value by the applicable tax rate, which varies depending on the location and the type of property.

The county is known for its diverse real estate landscape, ranging from suburban neighborhoods to rural areas, each with its own unique characteristics and tax considerations. The Shelby County Assessor's Office plays a crucial role in this process, responsible for determining the assessed value of each property.

The Assessment Process

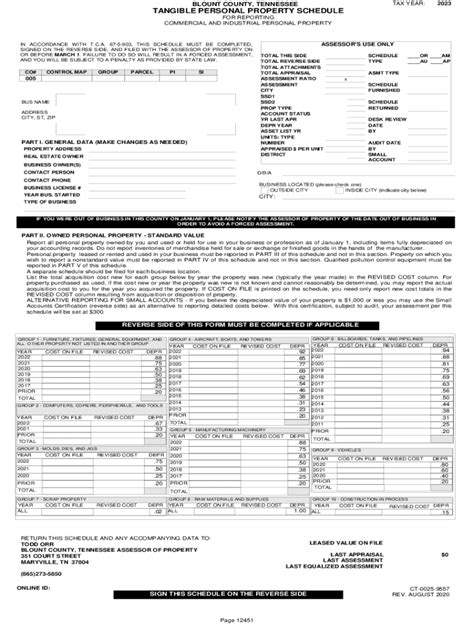

Property assessment in Shelby County is a detailed and meticulous process. The assessor’s office utilizes a combination of market analysis, sales data, and property inspections to determine the fair market value of each property. This value is then used as the basis for calculating property taxes.

Homeowners can expect to receive a notice of assessment each year, detailing the assessed value and any changes from the previous year. This notice serves as an important tool for homeowners to review and understand the basis for their property taxes.

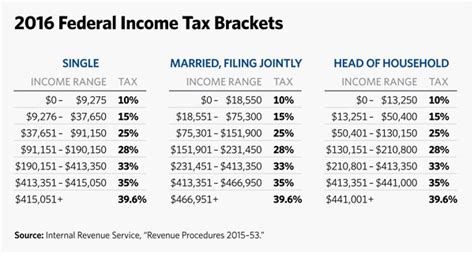

Tax Rates and Calculations

The tax rate in Shelby County is determined by the local government and can vary depending on the location within the county. Typically, the tax rate is expressed as a percentage, and it is applied to the assessed value of the property. For example, if a property is assessed at 200,000 and the tax rate is 0.3%, the annual property tax would amount to 600.

It's important to note that the tax rate can change annually, and it is influenced by factors such as the budget requirements of local governments and the need to fund specific projects or initiatives.

| Location | Tax Rate (%) |

|---|---|

| Memphis City | 0.375 |

| Shelby County | 0.282 |

| Suburban Areas | 0.268 - 0.327 |

Factors Influencing Property Taxes in Shelby County

Several factors contribute to the complexity of property taxes in Shelby County. Understanding these factors can help homeowners anticipate and plan for their tax obligations effectively.

Property Type and Usage

The type of property and its intended usage can impact the tax rate. For instance, residential properties may have different tax rates compared to commercial or industrial properties. Additionally, properties designated for specific purposes, such as agricultural land, may be subject to unique tax considerations.

Location and School Districts

The location of a property within Shelby County can significantly influence its tax rate. Different municipalities and school districts may have varying tax rates, and these rates can impact the overall tax burden. Homeowners should consider the school district when purchasing a property, as this can be a significant factor in property taxes.

Property Value and Market Trends

The assessed value of a property is a key determinant of the property tax. This value can fluctuate based on market trends, property improvements, and other factors. Homeowners should stay informed about the real estate market in Shelby County to anticipate potential changes in their property’s assessed value.

Special Assessments and Improvements

In some cases, special assessments may be levied on properties to fund specific infrastructure projects or improvements. These assessments are typically charged to properties within a defined area and can result in temporary increases in property taxes.

Paying Property Taxes in Shelby County

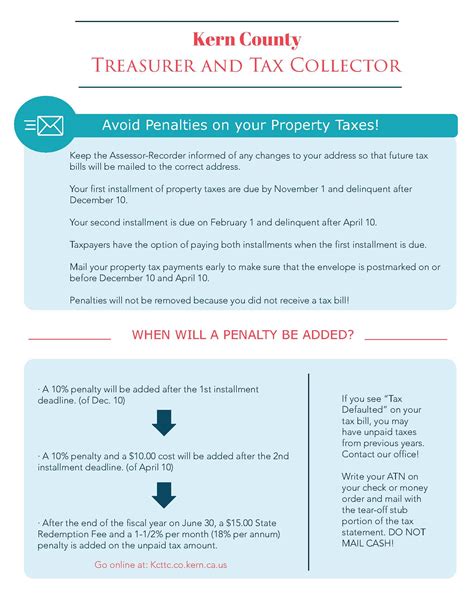

Homeowners in Shelby County have various options for paying their property taxes. The Shelby County Trustee’s Office is responsible for collecting property taxes and offers convenient payment methods, including online payments, in-person payments, and payment by mail.

It's important for homeowners to pay their property taxes on time to avoid penalties and interest charges. The due date for property taxes is typically set by the local government, and failure to pay by the deadline can result in late fees and other consequences.

Online Payment Options

The Shelby County Trustee’s Office provides an online payment portal, allowing homeowners to make secure payments from the comfort of their homes. This option is convenient and offers real-time confirmation of payment.

Online payments can be made using a credit card, debit card, or electronic check. Homeowners should be aware of any associated fees for using these payment methods.

In-Person and Mail Payments

For those who prefer traditional payment methods, the Trustee’s Office also accepts payments in person at their office locations. Homeowners can visit the office during business hours and make payments by cash, check, or money order.

Alternatively, homeowners can mail their property tax payments to the Trustee's Office. It's important to include the correct payment amount, the property address, and the tax year for which the payment is being made.

Understanding Tax Bills and Appeals

Receiving a property tax bill can be a complex process, and it’s essential for homeowners to understand the components of their tax bill. The tax bill outlines the assessed value, the applicable tax rate, and the total amount due. It also provides information on due dates and payment options.

Reviewing and Understanding Tax Bills

Homeowners should carefully review their tax bills to ensure accuracy. This includes verifying the assessed value, tax rate, and any applicable exemptions or deductions. Any discrepancies or errors should be addressed promptly with the Shelby County Assessor’s Office.

Appealing Property Assessments

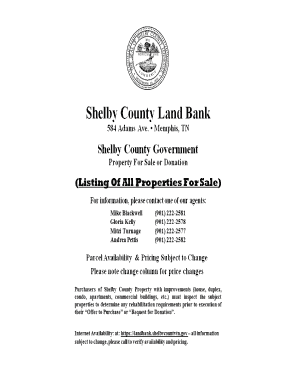

In cases where homeowners believe their property’s assessed value is inaccurate, they have the right to appeal the assessment. The appeals process in Shelby County involves a formal review by the Board of Assessment Appeals. Homeowners must provide evidence to support their claim, such as recent sales data or an independent appraisal.

It's important to note that the appeals process can be time-consuming and may require the assistance of a professional appraiser or tax consultant.

Property Tax Relief Programs in Shelby County

Shelby County offers a range of property tax relief programs to assist homeowners with their tax obligations. These programs are designed to provide financial relief to eligible homeowners, particularly those with limited incomes or special circumstances.

Senior Citizen Property Tax Freeze

The Senior Citizen Property Tax Freeze program is a valuable resource for elderly homeowners in Shelby County. This program freezes the assessed value of the property at the time of enrollment, preventing increases in property taxes due to rising property values.

To be eligible, homeowners must be at least 65 years old, have owned and occupied the property for at least five years, and meet certain income requirements. The program provides long-term financial stability for seniors, ensuring their property taxes remain manageable.

Disabled Veterans Exemption

Shelby County extends a property tax exemption to honorably discharged veterans with service-connected disabilities. This exemption reduces the assessed value of the veteran’s property, resulting in a lower property tax bill.

Eligible veterans must provide documentation of their disability and discharge status to the Shelby County Assessor's Office. The exemption applies to the primary residence and can provide significant savings for disabled veterans.

Other Tax Relief Programs

Shelby County offers additional tax relief programs, including the Low Income Elderly and Disabled Property Tax Relief program and the Property Tax Deferment program. These programs provide assistance to low-income seniors and disabled individuals, as well as those facing financial hardships.

Homeowners interested in these programs should contact the Shelby County Trustee's Office or the Assessor's Office for more information and to determine their eligibility.

Conclusion

Understanding property taxes in Shelby County is crucial for homeowners and prospective buyers. From the assessment process to payment options and tax relief programs, this comprehensive guide provides a deep dive into the world of Shelby County property taxes.

By staying informed and taking advantage of the resources available, homeowners can navigate the complexities of property taxes with confidence. Whether it's appealing an assessment, accessing tax relief programs, or simply understanding the tax bill, this knowledge empowers homeowners to make informed decisions and effectively manage their property tax obligations.

What is the average property tax rate in Shelby County, TN?

+The average property tax rate in Shelby County can vary depending on the location within the county. For instance, Memphis City has a tax rate of 0.375%, while Shelby County itself has a rate of 0.282%. Suburban areas can range from 0.268% to 0.327%.

When are property taxes due in Shelby County?

+Property taxes in Shelby County are typically due twice a year, with the first installment due in February and the second installment due in July. However, it’s important to check with the Shelby County Trustee’s Office for the exact due dates, as they may vary slightly from year to year.

How can I appeal my property assessment in Shelby County?

+If you believe your property assessment is inaccurate, you can appeal the assessment through the Shelby County Board of Assessment Appeals. The process involves submitting an appeal application, along with supporting evidence such as recent sales data or an independent appraisal. It’s advisable to consult with a tax professional or seek legal advice for a successful appeal.

Are there any property tax exemptions or relief programs in Shelby County?

+Yes, Shelby County offers several tax relief programs. These include the Senior Citizen Property Tax Freeze, Disabled Veterans Exemption, Low Income Elderly and Disabled Property Tax Relief, and the Property Tax Deferment program. Each program has specific eligibility criteria, so it’s important to review the requirements and consult with the Shelby County Trustee’s Office or Assessor’s Office for more information.