2016 Tax Brackets

In 2016, the U.S. federal tax system utilized a progressive tax structure, meaning that individuals and households were taxed at different rates depending on their income level. This system aimed to ensure that those with higher incomes contributed a larger proportion of their earnings to the government's revenue. The tax brackets, also known as marginal tax rates, determined the applicable tax rate for each income range. Understanding the 2016 tax brackets is essential for individuals and businesses to comprehend their tax obligations and plan their finances accordingly.

Tax Bracket Structure for 2016

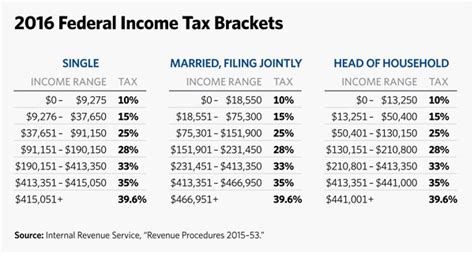

The Internal Revenue Service (IRS) sets the tax brackets annually, and for the tax year 2016, there were seven distinct tax brackets with corresponding tax rates. These brackets applied to both ordinary income and capital gains. The tax rates ranged from 10% to 39.6%, with each bracket representing a specific income range. Here is an overview of the 2016 tax brackets for single filers, married filing jointly or qualifying widow(er), married filing separately, and heads of household:

Single Filers

| Tax Rate | Taxable Income Bracket |

|---|---|

| 10% | 0 - 9,275 |

| 15% | 9,276 - 37,650 |

| 25% | 37,651 - 91,150 |

| 28% | 91,151 - 190,150 |

| 33% | 190,151 - 413,350 |

| 35% | 413,351 - 415,050 |

| 39.6% | Over $415,050 |

Married Filing Jointly or Qualifying Widow(er)

| Tax Rate | Taxable Income Bracket |

|---|---|

| 10% | 0 - 18,550 |

| 15% | 18,551 - 75,300 |

| 25% | 75,301 - 151,900 |

| 28% | 151,901 - 231,450 |

| 33% | 231,451 - 413,350 |

| 35% | 413,351 - 466,950 |

| 39.6% | Over $466,950 |

Married Filing Separately

| Tax Rate | Taxable Income Bracket |

|---|---|

| 10% | 0 - 9,275 |

| 15% | 9,276 - 37,650 |

| 25% | 37,651 - 75,950 |

| 28% | 75,951 - 115,725 |

| 33% | 115,726 - 206,675 |

| 35% | 206,676 - 233,475 |

| 39.6% | Over $233,475 |

Head of Household

| Tax Rate | Taxable Income Bracket |

|---|---|

| 10% | 0 - 13,250 |

| 15% | 13,251 - 50,200 |

| 25% | 50,201 - 151,900 |

| 28% | 151,901 - 231,450 |

| 33% | 231,451 - 413,350 |

| 35% | 413,351 - 444,550 |

| 39.6% | Over $444,550 |

Understanding Taxable Income and Adjustments

When determining your taxable income, various adjustments and deductions can impact the amount of income subject to taxation. Some common adjustments include contributions to retirement accounts, student loan interest payments, and certain business expenses. These adjustments reduce your taxable income, potentially moving you into a lower tax bracket or reducing the amount of tax owed.

Tax Credits and Deductions

Tax credits and deductions further reduce your tax liability. Tax credits directly reduce the amount of tax owed, while deductions reduce your taxable income. Common tax credits include the Child Tax Credit, Education Credits, and the Earned Income Tax Credit. Deductions can be claimed either as a standard deduction or by itemizing specific expenses such as medical costs, state and local taxes, and charitable donations.

Capital Gains Tax

Capital gains tax applies to profits made from the sale of assets, such as stocks, bonds, or real estate. In 2016, the capital gains tax rates were aligned with the tax brackets. Long-term capital gains, held for more than a year, were taxed at 0%, 15%, or 20% depending on the taxpayer’s income bracket. Short-term capital gains, held for a year or less, were taxed at the taxpayer’s ordinary income tax rate.

Impact of Tax Brackets on Taxpayers

The tax brackets play a significant role in determining an individual’s or household’s tax liability. As income increases, so does the applicable tax rate, resulting in a progressive tax system. This system ensures that those with higher incomes contribute a larger proportion of their earnings to government revenue. However, it’s important to note that the tax brackets are not static and can change annually based on economic conditions and tax policy.

For taxpayers with incomes that fall near the upper limits of a tax bracket, it can be advantageous to explore tax-saving strategies. These strategies may include maximizing retirement contributions, optimizing investment timing, or considering tax-efficient investment options. Additionally, understanding the impact of tax brackets can help individuals make informed decisions regarding their financial planning, such as timing income recognition or considering tax-efficient ways to reduce their taxable income.

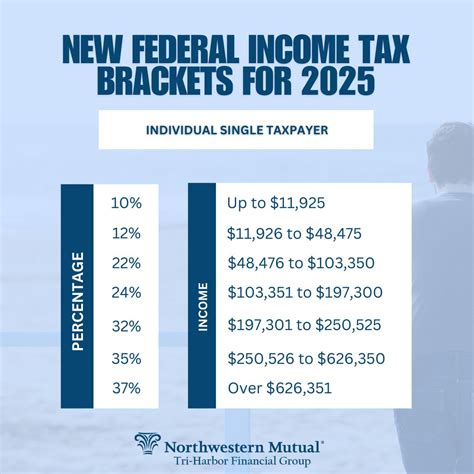

Future Outlook and Tax Policy Changes

The tax brackets and tax policies are subject to change over time. Since 2016, there have been significant tax reforms, most notably the Tax Cuts and Jobs Act of 2017, which introduced new tax brackets and rates for the 2018 tax year and beyond. These reforms aimed to simplify the tax code, lower tax rates, and provide tax relief to individuals and businesses.

Staying informed about tax policy changes is crucial for individuals and businesses to optimize their tax strategies and plan for the future. It's essential to consult with tax professionals or utilize reliable tax software to ensure compliance with the latest tax laws and regulations.

Conclusion

Understanding the 2016 tax brackets provides valuable insights into the progressive nature of the U.S. tax system and its impact on taxpayers. By recognizing the tax brackets and exploring tax-saving strategies, individuals can optimize their financial planning and minimize their tax liability. As tax policies evolve, staying updated on the latest changes is crucial to navigate the tax landscape effectively and make informed financial decisions.

How were the 2016 tax brackets determined?

+The 2016 tax brackets were established by the Internal Revenue Service (IRS) based on federal tax laws and regulations. The tax rates and brackets are typically adjusted annually to account for inflation and economic factors.

Did the tax brackets change after 2016?

+Yes, tax brackets and rates have undergone changes since 2016. The Tax Cuts and Jobs Act of 2017 introduced new tax brackets and rates for the 2018 tax year and beyond, resulting in significant tax reforms.

What is the difference between marginal tax rates and effective tax rates?

+Marginal tax rates, represented by the tax brackets, apply to different income ranges. Effective tax rates, on the other hand, are the average tax rates calculated by dividing total tax liability by total taxable income. Effective tax rates provide a more accurate representation of the overall tax burden.

Are there any tax-saving strategies for individuals near the upper limits of a tax bracket?

+Yes, individuals near the upper limits of a tax bracket can consider tax-saving strategies such as maximizing retirement contributions, optimizing investment timing, or utilizing tax-efficient investment options. Consulting with a tax professional can provide personalized advice based on individual circumstances.

How can I stay updated on the latest tax policy changes?

+Staying informed about tax policy changes is crucial. You can follow reputable tax websites, subscribe to tax-related newsletters, and consult with tax professionals or reliable tax software to ensure you have the latest information and guidance.