Ok Tax Return Status

The Ok Tax Return Status is a crucial aspect of managing one's financial obligations and ensuring compliance with tax regulations. This article aims to delve into the intricacies of this status, exploring its definition, significance, and the steps individuals and businesses can take to navigate it effectively. By understanding the Ok Tax Return Status, individuals can gain clarity on their tax liabilities, identify potential issues, and take proactive measures to maintain a positive tax standing.

Understanding Ok Tax Return Status

The Ok Tax Return Status is a designation given to a taxpayer’s financial record, indicating that their tax return has been processed and accepted by the relevant tax authority without any apparent issues or errors. It signifies that the taxpayer has fulfilled their tax obligations accurately and on time. This status is a positive indicator of compliance and can have significant implications for future tax filings and financial planning.

When a tax return is designated as "Ok," it means that the tax authorities have reviewed the return and found it to be complete, accurate, and in accordance with the applicable tax laws and regulations. This status reflects a taxpayer's adherence to the required filing procedures and their commitment to maintaining transparent financial records.

Key Elements of Ok Tax Return Status

The Ok Tax Return Status is determined by several factors, including the accuracy of reported income, deductions, and credits, as well as the timely submission of the tax return. Taxpayers who receive this status have typically met all the necessary requirements, ensuring a smooth and efficient tax processing experience.

- Income Reporting: Accurate reporting of all income sources is crucial for obtaining the Ok Tax Return Status. This includes wages, salaries, business income, investments, and any other taxable income.

- Deductions and Credits: Taxpayers must claim eligible deductions and credits correctly. These can include personal deductions, business expenses, education credits, and various other tax benefits.

- Timely Filing: Meeting the tax filing deadline is essential. Late filings can result in penalties and interest charges, potentially affecting the overall tax return status.

- Compliance with Tax Laws: Understanding and adhering to the applicable tax laws and regulations is fundamental. This includes following the correct filing procedures, using the appropriate tax forms, and providing accurate supporting documentation.

Obtaining the Ok Tax Return Status not only ensures compliance with tax regulations but also provides taxpayers with a sense of financial security and peace of mind. It demonstrates that their tax obligations have been met, reducing the risk of audits, penalties, and legal complications.

The Impact of Ok Tax Return Status

The Ok Tax Return Status has significant implications for taxpayers, both in the short and long term. It influences various aspects of financial management and can impact future tax planning strategies.

Short-Term Implications

In the immediate aftermath of receiving the Ok Tax Return Status, taxpayers can breathe a sigh of relief, knowing that their tax obligations for the current year have been met. This status provides clarity and certainty, allowing individuals and businesses to focus on other financial priorities.

Moreover, the Ok Tax Return Status often results in a timely refund or a reduced tax liability. Taxpayers who have overpaid their taxes during the year can expect to receive a refund, which can be a welcome boost to their financial situation. On the other hand, those with a reduced tax liability may have more funds available for other financial goals, such as savings or investments.

Long-Term Benefits

The benefits of maintaining an Ok Tax Return Status extend beyond the current tax year. A consistent record of timely and accurate filings can establish a positive relationship with tax authorities, reducing the likelihood of future audits or inquiries.

Additionally, a history of Ok Tax Return Statuses can enhance an individual's or business's creditworthiness. Financial institutions and lenders often consider tax compliance when evaluating loan applications or creditworthiness. A positive tax standing can improve an individual's chances of securing favorable loan terms or accessing credit facilities.

Furthermore, the Ok Tax Return Status can facilitate smoother financial planning. Taxpayers can leverage their positive tax history to make informed decisions about tax strategies, deductions, and credits. This proactive approach to tax planning can lead to significant savings and more efficient financial management.

Strategies for Maintaining Ok Tax Return Status

Maintaining an Ok Tax Return Status requires a proactive and organized approach to tax management. Here are some key strategies that taxpayers can employ to ensure they remain in good standing with tax authorities.

Organize Financial Records

Maintaining a well-organized system for financial records is essential. Taxpayers should keep track of all income statements, receipts, invoices, and other relevant documents. This ensures that they have the necessary information to accurately complete their tax returns and provides a reference for future tax planning.

Digital tools and cloud-based storage solutions can greatly assist in organizing financial records. Taxpayers can use dedicated tax software or online platforms to store and categorize their financial data, making it easily accessible when needed.

Stay Informed about Tax Laws and Updates

Tax laws and regulations are subject to change, and taxpayers must stay informed about any updates or amendments. This includes changes in tax rates, deductions, credits, and filing procedures. Staying abreast of these changes ensures that taxpayers can adapt their financial strategies accordingly.

Tax authorities often provide resources and guidelines to help taxpayers understand the latest tax laws. These resources can include official websites, publications, and even tax workshops or seminars. Engaging with these resources can provide valuable insights and ensure compliance with the latest tax requirements.

Seek Professional Guidance

For complex tax situations or when taxpayers feel uncertain about their tax obligations, seeking professional guidance can be beneficial. Tax professionals, such as certified public accountants (CPAs) or enrolled agents, have the expertise to navigate the complexities of tax laws and regulations.

Tax professionals can provide tailored advice based on an individual's or business's unique financial circumstances. They can assist with tax planning, identify eligible deductions and credits, and ensure that tax returns are completed accurately and on time. Engaging a tax professional can reduce the risk of errors and provide peace of mind during the tax filing process.

Addressing Common Challenges

Despite best efforts, taxpayers may encounter challenges that affect their Ok Tax Return Status. Here are some common issues and strategies for addressing them.

Missing or Inaccurate Information

One of the most common challenges taxpayers face is missing or inaccurate information on their tax returns. This can occur due to various reasons, such as lost documents, data entry errors, or complex financial transactions.

To address this challenge, taxpayers should thoroughly review their tax returns before submission. Double-checking all income sources, deductions, and credits can help identify any potential errors or omissions. Additionally, seeking professional assistance can provide an extra layer of accuracy and ensure that all relevant information is included.

Late Filing and Payment

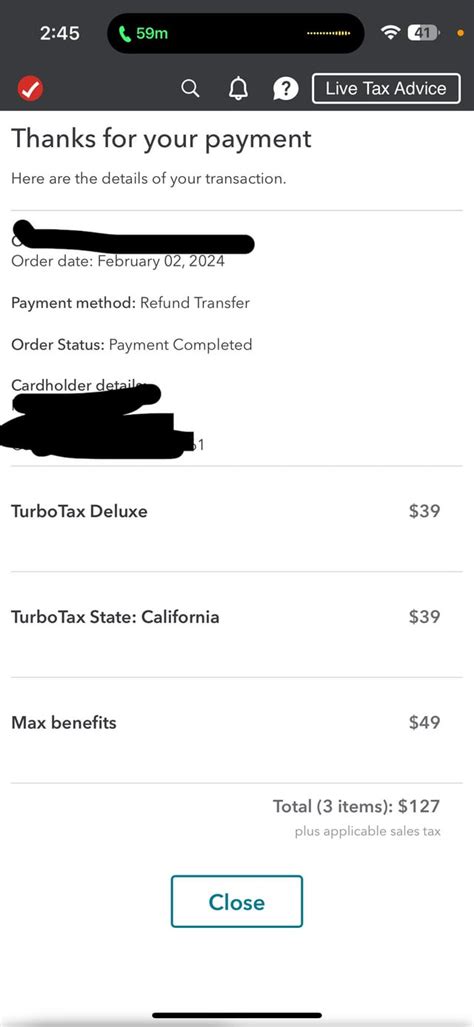

Missing the tax filing deadline or failing to make timely tax payments can result in penalties and interest charges. These issues can affect the Ok Tax Return Status and create additional financial burdens.

To avoid late filing and payment, taxpayers should prioritize their tax obligations and set reminders for important deadlines. Utilizing tax preparation software or engaging a tax professional can help ensure that returns are filed on time. Additionally, taxpayers should explore payment options, such as installment plans or payment agreements, if they anticipate difficulties in making a lump-sum payment.

Audit and Inquiries

Although the Ok Tax Return Status reduces the likelihood of audits, taxpayers may still be selected for further scrutiny. Tax authorities may conduct audits to verify the accuracy of tax returns or inquire about specific transactions or deductions.

If selected for an audit or inquiry, taxpayers should cooperate fully with the tax authorities. Providing accurate and complete information is essential. Engaging a tax professional who specializes in audit representation can be beneficial, as they can guide taxpayers through the process and negotiate on their behalf.

The Future of Ok Tax Return Status

As technology advances and tax systems evolve, the concept of Ok Tax Return Status is likely to undergo transformations. Here are some potential future implications and developments.

Digital Transformation

The increasing digitization of tax systems is likely to streamline the tax filing process and enhance the accuracy of tax returns. Digital platforms and tax software can automate certain calculations, reducing the risk of errors and simplifying the tax filing experience.

Additionally, the use of blockchain technology and smart contracts may revolutionize tax compliance. These technologies can provide secure and transparent records of financial transactions, making it easier for taxpayers to maintain accurate financial records and meet their tax obligations.

Data-Driven Tax Strategies

With the availability of vast amounts of data, taxpayers may increasingly rely on data-driven insights to optimize their tax strategies. Advanced analytics and predictive modeling can help identify trends, patterns, and opportunities for tax planning. This approach can lead to more efficient tax management and potentially reduce tax liabilities.

Global Tax Harmonization

As international trade and investment continue to grow, there may be a push for global tax harmonization. This could involve the standardization of tax rates, deductions, and reporting requirements across different jurisdictions. A more harmonized tax system could simplify tax compliance for multinational businesses and individuals with cross-border financial activities.

Conclusion

The Ok Tax Return Status is a critical aspect of financial management and tax compliance. By understanding its definition, significance, and the strategies for maintaining it, taxpayers can ensure a positive tax standing and avoid potential pitfalls. Whether through organized financial record-keeping, staying informed about tax laws, or seeking professional guidance, individuals and businesses can navigate the complexities of tax management with confidence.

As the tax landscape evolves, staying adaptable and proactive is essential. By embracing technological advancements and data-driven strategies, taxpayers can optimize their tax obligations and leverage opportunities for financial growth. Ultimately, the Ok Tax Return Status serves as a foundation for financial stability and a cornerstone of responsible tax management.

What happens if my tax return is not designated as “Ok”?

+If your tax return is not designated as “Ok,” it may indicate that there are issues or errors with your return. These issues could include inaccurate or incomplete information, missing forms, or discrepancies in reported income or deductions. In such cases, the tax authority may request additional information, clarify certain aspects of your return, or even initiate an audit. It is crucial to address these issues promptly and cooperate with the tax authority to resolve any concerns.

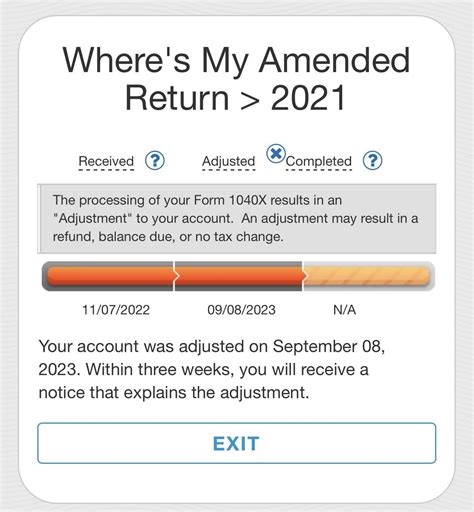

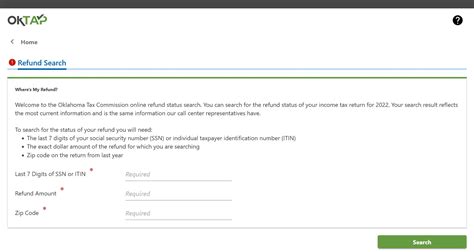

How long does it take to receive an “Ok” status for my tax return?

+The time it takes to receive an “Ok” status for your tax return can vary depending on several factors, including the complexity of your return, the volume of returns being processed by the tax authority, and any potential issues identified during the review process. In general, simple tax returns with no errors or discrepancies may receive an “Ok” status within a few weeks. However, more complex returns or those with issues may take longer to process. It is advisable to stay updated on the status of your return through the tax authority’s online portal or by contacting their support channels.

Can I appeal an “Ok” status if I disagree with the tax authority’s decision?

+Yes, if you disagree with the tax authority’s decision to designate your tax return as “Ok,” you have the right to appeal their determination. The process for appealing varies depending on the jurisdiction and the specific tax authority. Generally, you will need to provide detailed reasons for your appeal, along with any supporting documentation or evidence. It is crucial to carefully review the appeal process guidelines and ensure that you meet all the required steps and deadlines. Seeking professional guidance from a tax expert or legal advisor can be beneficial during the appeal process.