San Francisco County Tax Collector

Welcome to an in-depth exploration of the San Francisco County Tax Collector's office, an essential government entity that plays a crucial role in the city's administration and finance. This comprehensive guide will delve into the various facets of the Tax Collector's operations, shedding light on their services, responsibilities, and impact on the community.

The Role and Significance of the San Francisco County Tax Collector

The San Francisco County Tax Collector is an appointed official responsible for overseeing the collection and management of various taxes and fees within the county. This vital role ensures the city’s financial stability and contributes significantly to the overall economic health of the region. From property taxes to business taxes and other revenue streams, the Tax Collector’s office handles a diverse range of financial responsibilities, each playing a critical role in the city’s operations.

With a focus on transparency, efficiency, and fairness, the Tax Collector's office serves as a vital link between the government and the taxpayers of San Francisco. Their work ensures that the city receives the necessary funds to maintain infrastructure, provide essential services, and support community initiatives. Moreover, the office plays a crucial role in fostering economic growth by facilitating a stable and predictable tax environment for businesses and residents alike.

Services Offered by the San Francisco County Tax Collector

The San Francisco County Tax Collector offers a wide array of services tailored to meet the diverse needs of the community. These services are designed to simplify the tax payment process, provide assistance to taxpayers, and ensure compliance with the law.

Property Tax Services

One of the primary responsibilities of the Tax Collector’s office is the administration of property taxes. This involves assessing the value of properties within the county, issuing tax bills, and collecting property tax payments. The office also provides assistance to homeowners and property owners, offering guidance on payment options, tax exemptions, and appeals processes.

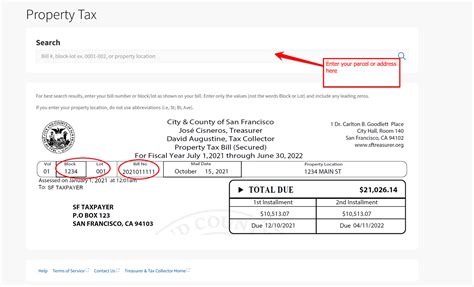

For instance, the Tax Collector's website offers an online property tax lookup tool, allowing taxpayers to easily access their property tax information. This tool provides real-time data, including the assessed value of the property, the current tax rate, and the estimated tax amount. This transparency ensures that taxpayers are well-informed and can plan their finances accordingly.

Business Tax Services

The office also handles business taxes, including the collection of business license fees, payroll taxes, and other relevant taxes. They provide resources and support to help businesses understand their tax obligations and ensure compliance. This includes offering guidance on tax registration, payment deadlines, and the various tax forms and documents required.

One notable initiative is the Business Tax E-Filing system, which allows businesses to file their tax returns and make payments online. This system not only streamlines the process but also reduces the environmental impact by minimizing the use of paper. Additionally, the Tax Collector's office offers a Business Tax Assistance Program, providing free tax consultation and support to small businesses.

Other Tax Services

Beyond property and business taxes, the Tax Collector’s office also manages other revenue streams. This includes the collection of vehicle registration fees, personal property taxes, and various other taxes and fees. They provide a comprehensive range of services to ensure that all taxpayers can fulfill their financial obligations to the county.

For example, the office offers a convenient online payment portal, allowing taxpayers to make payments for various taxes and fees using their credit or debit cards. This service is available 24/7, providing taxpayers with the flexibility to manage their payments at their convenience.

Performance and Transparency

The San Francisco County Tax Collector’s office is committed to maintaining high standards of performance and transparency. They strive to ensure that the tax collection process is efficient, fair, and accessible to all taxpayers. This commitment is reflected in their various initiatives and the data they publish, providing insight into their operations and performance.

Data and Performance Metrics

The Tax Collector’s office regularly publishes data and performance metrics, offering a transparent view of their operations. This data includes information on tax collections, delinquent accounts, and the efficiency of their processes. For instance, their annual report provides a comprehensive overview of the previous year’s activities, including the total tax revenue collected, the number of tax payments processed, and the percentage of timely payments.

Furthermore, the office provides detailed information on their collection rates, outlining the percentage of taxes collected for each type of tax. This data not only demonstrates their effectiveness but also highlights areas where they may need to improve. By making this data publicly available, the Tax Collector's office fosters accountability and allows the community to understand the impact of their work.

Initiatives for Taxpayer Assistance

The Tax Collector’s office is dedicated to assisting taxpayers and ensuring they have the resources they need. They offer a variety of initiatives and programs to support taxpayers, including tax clinics, workshops, and online resources. These initiatives aim to educate taxpayers about their rights and responsibilities, provide guidance on tax compliance, and offer assistance with complex tax issues.

One notable program is the Taxpayer Advocate Service, which provides personalized assistance to taxpayers facing complex or difficult tax situations. This service offers one-on-one support, helping taxpayers navigate the tax system and find solutions to their tax-related problems. Additionally, the Tax Collector's office regularly hosts community events and outreach programs, ensuring that taxpayers have access to the information and support they need.

Community Impact and Future Initiatives

The work of the San Francisco County Tax Collector extends beyond tax collection. Their efforts have a significant impact on the community, influencing economic development, infrastructure improvements, and community initiatives. The tax revenue collected is reinvested into the city, supporting a range of essential services and projects that benefit residents and businesses alike.

Economic Development and Job Creation

The Tax Collector’s office plays a pivotal role in fostering economic growth and job creation within the county. By efficiently collecting taxes and ensuring compliance, they contribute to a stable and predictable business environment. This, in turn, encourages investment, attracts new businesses, and supports the growth of existing ones. The revenue generated also funds various economic development initiatives, such as business incubation programs and job training schemes.

Infrastructure and Community Projects

Tax revenue is a key source of funding for infrastructure development and community projects. This includes the construction and maintenance of roads, bridges, public transportation systems, and other critical infrastructure. Additionally, the Tax Collector’s office supports a range of community initiatives, from arts and cultural programs to environmental projects and social services. Their work ensures that the community’s needs are met and that San Francisco remains a vibrant and sustainable city.

Future Initiatives and Technological Advancements

Looking ahead, the San Francisco County Tax Collector’s office is committed to continuous improvement and innovation. They are exploring new technologies and digital solutions to enhance their services and improve the taxpayer experience. This includes the development of mobile apps for tax payments, the integration of blockchain technology for secure and transparent transactions, and the implementation of artificial intelligence for more efficient data analysis and processing.

Furthermore, the office is dedicated to expanding its outreach and education programs. They aim to increase taxpayer awareness and understanding of the tax system, ensuring that everyone has the knowledge and resources to fulfill their tax obligations. By investing in these initiatives, the Tax Collector's office is not only improving its services but also strengthening the community's relationship with the government.

Conclusion

The San Francisco County Tax Collector’s office is a vital component of the city’s administration, playing a crucial role in the financial health and well-being of the community. Through their dedicated work and commitment to transparency and efficiency, they ensure that the city’s tax system is fair, accessible, and supportive of the community’s needs. As they continue to innovate and improve their services, the Tax Collector’s office will remain a cornerstone of San Francisco’s economic and social development.

Frequently Asked Questions

What is the role of the San Francisco County Tax Collector?

+The San Francisco County Tax Collector is responsible for collecting and managing various taxes and fees within the county, including property taxes, business taxes, and other revenue streams. They ensure the city receives the necessary funds to maintain infrastructure, provide services, and support community initiatives.

How can I pay my property taxes in San Francisco County?

+You can pay your property taxes online through the Tax Collector’s website, by mail, or in person at the Tax Collector’s office. The office accepts credit/debit card payments, e-checks, and cash. It’s important to note the payment deadlines to avoid penalties and interest.

What assistance programs does the Tax Collector offer to taxpayers?

+The Tax Collector’s office provides a range of assistance programs, including the Taxpayer Advocate Service, which offers personalized support to taxpayers facing complex tax situations. They also host tax clinics, workshops, and community events to educate and assist taxpayers.

How does the Tax Collector ensure transparency and accountability?

+The Tax Collector’s office is committed to transparency and regularly publishes data and performance metrics on their website. This includes information on tax collections, delinquent accounts, and the efficiency of their processes. They also welcome public feedback and inquiries to ensure accountability.

What is the impact of the Tax Collector’s work on the community?

+The Tax Collector’s work has a significant impact on the community, as the tax revenue collected is reinvested into the city. This supports economic development, infrastructure improvements, and a range of community initiatives, from arts programs to social services. It ensures that San Francisco remains a thriving and sustainable city.