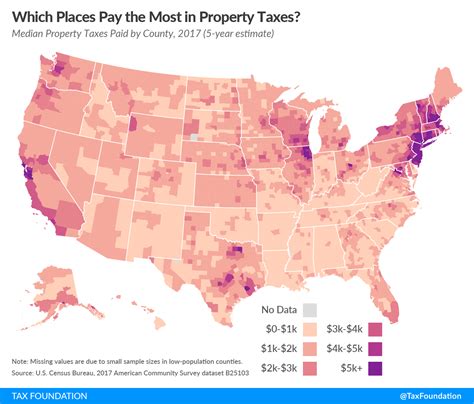

Clark County Property Tax

Welcome to an in-depth exploration of Clark County's property tax system, a critical component of the local economy and a topic of interest for many residents and property owners. Understanding how property taxes work and their implications is essential for making informed financial decisions and contributing to the vibrant community of Clark County.

The Clark County Property Tax System: An Overview

Property taxes in Clark County are a significant source of revenue for the local government, funding various essential services and infrastructure projects. The tax system is designed to ensure a fair and equitable distribution of the tax burden among property owners, taking into consideration the value of their real estate holdings.

The Clark County Assessor's Office plays a pivotal role in this process, responsible for assessing the value of each property within the county. This valuation is a critical determinant of the property tax liability for each owner. The assessment process is intricate, involving the evaluation of numerous factors, including the property's location, size, condition, and recent sales data.

Understanding Property Tax Rates

The property tax rate in Clark County is expressed as a millage rate, which is the amount of tax levied per $1,000 of assessed property value. This rate is subject to change annually and is determined by the Clark County Commission and other taxing authorities within the county, such as school districts and special taxing districts.

The millage rate is the product of two components: the basic rate, set by the county commission, and the supplemental rate, which varies depending on the specific taxing district in which the property is located. These rates are combined to determine the total millage rate applicable to each property.

| Taxing Authority | Millage Rate (Per $1,000 of Assessed Value) |

|---|---|

| Clark County General Fund | 50.00 |

| Clark County School District | 80.25 |

| Special Districts (e.g., Fire Protection, Parks & Recreation) | Varies by District |

Assessed Value and Tax Liability

The assessed value of a property is determined through a meticulous process, taking into account recent sales of similar properties, construction costs, and other relevant factors. This assessed value is then multiplied by the applicable millage rate to calculate the property tax liability.

For example, if a property has an assessed value of $200,000 and the total millage rate is 130.25 mills, the property tax liability would be calculated as follows: $200,000 x 0.13025 = $26,050. This amount would be the annual property tax bill for the owner.

Property Tax Exemptions and Relief Programs

Clark County recognizes the financial burden that property taxes can place on certain individuals and offers a range of exemptions and relief programs to ease this burden. These programs are designed to assist seniors, veterans, and low-income homeowners, among others.

Senior Citizen Exemption

Clark County offers a partial property tax exemption for senior citizens who meet certain age and income requirements. To qualify, homeowners must be at least 65 years old and have a total household income of less than 50,000 per year. The exemption reduces the assessed value of the property by up to 300,000, resulting in a significant decrease in the property tax liability.

Veteran’s Exemption

Honoring the service of veterans, Clark County provides a property tax exemption for those who have served in the U.S. Armed Forces. This exemption reduces the assessed value of the property by up to $150,000, leading to a substantial reduction in the tax liability. To qualify, veterans must have been honorably discharged and must occupy the property as their primary residence.

Low-Income Homeowner Assistance

Clark County understands the challenges faced by low-income homeowners and offers a Property Tax Relief Program to assist them. This program provides a reduction in property taxes for qualifying homeowners, with the potential for a 50% reduction in the tax liability. The eligibility criteria include income limits and an assessment of the homeowner’s ability to pay.

The Impact of Property Taxes on the Community

Property taxes are a crucial component of the financial foundation that supports the community of Clark County. The revenue generated from these taxes is used to fund a wide range of essential services and initiatives, contributing to the overall well-being and prosperity of the county.

Essential Services and Infrastructure

A significant portion of property tax revenue is allocated to critical services, including law enforcement, fire protection, and emergency response. These services are vital for the safety and security of residents and visitors alike. Additionally, property taxes fund the maintenance and improvement of infrastructure, such as roads, bridges, and public transportation systems, ensuring a high quality of life for the community.

Education and Youth Development

Clark County’s property taxes play a pivotal role in supporting the local education system. A substantial portion of the tax revenue is dedicated to funding public schools, ensuring that students receive a quality education. This investment in education has a long-term impact on the community, fostering a skilled and knowledgeable workforce and contributing to the county’s economic growth and development.

Community Programs and Initiatives

Beyond essential services, property taxes also support a range of community programs and initiatives. These include recreational facilities, cultural events, and programs aimed at enhancing the quality of life for residents. From parks and libraries to arts programs and senior centers, property taxes play a crucial role in fostering a vibrant and inclusive community.

Property Tax Appeals and Grievance Process

In instances where property owners believe their assessed value is inaccurate or excessive, Clark County provides a formal process for appealing the assessment. This process allows property owners to challenge the valuation and seek a fair and accurate determination of their property’s value.

Steps to File an Appeal

To initiate an appeal, property owners must first submit a Notice of Appeal to the Clark County Assessor’s Office within a specified timeframe. This notice should outline the reasons for the appeal and provide any relevant evidence or documentation to support the owner’s case. The Assessor’s Office will then review the appeal and make a determination, which will be communicated to the property owner.

Hearing Process

If the property owner is dissatisfied with the Assessor’s determination, they have the right to request a hearing before the Clark County Board of Equalization. This board is an independent body responsible for reviewing property tax appeals and making final decisions. During the hearing, property owners can present their case, provide evidence, and argue why the assessed value should be adjusted.

Resolution and Next Steps

Following the hearing, the Board of Equalization will issue a decision, which may involve a reduction, increase, or affirmation of the original assessed value. If the property owner is still dissatisfied with the outcome, they have the option to appeal further, either to the Nevada Tax Commission or to the courts, depending on the nature and severity of the case.

Conclusion: A Fair and Equitable System

The Clark County property tax system is designed to be fair and equitable, ensuring that each property owner contributes their fair share while also recognizing the financial challenges faced by certain individuals and providing support through exemptions and relief programs. Understanding this system is crucial for property owners to make informed decisions and contribute to the vibrant community of Clark County.

What is the timeline for paying property taxes in Clark County?

+

Property taxes in Clark County are due in two installments. The first installment is due on November 1st and the second installment is due on March 1st of the following year. Late payments are subject to penalties and interest charges.

How can I estimate my property tax liability before receiving my tax bill?

+

You can estimate your property tax liability by multiplying your property’s assessed value by the applicable millage rate. However, it’s important to note that the assessed value may change annually, so it’s advisable to consult with the Clark County Assessor’s Office for the most accurate information.

Are there any online tools available to help me understand my property tax bill?

+

Yes, Clark County provides an online property tax estimator tool on its official website. This tool allows property owners to input their property details and receive an estimated tax liability. It’s a useful resource for understanding your tax bill and planning your finances accordingly.

Can I receive a discount if I pay my property taxes early?

+

No, Clark County does not offer early payment discounts for property taxes. However, timely payment is essential to avoid late fees and penalties.