H R Block Tax Software 2025

Welcome to an in-depth exploration of the future of tax preparation with a focus on the H&R Block Tax Software for the year 2025. In this article, we delve into the advancements and innovations that are shaping the tax landscape and how H&R Block is poised to meet the evolving needs of taxpayers. As we navigate the complexities of the modern tax system, the role of intuitive and user-friendly software becomes increasingly vital. With each passing year, the tax code becomes more intricate, and the demand for accessible and efficient tax preparation tools grows. H&R Block, a pioneer in the tax industry, is committed to staying ahead of the curve, ensuring that its software remains a trusted companion for individuals and businesses alike.

Revolutionizing Tax Preparation: H&R Block's Vision for 2025

As we step into the year 2025, the tax preparation industry is undergoing a significant transformation. H&R Block, with its rich history and innovative spirit, is at the forefront of this evolution. The company's unwavering commitment to providing top-notch tax solutions has resulted in the development of cutting-edge software that simplifies the tax filing process, making it more accessible and efficient than ever before.

H&R Block Tax Software 2025 is designed to revolutionize the way taxpayers interact with their tax obligations. With an emphasis on user experience, ease of use, and advanced tax optimization strategies, the software aims to make tax filing a seamless and stress-free process. Let's explore the key features and advancements that set H&R Block apart in the competitive world of tax preparation.

Intuitive User Interface: A Tax Filing Experience Like No Other

One of the standout features of H&R Block Tax Software 2025 is its intuitive and user-friendly interface. The software is designed with the understanding that taxpayers come from diverse backgrounds and may have varying levels of tax expertise. By creating a simple and straightforward navigation system, H&R Block ensures that users can easily find the tools and information they need, regardless of their technical proficiency.

The interface is organized logically, guiding users through the tax filing process step by step. Clear and concise instructions, coupled with interactive elements, make it a breeze for taxpayers to input their information accurately. Whether it's entering income details, claiming deductions, or reviewing tax calculations, the software provides a seamless experience, minimizing the chances of errors and ensuring a smooth journey towards tax compliance.

Advanced Tax Optimization: Maximizing Refunds and Minimizing Headaches

H&R Block's expertise in tax optimization is a cornerstone of its success. The software leverages advanced algorithms and machine learning techniques to identify opportunities for tax savings. By analyzing a taxpayer's unique financial situation, the software suggests deductions, credits, and tax-saving strategies that are tailored to their specific needs.

For instance, the software takes into account factors such as investment income, business expenses, charitable contributions, and education-related deductions. It then applies complex tax calculations to determine the most advantageous tax position for the taxpayer. This not only helps maximize refunds but also ensures that taxpayers receive the full benefits they are entitled to under the tax code.

Furthermore, H&R Block Tax Software 2025 stays up-to-date with the latest tax law changes, ensuring that taxpayers are aware of any new deductions or credits they may be eligible for. The software's ability to adapt to the dynamic nature of tax laws is a significant advantage, providing users with peace of mind and confidence in their tax filings.

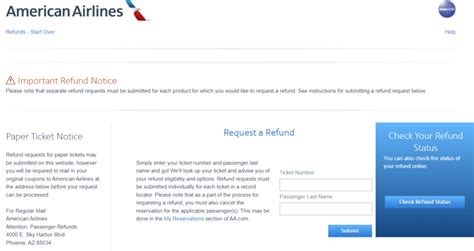

Enhanced Security Measures: Protecting Taxpayers' Sensitive Information

In an era where cybersecurity threats are ever-present, H&R Block recognizes the importance of safeguarding taxpayers' sensitive information. The company has invested heavily in developing robust security protocols to protect user data during the tax filing process.

H&R Block Tax Software 2025 employs state-of-the-art encryption technologies to secure taxpayers' personal and financial information. From the moment users log in to the software, their data is encrypted, ensuring that it remains confidential and inaccessible to unauthorized individuals. The software also implements multi-factor authentication, adding an extra layer of protection to prevent unauthorized access.

Additionally, H&R Block has implemented strict data storage and retention policies, ensuring that user data is only retained for the necessary period and then securely deleted. This commitment to data privacy and security aligns with the company's core values and demonstrates its dedication to protecting taxpayers' interests.

Seamless Integration with Third-Party Apps and Services

H&R Block understands that taxpayers often rely on a range of financial tools and services to manage their finances. To enhance the overall tax filing experience, the company has integrated its software with popular third-party apps and platforms.

For instance, H&R Block Tax Software 2025 seamlessly integrates with popular accounting software, allowing taxpayers to import their financial data directly into the tax filing platform. This integration streamlines the process, eliminating the need for manual data entry and reducing the chances of errors. Similarly, the software integrates with investment platforms, enabling taxpayers to retrieve their investment-related information effortlessly.

By partnering with leading financial institutions and service providers, H&R Block ensures that taxpayers have a comprehensive and connected tax filing experience. This integration of multiple services under one platform saves taxpayers time and effort, making the tax filing process more efficient and convenient.

Real-Time Tax Guidance: Expert Support at Your Fingertips

One of the unique features of H&R Block Tax Software 2025 is its real-time tax guidance system. Understanding that taxpayers may have questions or face complexities during the filing process, the software provides instant access to expert tax advice.

Through an integrated chat feature, users can connect with experienced tax professionals who are available 24/7. These tax experts can provide clarification on specific tax scenarios, offer guidance on filing strategies, and address any concerns that taxpayers may have. This real-time support ensures that taxpayers can navigate the tax filing journey with confidence, knowing that expert assistance is just a click away.

Additionally, the software incorporates a comprehensive knowledge base, containing detailed articles, tutorials, and FAQs. Taxpayers can easily search for information on various tax-related topics, further enhancing their understanding of the tax landscape and empowering them to make informed decisions.

Mobile Accessibility: Tax Filing on the Go

In today's fast-paced world, taxpayers often require flexibility and convenience when it comes to their tax obligations. Recognizing this, H&R Block Tax Software 2025 is optimized for mobile devices, allowing users to access the platform from anywhere, at any time.

The mobile version of the software offers a seamless experience, ensuring that taxpayers can complete their tax filings without being tied to a desktop or laptop. Whether it's entering income details, reviewing tax calculations, or e-filing their returns, taxpayers can manage their tax affairs from the comfort of their smartphones or tablets.

The mobile app is designed with the same intuitive interface as the desktop version, making it easy for users to navigate and complete their tax filings. With push notifications and real-time updates, taxpayers can stay informed about the status of their tax filings, ensuring a stress-free experience even when on the go.

Data-Driven Insights: Empowering Taxpayers with Informed Decisions

H&R Block Tax Software 2025 goes beyond traditional tax filing by providing users with valuable insights and analytics. The software utilizes advanced data analytics tools to generate customized reports and visual representations of taxpayers' financial data.

These insights help taxpayers understand their financial position, identify areas for improvement, and make informed decisions regarding their tax strategies. For instance, the software may highlight trends in spending patterns, suggest tax-efficient savings strategies, or provide an overview of the taxpayer's overall tax liability.

By empowering taxpayers with data-driven insights, H&R Block enables them to take control of their financial future. This proactive approach to tax planning ensures that taxpayers are not only compliant with tax regulations but also strategically positioned to optimize their financial well-being.

The Impact of H&R Block Tax Software 2025 on Taxpayers

The introduction of H&R Block Tax Software 2025 marks a significant milestone in the evolution of tax preparation. The software's advanced features and user-centric design have the potential to transform the tax filing experience for millions of taxpayers.

For individuals and families, the software simplifies the often daunting task of tax filing. With its intuitive interface and real-time guidance, taxpayers can navigate the complexities of the tax code with confidence. The software's ability to maximize refunds and provide personalized tax optimization strategies ensures that taxpayers receive the full benefits they are entitled to, empowering them to make the most of their hard-earned money.

For small business owners and entrepreneurs, H&R Block Tax Software 2025 offers a comprehensive solution for their tax needs. The software's seamless integration with accounting and investment platforms streamlines the tax filing process, saving valuable time and resources. By providing expert tax guidance and data-driven insights, the software helps business owners make informed decisions, optimize their tax positions, and focus on growing their ventures.

Furthermore, the software's mobile accessibility and real-time updates ensure that taxpayers stay connected and informed throughout the tax filing journey. Whether it's receiving notifications about upcoming tax deadlines or tracking the progress of their tax returns, taxpayers can stay on top of their tax obligations with ease.

Future Outlook: H&R Block's Commitment to Innovation

As we look towards the future, H&R Block remains committed to staying at the forefront of tax innovation. The company's investment in research and development ensures that its software continues to evolve, adapting to the changing needs of taxpayers and the ever-evolving tax landscape.

H&R Block recognizes that technology plays a pivotal role in shaping the tax preparation industry. By leveraging advanced technologies such as artificial intelligence, machine learning, and blockchain, the company aims to further enhance the tax filing experience. These technologies have the potential to revolutionize tax filing, making it even more efficient, secure, and accessible.

Additionally, H&R Block is actively engaged in partnerships and collaborations with industry leaders and startups to stay abreast of emerging trends and developments. By fostering an innovative ecosystem, the company ensures that its software remains at the cutting edge, providing taxpayers with the best possible solutions.

Conclusion: Embracing the Future of Tax Preparation

H&R Block Tax Software 2025 represents a significant leap forward in the world of tax preparation. With its intuitive design, advanced tax optimization strategies, and commitment to data security, the software sets a new standard for tax filing. By embracing technology and innovation, H&R Block continues to empower taxpayers, making the tax filing process more accessible, efficient, and stress-free.

As we navigate the complexities of the modern tax system, H&R Block stands as a trusted partner, guiding taxpayers towards financial success and compliance. With its vision for the future, the company ensures that taxpayers can embrace the opportunities and challenges that lie ahead, knowing that they have a reliable and innovative tax preparation solution by their side.

How does H&R Block Tax Software 2025 ensure data security during the tax filing process?

+H&R Block Tax Software 2025 employs advanced encryption technologies to secure taxpayers’ personal and financial information. The software also implements multi-factor authentication to prevent unauthorized access. Additionally, the company follows strict data storage and retention policies to ensure user data is protected.

Can H&R Block Tax Software 2025 integrate with third-party accounting software and platforms?

+Yes, H&R Block Tax Software 2025 seamlessly integrates with popular accounting software and investment platforms. This integration allows taxpayers to import their financial data directly into the tax filing platform, streamlining the process and reducing manual errors.

What kind of expert support is available through H&R Block Tax Software 2025’s real-time guidance system?

+H&R Block Tax Software 2025 provides access to experienced tax professionals through an integrated chat feature. These experts can offer guidance on specific tax scenarios, filing strategies, and address any concerns taxpayers may have. Additionally, the software includes a comprehensive knowledge base with detailed articles and FAQs.

Is H&R Block Tax Software 2025 optimized for mobile devices?

+Absolutely! H&R Block Tax Software 2025 is designed to be fully accessible on mobile devices. Taxpayers can complete their tax filings on their smartphones or tablets, ensuring flexibility and convenience.