Ventura Sales Tax

The city of Ventura, nestled along the picturesque California coast, has a rich history and a vibrant economy. As an essential part of its fiscal landscape, the Ventura Sales Tax plays a pivotal role in funding local initiatives and services. This article aims to delve into the intricacies of Ventura's sales tax system, exploring its rates, applications, and impact on the community.

Understanding the Ventura Sales Tax Structure

Ventura, like many cities in California, operates within a complex sales tax system. This system is composed of both state and local taxes, with each level contributing to the overall sales tax rate.

State Sales Tax

The state of California imposes a statewide sales tax to fund various state-wide programs and services. As of the last update, the state sales tax rate stands at 7.25%, a figure that is consistent across the state.

Local Sales Tax

In addition to the state sales tax, Ventura levies its own local sales tax, known as the city sales tax. This additional tax is applied on top of the state rate and is used to support local projects and initiatives. As of our most recent data, the Ventura city sales tax rate is 1.25%, bringing the total sales tax rate in Ventura to 8.50%.

It's important to note that the city sales tax rate can vary across different cities and counties within California. This local variation allows cities to raise funds for specific local needs, such as infrastructure development, public safety, or community services.

Taxable Items and Exemptions

The Ventura Sales Tax applies to a wide range of tangible personal property and services purchased within the city limits. This includes items like clothing, electronics, furniture, and groceries. However, there are certain exemptions to the sales tax, such as prescription medications, most food items, and certain agricultural products.

Additionally, some services, like medical and educational services, are also exempt from sales tax. It's worth mentioning that the specific items and services subject to sales tax can vary based on state and local regulations, so it's always a good idea to stay informed about the latest tax laws.

How Ventura Sales Tax Benefits the Community

The revenue generated from the Ventura Sales Tax is a crucial source of funding for the city’s operations and development. Here’s a closer look at how the sales tax benefits the Ventura community:

Funding Essential Services

The sales tax revenue is a primary source of funding for essential city services, including police and fire protection, street maintenance, and waste management. These services are vital to the daily lives and safety of Ventura residents.

For instance, a significant portion of the sales tax revenue goes towards maintaining the city's renowned public safety department, ensuring that Ventura remains a safe and secure place to live and visit.

Supporting Infrastructure Projects

Ventura’s sales tax revenue also plays a key role in funding infrastructure projects, such as road repairs, bridge maintenance, and the development of new public spaces. These projects not only enhance the city’s aesthetics and functionality but also contribute to its economic growth and sustainability.

One notable example is the recent revitalization of Ventura's downtown area, which was made possible in part by sales tax revenue. The project transformed the downtown into a vibrant hub for businesses and community gatherings, boosting the local economy and enhancing the overall quality of life for residents.

Investing in Community Programs

A portion of the sales tax revenue is allocated towards community programs and initiatives that enhance the well-being and opportunities for Ventura residents. These programs cover a wide range of areas, including recreation and leisure, arts and culture, and education.

One such initiative is the Ventura Youth Center, which provides a safe and enriching environment for local youth, offering activities and resources that foster personal growth and community involvement. The sales tax revenue ensures that this vital community asset remains accessible and well-supported.

The Future of Ventura Sales Tax

As Ventura continues to evolve and grow, the role of the sales tax in shaping the city’s future becomes increasingly significant. Here’s a glimpse into the potential implications and considerations surrounding the Ventura Sales Tax:

Economic Growth and Development

Ventura’s sales tax revenue is expected to play a pivotal role in facilitating economic growth and development in the coming years. As the city attracts new businesses and residents, the sales tax will continue to be a key driver of economic prosperity, funding vital infrastructure and services that support a thriving community.

One potential area of focus is the development of a robust tech sector in Ventura. With the right infrastructure and incentives, the city could become a hub for tech startups and innovation, creating new job opportunities and contributing to a diverse and dynamic local economy.

Addressing Social Needs

The sales tax revenue also presents an opportunity to address pressing social needs within the community. This could involve investing in initiatives to combat homelessness, improve affordable housing options, and enhance access to healthcare and social services.

For instance, the city could allocate a portion of the sales tax revenue to support local non-profit organizations that provide vital services to underserved populations. This would not only improve the quality of life for those in need but also foster a more equitable and resilient community.

Maintaining a Competitive Tax Environment

While the Ventura Sales Tax is an essential tool for funding local initiatives, it’s crucial to maintain a competitive tax environment to attract businesses and residents. This involves carefully considering the balance between tax rates and the services and amenities provided.

The city might explore strategies such as offering tax incentives for new businesses or lowering tax rates for certain industries, especially those that align with Ventura's economic development goals. Such measures could make Ventura more attractive to businesses and investors, ultimately boosting the local economy.

How often are sales tax rates updated in Ventura?

+Sales tax rates in Ventura, as in many cities, are subject to change. These changes typically occur when there are shifts in state or local regulations, or when new initiatives require additional funding. While there is no set schedule for updates, it’s important for businesses and residents to stay informed about any changes to the sales tax rates.

Are there any online resources to help me calculate the total sales tax in Ventura?

+Yes, there are several online tools and calculators available that can help you determine the total sales tax in Ventura. These tools typically consider the combined state and local sales tax rates, making it easier to estimate the final cost of purchases. Simply search for “Ventura sales tax calculator” to find these resources.

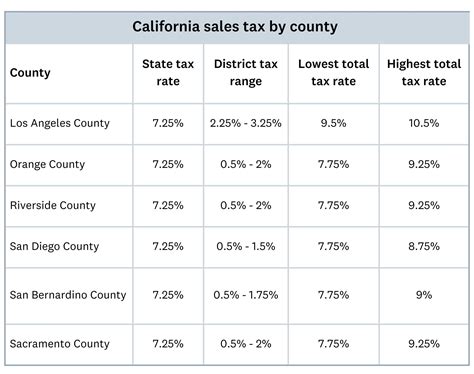

How does Ventura’s sales tax compare to other cities in California?

+Ventura’s total sales tax rate of 8.50% is on the lower end compared to many other cities in California. For instance, cities like San Francisco and Los Angeles have total sales tax rates exceeding 10%. This can make Ventura an attractive destination for shoppers seeking lower tax rates.

Are there any special tax holidays or exemptions in Ventura?

+While Ventura doesn’t have specific tax holidays, there are certain exemptions and special tax rates for certain items. For example, some cities in California have designated “Back to School” tax holidays, where certain school supplies and clothing are exempt from sales tax. It’s always a good idea to check for any ongoing tax exemptions or special rates.