Free Tax Usa Login

Welcome to the comprehensive guide on Free Tax USA Login, a platform designed to simplify the tax filing process for individuals and small businesses. In today's fast-paced world, managing finances and staying on top of tax obligations can be challenging. That's where Free Tax USA steps in, offering a user-friendly and efficient solution. This article will delve into the features, benefits, and step-by-step process of using the Free Tax USA platform, ensuring you have a seamless experience.

The Free Tax USA Platform: An Overview

Free Tax USA is an online tax preparation and filing service that has gained popularity for its ease of use and cost-effectiveness. The platform was developed with the aim of providing a streamlined tax experience, especially for those who may find traditional tax filing methods daunting or time-consuming. With a focus on simplicity and accessibility, Free Tax USA has become a go-to choice for many taxpayers.

One of the key advantages of Free Tax USA is its user-friendly interface. The platform is designed with a clean and intuitive layout, making it easy for users of all technical backgrounds to navigate and understand. Whether you're a first-time user or a seasoned taxpayer, the platform's straightforward approach ensures a smooth and stress-free tax filing journey.

Key Features of Free Tax USA

- Secure Data Encryption: Free Tax USA prioritizes the security of your personal and financial information. The platform utilizes advanced encryption protocols to safeguard your data during transmission and storage, ensuring peace of mind while filing your taxes.

- Step-by-Step Guidance: The platform provides clear and concise instructions at every step of the filing process. From gathering necessary documents to entering financial details, Free Tax USA offers comprehensive guidance, making it accessible even for those with limited tax knowledge.

- Real-Time Error Checking: To minimize errors and potential audits, Free Tax USA employs real-time error-checking mechanisms. As you input your information, the system identifies potential issues and provides instant feedback, helping you file accurate tax returns.

- Multiple Filing Options: Free Tax USA supports various filing scenarios, catering to different taxpayer needs. Whether you’re an individual filer, a business owner, or have complex tax situations, the platform offers tailored solutions to ensure accurate and timely filing.

Additionally, Free Tax USA provides valuable resources and tools to enhance your tax filing experience. These include tax calculators, deduction estimators, and helpful articles covering a wide range of tax-related topics. With these resources, you can optimize your tax strategy and make informed decisions.

Getting Started: The Free Tax USA Login Process

Logging into your Free Tax USA account is a straightforward process, ensuring a quick and seamless connection to your tax information. Here’s a step-by-step guide to help you get started:

- Visit the Official Website: Begin by accessing the Free Tax USA website. You can find it by searching for "Free Tax USA" in your preferred web browser. The official website URL is https://www.freetaxusa.com.

- Click on "Login": Once you're on the homepage, locate the "Login" button, typically found in the upper right corner of the screen. Clicking on it will direct you to the login page.

- Enter Your Credentials: On the login page, you'll be prompted to enter your username and password. Ensure that you use the correct credentials associated with your Free Tax USA account. If you're a new user, you can create an account by clicking on the "Sign Up" or "Register" option.

- Secure Login: After entering your credentials, click on the "Log In" button. The platform will verify your information, and you'll be securely logged into your account.

- Dashboard Overview: Upon successful login, you'll be directed to your personalized dashboard. Here, you'll find an overview of your tax information, including any previously filed returns, current filing status, and important notifications.

It's worth noting that Free Tax USA prioritizes user privacy and security. The platform employs robust security measures to protect your data, including secure socket layer (SSL) encryption and two-factor authentication options. These measures ensure that your tax information remains confidential and inaccessible to unauthorized individuals.

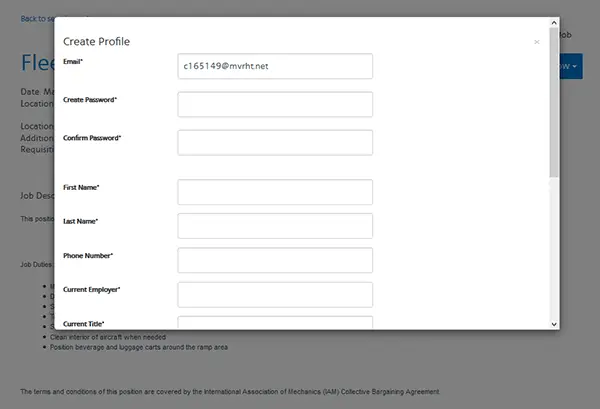

Creating a Free Tax USA Account

If you’re a new user, creating an account on Free Tax USA is a simple process. Here’s a guide to help you get started:

- Access the Registration Page: Visit the Free Tax USA website and click on the "Sign Up" or "Register" option. This will direct you to the registration page.

- Provide Basic Information: On the registration page, you'll be asked to provide some basic details, including your name, email address, and a preferred username. Ensure that the email address you provide is active and accessible, as it will be used for important account-related communications.

- Set a Secure Password: Choose a strong and unique password for your Free Tax USA account. A combination of uppercase and lowercase letters, numbers, and special characters is recommended to enhance security.

- Verify Your Email: After completing the registration form, you'll receive an email with a verification link. Click on the link to confirm your email address. This step is crucial to ensure that your account is secure and accessible only to you.

- Activate Your Account: Once you've verified your email, log in to your Free Tax USA account using the credentials you created. You'll now have full access to the platform's features and can begin filing your taxes.

Remember, it's important to keep your account information secure and not share your login credentials with anyone. Regularly updating your password and enabling two-factor authentication can further enhance the security of your Free Tax USA account.

Navigating the Free Tax USA Dashboard

The Free Tax USA dashboard serves as your central hub for managing your tax-related activities. It provides a comprehensive overview of your tax situation and offers easy access to various tools and features. Here’s a closer look at what you can expect from the dashboard:

- Tax Return Overview: The dashboard displays a summary of your tax returns, including the status of your current filing, any past returns, and important deadlines. This overview helps you stay organized and on top of your tax obligations.

- Quick Access to Tools: From the dashboard, you can easily access essential tax preparation tools. These include calculators for estimating deductions, estimating tax refunds, and evaluating the impact of tax credits. These tools empower you to make informed decisions during the filing process.

- Personalized Recommendations: Based on your tax situation and previous filings, Free Tax USA may offer personalized recommendations to optimize your tax strategy. These recommendations can include suggestions for deductions, credits, or other tax-saving opportunities tailored to your specific circumstances.

- Secure Document Storage: The dashboard provides a secure storage space for important tax-related documents. You can upload and store documents such as W-2 forms, 1099s, and other relevant paperwork. This feature ensures that you have easy access to your documents when needed, eliminating the hassle of physical storage and potential misplacement.

The Free Tax USA dashboard is designed with simplicity and efficiency in mind. Its intuitive layout and user-friendly interface make it easy to navigate and understand, even for users who are new to online tax filing. With just a few clicks, you can access the tools and information you need to complete your tax return accurately and efficiently.

Using the Free Tax USA Filing Wizard

One of the standout features of Free Tax USA is its intuitive filing wizard, which guides you through the tax filing process step by step. Here’s how it works:

- Start the Wizard: From your dashboard, locate and click on the "Start Filing" button. This will initiate the filing wizard, taking you through a series of straightforward questions and prompts.

- Provide Basic Information: The wizard will begin by asking for basic personal information, such as your name, address, and social security number. It's important to provide accurate and up-to-date information to ensure the accuracy of your tax return.

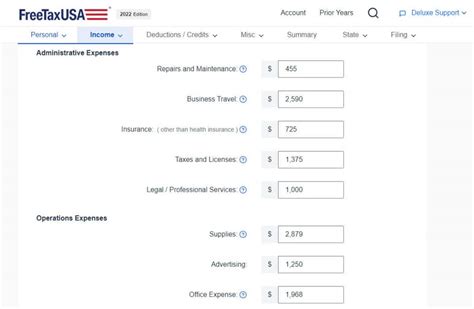

- Income and Deduction Details: Next, you'll be prompted to enter details about your income, deductions, and tax credits. The wizard provides clear instructions and helps you identify the relevant forms and schedules to complete. If you have any uncertainties, Free Tax USA offers helpful tips and explanations to guide you through the process.

- Review and Verify: Once you've provided all the necessary information, the wizard will generate a draft of your tax return. Review the draft carefully, ensuring that all the details are accurate. You can make edits and adjustments as needed before finalizing your return.

- E-File and Payment Options: After verifying your tax return, you can choose to e-file your taxes directly from the Free Tax USA platform. The platform offers secure e-filing options, ensuring a quick and efficient process. Additionally, you can explore various payment options, including direct debit, credit card payments, or even paying from your tax refund.

Throughout the filing process, Free Tax USA provides real-time support and assistance. If you encounter any challenges or have questions, the platform offers a dedicated support team that can be reached via live chat, email, or phone. This ensures that you have the guidance you need to complete your tax return with confidence.

Free Tax USA’s Support and Resources

Free Tax USA understands that tax filing can be complex and sometimes overwhelming. To ensure a smooth and stress-free experience, the platform offers a range of support and resources to assist users at every step of the way.

Customer Support Options

Free Tax USA provides multiple channels for users to seek assistance. Whether you have a technical issue, a question about your tax return, or need general guidance, the support team is ready to help. Here’s an overview of the support options available:

- Live Chat Support: The platform offers real-time live chat support, allowing you to connect with a support agent instantly. Simply click on the live chat icon on the website, and you'll be connected to a knowledgeable representative who can provide immediate assistance.

- Email Support: If you prefer a more detailed explanation or need to attach supporting documents, email support is an excellent option. You can send your queries to the Free Tax USA support team, and they will respond promptly with the necessary guidance.

- Phone Support: For urgent matters or complex issues, Free Tax USA provides a dedicated phone support line. You can reach out to their team of tax experts who can offer personalized advice and assistance over the phone.

The support team at Free Tax USA is highly trained and experienced in handling a wide range of tax-related queries. They are committed to providing prompt and accurate responses, ensuring that you can navigate the tax filing process with confidence and ease.

Helpful Resources and Articles

In addition to direct support, Free Tax USA offers a wealth of resources and educational articles to empower users with tax knowledge. These resources cover a wide range of topics, from basic tax concepts to advanced strategies. Here’s a glimpse of what you can expect:

- Tax Glossary: A comprehensive glossary of tax terms and definitions, helping users understand the jargon used in tax filings.

- Tax Tips and Strategies: Useful articles and guides offering tips on optimizing tax returns, claiming deductions, and maximizing tax refunds.

- Tax Law Updates: Regular updates on changes in tax laws and regulations, ensuring users stay informed about the latest developments.

- Case Studies and Success Stories: Real-life examples and success stories showcasing how Free Tax USA has helped users save time and money on their tax filings.

By providing these resources, Free Tax USA aims to empower users with the knowledge and tools they need to make informed decisions and navigate the tax landscape with confidence. Whether you're a first-time filer or a seasoned taxpayer, these resources can enhance your understanding of tax matters and help you make the most of your tax filing experience.

Conclusion: Simplifying Tax Filing with Free Tax USA

Free Tax USA has revolutionized the way individuals and small businesses approach tax filing. With its user-friendly interface, robust features, and comprehensive support, the platform has made tax filing accessible and efficient for all. By following the step-by-step guide outlined in this article, you can confidently navigate the Free Tax USA platform and complete your tax obligations with ease.

Whether you're a first-time user or a returning filer, the platform's intuitive design and clear instructions ensure a seamless experience. From login to filing and beyond, Free Tax USA is dedicated to providing a stress-free and secure environment for all your tax-related needs. So, why wait? Start your tax filing journey with Free Tax USA today and experience the simplicity and convenience it offers.

Can I file my taxes for free with Free Tax USA?

+

Yes, Free Tax USA offers a free filing option for simple tax returns. However, more complex returns may require a paid plan.

Is my data secure on Free Tax USA?

+

Absolutely! Free Tax USA employs advanced security measures, including encryption and two-factor authentication, to protect your data.

What if I need help during the filing process?

+

Free Tax USA provides live chat, email, and phone support to assist you with any questions or issues you may encounter.

Can I import my tax data from previous years?

+

Yes, Free Tax USA allows you to import data from previous tax returns, making the filing process quicker and more convenient.

Are there any additional fees for e-filing with Free Tax USA?

+

No, e-filing is included in all Free Tax USA plans, ensuring a seamless and cost-effective filing experience.