Understanding Boston MA Sales Tax: A Simple Guide

In the bustling economic landscape of Boston, Massachusetts, understanding the nuances of sales tax isn't just a matter of fiscal responsibility—it's pivotal for consumers, entrepreneurs, and established businesses alike. While it may seem straightforward on the surface, myriad misconceptions cloud the true nature of Boston’s sales tax structure, leading many to miscalculate costs, affect compliance, or overlook opportunities for optimization. This comprehensive guide aims to debunk prevalent myths, clarify intricate details with evidence-based analysis, and provide a nuanced understanding of Boston's sales tax environment—empowering stakeholders to navigate it with confidence and precision.

Common Misconceptions About Boston MA Sales Tax

Before delving into the specifics, it’s essential to address some of the most widespread myths surrounding Boston’s sales tax system. Misunderstandings in this domain can lead to costly errors—be it non-compliance fines, mispricing, or missed exemption opportunities. By systematically questioning these assumptions, we can establish a clear, authoritative baseline for accurate comprehension.

Myth 1: Boston’s sales tax is exactly the same as the Massachusetts state sales tax rate

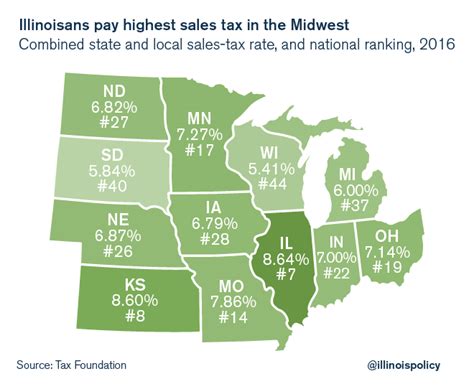

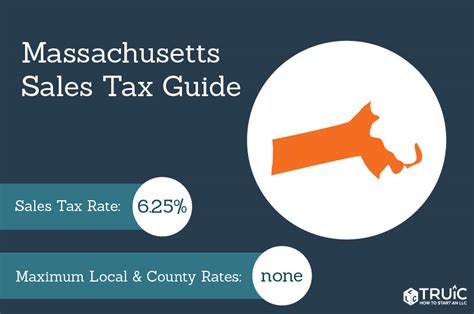

Many assume that Boston’s sales tax aligns entirely with the Massachusetts statewide rate of 6.25%. While this is technically accurate for general transactions, the reality introduces added complexity due to local surcharges and specific exemptions that can alter the effective rate for certain goods and services. Boston, as a major urban center, often encounters nuances driven by local ordinances and special district taxes, which if ignored, can result in under- or over-collecting taxes.

Myth 2: All tangible goods are taxed equally in Boston

Contrary to the belief that all tangible goods attract the same tax rate, the reality involves multiple layers of differentiation. Some items, such as clothing under a certain price threshold, might be tax-exempt, while others, like prepared foods or certain digital products, could be subject to specific surcharge rates or exemptions. Recognizing these distinctions is vital for accurate pricing and compliance standards.

Myth 3: Digital and online sales are exempt from Boston sales tax

This misconception stems from the earlier era of e-commerce, but current legislation, especially post the 2018 Supreme Court ruling in South Dakota v. Wayfair, clarifies that remote sales are indeed subject to local sales tax if certain thresholds are met. Boston’s residents and online vendors doing business in Boston must account for these laws, which significantly impact online transactions and compliance practices.

Myth 4: Sales tax applies only at the point of purchase

While point-of-sale collection is standard, more complex situations—such as leasing, renting, or providing services—introduce additional tax considerations. For example, certain lease agreements or digital service subscriptions may be taxed differently, often requiring nuanced understanding to prevent oversight.

Breaking Down Boston’s Sales Tax Structure

To grasp the functioning of Boston’s sales tax system, one must appreciate the layered architecture of taxation, combining state laws with local ordinances, and specific industry exemptions. This section dissects these components, highlighting their interplay and real-world implications.

Massachusetts State Sales Tax: Core Foundations

The core sales tax rate in Massachusetts stands at 6.25%. This rate applies broadly to tangible personal property unless explicitly exempted. The Massachusetts Department of Revenue (DOR) oversees collection, remittance, and compliance, establishing standardized classifications and reporting procedures, which many businesses must adhere to for lawful operation. Statewide, the sales tax is designed to generate revenue for infrastructure, public services, and local budgets.

Local Add-on Taxes and Boston-Specific Surcharges

Boston, classified as a dense urban municipality, often advocates for local taxes that supplement state rates to fund city-specific projects. However, Massachusetts law currently caps local option taxes at a combined rate limit, with Boston traditionally adhering closely to the base 6.25%, but it has had historical proposals for additional levies, especially on accommodations and hospitality sectors.

| Relevant Category | Substantive Data |

|---|---|

| Massachusetts standard rate | 6.25% |

| Boston local surcharge | Typically zero or minimal; varies per specific category |

| Additional district taxes | None currently applicable; subject to legislative change |

Impact of Exemptions and Special Taxation Rules

Not all transactions are taxed equally. In fact, a multitude of exemptions and special rules exist, aimed at balancing revenue generation with policy goals such as affordability or industry support. Understanding these intricacies is fundamental for correct application and avoiding costly errors.

Customer Exemptions and Industry-Specific Exemptions

For example, sales to government entities, non-profit organizations, or certain healthcare providers often qualify for exemptions. Conversely, items like hotel accommodations or prepared foods are taxed at the full rate, sometimes with additional surcharges pertinent to hospitality industry regulations. Recognizing these nuances is critical, particularly in retail and service-oriented sectors that interface with sensitive transaction types.

Digital Goods and Services Taxation in Boston

The debate over taxing digital products like e-books, streaming services, or software downloads persists. Boston, aligned with Massachusetts law, generally taxes digital tangible personal property at the same rate. However, certain exemptions, such as institutional or educational use, can influence tax obligations, demanding precise categorization and reporting from vendors.

| Relevant Category | Substantive Data |

|---|---|

| Digital goods taxation rate | 6.25%, with exemptions where applicable |

| Special considerations | Subscription models may be taxed differently based on access rights |

Strategic Compliance and Optimization

Compliance isn’t merely about avoiding penalties—it’s an opportunity for strategic tax planning that can optimize cash flow and market competitiveness. This requires a thorough understanding of local legal landscapes, technological integration, and proactive audit practices.

Technological Tools for Sales Tax Management

Platforms like Avalara, TaxJar, or Vertex automate sales tax collection, calculation, and remittance, especially crucial in jurisdictions like Boston where layered rules exist. These tools update dynamically with legislation, reducing human error and ensuring timely filings.

Pricing Strategies and Consumer Perception

Properly communicating tax-inclusive pricing and transparently explaining surcharge policies fosters trust and avoids customer dissatisfaction. Businesses often incorporate anticipated tax costs into base prices for simplicity, but must remain compliant with disclosure laws.

Audit Preparedness and Risk Management

Regular internal audits, coupled with third-party reviews, help identify compliance gaps and risk areas. Maintaining detailed documentation of transaction classifications and exemption certificates is indispensable for defending against audits.

| Relevant Metric | Context |

|---|---|

| Audit frequency | Every 2-3 years for most businesses in Massachusetts |

| Penalty for non-compliance | Up to 25% of unpaid tax, plus interest |

Future Trends and Policy Developments in Boston Sales Tax

As Boston and Massachusetts navigate a shifting fiscal landscape, several key policies are under consideration or recent implementation that could reshape local sales tax frameworks. Staying ahead involves monitoring legislative debates, ballot initiatives, and industry advocacy efforts.

Potential Modifications to Tax Rates and Bases

Proposals for expanding the sales tax to digital advertising, online marketplaces, or new sectors are common. For instance, recent discussions include expanding the definition of taxable digital services, which could increase revenue but also complicate compliance for small businesses.

Impact of Federal and State-Level Legislation

The federal government’s interest in digital sales and marketplace fairness influences state policies. Current initiatives aim to standardize taxation of remote sales nationwide, which bodes well for simplicity but requires ongoing legislative adaptation.

Technology-Driven Policy Innovation

Emerging technologies like blockchain-enabled tokenization or real-time tax reporting could revolutionize sales tax collection and audit processes, providing more transparency and reducing evasion opportunities.

What is the current sales tax rate in Boston?

+The Massachusetts statewide sales tax rate is 6.25%. Boston typically does not impose additional local sales taxes, but this can vary depending on specific circumstances and special district charges.

Are online sales taxed in Boston?

+Yes, following the 2018 South Dakota v. Wayfair decision, remote sales made to Boston residents are taxable if the seller meets state and local economic nexus thresholds, which Massachusetts enforces.

Which goods or services are exempt from sales tax in Boston?

+

Common exemptions include most clothing under a certain price, prescription medications, and certain educational materials. Specific exemptions depend on the transaction type and relevant legislation.

How do digital goods get taxed in Boston?

+Digital goods like e-books, music downloads, and streaming services are subject to the same 6.25% rate unless specific exemptions apply. Vendors need to classify their products carefully to comply with current laws.

What are best practices for sales tax compliance in Boston?

+Use automated tax software, maintain detailed exemption certificates, stay updated on policy changes, and regularly audit transactions. Engaging with local tax professionals can also help optimize compliance strategies.