Illinois State Sales Tax On Cars

Illinois, a state known for its diverse economy and vibrant cities, has a unique approach to taxing vehicle purchases, which includes a sales tax on cars. Understanding the intricacies of this tax system is crucial for both residents and visitors looking to purchase vehicles within the state's borders. In this comprehensive guide, we delve into the specifics of the Illinois State Sales Tax on cars, exploring the rates, exemptions, and the overall impact on consumers.

Understanding the Illinois State Sales Tax on Cars

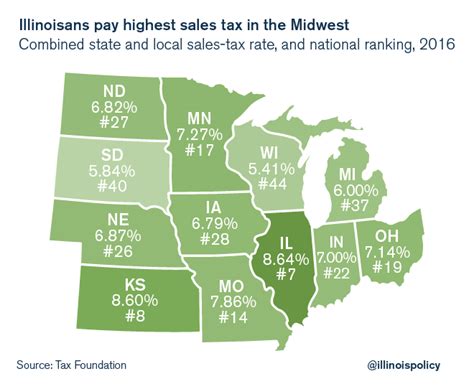

The Illinois State Sales Tax is a consumption tax levied on the sale of tangible personal property, including vehicles. It is an essential source of revenue for the state, contributing to various public services and infrastructure development. When it comes to car purchases, the sales tax rate can significantly impact the overall cost, making it a critical consideration for buyers.

Tax Rates and Calculations

The sales tax rate for vehicles in Illinois is not a flat rate but varies based on the county where the purchase is made. This county-specific approach allows for local governments to determine their own tax rates, often resulting in slight variations across the state.

| County | Sales Tax Rate |

|---|---|

| Cook County | 10.25% |

| Coles County | 7.25% |

| DuPage County | 8.25% |

| LaSalle County | 7.25% |

| Champaign County | 7.75% |

| ... (Additional Counties) | ... |

To calculate the sales tax for a vehicle purchase, multiply the purchase price by the applicable tax rate. For instance, if you buy a car in Cook County with a purchase price of $\text{\textdollar}30,000$, the sales tax would be calculated as follows: $\text{\textdollar}30,000 \times 0.1025 = \text{\textdollar}3,075$.

Exemptions and Special Considerations

While the sales tax on cars is a standard practice in Illinois, certain exemptions and special considerations exist to accommodate specific circumstances.

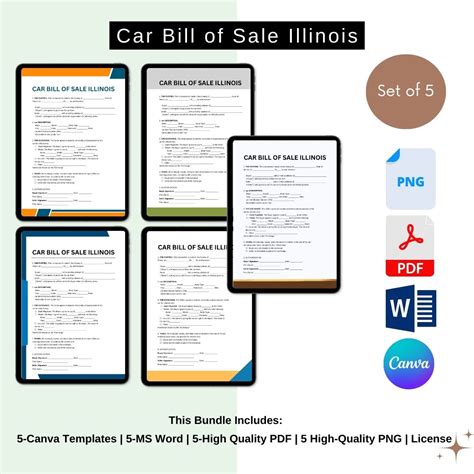

- Trade-Ins: When trading in an old vehicle as part of a new purchase, the sales tax is calculated based on the difference between the trade-in value and the purchase price of the new vehicle. This ensures that buyers are not taxed twice on the same vehicle.

- Military Personnel: Active-duty military personnel stationed in Illinois are eligible for a sales tax exemption on vehicle purchases. This exemption aims to support military families and is an appreciation for their service.

- Leased Vehicles: The sales tax for leased vehicles is calculated differently. Instead of applying to the full purchase price, the tax is levied on the monthly lease payments. This method ensures that the tax burden is spread out over the lease term.

The Impact on Car Buyers

The Illinois State Sales Tax on cars has a direct impact on the purchasing power of consumers. For many, the added tax can significantly increase the overall cost of a vehicle, making it a critical consideration when budgeting for a new car.

Financial Considerations

The sales tax rate can add thousands of dollars to the final purchase price, especially for high-value vehicles. For instance, in Cook County, a $\text{\textdollar}50,000$ car would incur a sales tax of $\text{\textdollar}5,125$, increasing the total cost to $\text{\textdollar}55,125$. This additional cost can influence buyers' decisions, potentially leading them to opt for more affordable options or seek out counties with lower tax rates.

Strategic Purchasing

With varying tax rates across counties, some buyers engage in strategic purchasing. This involves researching and comparing tax rates to identify the most cost-effective counties for vehicle purchases. While this strategy can save money, it may not always be feasible or convenient, especially for those residing in specific regions.

Online and Out-of-State Purchases

The sales tax system also affects online and out-of-state purchases. When buying a vehicle online or from a different state, the sales tax is typically calculated based on the buyer's residence. This means that even if the vehicle is purchased from an out-of-state dealer, the Illinois sales tax rate still applies. This rule ensures fairness and prevents buyers from circumventing the tax system.

The Role of Dealers and Online Platforms

Vehicle dealers and online platforms play a crucial role in facilitating car purchases and assisting buyers with tax-related matters.

Dealer Services

Dealers often provide a seamless purchasing experience, including assistance with tax calculations and paperwork. They can help buyers understand the applicable tax rate and ensure that all necessary documents are completed accurately. Additionally, dealers may offer financing options that can help spread out the tax burden over time.

Online Platforms and Research

Online platforms and resources have made it easier for buyers to research and compare vehicle prices, tax rates, and dealer reputations. These platforms often provide tools to estimate the total cost of a vehicle, including sales tax, allowing buyers to make informed decisions before visiting a dealership.

Future Implications and Potential Changes

The Illinois State Sales Tax on cars is subject to potential changes and adjustments, driven by economic factors and legislative decisions.

Economic Factors

The state's economic health and revenue needs can influence the sales tax rate. During periods of economic growth, the tax rate might remain stable or even decrease to stimulate consumer spending. Conversely, economic downturns could lead to rate increases to generate additional revenue.

Legislative Decisions

The Illinois General Assembly has the authority to adjust tax rates and policies. While changes are not frequent, they can occur to address budgetary concerns or to align with broader tax reform initiatives. Staying informed about potential legislative changes is crucial for buyers and dealers alike.

Alternative Revenue Sources

As states explore diverse revenue streams, the future of the sales tax on cars could be influenced by the implementation of alternative taxes or fees. For instance, some states have considered road usage charges or vehicle mileage taxes as potential replacements for sales taxes. These alternatives aim to ensure fairness and sustainability in revenue generation.

Conclusion: Navigating the Illinois State Sales Tax on Cars

Understanding the Illinois State Sales Tax on cars is an essential step for anyone considering a vehicle purchase within the state. The varying tax rates, exemptions, and strategic considerations provide a complex yet manageable landscape for buyers. By staying informed and leveraging the expertise of dealers and online resources, consumers can make informed decisions that align with their financial goals and preferences.

As Illinois continues to adapt its tax policies, staying updated on potential changes will be crucial for both buyers and the automotive industry. In the ever-evolving world of taxation, being proactive and knowledgeable is key to navigating the complexities of the Illinois State Sales Tax on cars.

Are there any ways to reduce the sales tax burden on vehicle purchases in Illinois?

+While the sales tax is a standard practice, there are some strategies to mitigate its impact. These include exploring financing options, taking advantage of trade-in values, and considering counties with lower tax rates. Additionally, military personnel and certain qualifying individuals may be eligible for tax exemptions.

How often are sales tax rates reviewed and adjusted in Illinois?

+Sales tax rates are generally reviewed and adjusted as part of broader tax reform initiatives or in response to specific economic conditions. While changes are not frequent, they can occur to address revenue needs or align with legislative priorities. Staying informed about potential changes is advisable.

Are there any online resources to help calculate the sales tax on a vehicle purchase in Illinois?

+Yes, several online tools and calculators are available to assist with sales tax calculations. These resources often consider the purchase price, applicable tax rate, and any applicable exemptions. Using these tools can provide a quick estimate of the sales tax burden before finalizing a vehicle purchase.