Seattle Sales Tax Rate

In the bustling city of Seattle, Washington, the sales tax rate is an important factor to consider for both residents and businesses. The city's vibrant economy and diverse range of industries make it a hub of economic activity, and understanding the sales tax structure is crucial for effective financial planning and decision-making. This article aims to provide an in-depth analysis of the Seattle sales tax rate, its components, and its implications for various sectors.

The Complexity of Seattle’s Sales Tax Structure

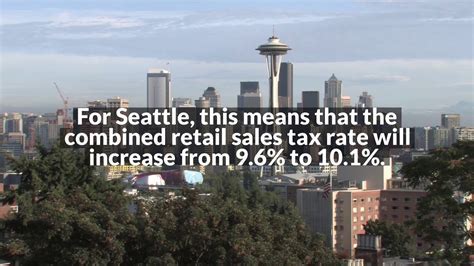

Seattle’s sales tax system is a comprehensive and nuanced framework, comprising several layers of taxation. At its core, the sales tax is a percentage-based levy applied to the retail sale of goods and certain services within the city limits. However, the true complexity arises from the interplay of various tax rates and jurisdictions.

The city of Seattle operates under a combined tax system, where the state, county, and city each contribute a specific percentage to the overall sales tax rate. This unique arrangement ensures that a portion of the tax revenue benefits the state as a whole, while the remaining revenue is distributed among local governments for essential services and infrastructure development.

State Sales Tax

The State of Washington imposes a uniform sales tax rate across all jurisdictions. As of [current year], the state sales tax rate stands at 6.5%, making it a significant contributor to the overall tax burden.

County Sales Tax

King County, in which Seattle is located, imposes an additional sales tax on top of the state rate. This county-level tax serves to fund local initiatives and maintain the county’s infrastructure. The current King County sales tax rate is 0.4%, bringing the combined state and county sales tax to 6.9%.

City Sales Tax

The city of Seattle, known for its progressive policies and commitment to sustainability, adds its own sales tax to the equation. The Seattle sales tax rate, which varies depending on the type of transaction, is designed to support the city’s ambitious environmental and social programs. As of the latest update, the Seattle sales tax rate stands at 2.25%, applied to most retail sales within city limits.

However, it's important to note that certain goods and services are exempt from the Seattle sales tax. These exemptions are designed to alleviate the tax burden on essential items and promote specific industries. For instance, food products, prescription medications, and certain types of manufacturing equipment are exempt from the city's sales tax.

| Tax Jurisdiction | Sales Tax Rate (%) |

|---|---|

| State of Washington | 6.5% |

| King County | 0.4% |

| City of Seattle | 2.25% |

| Total Combined Rate | 9.15% |

Impact on Local Businesses and Consumers

The Seattle sales tax rate has a profound impact on both local businesses and consumers. For businesses, particularly those in the retail and service sectors, the tax rate directly affects their pricing strategies and profit margins. In a competitive market, businesses must carefully consider the tax implications when setting their prices to remain attractive to consumers while maintaining a healthy bottom line.

Consumers, on the other hand, bear the brunt of the sales tax when making purchases. The tax adds to the final cost of goods and services, potentially influencing consumer behavior and purchasing decisions. Understanding the sales tax rate can help consumers budget effectively and make informed choices, especially when comparing prices across different retailers or considering online purchases from out-of-state vendors.

Sector-Specific Considerations

The impact of the sales tax rate varies across different sectors of Seattle’s economy. For instance, the technology and e-commerce sectors, which are thriving in the city, often have unique considerations when it comes to sales tax. Online retailers must navigate the complexities of sales tax laws, especially when selling to customers outside Seattle, as tax rates can vary significantly across states and even counties.

In contrast, the tourism and hospitality industries in Seattle are heavily reliant on consumer spending. The sales tax rate can directly affect the attractiveness of the city as a tourist destination. Higher tax rates may deter visitors, especially those on a budget, while a more favorable tax structure could enhance Seattle's competitiveness in the tourism market.

Compliance and Revenue Management

Ensuring compliance with the sales tax laws is a critical responsibility for businesses operating in Seattle. The city’s revenue department provides clear guidelines and resources to help businesses understand their tax obligations. Failure to comply with sales tax regulations can result in significant penalties and legal consequences.

From a revenue management perspective, the sales tax contributes significantly to Seattle's budget. The funds generated through sales tax are essential for funding public services, infrastructure development, and various city initiatives. The city's commitment to transparency and accountability ensures that tax revenue is utilized efficiently and effectively for the benefit of its residents.

Sales Tax Audits and Best Practices

To maintain compliance and avoid potential audits, businesses should implement robust sales tax management practices. This includes accurately tracking and recording sales transactions, ensuring proper tax classification, and staying updated with any changes in tax laws or regulations. Regular reviews of sales tax processes and the use of dedicated sales tax software can help businesses streamline their compliance efforts and minimize the risk of errors.

In the event of a sales tax audit, businesses should cooperate fully with the revenue department and provide all necessary documentation. Being proactive and transparent during the audit process can help resolve any issues promptly and minimize the impact on the business's operations.

Future Implications and Policy Considerations

As Seattle continues to evolve and adapt to changing economic landscapes, the sales tax rate and its structure may undergo revisions. The city’s leadership and policymakers play a crucial role in shaping the tax system to meet the needs of its residents and businesses.

One key consideration is the balance between generating sufficient revenue for essential services and maintaining a competitive business environment. A higher sales tax rate, while beneficial for revenue generation, could potentially discourage economic growth and investment. On the other hand, a lower rate might attract more businesses but could impact the availability of public services and infrastructure improvements.

Additionally, the city may explore alternative revenue streams or tax structures to complement the sales tax. This could include property taxes, income taxes, or even innovative tax policies designed to support specific industries or initiatives. The goal is to create a sustainable and equitable tax system that fosters economic growth while ensuring the well-being of Seattle's residents.

Potential Policy Changes

Potential policy changes could involve adjustments to the sales tax rate itself or the introduction of new tax categories. For instance, the city might consider a tiered sales tax system, where different tax rates apply to different types of goods or services. This approach could encourage the consumption of certain products while discouraging others, aligning with the city’s sustainability and social goals.

Furthermore, the city could explore the possibility of tax incentives or credits to promote specific industries or attract new businesses. Such incentives could be particularly beneficial for sectors that align with Seattle's strategic vision, such as clean technology, healthcare, or education.

In conclusion, the Seattle sales tax rate is a dynamic and integral part of the city's economic landscape. Its impact reaches far and wide, influencing businesses, consumers, and the overall health of the local economy. As Seattle continues to thrive and evolve, a comprehensive understanding of the sales tax structure and its potential future directions will be essential for all stakeholders.

How often are sales tax rates updated in Seattle?

+Sales tax rates in Seattle are subject to periodic updates, typically aligned with changes in state or local tax policies. While there is no set schedule for these updates, they are usually announced in advance to allow businesses and consumers to adjust their financial plans accordingly.

Are there any special sales tax rates for certain industries in Seattle?

+Yes, Seattle has implemented special sales tax rates for specific industries. For example, the city offers a reduced sales tax rate for certain manufacturing equipment purchases. These incentives are designed to promote economic growth and support key sectors.

How does Seattle’s sales tax rate compare to other major cities in the US?

+Seattle’s combined sales tax rate of 9.15% is higher than many other major cities in the US. For instance, New York City’s sales tax rate is 8.875%, while Los Angeles has a rate of 9.5%. However, it’s important to note that sales tax rates can vary significantly across states and even within the same state.