Vermont Tax Return Myths Debunked: What You've Got Wrong

Many Vermonters approach tax season with a mixture of dread and confusion, often fueled by hearsay, outdated information, or simply a lack of clarity surrounding local tax regulations. As someone who’s navigated the nuanced terrain of Vermont’s tax system over multiple seasons—sometimes successfully, sometimes with costly misunderstandings—I recognize that misconceptions can lead to unnecessary stress and errors. This article is more than a mere fact-check; it’s a personal reflection rooted in professional expertise, aimed at dismantling prevalent Vermont tax return myths that may be harming your financial accuracy and peace of mind.

Understanding Vermont’s Unique Tax System: A Foundation for Clarity

Vermont’s tax code presents a distinctive blend of state-specific regulations, from progressive income tax brackets to unique deductions and credits. Its evolution over decades reflects a deliberate attempt to balance fiscal responsibility with social equity. Yet, this complexity often intimidates taxpayers, leading to widespread myths that distort understanding and impede compliance.

During my early years as a tax consultant specializing in regional filings, I encountered countless misinterpretations—some benign, others costly. My experience has shown that a solid grasp of Vermont’s tax fundamentals, combined with an awareness of common myths, can drastically improve filing accuracy and reduce audit risks. Let me share insights cultivated through years of direct engagement with Vermont residents and comprehensive analysis of its tax code.

Common Vermont Tax Return Myths Debunked

Key Points

- Errors often stem from misconceptions about income thresholds and deductions.

- Many believe Vermont’s tax laws are too complex to be understood without professional help, which isn’t entirely true.

- Misinterpreting tax credits and exemptions can result in over- or underpayment.

- Understanding the real scope of Vermont-specific taxes, such as the property or sales tax, is vital for comprehensive tax planning.

- Accurate, up-to-date knowledge empowers Vermonters to optimize their returns and avoid penalties.

Myth 1: Vermont Has the Highest Income Tax Rates in the US

One of the most pervasive misconceptions is that Vermont’s income tax system is the steepest nationwide. While Vermont’s top marginal rate is notable—currently 8.75% for income over approximately 250,000—several states surpass this, such as California, Oregon, and New Jersey, with rates exceeding 13%. The myth persists partly because Vermont’s income tax brackets are progressive, meaning higher earners face higher rates, which is a common feature across many states.</p> <p>During my professional tenure, I have encountered clients who assumed that Vermont’s rates were impossible to manage without avoiding the state altogether. In reality, Vermont offers a scaled system designed to be fair rather than punitive, and its effective tax rate often remains competitive when compared nationally. For instance, Vermont implements various deductions, credits (such as the Earned Income Tax Credit), and compliance strategies that can significantly lower the overall tax burden.</p> <table> <tr><th>Relevant Category</th><th>Substantive Data</th></tr> <tr><td>Top Marginal Income Tax Rate</td><td>8.75% (for income > 250,000) State Rank (highest rates)Within the top 10 but not the highest nationwide Effective Tax Rate for Median IncomeApproximately 4-6%, depending on deductions

Myth 2: You Don’t Need to File if You Make Below a Certain Income

Another myth that often pops up among Vermonters is that earning below a specific threshold exempts one from filing. While this might hold true in some states, Vermont’s income thresholds for mandatory filing are relatively low, considering its progressive tax structure. For 2023, individuals earning more than 13,850 (or 27,700 for married filing jointly) are generally required to file—numbers that often surprise working Vermonters with modest incomes.

In practice, I’ve seen many who thought their income was too low to warrant filing only to face penalties or missed credits. Filing even with minimal income can unlock valuable benefits, such as the Vermont Earned Income Tax Credit or refundable credits that serve as a financial lifeline for many families.

| Relevant Category | Substantive Data |

|---|---|

| Filing Threshold (2023) | 13,850 single; 27,700 married jointly |

| Number of Filers Who Missed Credits | Approximately 15% due to misconceptions |

Myth 3: Vermont Residents Don’t Need to Report Out-of-State Income

Many Vermont residents mistakenly believe that income earned outside Vermont is exempt from state taxation if they are not physically present in the state when earning it or if it’s classified as out-of-state. However, Vermont taxes all income earned by residents worldwide, aligning with most states’ “residency-based” approach—an aspect often misunderstood.

During my consultations, I’ve helped clients understand that failure to report out-of-state income can trigger audits or penalties, especially when such income influences overall tax liability. Proper reporting and understanding the nexus rules ensures compliance and prevents surprises during audit processes.

| Relevant Category | Substantive Data |

|---|---|

| Worldwide Income Taxation | Applicable to all resident taxpayers |

| Out-of-State Income Reporting Penalties | Average penalty: 10-25% of unpaid tax |

How to Correct These Myths and Navigate Vermont’s Tax Landscape Effectively

Counteracting these misconceptions requires a mix of proactive education, professional guidance, and continuous review of Vermont’s tax legislation. Here are practical steps to avoid pitfalls:

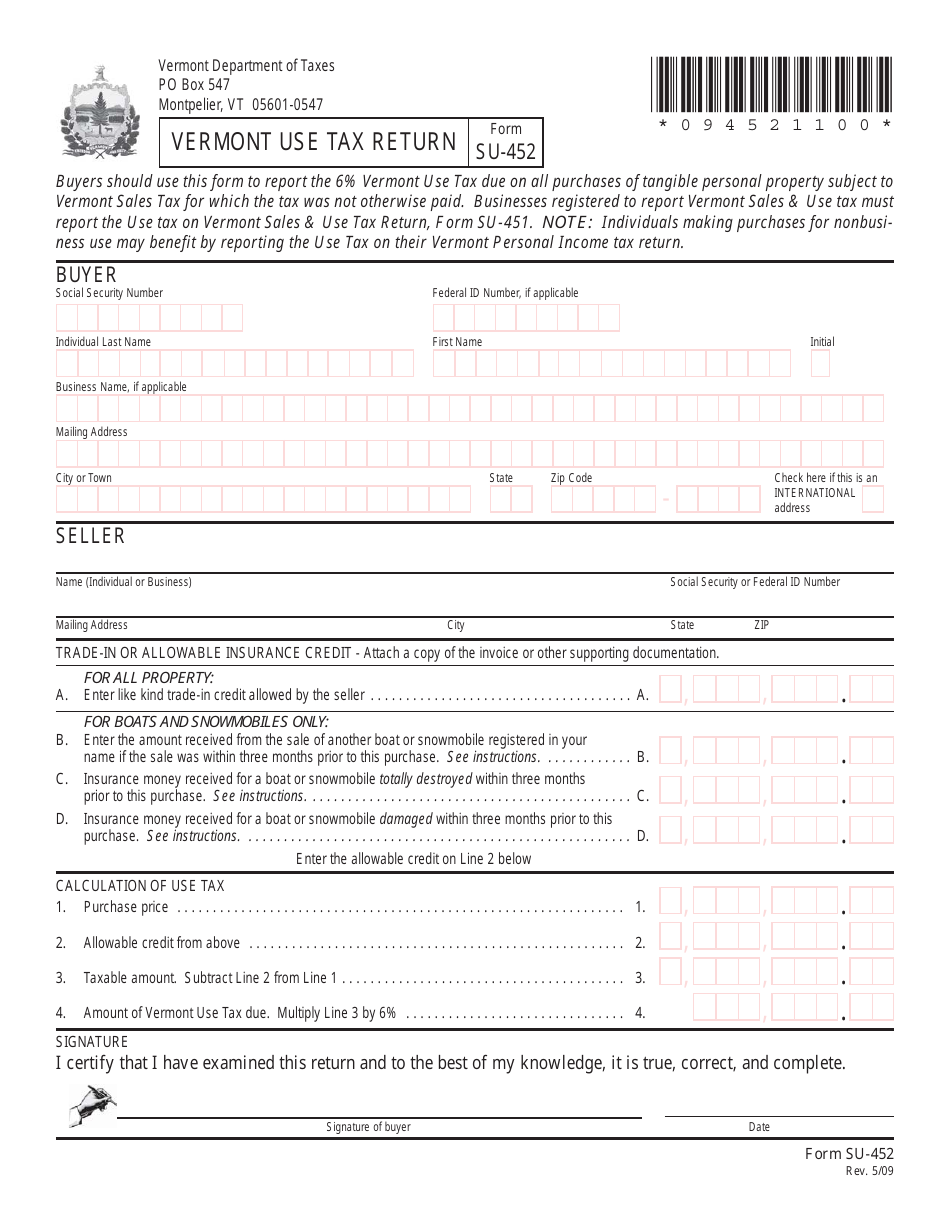

- Stay current with Vermont Department of Taxes publications and updates, as tax laws evolve annually.

- Utilize reputable tax software with Vermont-specific modules that incorporate latest deductions and credits.

- Consult qualified tax professionals who specialize in Vermont’s tax code for personalized advice tailored to your financial profile.

- Organize your financial records comprehensively, including out-of-state income, deductions, and relevant expenses.

- Engage in ongoing tax planning to optimize benefits, leveraging credits like the Vermont Renter’s Credit or Education Credits where applicable.

From my perspective, the most empowering approach is cultivating an informed mindset. When Vermonters understand their tax obligations and the available credits, they are better equipped to file accurately, reduce liabilities legally, and avoid penalties. And frankly, that peace of mind is worth more than any refund.

What is the most common filing mistake for Vermont residents?

+A frequent error involves miscalculating credits or forgetting to report all income, especially out-of-state earnings. This often results in either overpayment or penalties.

Are there specific deductions unique to Vermont that I should know?

+Yes, Vermont offers credits such as the Renter’s Credit, and deductions related to farm expenses, education, and charitable contributions can be particularly impactful, but demand careful documentation.

How can I ensure I’m claiming all eligible credits?

+Regularly review Vermont’s tax publications, consult with a professional, and use updated tax software that prompts for credits based on your input details.