Rsu Stock Tax

When it comes to Restricted Stock Units (RSUs), understanding the tax implications is crucial for individuals who receive these equity-based incentives. RSUs are a popular form of employee compensation, especially in the tech industry, where companies often offer them as part of their employee stock plans. This article aims to delve into the complex world of RSU stock taxes, providing an in-depth analysis and expert insights to help you navigate this often-confusing topic.

Unraveling the Complexity of RSU Stock Taxes

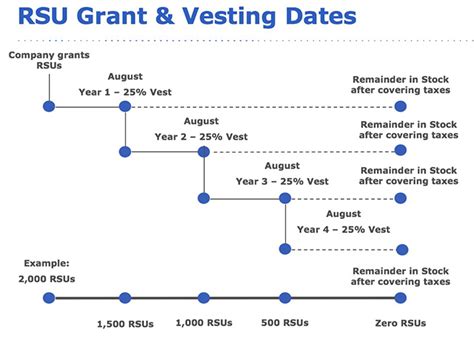

Restricted Stock Units, or RSUs, are a type of equity compensation that grants employees the right to receive shares of a company’s stock upon the satisfaction of certain conditions, typically after a specified vesting period. Unlike other forms of equity compensation like stock options, RSUs do not provide immediate ownership but rather represent a promise of future stock ownership. This unique characteristic adds a layer of complexity to the tax implications.

The tax treatment of RSUs can be divided into two main phases: the vesting period and the post-vesting period. During the vesting period, the employee does not have access to the underlying shares, and no tax liability arises. However, the value of the RSUs is typically included in the employee's gross income upon vesting, triggering a tax obligation.

Taxation During the Vesting Period

The tax treatment during the vesting period can vary depending on the country and the specific tax laws in place. In the United States, for example, the value of RSUs is generally considered ordinary income and is subject to federal, state, and local taxes. This means that when the RSUs vest, the employee must include the fair market value (FMV) of the shares in their taxable income for that year.

Let's consider an example to illustrate this. Suppose an employee is granted 1,000 RSUs with a grant date fair market value of $50 per share. If these RSUs vest one year later, and the FMV at vesting is $60 per share, the employee would have a taxable income of $10,000 (1,000 shares x $10 increase in FMV). This amount would be subject to the applicable tax rates for ordinary income, which can vary based on the employee's tax bracket.

| Grant Date FMV | $50 per share |

|---|---|

| Vesting Date FMV | $60 per share |

| Taxable Income | $10,000 |

Post-Vesting Tax Considerations

Once the RSUs vest, the employee gains access to the underlying shares. At this point, the employee has two primary options: sell the shares immediately or hold onto them. Each option carries different tax consequences.

- Selling the Shares: If the employee chooses to sell the shares immediately after vesting, the tax treatment is relatively straightforward. The employee will owe capital gains tax on the difference between the FMV of the shares at the time of vesting and the sale price. The holding period, which determines the tax rate for capital gains, begins from the date of vesting. If the employee holds the shares for more than one year after vesting, long-term capital gains tax rates apply; otherwise, short-term capital gains tax rates are applicable.

- Holding the Shares: If the employee decides to hold onto the shares, the tax liability is deferred until the shares are sold. In this case, the employee will pay capital gains tax on the difference between the FMV at vesting and the eventual sale price. However, the holding period starts from the vesting date, which can impact the tax rate upon the sale of the shares.

Additional Tax Considerations

There are several other factors that can influence the tax implications of RSUs. These include:

- Dividends: If the company pays dividends on its stock while the RSUs are outstanding, the employee may be entitled to receive dividends on the vested shares. These dividends are typically taxable as ordinary income.

- Withholding Taxes: Employers often withhold a portion of the shares upon vesting to cover the tax liability. This can be a convenient way to manage the tax obligation, but it may result in the employee receiving fewer shares than expected.

- AMT Considerations: In some cases, the exercise of stock options or the vesting of RSUs can trigger the alternative minimum tax (AMT). This is a complex tax calculation that can impact the employee's overall tax liability.

- International Tax Implications: For employees working in multiple countries or with international employers, the tax treatment of RSUs can become even more complex. It's essential to consider the tax laws of each jurisdiction and ensure compliance.

Maximizing Tax Efficiency with RSUs

While the tax implications of RSUs can be intricate, there are strategies that employees can employ to optimize their tax situation. Here are some expert tips to consider:

- Exercise and Sell Strategy: Some employees may choose to exercise their stock options or allow their RSUs to vest and immediately sell a portion of the shares to cover the tax liability. This strategy can help manage cash flow and ensure sufficient funds to cover taxes.

- Diversification: Holding onto a portion of the shares can provide diversification benefits and potentially lead to long-term capital gains. However, it's crucial to carefully consider the risk tolerance and financial goals before implementing this strategy.

- Tax Loss Harvesting: If the value of the shares decreases after vesting, employees may consider selling a portion of the shares to realize a capital loss. This loss can be used to offset capital gains in other investments, potentially reducing the overall tax liability.

- Employee Stock Purchase Plans (ESPP): Participating in an ESPP can offer additional tax benefits. Employees can purchase company stock at a discount, and the discount amount is generally considered ordinary income, which can help manage the tax liability.

- Financial Planning: Working with a financial advisor or tax professional can provide valuable guidance in navigating the complex tax landscape associated with RSUs. They can help develop a comprehensive financial plan that aligns with the employee's goals and tax obligations.

Conclusion: Navigating the RSU Stock Tax Landscape

Understanding the tax implications of RSUs is crucial for employees who receive these equity-based incentives. The tax treatment can be complex and varies depending on the jurisdiction and the specific terms of the RSU grant. By familiarizing themselves with the tax laws and exploring various strategies, employees can optimize their tax situation and make informed decisions regarding their RSUs.

Remember, the information provided in this article serves as a general guide. Tax laws and regulations are subject to change, and individual circumstances can vary significantly. It is always recommended to seek professional advice to ensure compliance and make the most of your RSU stock tax situation.

How are RSUs taxed during the vesting period in the United States?

+

In the U.S., the value of RSUs is generally considered ordinary income and is subject to federal, state, and local taxes. The employee must include the fair market value (FMV) of the shares in their taxable income for the year in which the RSUs vest.

What are the tax implications if I sell my RSU shares immediately after vesting?

+

If you sell your RSU shares immediately after vesting, you will owe capital gains tax on the difference between the FMV of the shares at vesting and the sale price. The holding period determines the tax rate for capital gains, with long-term capital gains rates applicable if you hold the shares for more than one year after vesting.

Can I defer the tax liability by holding onto my RSU shares?

+

Yes, by holding onto your RSU shares, you can defer the tax liability until the shares are sold. The tax will be based on the difference between the FMV at vesting and the eventual sale price. However, the holding period starts from the vesting date, impacting the tax rate upon the sale.