Vermont Sales Tax

Vermont, a state nestled in the heart of New England, has a unique sales tax system that plays a significant role in its economy and governance. The sales tax, a crucial source of revenue for the state, influences various aspects of business operations and consumer spending. Understanding the specifics of Vermont's sales tax is essential for both businesses and consumers to navigate the state's economic landscape effectively.

Understanding Vermont's Sales Tax Structure

The sales tax in Vermont operates as a standard state-wide tax, applying to most tangible personal property and certain services. It is a vital component of the state's revenue system, contributing significantly to the funding of essential public services and infrastructure.

As of my last update in January 2023, the general sales and use tax rate in Vermont stands at 6%. This rate is uniform across the state, meaning that regardless of where you make a purchase within Vermont, the sales tax remains consistent. However, it's important to note that certain jurisdictions may levy additional local taxes, which can increase the overall tax rate.

Taxable Items and Exemptions

Vermont's sales tax applies to a wide range of goods and services. This includes retail sales of tangible personal property, such as clothing, electronics, and furniture. Additionally, certain services, like repair and installation services, are also subject to sales tax. However, there are specific exemptions to this rule.

Items considered necessities or those with specific economic or social value are often exempt from sales tax. For instance, most groceries, prescription drugs, and certain medical devices are not taxed. Additionally, Vermont offers exemptions for specific industries, such as manufacturing, which can claim a sales and use tax exemption for purchases related to their operations.

Understanding these exemptions is crucial for businesses and consumers alike. It allows businesses to accurately calculate their tax liabilities and provides consumers with a clearer picture of their spending and the associated taxes.

| Taxable Item | Tax Rate |

|---|---|

| Tangible Personal Property | 6% |

| Select Services (e.g., Repairs) | 6% |

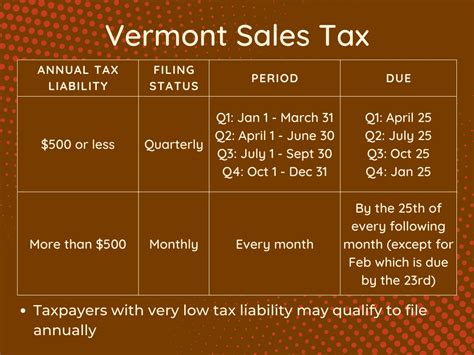

Compliance and Filing Requirements

Businesses operating within Vermont, or those making sales into the state, have specific compliance and filing requirements to adhere to. These requirements ensure that the state collects the appropriate taxes and that businesses maintain accurate records.

All businesses that sell taxable goods or services in Vermont are required to register with the Vermont Department of Taxes and obtain a Sales and Use Tax Permit. This permit allows businesses to collect and remit sales tax on behalf of the state. The registration process typically involves providing business information, such as the type of business, location, and expected sales volume.

Once registered, businesses must collect sales tax from customers at the point of sale. This tax is then held in trust for the state until it is remitted, usually on a monthly or quarterly basis. The exact frequency of filings depends on the business's tax liability and the guidelines set by the Department of Taxes.

Sales Tax Returns and Payments

Filing sales tax returns involves submitting detailed reports of taxable sales and the corresponding tax collected during the reporting period. These returns are due by the 20th day of the month following the reporting period. For instance, sales tax for the month of January would be due by February 20th.

Along with the sales tax return, businesses must also remit the tax collected during the same period. Failure to remit sales tax or file returns on time can result in penalties and interest charges. Therefore, it is crucial for businesses to maintain accurate records and ensure timely compliance.

| Registration Requirement | Registration Process |

|---|---|

| Obtain a Sales and Use Tax Permit | Register with the Vermont Department of Taxes |

| Collect Sales Tax | Remit tax on behalf of the state |

| Filing Frequency | Monthly or quarterly, depending on tax liability |

Impact on Business and Consumer Behavior

Vermont's sales tax significantly influences the behavior of both businesses and consumers. For businesses, it impacts pricing strategies, operational costs, and compliance efforts. On the consumer side, it affects purchasing decisions and spending habits.

Pricing Strategies and Business Operations

Businesses operating in Vermont must carefully consider the sales tax when setting their prices. Incorporating the tax into the final price can be a straightforward approach, providing transparency to consumers. Alternatively, businesses might choose to display prices excluding tax, a common practice in certain industries.

Additionally, the sales tax can impact the overall cost of doing business in Vermont. Businesses must account for the tax when purchasing inventory or equipment, potentially influencing their procurement strategies. Furthermore, the tax can also affect the competitiveness of Vermont-based businesses when compared to those in neighboring states with different tax rates.

Consumer Spending and Purchase Decisions

Vermont's sales tax can play a significant role in consumer spending behavior. Consumers often consider the tax when making purchase decisions, especially for larger-ticket items. The tax can influence where and when consumers choose to shop, with some opting to make purchases online or across state lines to avoid the tax.

However, the tax also provides an incentive for consumers to support local businesses. By shopping locally, consumers contribute to the state's economy and help fund essential public services. This dynamic underscores the interconnected nature of sales tax, business operations, and consumer behavior.

| Business Impact | Consumer Impact |

|---|---|

| Pricing strategies | Purchase decisions |

| Operational costs | Spending habits |

| Competitiveness | Support for local businesses |

Conclusion

Vermont's sales tax system is a critical aspect of the state's economy, providing a stable revenue source for public services and infrastructure. While the general sales tax rate is straightforward, it's important for businesses and consumers to be aware of local variations and specific exemptions.

Compliance with sales tax regulations is a shared responsibility, ensuring the state's financial stability and the fair contribution of all stakeholders. By understanding and adhering to these regulations, businesses can operate successfully within Vermont's economic landscape, while consumers can make informed purchasing decisions that support the state's economy.

Frequently Asked Questions

How often do businesses need to file sales tax returns in Vermont?

+The frequency of sales tax return filings in Vermont depends on the business's tax liability. Typically, businesses file returns on a monthly or quarterly basis. However, certain businesses with higher tax liabilities may be required to file more frequently.

<div class="faq-item">

<div class="faq-question">

<h3>Are there any sales tax holidays in Vermont?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Vermont does not currently observe any sales tax holidays. However, certain purchases, such as back-to-school items or energy-efficient appliances, may be eligible for tax exemptions or reduced rates during specific promotional periods.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>What happens if a business fails to collect or remit sales tax in Vermont?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Failure to collect or remit sales tax in Vermont can result in penalties and interest charges. The severity of these penalties depends on the nature and extent of the non-compliance. It's crucial for businesses to stay compliant to avoid such consequences.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Are online purchases subject to sales tax in Vermont?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, online purchases made by Vermont residents are generally subject to sales tax. This includes purchases from out-of-state sellers. The responsibility to collect and remit this tax often falls on the seller, who must comply with Vermont's sales tax regulations.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>How does Vermont handle sales tax for remote sellers?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Vermont has implemented a law requiring remote sellers to collect and remit sales tax on sales made to Vermont residents. This law aims to ensure fair competition between in-state and out-of-state sellers and maintain a level playing field for all businesses operating in the state.</p>

</div>

</div>

</div>