Where Do I Mail My Nys Tax Return

Tax season is upon us, and for New Yorkers, the question of where to send their tax returns is an important one. The New York State Department of Taxation and Finance has specific guidelines and addresses for mailing tax returns, depending on the type of return and the county in which you reside. Let's dive into the details to ensure your tax return reaches its destination promptly and securely.

Understanding the Mailing Addresses for NYS Tax Returns

The New York State tax authorities have designated specific mailing addresses for different types of tax returns. These addresses are crucial to ensure that your return is processed efficiently and accurately. Here’s a breakdown of the mailing addresses based on the type of return you are filing:

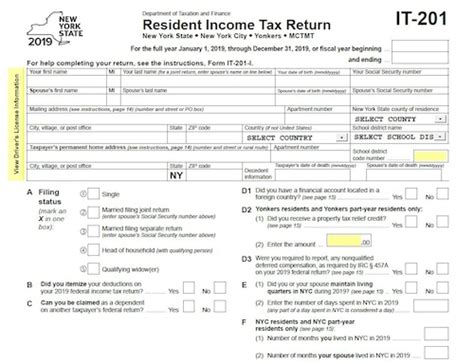

Individual Income Tax Returns

If you are an individual taxpayer filing your income tax return, the mailing address depends on the county you reside in. New York State is divided into various processing centers, each responsible for a specific set of counties. Here’s a comprehensive list:

| Processing Center | Counties Served | Mailing Address |

|---|---|---|

| Albany | Albany, Columbia, Delaware, Greene, Otsego, Rensselaer, Schoharie, Schenectady, and Ulster Counties | NYS Department of Taxation and Finance W.A. Harriman Campus Albany, NY 12227-0001 |

| Binghamton | Broome, Chenango, Cortland, Madison, Oneida, Onondaga, Oswego, and Tioga Counties | NYS Department of Taxation and Finance Binghamton State Office Building P.O. Box 1459 Binghamton, NY 13902-1459 |

| Buffalo | Cattaraugus, Chautauqua, Erie, Genesee, Niagara, Orleans, and Wyoming Counties | NYS Department of Taxation and Finance 3 Empire State Plaza Agency Building 9 Albany, NY 12227-1300 |

| Elmira | Chemung, Livingston, Monroe, Ontario, Schuyler, Seneca, Steuben, Wayne, and Yates Counties | NYS Department of Taxation and Finance Elmira State Office Building 301 East State Street Elmira, NY 14901-3005 |

| Hauppauge | Nassau and Suffolk Counties | NYS Department of Taxation and Finance Hauppauge State Office Building P.O. Box 5100 Hauppauge, NY 11788-5100 |

| Poughkeepsie | Dutchess, Orange, Putnam, Rockland, Sullivan, and Westchester Counties | NYS Department of Taxation and Finance Poughkeepsie State Office Building 200 North Hamilton Street Poughkeepsie, NY 12601-2503 |

| Syracuse | Cayuga, Fulton, Herkimer, Jefferson, Lewis, Montgomery, St. Lawrence, and Tompkins Counties | NYS Department of Taxation and Finance Syracuse State Office Building 333 E. Washington Street Syracuse, NY 13202-1717 |

| Utica | Clinton, Essex, Franklin, Hamilton, Saratoga, Warren, and Washington Counties | NYS Department of Taxation and Finance Utica State Office Building 207 Genesee Street Utica, NY 13501-2812 |

It's important to note that the addresses for individual income tax returns are the same for both paper and electronic returns. However, if you are submitting a paper return, ensure that you use the correct address for your county to avoid any processing delays.

Business Tax Returns

For businesses filing their tax returns in New York State, the mailing address is centralized and does not depend on the county of operation. Here’s the address for all business tax returns:

| Type of Return | Mailing Address |

|---|---|

| Corporation Tax Returns | NYS Department of Taxation and Finance W.A. Harriman Campus Albany, NY 12227-0001 |

| Partnership Tax Returns | NYS Department of Taxation and Finance W.A. Harriman Campus Albany, NY 12227-0001 |

| S Corporation Tax Returns | NYS Department of Taxation and Finance W.A. Harriman Campus Albany, NY 12227-0001 |

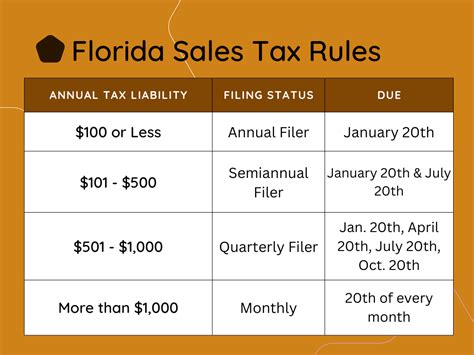

| Sales and Use Tax Returns | NYS Department of Taxation and Finance W.A. Harriman Campus Albany, NY 12227-0001 |

| Other Business Tax Returns | NYS Department of Taxation and Finance W.A. Harriman Campus Albany, NY 12227-0001 |

Ensure that you are using the correct form for your type of business and that all the required information is included. Any discrepancies or missing information can lead to delays in processing your return.

Amended Returns

If you need to file an amended return, whether it’s an individual or business return, the mailing address is the same as the one for the original return. Simply indicate that you are filing an amended return and include the necessary changes.

Tips for a Smooth Mailing Process

Here are some additional tips to ensure a smooth and timely mailing process for your NYS tax return:

- Use the Correct Form: Make sure you are using the appropriate form for your type of return. The wrong form can lead to processing delays and potential penalties.

- Double-Check Your Information: Accuracy is crucial. Review your return carefully to ensure all the information, including your name, address, and Social Security number (or tax identification number for businesses), is correct.

- Include Payment or Request Direct Deposit: If you owe taxes, include a check or money order made payable to the "New York State Department of Taxation and Finance." If you are expecting a refund, consider requesting direct deposit to receive your refund faster.

- Use Certified Mail: Consider using certified mail with a return receipt when sending your return. This provides you with proof of mailing and delivery, which can be useful if there are any issues with the processing of your return.

- Allow Sufficient Time: Plan ahead and allow enough time for your return to reach the processing center. Mailing it too close to the deadline can increase the chances of delays.

Stay Informed, Stay Compliant

Tax compliance is a serious matter, and ensuring your tax return reaches the correct destination is an important step in that process. By following the guidelines outlined above and staying informed about any changes or updates from the New York State Department of Taxation and Finance, you can contribute to a smoother tax season for everyone involved.

What happens if I send my tax return to the wrong address?

+If you send your tax return to the wrong address, it may result in processing delays. The tax authorities will forward your return to the correct processing center, but this can take additional time. To avoid this, ensure you are using the correct address for your county or type of return.

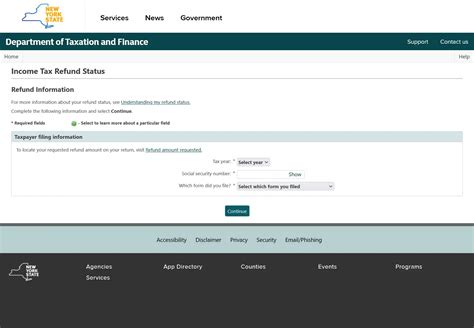

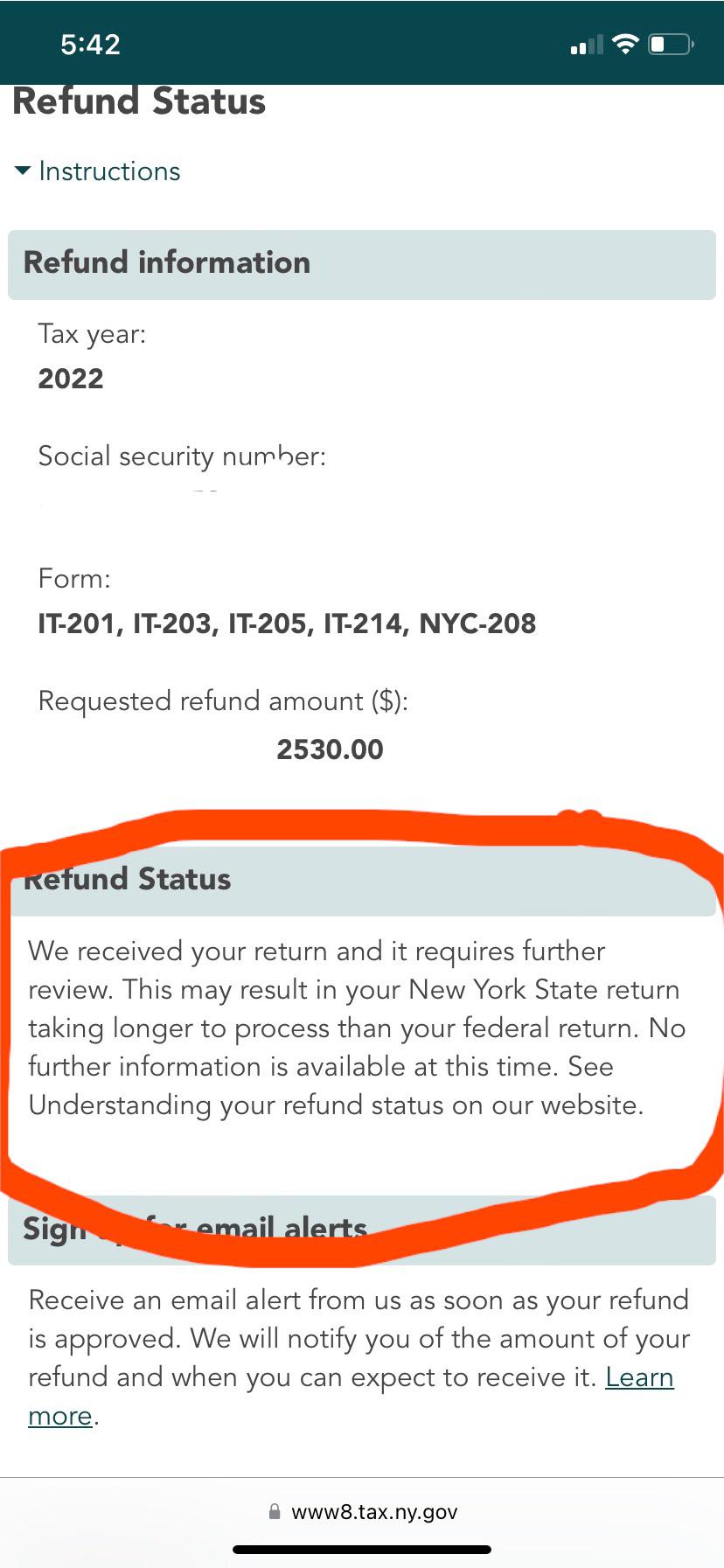

Can I track the status of my mailed tax return?

+Yes, you can track the status of your mailed tax return by creating an account on the New York State Department of Taxation and Finance’s website. Once you have an account, you can log in and view the processing status of your return.

Are there any online options for filing my NYS tax return?

+Yes, the NYS Department of Taxation and Finance offers online filing options through its website. You can file your individual income tax return electronically, which is a faster and more secure method. Additionally, there are online platforms and software that can assist you with the filing process.

What should I do if I have further questions or need assistance?

+If you have questions or need assistance with your NYS tax return, you can contact the New York State Department of Taxation and Finance’s customer service center. They can provide guidance and support to ensure you are on the right track. You can reach them by phone, email, or through their website’s contact form.