7 Proven Strategies to Maximize Savings with Ramsey Tax

Effective tax planning stands as a cornerstone of financial mastery, especially when it aligns with strategic savings goals. Ramsey Tax, a rapidly evolving entity within the taxation landscape, has garnered attention for its innovative approaches to reducing tax liabilities while enhancing savings. This guide aims to dissect seven proven strategies tailored to maximize your savings through Ramsey Tax, integrated with evidence-based practices and industry expertise. Whether you're an individual taxpayer, a small business owner, or a financial planner, understanding these methodologies can empower you to optimize your financial position legally and efficiently.

Understanding Ramsey Tax: A Foundation for Strategic Savings

Ramsey Tax operates within a framework that emphasizes transparency, compliance, and strategic planning. By leveraging specific tax codes, credits, and deductions, it offers avenues for substantial tax reductions. The primary goal is to minimize taxable income through legal means, thereby increasing your available cash flow for other financial goals such as investments, debt payoff, or emergency reserves.

The Importance of Informed Tax Planning

Optimizing tax savings with Ramsey Tax necessitates a comprehension of current tax laws, industry best practices, and personalized financial circumstances. This involves ongoing education, strategic record-keeping, and a proactive approach to incorporating tax-efficient strategies into your annual financial planning process. The intersection of compliance and innovation makes Ramsey Tax an optimal avenue for taxpayers seeking to enhance their fiscal health.

Key Points

- Implementing targeted deductions can significantly reduce taxable income and improve cash flow.

- Tax credits uniquely diminish your tax liability directly, offering substantial savings.

- Strategic investment in tax-advantaged accounts maximizes long-term growth with tax efficiency.

- Proper record-keeping and documentation streamline audits and ensure compliance.

- Personalized planning aligned with Ramsey Tax guidelines yields the highest optimized outcomes.

Step 1: Maximize Itemized Deductions within Ramsey Tax Framework

Itemizing deductions remains one of the most impactful strategies to reduce taxable income. Ramsey Tax encourages taxpayers to track eligible expenses meticulously—such as mortgage interest, state and local taxes, charitable contributions, and medical expenses exceeding AGI thresholds. Recent studies indicate that taxpayers who itemize properly can reduce their taxable income by an average of 15-20%, leading to substantial savings.

Implementing the Deduction Strategy

Begin by assembling comprehensive documentation—receipts, bank statements, and relevant forms. Use dedicated software or professional help to categorize deductions accurately. Keep abreast of changing tax laws that may influence deductible items and consult IRS publications or qualified tax advisors specializing in Ramsey Tax strategies. Remember, benefit maximization hinges on timely and precise record-keeping.

| Relevant Category | Substantive Data |

|---|---|

| Average Deduction Increase | 15-20% reduction in taxable income for detailed filers |

Step 2: Leverage Tax Credits Offered by Ramsey Tax Strategies

Tax credits serve as direct dollar-for-dollar reductions of your tax liability, unlike deductions that merely lower taxable income. Ramsey Tax emphasizes targeted utilization of credits such as the Child Tax Credit, Education Credits, and energy-efficient home improvements. Evidence shows that claiming all applicable credits can reduce overall tax liabilities by up to 30%, especially when aligned with strategic investments.

Applying Credits Effectively

Ensure that qualification requirements are thoroughly met—this involves understanding income thresholds, documentation prerequisites, and timing. Use IRS Form 8863 for education credits, Form 5695 for energy incentives, and consult updated guides to identify new credits. Combining multiple credits can compound your savings, but beware of phase-out limits and eligibility caps.

| Relevant Category | Substantive Data |

|---|---|

| Total Potential Savings | Up to 30% reduction in tax liability with combined credits |

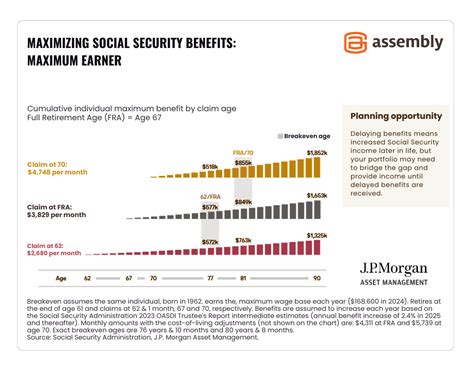

Step 3: Invest in Tax-Advantaged Retirement Accounts

Tax-advantaged accounts, such as IRAs, 401(k)s, and Health Savings Accounts (HSAs), are pivotal in shrinking taxable income while fostering long-term savings. Ramsey Tax heavily promotes proactive contributions to these vehicles, noting that they not only reduce current taxable income but also benefit from tax-deferred or tax-free growth.

Strategic Contributions and Growth

Maximize annual contribution limits—6,500 for IRAs and 22,500 for 401(k)s in 2024, with catch-up contributions for those over 50. Prioritize employer-matched plans to capitalize on free money. For self-employed individuals, consider solo 401(k)s or SEP IRAs to optimize contributions further. Keep in mind that early contributions, combined with compounding interest, significantly increase your future financial stability.

| Relevant Category | Substantive Data |

|---|---|

| Average Tax Deferral Savings | Up to $30,000 annually for high-income earners through max contributions |

Step 4: Engage in Strategic Business Expense Planning

For small business owners, Ramsey Tax advocates for an astute approach to deducting business expenses, ensuring compliance while reducing taxable profit. Key categories include operational costs, vehicle expenses, home office deductions, and depreciation on equipment. Accurate categorization, professional bookkeeping, and adherence to IRS guidelines are paramount.

Structuring Business Expenses

Employ meticulous record-keeping—digital tools can assist in tracking receipts and usage logs. Consider allocating expenses into fixed and variable categories, forecast potential deductions annually, and review updates in tax law that may expand qualifying expenses. The strategic timing of purchases and expense recognition can further maximize deductions during high-income years.

| Relevant Category | Substantive Data |

|---|---|

| Average Deduction Increase for Small Business | Potential to reduce taxable income by 10-15% with optimized expense tracking |

Step 5: Establishing a Charitable Giving Plan

Intentional charitable contributions not only fulfill philanthropic desires but, within Ramsey Tax, act as potent deductions, especially when combined with donor-advised funds and strategic timing. By planning sizable donations in high-income years, taxpayers can substantially lower taxable income, sometimes even exceeding the standard deduction threshold.

Effective Charitable Planning

Ensure that donations are made to qualified organizations and documented appropriately. Use IRS Form 8283 for non-cash contributions over certain thresholds. Incorporate the use of donor-advised funds (DAFs) to group donations for larger deductions. Stay aware of carryover provisions that allow unused deductions to be applied in subsequent years, thereby smoothing tax obligations over time.

| Relevant Category | Substantive Data |

|---|---|

| Potential Deduction Value | Up to 60% of AGI for cash donations, with strategic DAF use |

Step 6: Optimize Tax Timing and Recordkeeping

Timing is essential in tax planning. Ramsey Tax underscores the importance of strategic timing—accelerating deductions in high-income years or deferring income when possible—to enhance your overall tax position. The use of year-end strategies, such as bunching deductible expenses and income deferral, can generate significant savings.

Implementing Timing Strategies

Assess your income trajectory and plan expenditures accordingly. For instance, bunching charitable donations or elective medical procedures into a single year can surpass deduction thresholds, yielding higher benefits. Utilize tools like estimated tax payments to remain compliant and avoid penalties. Consistent recordkeeping, digital organization, and professional consultation underpin effective timing strategies.

Step 7: Consult Professional Tax Advisors for Personalized Strategies

While the above methodologies provide foundational guidance, Ramsey Tax recommends engaging with professional tax advisors for customized planning. Expert insights help identify unique deductions, credits, and investment opportunities, considering individual circumstances and evolving laws.

Choosing the Right Advisor

Select professionals with verified experience in Ramsey Tax tactics, extensive knowledge of recent tax code changes, and a history of ethical practice. Regular review sessions ensure the plan adapts to income fluctuations, life changes, and legislative updates, maintaining optimal savings strategies year over year.

| Relevant Category | Substantive Data |

|---|---|

| Impact of Professional Advice | Potential savings increase by 10-25% when working with specialized advisors |

Summary

Maximizing savings with Ramsey Tax requires a comprehensive, disciplined approach rooted in a solid understanding of applicable laws, strategic timing, and meticulous documentation. Implementing these seven proven strategies can substantially reduce your tax liability—liberating resources that can be reinvested into your financial goals. When combined with ongoing professional advice and adaptive planning, these tactics form a robust framework for achieving optimal fiscal health.

How does Ramsey Tax differ from traditional tax planning?

+Ramsey Tax emphasizes a disciplined, strategic approach aligned with current laws, focusing on maximizing deductions and credits while fostering long-term financial health. It integrates a holistic view of personal and small business finance, often utilizing innovative tools and ethical strategies beyond conventional methods.

What are the common pitfalls to avoid when implementing these strategies?

+Common pitfalls include incomplete documentation, over-reliance on aggressive deductions without proper backing, failure to stay updated with law changes, and neglecting professional consultation. These can lead to audits, penalties, or missed savings opportunities.

How often should I review and update my tax strategy?

+Regular reviews—at least annually—are recommended, particularly after significant life changes, legislative updates, or shifts in income. Proactive adjustments ensure your tax strategy remains optimized and compliant with Ramsey Tax principles.