What Is Florida Sales Tax

Florida, known as the Sunshine State, boasts a vibrant economy and a diverse business landscape. Understanding its sales tax system is crucial for both residents and businesses operating within the state. This comprehensive guide aims to unravel the intricacies of Florida's sales tax, providing an in-depth analysis for professionals seeking clarity on this essential aspect of financial management.

Unraveling Florida’s Sales Tax Structure

Florida’s sales tax system is a fundamental component of its revenue generation strategy, contributing significantly to the state’s financial health. The tax is imposed on the sale or lease of tangible personal property and certain services within the state’s borders. This includes everything from retail goods to rental agreements and specific services, ensuring a broad base for tax collection.

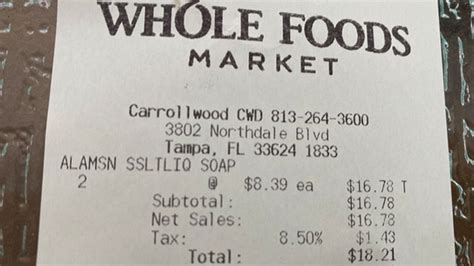

The state of Florida levies a 6% general sales tax rate, which applies uniformly across the state. This base rate is a key foundation for the state's tax structure, providing a consistent framework for businesses and consumers alike. However, it's important to note that local governments, including counties and municipalities, have the authority to impose additional discretionary sales surtaxes, which can vary across different regions within the state.

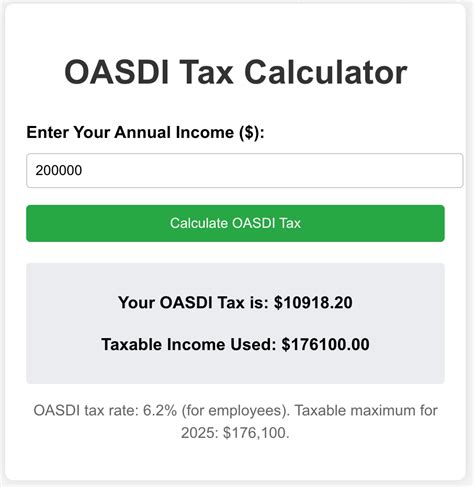

| Tax Component | Rate |

|---|---|

| State Sales Tax | 6% |

| Local Sales Surtaxes | Varies by County |

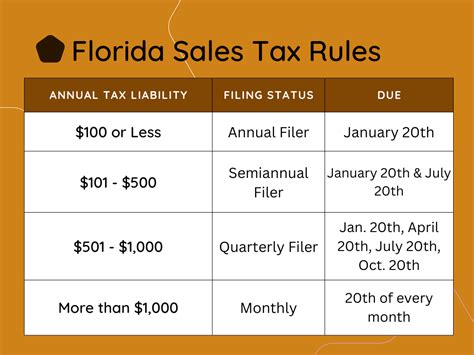

These local surtaxes are implemented to address specific regional needs, such as funding infrastructure projects or supporting local initiatives. The variability in these surtaxes results in a range of effective sales tax rates across Florida. For instance, in Miami-Dade County, the combined state and local sales tax rate is 7%, while in Orange County, which includes Orlando, the rate rises to 7.5%. These differences highlight the complexity of Florida's sales tax landscape and the need for businesses to stay informed about the specific tax rates applicable to their operations.

Exemptions and Special Considerations

Florida’s sales tax system also incorporates a range of exemptions and special provisions. Certain goods and services are exempt from sales tax, such as most groceries, prescription drugs, and non-prepared foods. Additionally, Florida offers tax exemptions for specific industries and situations, including manufacturing, research and development, and space exploration, among others.

Understanding these exemptions is crucial for businesses to navigate the tax system effectively. For instance, the Research and Development (R&D) Tax Refund allows eligible businesses to claim a refund on sales tax paid on purchases related to R&D activities. This incentive is a key aspect of Florida's strategy to encourage innovation and economic growth.

Sales Tax Compliance and Collection

Compliance with Florida’s sales tax regulations is a critical aspect for businesses. The Florida Department of Revenue (DOR) is responsible for administering and enforcing these regulations. Businesses are required to register with the DOR, collect the appropriate sales tax based on their location and the nature of their transactions, and remit these taxes regularly.

The DOR provides resources and guidance to help businesses navigate the sales tax process, including registration forms, tax rate lookup tools, and compliance guidelines. Failure to comply with sales tax regulations can result in penalties and interest, underscoring the importance of accurate and timely tax reporting.

The Impact of Florida Sales Tax on Businesses and Consumers

Florida’s sales tax structure has far-reaching implications for both businesses and consumers within the state. The tax not only contributes to state revenue but also influences consumer behavior, business strategies, and the overall economic landscape.

Influencing Consumer Behavior

The presence of a sales tax can impact consumer purchasing decisions. While a higher tax rate may discourage some consumers from making certain purchases, especially for discretionary items, it can also incentivize consumers to seek out tax-free alternatives or shop in lower-tax jurisdictions. This dynamic can influence the location of businesses and the strategies they employ to attract customers.

For instance, consumers in areas with higher sales tax rates may be more inclined to shop online or at outlets offering tax-free shopping experiences. This behavior can shape the retail landscape, with businesses adapting their strategies to cater to these changing consumer preferences.

Business Strategies and Competitiveness

Florida’s sales tax rates can significantly influence business operations and strategies. Businesses must consider the tax implications when pricing their goods and services, as higher taxes can affect their competitive positioning in the market. Additionally, businesses may need to factor in the cost of compliance, including the time and resources required for accurate tax reporting and remittance.

The variability in sales tax rates across Florida can also create competitive advantages or challenges for businesses. For example, a business located in a region with a lower sales tax rate may have a pricing advantage over competitors in higher-tax areas, potentially attracting more customers and increasing market share.

Economic Implications and Regional Development

The distribution of sales tax revenue can have a significant impact on regional development. Local governments often rely on sales tax revenue to fund essential services and infrastructure projects. In areas with higher sales tax rates or greater commercial activity, this revenue can lead to improved public services, enhanced infrastructure, and increased investment in the community.

Conversely, regions with lower sales tax rates or less commercial activity may struggle to fund these essential services, potentially leading to disparities in the quality of life and economic opportunities across the state. Effective sales tax management and equitable distribution of tax revenue are therefore crucial for balanced regional development.

Navigating Florida’s Sales Tax: Strategies for Businesses

For businesses operating in Florida, navigating the state’s sales tax landscape is essential for compliance and competitiveness. Here are some key strategies to consider:

Stay Informed about Tax Rates and Exemptions

Understanding the applicable sales tax rates and exemptions is crucial. Businesses should regularly monitor any changes in tax rates, especially if they have multiple locations or conduct business across different counties. This knowledge is vital for accurate pricing and compliance.

Implement Efficient Tax Compliance Systems

Developing robust systems for sales tax compliance is essential. This includes implementing software or processes that accurately calculate and track sales tax based on the location of the sale and the nature of the transaction. Efficient compliance systems can save businesses time and resources while minimizing the risk of errors and penalties.

Explore Tax Incentives and Exemptions

Florida offers a range of tax incentives and exemptions to promote certain industries and activities. Businesses should research and understand these incentives, as they can significantly reduce their tax burden. For example, the state’s incentives for manufacturing, R&D, and space exploration can provide substantial savings for eligible businesses.

Strategic Pricing and Market Positioning

Businesses should carefully consider the impact of sales tax on their pricing strategies. While higher taxes may require adjustments in pricing, businesses can also leverage tax-free offerings or incentives to enhance their competitive positioning. This may involve offering tax-free periods, bundling services to reduce the tax impact, or providing loyalty programs that offer tax-free benefits.

Engage with Tax Professionals

Navigating the complexities of sales tax can be challenging. Engaging with tax professionals or consultants who specialize in Florida’s tax system can provide valuable insights and guidance. These experts can help businesses understand the latest regulations, identify potential savings opportunities, and ensure compliance with the state’s tax laws.

Future Outlook and Potential Changes

Florida’s sales tax system is subject to ongoing evaluation and potential changes. As the state’s economic landscape evolves, so too may its tax policies. Here are some key considerations for the future:

Potential Tax Rate Adjustments

The state’s general sales tax rate of 6% has remained relatively stable, but there have been discussions about potential adjustments. While some advocate for a lower rate to boost consumer spending and business competitiveness, others propose increases to fund specific initiatives or address budget shortfalls. The outcome of these discussions can significantly impact the state’s economic landscape.

Technology-Driven Changes

Advancements in technology are likely to influence the sales tax system. The use of digital platforms and e-commerce is growing, and Florida may need to adapt its tax regulations to accommodate these changes. This could involve updating tax collection methods, addressing issues related to remote sales, and ensuring compliance with evolving business models.

Equitable Tax Distribution and Regional Development

The variability in sales tax rates across Florida raises questions about equitable tax distribution and regional development. Addressing these concerns may involve reevaluating the distribution of tax revenue or implementing measures to support regions with lower tax rates or economic challenges. Finding a balance that promotes fair regional development is a key challenge for policymakers.

Simplification and Compliance

Simplifying the sales tax system could be a focus in the future, particularly to ease compliance burdens on businesses. This could involve streamlining registration processes, improving tax rate lookup tools, and enhancing guidance materials. Simplification efforts can make the tax system more accessible and user-friendly, benefiting both businesses and consumers.

Policy Changes and Incentives

Florida’s tax policies are shaped by various factors, including economic conditions, political priorities, and external influences. Changes in these factors can lead to revisions in tax incentives, exemptions, or rates. Staying informed about these policy changes is crucial for businesses to adapt their strategies and remain compliant.

What is the current state sales tax rate in Florida?

+The current state sales tax rate in Florida is 6%.

Do counties in Florida have the authority to impose additional sales taxes?

+Yes, counties in Florida can impose additional sales surtaxes to fund local initiatives and projects.

Are there any exemptions from Florida’s sales tax?

+Yes, certain goods and services are exempt from Florida’s sales tax, including most groceries, prescription drugs, and non-prepared foods.

How can businesses ensure compliance with Florida’s sales tax regulations?

+Businesses should register with the Florida Department of Revenue, collect the appropriate sales tax based on their location and transaction type, and remit these taxes regularly. Staying informed about tax rates and exemptions is also crucial.

What potential changes might Florida’s sales tax system undergo in the future?

+Florida’s sales tax system may see potential changes in tax rates, technology-driven adaptations, revisions in tax incentives or exemptions, and efforts to simplify the tax system for better compliance.