Nebraska Property Tax

Welcome to our in-depth exploration of Nebraska's property tax system, a topic of great interest to homeowners, investors, and real estate enthusiasts alike. In this comprehensive guide, we will delve into the intricacies of property taxation in the Cornhusker State, shedding light on the key aspects that impact homeowners and businesses. Nebraska's property tax landscape is unique and dynamic, offering a blend of traditional assessment methods and modern approaches to ensure fairness and transparency. As we navigate through this guide, we will uncover the factors that influence property values, the assessment process, and the strategies available to manage and minimize tax liabilities. So, whether you're a resident looking to understand your property tax obligations or an investor seeking insights into Nebraska's real estate market, this article promises to deliver expert analysis and practical insights.

Understanding Nebraska’s Property Tax System: An Overview

Nebraska’s property tax system is a vital component of the state’s revenue generation, playing a significant role in funding essential services like education, infrastructure development, and public safety. The state’s property tax structure is designed to ensure that property owners contribute proportionally to these public services based on the value of their real estate holdings.

At the heart of Nebraska's property tax system is the concept of ad valorem taxation, which translates to "according to value." This means that the amount of property tax an owner pays is directly proportional to the assessed value of their property. The state's assessment process involves evaluating the market value of each property, considering factors such as location, improvements, and market conditions. This ensures that property owners are taxed fairly and equitably based on their property's actual worth.

Nebraska's property tax system is primarily administered at the local level, with each of the state's 93 counties responsible for assessing and collecting property taxes. This decentralized approach allows for local control and flexibility in tax rates and assessment practices. However, the state also provides guidelines and oversight to ensure consistency and fairness across counties.

One of the unique aspects of Nebraska's property tax system is the reassessment process, which occurs every two years. During this process, county assessors evaluate properties to determine if their values have changed since the last assessment. This ensures that property taxes remain up-to-date and reflective of the current market conditions. The reassessment process is a critical component of the system, as it helps maintain fairness and prevents property owners from paying taxes based on outdated values.

In addition to the regular reassessment, Nebraska also offers a property tax relief program to assist homeowners. This program provides credits or refunds to eligible homeowners, helping to reduce the burden of property taxes. The eligibility criteria and benefits vary depending on factors such as income, age, and property value. The tax relief program is a testament to the state's commitment to supporting its residents and ensuring that property taxes remain manageable.

Understanding the basics of Nebraska's property tax system is the first step towards navigating this complex landscape. As we delve deeper into the subsequent sections, we will explore the assessment process, tax rates, and the strategies available to homeowners and businesses to manage their property tax obligations effectively.

The Assessment Process: How Property Values Are Determined

The assessment process is a critical component of Nebraska’s property tax system, as it directly influences the tax liabilities of property owners. This process involves a meticulous evaluation of each property to determine its market value, which forms the basis for calculating property taxes.

Factors Influencing Property Values

Several factors come into play when assessing the value of a property in Nebraska. These factors include:

- Location: The location of a property is a significant determinant of its value. Properties in desirable neighborhoods or areas with excellent amenities and infrastructure tend to command higher prices.

- Size and Improvements: The size of a property, including the square footage of the building and the land area, plays a role in its valuation. Additionally, any improvements made to the property, such as renovations or additions, can increase its value.

- Market Conditions: The overall real estate market conditions in a particular area can influence property values. Factors like supply and demand, economic trends, and local development projects can impact the market value of properties.

- Comparable Sales: Assessing the sale prices of similar properties in the same area is a crucial aspect of the valuation process. By analyzing recent sales of comparable properties, assessors can establish a fair market value for a given property.

Assessment Methodology

Nebraska employs a mass appraisal approach to assess property values. This method involves using statistical techniques and market data to estimate the value of a large number of properties simultaneously. Mass appraisal ensures consistency and efficiency in the assessment process, especially when dealing with a large number of properties in a county.

The mass appraisal process typically involves the following steps:

- Data Collection: Assessors gather information about each property, including its physical characteristics, improvements, and recent sales data.

- Data Analysis: The collected data is then analyzed to identify patterns and trends in the market. This analysis helps assessors determine the factors that influence property values in a given area.

- Estimation of Value: Using the analyzed data and statistical models, assessors estimate the market value of each property. This value is then used as the basis for calculating property taxes.

- Review and Appeal: Property owners have the right to review their assessed values and appeal if they believe the assessment is inaccurate. The appeal process provides an opportunity for property owners to provide additional information or evidence to support their case.

The assessment process in Nebraska is designed to be transparent and fair, with clear guidelines and procedures in place. Property owners can access information about the assessment process, understand how their property values are determined, and exercise their rights to appeal if necessary.

By understanding the assessment process and the factors that influence property values, homeowners and businesses can better anticipate their property tax obligations and make informed decisions about their real estate holdings.

Property Tax Rates and Levy: Understanding the Breakdown

Nebraska’s property tax system is characterized by a two-tiered structure, comprising a state tax rate and local tax levies. This structure allows for a balanced approach to property taxation, ensuring that both state and local governments have the necessary funds to provide essential services to their residents.

State Tax Rate

The state tax rate in Nebraska is set by the Nebraska Legislature and is applied uniformly across the state. This rate determines the amount of property tax revenue that goes towards funding state-level programs and services, such as education, public health, and infrastructure projects.

The state tax rate is typically expressed as a percentage and is calculated based on the assessed value of a property. For example, if the state tax rate is set at 1%, a property with an assessed value of $200,000 would be subject to a state property tax of $2,000.

Local Tax Levies

In addition to the state tax rate, Nebraska’s property tax system includes local tax levies, which are determined by local taxing districts, such as cities, counties, school districts, and special purpose districts.

Local tax levies are established by these districts to fund their specific operations and services. For instance, a city may levy a tax to finance local government operations, while a school district may impose a tax to support education programs and facilities.

The local tax levy is typically expressed as a mill levy, which is calculated based on the assessed value of a property. A mill is equivalent to one-tenth of one percent, so a mill levy of 100 mills would equate to a tax rate of 1%.

The total property tax liability for a property is calculated by summing up the state tax rate and all applicable local tax levies. This total tax rate is then applied to the assessed value of the property to determine the annual property tax bill.

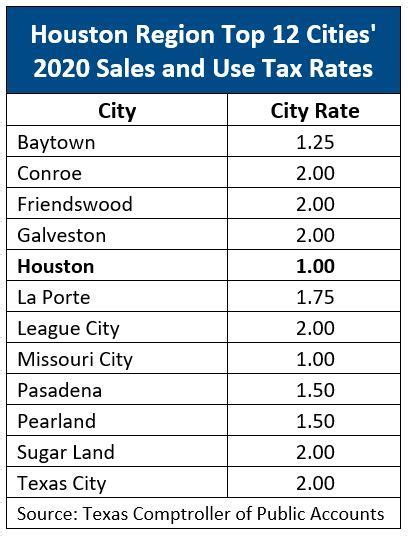

| Taxing Entity | Tax Rate (Mills) |

|---|---|

| State of Nebraska | Varies (Statewide) |

| City of Lincoln | 150 |

| Lancaster County | 250 |

| Lincoln Public Schools | 200 |

| Special Purpose Districts | Varies |

The breakdown of property tax rates and levies can vary significantly across Nebraska, as each taxing district has the autonomy to set its own tax rates based on its funding needs. This flexibility allows local governments to tailor their tax structures to meet the specific needs and priorities of their communities.

Understanding the breakdown of property tax rates and levies is crucial for property owners, as it helps them estimate their annual tax obligations and plan their finances accordingly. Additionally, being aware of the tax rates in different areas can influence real estate decisions, such as choosing a location for a new home or business.

Strategies for Managing Property Taxes: Tips and Best Practices

Managing property taxes is an essential aspect of financial planning for homeowners and businesses in Nebraska. While property taxes are a necessary contribution to support public services, there are strategies and best practices that can help minimize tax liabilities and optimize financial resources.

Understanding Your Property Assessment

The first step in managing property taxes effectively is to thoroughly understand your property assessment. This involves reviewing your assessment notice, which should detail the assessed value of your property and the factors considered in the valuation process. By understanding how your property’s value was determined, you can identify areas where you may be able to challenge or appeal the assessment if you believe it is inaccurate.

Appealing Your Property Assessment

If you believe your property’s assessed value is too high, you have the right to appeal the assessment. The appeal process in Nebraska is designed to be fair and accessible, providing property owners with an opportunity to present their case and potentially reduce their tax liabilities.

To initiate an appeal, you'll need to gather evidence to support your claim, such as recent sales data of comparable properties, appraisals, or expert testimony. It's important to thoroughly research and prepare your case, as the appeal process can be complex and requires a strong understanding of the assessment process and property valuation methods.

Maximizing Property Tax Relief Programs

Nebraska offers several property tax relief programs to assist homeowners, particularly those with limited incomes or special circumstances. These programs can provide credits, refunds, or exemptions to eligible homeowners, helping to reduce their property tax burdens.

Some common tax relief programs in Nebraska include:

- Homestead Exemption: Provides a partial exemption from property taxes for homeowners who meet certain income and residency requirements.

- Senior Property Tax Relief: Offers tax relief to elderly homeowners based on their income and property value.

- Disability Property Tax Exemption: Provides an exemption from property taxes for homeowners with qualifying disabilities.

- Veterans' Property Tax Exemption: Offers tax benefits to veterans and their surviving spouses based on their service and disability status.

It's important to research and understand the eligibility criteria and application process for these programs to maximize the benefits available to you. Each program has its own guidelines and requirements, so staying informed and proactive can help ensure you receive the tax relief you're entitled to.

Considerations for Business Owners

Business owners face unique challenges when it comes to property taxes, as commercial properties are typically assessed at higher values than residential properties. Here are some strategies for business owners to manage their property tax obligations:

- Appeal the Assessment: Just like homeowners, business owners can appeal their property assessments if they believe the value is inaccurate. This may involve providing evidence of recent sales of comparable commercial properties or expert testimony to support your case.

- Negotiate Tax Incentives: In some cases, local governments may offer tax incentives or abatements to attract or retain businesses. Business owners can explore these opportunities and negotiate with local authorities to secure favorable tax arrangements.

- Consider Ownership Structures: The way a business is structured can impact its property tax liabilities. For instance, owning a commercial property through an LLC or a partnership may offer certain tax advantages compared to owning it personally. Consulting with a tax professional can help business owners explore these options.

By implementing these strategies and staying informed about the latest tax laws and regulations, homeowners and businesses in Nebraska can effectively manage their property tax obligations and optimize their financial resources.

Future Outlook and Implications: Nebraska’s Property Tax Landscape

Nebraska’s property tax system, like any other, is subject to changes and evolutions over time. As the state’s economy, population, and real estate market dynamics shift, the property tax landscape is likely to adapt to meet the changing needs and priorities of its residents and businesses.

Potential Changes and Reforms

One area of potential reform in Nebraska’s property tax system is the frequency of reassessments. Currently, the state conducts reassessments every two years, which ensures that property values are kept up-to-date. However, some stakeholders argue that more frequent reassessments could provide a more accurate representation of property values, especially in rapidly changing markets.

Another area of focus for potential reforms is the distribution of tax revenues among different taxing districts. As the state's population and economic centers shift, certain areas may experience growth while others face decline. Ensuring that tax revenues are distributed equitably and that all communities have access to adequate public services is a key challenge for policymakers.

Impact of Economic Factors

The state’s economic health and real estate market trends significantly influence Nebraska’s property tax landscape. During periods of economic growth, property values tend to increase, leading to higher tax revenues for local governments. Conversely, economic downturns or recessions can result in declining property values, impacting tax revenues and potentially necessitating adjustments to tax rates or assessment practices.

The Role of Technology and Data

Advancements in technology and data analytics are likely to play an increasingly significant role in Nebraska’s property tax system. The use of advanced data analytics and machine learning can enhance the accuracy and efficiency of property assessments, ensuring that property values are determined more objectively and consistently.

Additionally, technology can streamline the tax collection and payment processes, making it easier for property owners to understand and manage their tax obligations. Online platforms and mobile apps can provide real-time information about tax rates, assessment values, and payment due dates, empowering homeowners and businesses to stay on top of their property tax responsibilities.

Community Engagement and Education

Engaging the community and promoting education about property taxes is essential for maintaining a fair and transparent system. Providing clear and accessible information about the assessment process, tax rates, and relief programs can help property owners understand their rights and responsibilities, leading to a more cooperative and informed citizenry.

Educational initiatives can also help dispel misconceptions and address concerns about property taxes, fostering a better understanding of the role that property taxes play in funding essential public services.

As Nebraska's property tax system continues to evolve, a balance between stability and adaptability will be key. Policymakers and stakeholders will need to navigate economic fluctuations, technological advancements, and community expectations to ensure that the property tax system remains fair, efficient, and responsive to the needs of Nebraskans.

What is the average property tax rate in Nebraska?

+The average property tax rate in Nebraska varies depending on the location and type of property. As of 2023, the statewide average effective property tax rate is approximately 1.42%, but this can range from 1.2% to 1.8% in different counties.

How often are property values reassessed in Nebraska?

+Property values in Nebraska are reassessed every two years as part of the state’s reassessment process. This ensures that property taxes remain up-to-date and reflective of current market conditions.

Are there any property tax relief programs available in Nebraska?

+Yes, Nebraska offers several property tax relief programs to assist homeowners. These include the Homestead Exemption, Senior Property Tax Relief, Disability Property Tax Exemption, and Veterans’ Property Tax Exemption