Tucson Sales Tax

Tucson, a vibrant city in Arizona, is renowned for its vibrant culture, stunning desert landscapes, and unique attractions. As a bustling hub, it attracts visitors and residents alike, and understanding the sales tax landscape is crucial for both consumers and businesses operating in this dynamic region.

Unraveling the Tucson Sales Tax System

The sales tax in Tucson is a fundamental aspect of the city’s economic framework, playing a pivotal role in funding public services and infrastructure development. This comprehensive guide aims to shed light on the intricacies of Tucson’s sales tax structure, providing an in-depth analysis for a clear understanding.

Sales Tax Rates: A Comprehensive Breakdown

Tucson’s sales tax system is a combination of state, county, and city taxes, each contributing to the overall tax rate applied to various goods and services. As of the latest data, the total sales tax rate in Tucson stands at 8.1%, which is slightly above the national average.

Here’s a detailed breakdown of the tax rates:

- State Sales Tax: 5.6% - This is a consistent rate across Arizona, contributing significantly to the state’s revenue.

- County Sales Tax: 2.0% - Pima County, where Tucson is located, imposes an additional tax to support county-wide initiatives.

- City Sales Tax: 0.5% - Tucson’s city government levies this tax to fund local projects and maintain city infrastructure.

It's important to note that these rates are subject to change based on legislative decisions and economic conditions. Businesses and consumers should stay updated with the latest tax rates to ensure compliance and accurate financial planning.

Goods and Services Affected by Sales Tax

Sales tax in Tucson applies to a wide range of goods and services, encompassing almost all retail purchases. However, there are certain exceptions and exemptions that can significantly impact businesses and consumers alike.

- Taxable Items: Clothing, electronics, groceries (excluding non-prepared food items), vehicles, and most consumer goods are subject to sales tax.

- Exemptions: Some essential items like prescription medications, medical devices, and educational materials are exempt from sales tax. Additionally, certain services like legal and professional services are often exempt.

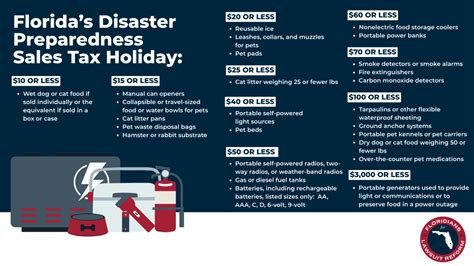

- Special Considerations: Tucson’s sales tax regulations also include provisions for tax holidays, where specific items are exempt from tax for a limited time, typically during back-to-school or holiday shopping seasons.

Sales Tax Compliance for Businesses

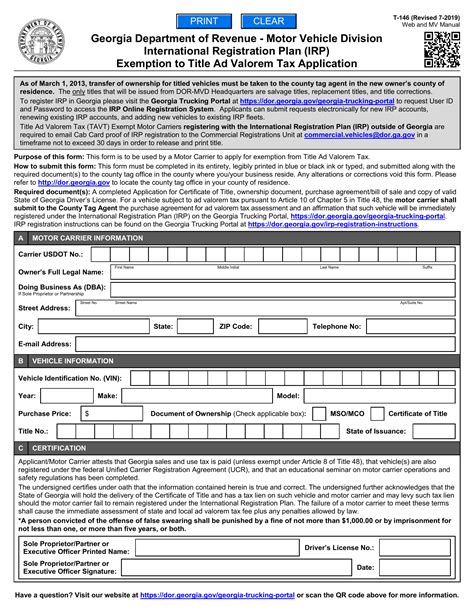

For businesses operating in Tucson, sales tax compliance is a critical aspect of their financial and legal obligations. Here’s an overview of key considerations:

- Registration: All businesses selling taxable goods or services must register with the Arizona Department of Revenue to obtain a Transaction Privilege Tax License. This license allows businesses to collect and remit sales tax.

- Collection: Businesses are responsible for collecting the appropriate sales tax from customers at the point of sale. The collected tax is then remitted to the state, county, and city tax authorities based on their respective rates.

- Reporting: Accurate and timely reporting is essential. Businesses must file sales tax returns periodically, providing details of sales transactions and the calculated tax amounts. Late or inaccurate filings can result in penalties.

- Tax Exemptions: Understanding the various tax exemptions and qualifications is crucial for businesses to avoid over-collection of sales tax. This includes staying updated with the latest regulations and seeking professional guidance when needed.

Impact on Consumers and the Local Economy

The sales tax system in Tucson has a direct impact on consumers’ purchasing power and their perception of the city’s cost of living. Here’s a closer look:

- Price Sensitivity: Consumers often consider sales tax when making purchasing decisions, especially for higher-value items. This can influence their shopping behavior and preferences, potentially impacting local businesses.

- Economic Growth: The sales tax revenue contributes significantly to the city’s economic development, funding infrastructure projects, education, and public services. This, in turn, attracts businesses and residents, fostering a healthy local economy.

- Tourism and Visitor Spending: For tourists and visitors, the sales tax adds to their overall travel expenses. However, Tucson’s vibrant culture and attractions often outweigh the tax considerations, making it a popular destination.

Comparative Analysis: Tucson vs. Other Cities

Understanding Tucson’s sales tax landscape in comparison to other cities can provide valuable insights into its economic competitiveness.

| City | Total Sales Tax Rate |

|---|---|

| Tucson, AZ | 8.1% |

| Phoenix, AZ | 8.3% |

| Los Angeles, CA | 9.5% |

| New York City, NY | 8.875% |

| Chicago, IL | 10.25% |

As the table illustrates, Tucson's sales tax rate is relatively competitive compared to other major cities. This factor, coupled with its vibrant culture and business environment, makes Tucson an attractive destination for businesses and consumers alike.

Frequently Asked Questions

How often do sales tax rates change in Tucson?

+Sales tax rates in Tucson, and Arizona as a whole, can change annually or even more frequently. These changes are often a result of legislative decisions or budget considerations. It’s crucial for businesses and consumers to stay updated with the latest rates to avoid compliance issues.

Are there any sales tax holidays in Tucson?

+Yes, Tucson, along with the rest of Arizona, does have sales tax holidays. These are designated periods, usually around major shopping seasons like back-to-school or holidays, where specific items are exempt from sales tax. These holidays are a great opportunity for consumers to save on essential purchases.

How can businesses ensure they are compliant with sales tax regulations in Tucson?

+Businesses can ensure compliance by registering with the Arizona Department of Revenue, collecting the correct sales tax rates, and filing accurate and timely sales tax returns. It’s also beneficial to stay updated with the latest tax regulations and consider seeking professional advice for complex tax scenarios.

What happens if a business fails to collect or remit sales tax in Tucson?

+Failure to collect or remit sales tax can result in significant penalties and legal consequences for businesses. It’s a serious offense that can lead to audits, fines, and even revocation of business licenses. Therefore, businesses should prioritize sales tax compliance.