Delaware County Property Taxes

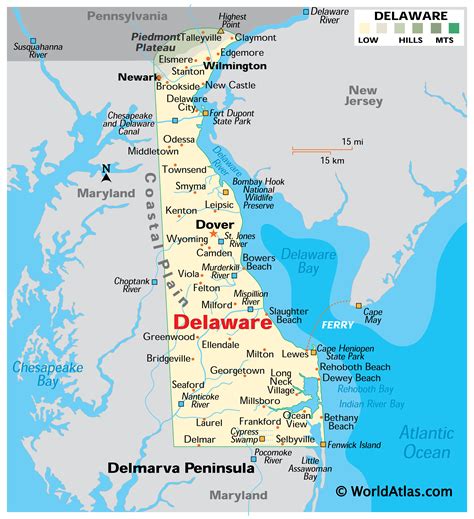

Delaware County, located in the state of Pennsylvania, is renowned for its vibrant communities, excellent schools, and diverse residential areas. However, one aspect that often sparks curiosity and discussion among residents and prospective homebuyers is the topic of property taxes. Understanding the intricacies of Delaware County's property tax system is crucial for making informed financial decisions and effectively managing one's real estate investments. In this comprehensive guide, we delve into the specifics of Delaware County property taxes, exploring how they are calculated, what factors influence them, and the various strategies available to taxpayers.

Understanding the Delaware County Property Tax System

Delaware County, like many other counties in Pennsylvania, operates on a countywide tax assessment system. This means that the county assesses the value of all properties within its jurisdiction, and these assessments are then used as the basis for calculating property taxes. The primary entity responsible for conducting these assessments is the Delaware County Office of Assessment and Tax Collection.

The property tax system in Delaware County is designed to generate revenue for various local government entities, including the county itself, municipalities, school districts, and other special taxing authorities. This revenue is crucial for funding essential services such as public education, infrastructure development, public safety, and more.

Property Tax Calculation

The process of calculating property taxes in Delaware County involves several key steps. First, the county conducts a comprehensive assessment of all properties, determining their market value. This assessment takes into account factors such as the property’s size, location, condition, and recent sales data of similar properties in the area. Once the market value is established, it is multiplied by the predetermined tax rate set by the local government authorities.

The tax rate in Delaware County is expressed as a millage rate, which represents the amount of tax owed per thousand dollars of assessed property value. For instance, a millage rate of 15 mills means that for every $1,000 of assessed value, the property owner will owe $15 in property taxes. This rate can vary across different municipalities and school districts within the county, as each has its own taxing authority and budget requirements.

To illustrate this calculation, consider the following example: if a property in Delaware County has an assessed value of $200,000 and the applicable millage rate is 20 mills, the annual property tax liability would be calculated as follows:

| Assessed Value | Millage Rate | Annual Property Tax |

|---|---|---|

| $200,000 | 20 mills | $4,000 |

In this case, the property owner would be responsible for paying $4,000 in annual property taxes.

Factors Influencing Property Taxes

Several factors contribute to the variability of property taxes across Delaware County. One significant factor is the location of the property within the county. Different municipalities and school districts may have varying tax rates and budgets, leading to differences in the tax liability for properties situated in these areas. Additionally, the market value of the property, as determined by the county’s assessment process, plays a crucial role in calculating property taxes.

Other factors that can influence property taxes include:

- Property Improvements: Upgrades or renovations made to a property can increase its market value, which may lead to higher property taxes.

- Economic Conditions: Changes in the local economy, such as fluctuations in real estate market values, can impact property assessments and, consequently, tax liabilities.

- Special Assessments: In some cases, local governments may impose special assessments on properties to fund specific projects or improvements, such as infrastructure upgrades.

- Exemptions and Deductions: Delaware County offers certain exemptions and deductions to eligible taxpayers, which can reduce their overall property tax burden. These may include homestead exemptions, senior citizen discounts, and veterans' exemptions.

Strategies for Managing Delaware County Property Taxes

For homeowners and prospective buyers in Delaware County, being proactive and well-informed about property taxes is essential for financial planning and maintaining a healthy financial relationship with their real estate investments. Here are some strategies and considerations to keep in mind:

Stay Informed about Tax Rates and Assessments

Keeping up-to-date with the tax rates and assessment practices in your specific municipality and school district is vital. These rates can change annually, and understanding the latest rates will help you accurately estimate your property tax liability.

The Delaware County Office of Assessment and Tax Collection provides valuable resources and information on its website, including tax rate tables, assessment data, and relevant forms and guidelines. Regularly checking these sources will ensure you have the most accurate and current information.

Review Your Property Assessment

Property assessments are conducted periodically, typically every few years, to update the market value of properties. It is essential to review your assessment to ensure its accuracy. If you believe your property’s assessed value is significantly higher than its actual market value, you may have grounds for an appeal.

The appeals process in Delaware County involves submitting a formal request for review, often with supporting documentation, to the county's Board of Assessment Appeals. If your appeal is successful, it can result in a reduction of your property's assessed value, leading to lower property taxes.

Explore Available Exemptions and Deductions

Delaware County offers several exemptions and deductions that can reduce your property tax liability. These include:

- Homestead Exemption: This exemption is available to homeowners who use their property as their primary residence. It provides a reduction in the assessed value of the property, resulting in lower taxes.

- Senior Citizen Discount: Delaware County offers a discount on property taxes for senior citizens who meet certain age and income requirements. This discount can significantly reduce the tax burden for eligible homeowners.

- Veterans' Exemptions: Active-duty military personnel and veterans may be eligible for property tax exemptions or discounts. These exemptions can vary based on the individual's service record and other factors.

It is crucial to research and understand the specific requirements and qualifications for these exemptions and deductions. The Delaware County Office of Assessment and Tax Collection provides detailed information on its website, and you can also consult with a tax professional to ensure you are maximizing the benefits available to you.

Consider the Impact of Property Improvements

While making improvements to your property can enhance its value and appeal, it’s important to be aware of the potential impact on your property taxes. Significant upgrades or renovations may increase your property’s assessed value, leading to higher taxes. However, some improvements, such as energy-efficient upgrades or accessibility modifications, may be eligible for tax credits or deductions.

When planning property improvements, consider consulting with a tax professional or the county's assessment office to understand how these changes may affect your tax liability. This proactive approach can help you make informed decisions and potentially mitigate any unexpected tax increases.

Stay Engaged with Local Government

Property taxes are a vital source of revenue for local governments, and as a taxpayer, you have a stake in how these funds are allocated and spent. Staying engaged with your local government and attending public meetings can provide valuable insights into budget decisions and tax policy changes.

By actively participating in the local governance process, you can voice your concerns, advocate for your interests, and stay informed about initiatives that may impact your property taxes. This engagement can also help foster a sense of community and contribute to the overall well-being of your neighborhood and municipality.

Conclusion: Navigating Delaware County Property Taxes

Understanding and managing Delaware County property taxes is an essential aspect of homeownership and real estate investment. By staying informed about tax rates, assessment practices, and available exemptions, homeowners can make informed financial decisions and effectively plan their budgets. Additionally, being proactive in reviewing assessments and exploring tax-saving strategies can lead to significant savings over time.

Delaware County's property tax system, while complex, is designed to support the vibrant communities and essential services that make the county a desirable place to live and work. By staying engaged and informed, taxpayers can ensure they are contributing fairly to these services while also optimizing their financial relationship with their real estate investments.

How often are property assessments conducted in Delaware County?

+Property assessments in Delaware County are conducted every three years. This assessment cycle allows the county to update property values and ensure fairness and accuracy in the tax system.

Can I appeal my property assessment if I believe it is inaccurate?

+Yes, Delaware County provides a formal appeals process for taxpayers who believe their property assessment is incorrect. You can submit a request for review, along with supporting evidence, to the Board of Assessment Appeals. If your appeal is successful, it can result in a reduction of your property’s assessed value and, consequently, lower taxes.

Are there any tax breaks or exemptions available for senior citizens in Delaware County?

+Yes, Delaware County offers a Senior Citizen Discount on property taxes. To qualify, you must be at least 65 years old, meet certain income requirements, and own and occupy the property as your primary residence. This discount can significantly reduce the tax burden for eligible senior homeowners.

How can I stay informed about changes in tax rates and assessments in my municipality?

+The best way to stay informed is to regularly check the official websites of your municipality and school district. These websites often provide tax rate tables, assessment information, and updates on any proposed changes or initiatives. Additionally, attending local government meetings and subscribing to newsletters can keep you up-to-date with the latest developments.