Gccisd Tax Office

Welcome to an in-depth exploration of the Gccisd Tax Office, a vital institution within the Grand Prairie Independent School District in Texas. This comprehensive article will delve into the workings of the tax office, its services, and its impact on the local community. With a focus on accuracy and detail, we aim to provide a clear understanding of this essential government entity.

The Role and Significance of Gccisd Tax Office

The Grand Prairie Independent School District, or Gccisd as it is commonly known, is a large school district serving the city of Grand Prairie and parts of Arlington, Dallas, and Irving in Texas. At the heart of this educational system is the Gccisd Tax Office, a dedicated department responsible for managing the district’s tax-related affairs.

The tax office plays a crucial role in ensuring the financial stability and sustainability of the school district. Its primary function is to assess, collect, and distribute property taxes, which constitute a significant portion of the district's revenue. These taxes are instrumental in funding the various educational programs, facilities, and services provided by Gccisd.

Understanding the Tax Assessment Process

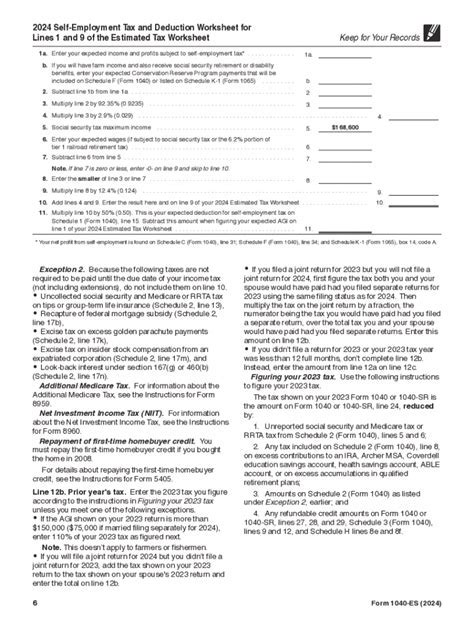

The tax assessment process undertaken by the Gccisd Tax Office is a meticulous and regulated procedure. It involves evaluating the value of properties within the district’s boundaries, considering factors such as location, size, improvements, and market conditions. This assessment determines the tax rate applicable to each property owner.

The tax office employs a team of skilled professionals who utilize advanced valuation techniques and software to ensure fair and accurate assessments. Property owners are given the opportunity to review and appeal their assessments if they believe there has been an error or if they disagree with the valuation.

| Assessment Type | Description |

|---|---|

| Market Value Assessment | Determines property value based on recent sales and market trends. |

| Income Approach | Estimates value based on potential rental income and operating expenses. |

| Cost Approach | Calculates value by considering the cost of replacing the property. |

Tax Collection and Distribution

Once assessments are finalized, the Gccisd Tax Office initiates the collection process. Property owners are issued tax bills, which outline the amount due and the payment deadlines. The tax office offers various payment methods, including online payments, mail-in checks, and in-person payments at designated locations.

The collected taxes are then distributed to the appropriate entities, primarily the school district itself. A significant portion of the tax revenue goes towards funding the district's operations, including teacher salaries, maintenance of schools and facilities, educational resources, and various student support programs. The remaining portion is distributed to other local taxing authorities, such as the city and county governments.

Services Offered by Gccisd Tax Office

Beyond tax assessment and collection, the Gccisd Tax Office provides a range of services to support property owners and ensure a smooth and efficient process.

Tax Payment Assistance

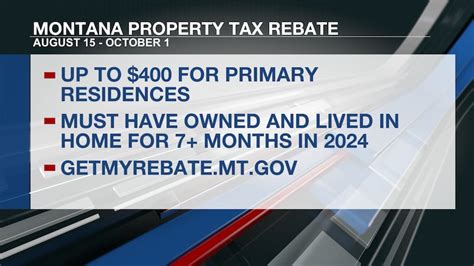

Recognizing that property taxes can be a significant financial burden, especially for low-income households, the tax office offers assistance programs. These programs provide information and guidance on tax deferral options, homestead exemptions, and other tax relief measures. By helping property owners navigate these benefits, the tax office aims to ease the financial strain and promote homeownership.

For instance, the Homestead Exemption program allows qualifying homeowners to reduce their taxable property value, resulting in lower tax bills. The tax office actively promotes this and other similar programs to ensure eligible residents can take advantage of these benefits.

Online Tax Services

In an effort to enhance convenience and accessibility, the Gccisd Tax Office has embraced digital transformation. Property owners can now access a wide range of services online, including tax bill payments, assessment reviews, and exemption applications. The online platform provides real-time updates, allowing taxpayers to monitor their account status and payment history.

Additionally, the tax office regularly sends email notifications and updates to registered users, keeping them informed about upcoming deadlines, tax rate changes, and other relevant information. This digital approach not only streamlines the tax process but also reduces administrative costs and minimizes errors.

Community Engagement and Education

The Gccisd Tax Office understands the importance of community engagement and education. It actively participates in local events and initiatives, providing information booths and hosting workshops to educate residents about tax-related matters. By fostering a culture of transparency and open communication, the tax office aims to build trust and understanding with the community.

Furthermore, the tax office maintains an extensive resource center on its website, offering guides, FAQs, and educational materials. These resources cover a wide range of topics, from understanding tax assessments to navigating the appeal process. By empowering property owners with knowledge, the tax office ensures a more informed and engaged community.

Performance and Impact

The Gccisd Tax Office’s performance and impact on the community are significant and far-reaching. By efficiently collecting and distributing property taxes, the tax office plays a vital role in supporting the educational system and local infrastructure.

Funding Educational Excellence

The tax revenue generated by the Gccisd Tax Office directly contributes to the district’s ability to provide high-quality education. It funds a range of initiatives, including:

- Teacher Compensation: Ensuring competitive salaries to attract and retain talented educators.

- School Facilities: Upgrading and maintaining school buildings, ensuring a safe and conducive learning environment.

- Educational Resources: Providing textbooks, technology, and other resources to enhance student learning.

- Extracurricular Activities: Supporting sports teams, music programs, and other extracurricular activities that enrich the student experience.

Community Development and Infrastructure

Beyond education, the tax office’s work also impacts the broader community. A portion of the tax revenue is allocated to local government bodies, contributing to the development and maintenance of essential infrastructure. This includes roads, public parks, libraries, and other public amenities that enhance the quality of life for residents.

For instance, the Grand Prairie Public Library, a well-loved community hub, receives funding support from the tax office. This funding ensures the library can offer a diverse range of programs, resources, and events, benefiting residents of all ages and backgrounds.

Future Implications and Continuous Improvement

As the Grand Prairie community continues to grow and evolve, the Gccisd Tax Office remains committed to adapting and improving its services. By staying abreast of industry best practices and technological advancements, the tax office aims to enhance efficiency, transparency, and taxpayer satisfaction.

Digital Transformation and Data Analytics

The tax office is exploring ways to further leverage technology to streamline processes and improve decision-making. Implementing advanced data analytics tools can enable more accurate tax assessments and identify potential inefficiencies in the collection process. Additionally, integrating digital payment systems and online platforms can continue to enhance the user experience for taxpayers.

Community Engagement and Feedback

Engaging with the community remains a top priority for the Gccisd Tax Office. By actively seeking feedback and suggestions, the tax office can identify areas for improvement and tailor its services to better meet the needs of property owners. This continuous dialogue fosters a sense of partnership and ensures the tax office remains responsive to the community’s evolving needs.

Furthermore, the tax office aims to expand its outreach efforts, particularly to underserved communities, to ensure equal access to information and support. By bridging any existing communication gaps, the tax office can promote financial literacy and empower residents to make informed decisions about their property taxes.

Conclusion

The Gccisd Tax Office stands as a vital pillar within the Grand Prairie Independent School District, playing a critical role in funding education and supporting the local community. Through its dedicated efforts in tax assessment, collection, and distribution, the tax office ensures the financial stability of the district and enhances the overall quality of life for residents.

As it continues to innovate and improve, the Gccisd Tax Office remains committed to transparency, efficiency, and community engagement. By embracing digital transformation and continuous improvement, the tax office aims to deliver exceptional services and contribute to the prosperity and well-being of the Grand Prairie community.

How can I access my tax assessment information?

+You can access your tax assessment information online through the Gccisd Tax Office website. Log in to your account, and you’ll find detailed assessment data, including the assessed value, tax rate, and any applicable exemptions.

What are the payment options for my property taxes?

+Gccisd Tax Office offers various payment options, including online payments through their secure portal, mail-in checks, and in-person payments at designated locations. You can choose the method that best suits your preferences and convenience.

How do I apply for a homestead exemption?

+To apply for a homestead exemption, you can visit the Gccisd Tax Office website and download the necessary application form. Fill out the form, gather the required supporting documents, and submit it to the tax office. They will review your application and inform you of the outcome.