Riverside County Ca Property Tax

Property taxes are an essential aspect of homeownership and local government funding in the United States. Riverside County, California, is known for its diverse landscapes, ranging from the scenic mountains and deserts to vibrant urban areas. With a population of over 2 million, it is the fourth-most populous county in California and home to numerous communities, including the city of Riverside, which serves as the county seat.

Understanding property taxes in Riverside County is crucial for both current and prospective homeowners. This comprehensive guide aims to delve into the intricacies of Riverside County property taxes, providing valuable insights into how they work, how they are calculated, and what factors influence them.

The Basics of Riverside County Property Taxes

Property taxes in Riverside County, as in many other places, are a vital source of revenue for local governments, including cities, school districts, and special districts. These taxes are used to fund essential public services such as education, public safety, infrastructure, and other community needs.

In Riverside County, property taxes are primarily assessed and collected by the County Assessor's Office, with additional assessments by various local entities, including school districts. These assessments are then forwarded to the County Tax Collector, who issues tax bills and collects the taxes.

It's important to note that property taxes in California, and by extension, Riverside County, are subject to Proposition 13, a constitutional amendment passed in 1978. Proposition 13 set limits on property tax increases, ensuring that homeowners are not faced with exorbitant tax hikes year after year. This proposition has significantly impacted the way property taxes are assessed and collected in the state.

The Role of Proposition 13 in Riverside County Property Taxes

Proposition 13, or Prop 13 as it is commonly known, limits the annual increase in the assessed value of a property to a maximum of 2% or the inflation rate, whichever is lower. This means that even if a property’s market value increases significantly in a given year, the assessed value for tax purposes cannot exceed this limit.

However, there are a few exceptions to this rule. When a property is sold, its assessed value is reset to the current fair market value, and the new owner is subject to the 2% annual increase limit. Additionally, if improvements are made to a property, the assessed value may increase accordingly.

| Property Tax Base | Description |

|---|---|

| Assessed Value | The value of the property as determined by the County Assessor's Office. |

| Tax Rate | The rate at which the assessed value is taxed, consisting of the base rate and additional assessments. |

| Base Rate | The basic tax rate set by the county, currently at 1% in Riverside County. |

| Additional Assessments | Supplemental taxes for special districts, school bonds, and other local services. |

How Riverside County Property Taxes are Calculated

The calculation of property taxes in Riverside County involves several steps, ensuring that each property owner pays their fair share based on the value of their property.

Assessed Value Determination

The first step in calculating property taxes is determining the assessed value of the property. This value is established by the County Assessor’s Office and is based on the property’s fair market value, which is the price the property would likely sell for on the open market.

The assessor takes into account various factors when determining the fair market value, including:

- Recent sales of similar properties in the area.

- Property features, such as size, age, and condition.

- Location and view.

- Any improvements or additions made to the property.

Once the assessed value is determined, it is subject to the Proposition 13 limitations, as discussed earlier. This means that the assessed value cannot increase by more than 2% (or the inflation rate) annually unless there is a change in ownership or new construction.

Tax Rate Application

After the assessed value is established, the tax rate is applied to calculate the actual property tax amount. The tax rate is a combination of the base rate and any additional assessments for specific services or improvements.

In Riverside County, the base rate is currently set at 1% of the assessed value. However, this base rate may vary slightly from one city or district to another within the county.

In addition to the base rate, there may be supplemental taxes or special assessments applied to a property. These additional taxes fund specific services or infrastructure improvements in the area and are typically set by local governments or special districts.

Calculating the Final Tax Amount

To calculate the final property tax amount, the assessed value is multiplied by the applicable tax rate, including both the base rate and any additional assessments.

Here's a simplified formula to understand the calculation:

Final Tax Amount = Assessed Value x (Base Rate + Additional Assessments)

For example, if a property has an assessed value of $500,000, and the base rate is 1% with additional assessments of 0.5%, the calculation would be as follows:

Final Tax Amount = $500,000 x (0.01 + 0.005) = $5,250

So, in this example, the property owner would owe $5,250 in property taxes for the year.

Factors Influencing Riverside County Property Taxes

Several factors can influence the amount of property taxes owed by a homeowner in Riverside County. Understanding these factors can help homeowners anticipate and plan for their annual tax obligations.

Property Value Changes

The most significant factor affecting property taxes is the change in property value. While Proposition 13 limits annual increases in assessed value, it does not prevent the market value of a property from rising or falling.

If a property's market value increases significantly due to factors such as renovations, additions, or a booming real estate market, the assessed value may be adjusted accordingly when the property is sold. This can result in a higher tax bill for the new owner.

Local Services and Infrastructure

The level and quality of local services and infrastructure can impact property taxes. For instance, if a community invests in improving schools, parks, or public safety, these improvements may be funded through additional assessments on property taxes.

Similarly, if a special district, such as a water or fire protection district, provides services to a specific area, property owners within that district may pay additional taxes to support those services.

Economic Conditions

Economic conditions, both locally and nationally, can influence property values and, by extension, property taxes. During economic downturns, property values may decrease, leading to lower assessed values and potentially lower property taxes.

Conversely, during periods of economic growth and prosperity, property values may rise, resulting in higher assessed values and potentially higher property taxes, especially if there is a change in ownership.

Tax Incentives and Exemptions

California offers certain tax incentives and exemptions that can reduce the property tax burden for eligible homeowners. For example, the Homeowners’ Exemption reduces the assessed value of a primary residence by $7,000, resulting in lower property taxes.

Additionally, veterans, seniors, and disabled individuals may be eligible for property tax exclusions or deferrals, which can significantly reduce their tax obligations.

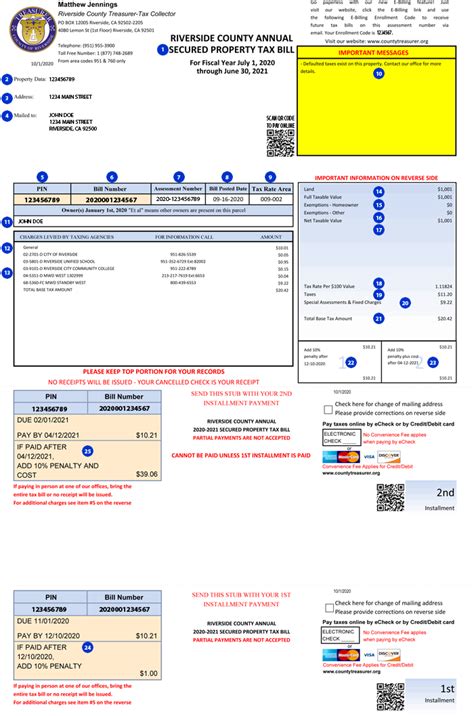

Property Tax Bills and Payment Options in Riverside County

Once the property taxes have been calculated, the County Tax Collector’s Office issues tax bills to property owners. These bills outline the total amount due, the due dates, and any applicable penalties for late payments.

In Riverside County, property taxes are typically due in two installments, with the first installment due on November 1st and the second installment due on February 1st of the following year. If the first installment is not paid by December 10th, a 10% penalty is applied.

There are several payment options available to Riverside County property owners, including:

- Online payment through the County's official website.

- Mail-in payments using the remittance coupon provided with the tax bill.

- In-person payments at designated locations, including the County Tax Collector's Office.

- Automatic payment plans, where the tax amount is deducted directly from a bank account.

It's important for property owners to ensure that their taxes are paid on time to avoid penalties and potential legal consequences, including tax liens and foreclosure.

Challenging Property Tax Assessments in Riverside County

If a Riverside County property owner believes that their property’s assessed value is inaccurate or unfair, they have the right to challenge the assessment. This process, known as a property tax appeal, can result in a reduction of the assessed value and, consequently, a lower tax bill.

To initiate a property tax appeal, the property owner must file a property tax assessment appeal application with the County Assessment Appeals Board. This application typically requires detailed information about the property and evidence supporting the claimed value.

The Assessment Appeals Board will review the appeal and may request additional information or schedule a hearing to make a final determination. If the appeal is successful, the assessed value of the property may be adjusted, leading to a refund or a reduced tax bill for the current and future years.

Conclusion

Understanding Riverside County property taxes is essential for homeowners in the area. By grasping the fundamentals of how property taxes are assessed, calculated, and influenced by various factors, homeowners can make informed decisions and plan their finances accordingly.

While property taxes can be a significant expense, they are an integral part of supporting the local community and ensuring the availability of essential public services. With the right knowledge and resources, homeowners can navigate the property tax landscape with confidence and ensure their obligations are met.

What happens if I don’t pay my property taxes in Riverside County?

+Failure to pay property taxes can result in penalties, interest, and potentially more severe consequences. If taxes remain unpaid, the County may place a tax lien on the property, which can lead to foreclosure and the loss of ownership. It’s important to pay taxes on time or explore options for payment plans to avoid these issues.

Can I deduct my property taxes from my federal taxes?

+Yes, property taxes are generally deductible on federal income tax returns. However, there are limits and restrictions, especially with the Tax Cuts and Jobs Act of 2017. It’s advisable to consult with a tax professional to understand the current deductions available and ensure compliance with IRS regulations.

Are there any exemptions or reductions available for property taxes in Riverside County?

+Yes, Riverside County offers several exemptions and reductions for property taxes. These include the Homeowners’ Exemption, which reduces the assessed value by $7,000, as well as exemptions for veterans, seniors, and disabled individuals. It’s recommended to explore these options to potentially lower your tax burden.

How often are property tax assessments reviewed in Riverside County?

+Property tax assessments are reviewed annually in Riverside County. However, due to Proposition 13, the assessed value can only increase by a maximum of 2% (or the inflation rate) annually unless there is a change in ownership or new construction. This ensures stability for homeowners.