Sales Tax Of Pa

In the state of Pennsylvania, sales tax is an essential component of the state's revenue generation, contributing significantly to the funding of various public services and infrastructure. Understanding the intricacies of Pennsylvania's sales tax system is crucial for businesses operating within the state and for consumers who wish to make informed financial decisions. This article aims to provide a comprehensive guide to Pennsylvania's sales tax, covering its history, current rates, applicable goods and services, exemptions, collection, and remittance processes, as well as its impact on the state's economy.

A Historical Perspective on Pennsylvania Sales Tax

The history of sales tax in Pennsylvania dates back to the early 20th century when the state first introduced the concept as a means to generate additional revenue for essential public services. Over the years, the sales tax system has undergone various transformations, with rate changes and amendments to the types of goods and services subject to taxation. These changes have been influenced by economic factors, political decisions, and the evolving needs of the state.

One notable event in the history of Pennsylvania's sales tax was the implementation of the Sales Tax Act in 1951, which established a uniform sales tax rate across the state. This act served as a foundation for the modern sales tax system, although subsequent amendments have led to variations in tax rates across different municipalities and jurisdictions.

Current Sales Tax Rates and Local Variations

As of [current date], Pennsylvania’s state-wide sales tax rate stands at [current state-wide sales tax rate] percent. However, it’s important to note that this rate can vary depending on the specific location within the state. Local jurisdictions, such as counties and municipalities, have the authority to impose additional sales taxes, resulting in varying tax rates across Pennsylvania.

For instance, in the city of Philadelphia, the sales tax rate is [Philadelphia sales tax rate] percent, which includes both the state and local sales tax components. On the other hand, in counties like Adams and Franklin, the sales tax rate is lower at [Adams and Franklin counties sales tax rate] percent, reflecting the absence of additional local taxes.

These local variations in sales tax rates can have a significant impact on businesses operating across different regions of Pennsylvania. It's crucial for businesses to stay updated on the specific tax rates applicable to their locations to ensure compliance and accurate tax remittance.

Understanding Local Sales Tax Add-ons

In addition to the state-wide sales tax, many local jurisdictions in Pennsylvania impose their own local sales tax add-ons. These add-ons are designed to fund specific projects or initiatives within the community, such as infrastructure development, education, or public safety programs.

For example, the city of Pittsburgh levies a local sales tax add-on of [Pittsburgh local sales tax add-on rate] percent, dedicated to supporting the city's public transit system. Similarly, in the borough of Erie, a local sales tax add-on of [Erie local sales tax add-on rate] percent is used to fund various community development projects.

These local sales tax add-ons can significantly impact the overall tax burden for consumers and businesses, emphasizing the importance of staying informed about the specific tax rates applicable to each jurisdiction.

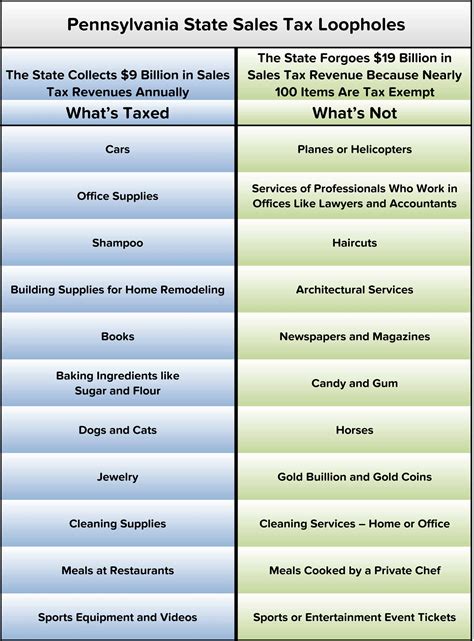

Goods and Services Subject to Sales Tax

Pennsylvania’s sales tax applies to a wide range of goods and services, encompassing most consumer transactions. However, it’s essential to note that certain items are exempt from sales tax, and others may be subject to specific tax rates or regulations.

Taxable Goods and Services

The list of taxable goods and services in Pennsylvania is extensive and includes, but is not limited to:

- Clothing and footwear

- Electronics and appliances

- Furniture and home goods

- Groceries and non-prescription drugs

- Restaurant meals and prepared foods

- Vehicles and automotive services

- Hotel and lodging accommodations

- Entertainment and recreational services

- Construction and renovation services

- Professional services, such as legal and accounting fees

Businesses engaged in the sale of these goods or services are responsible for collecting and remitting the appropriate sales tax to the state.

Exemptions and Special Considerations

While Pennsylvania’s sales tax applies to a broad spectrum of goods and services, certain items are exempt from taxation. These exemptions are designed to provide relief to specific industries or to support essential services.

For instance, the following items are generally exempt from Pennsylvania's sales tax:

- Prescription medications and medical devices

- Residential utilities, including electricity, gas, and water

- Certain agricultural equipment and supplies

- Educational materials and textbooks

- Religious publications and items

- Certain types of machinery and equipment used in manufacturing

Additionally, Pennsylvania offers various special considerations and reduced tax rates for specific goods and services. For example, the state offers a reduced sales tax rate of [reduced tax rate] percent for the sale of qualifying food items, such as unprepared groceries and non-taxable food products.

Sales Tax Collection and Remittance

The process of collecting and remitting sales tax in Pennsylvania involves several key steps, ensuring compliance with state regulations and timely payment of taxes.

Registering for a Sales Tax Permit

Businesses engaged in taxable sales within Pennsylvania must obtain a Sales Tax Permit from the Pennsylvania Department of Revenue. This permit authorizes businesses to collect and remit sales tax on behalf of the state.

The registration process involves completing the necessary paperwork, providing business details, and paying the applicable registration fee. Once registered, businesses are assigned a unique permit number, which must be displayed on all sales tax documents and records.

Sales Tax Collection

Businesses are responsible for collecting sales tax from customers at the point of sale. The tax is calculated based on the applicable tax rate for the specific jurisdiction where the sale occurs. It’s crucial for businesses to maintain accurate records of sales transactions, including the tax collected, to ensure compliance with reporting requirements.

In Pennsylvania, sales tax is typically collected at the time of payment, whether it's through cash, credit card, or other payment methods. Businesses must clearly indicate the sales tax amount on the customer's receipt, providing transparency and ensuring consumer awareness.

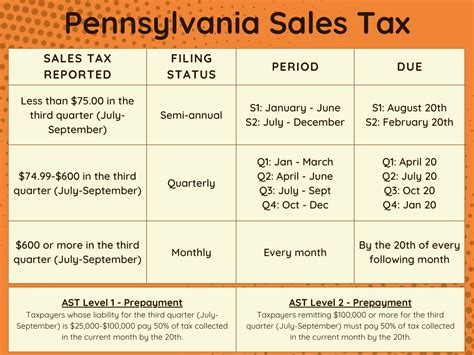

Sales Tax Remittance

Once sales tax has been collected, businesses are required to remit the tax to the Pennsylvania Department of Revenue within a specified timeframe. The remittance process involves completing the appropriate tax forms, providing sales and tax information, and making the payment to the state.

Pennsylvania offers various methods for tax remittance, including electronic filing and payment systems, such as the e-Tax System, which provides a secure and convenient platform for businesses to manage their tax obligations.

It's essential for businesses to adhere to the remittance deadlines to avoid penalties and interest charges. The frequency of remittance can vary depending on the business's sales volume and tax liability, with options for monthly, quarterly, or annual remittance.

Impact of Sales Tax on Pennsylvania’s Economy

Pennsylvania’s sales tax system plays a significant role in the state’s economy, influencing consumer spending, business operations, and the overall financial health of the state.

Consumer Spending and Tax Burden

Sales tax has a direct impact on consumer spending behavior. The tax burden can influence purchasing decisions, with consumers potentially adjusting their spending habits based on the tax rates and their financial circumstances.

In Pennsylvania, the varying sales tax rates across different regions can create incentives for consumers to shop in areas with lower tax rates. This phenomenon, known as tax arbitrage, can impact local businesses and the overall economic vitality of a region.

Business Operations and Compliance

For businesses, the sales tax system presents both opportunities and challenges. On one hand, sales tax collection provides a steady stream of revenue for the state, which can benefit businesses through improved public services and infrastructure. On the other hand, businesses must navigate the complexities of the tax system, ensuring compliance with registration, collection, and remittance requirements.

The burden of sales tax compliance can vary depending on the size and nature of the business. Larger businesses with dedicated accounting and tax teams may have a more streamlined process, while smaller businesses may face challenges in managing their tax obligations alongside their core operations.

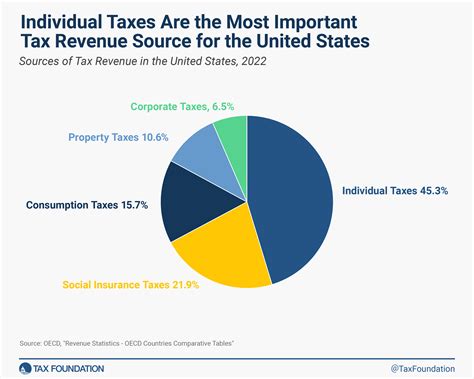

Revenue Generation and State Finances

Pennsylvania’s sales tax is a critical component of the state’s revenue generation, contributing significantly to the state’s overall budget. The revenue collected from sales tax is used to fund essential services, including education, healthcare, transportation, and public safety.

The state's ability to maintain a stable and predictable sales tax system is crucial for attracting businesses and promoting economic growth. A well-managed sales tax system can provide a competitive advantage for Pennsylvania, encouraging investment and job creation within the state.

Future Implications and Potential Reforms

As Pennsylvania’s economy continues to evolve, the state’s sales tax system may undergo further reforms and amendments. The state government regularly reviews the sales tax structure to ensure it aligns with the changing economic landscape and the needs of its residents.

Potential reforms could include revisions to the tax rates, expansion or reduction of taxable goods and services, or the introduction of new tax incentives to support specific industries or initiatives. These reforms aim to strike a balance between generating sufficient revenue for the state and minimizing the tax burden on consumers and businesses.

What is the current state-wide sales tax rate in Pennsylvania?

+As of [current date], the state-wide sales tax rate in Pennsylvania is [current state-wide sales tax rate] percent.

Are there any local variations in sales tax rates within Pennsylvania?

+Yes, local jurisdictions in Pennsylvania have the authority to impose additional sales taxes, resulting in varying tax rates across the state. For example, Philadelphia has a higher sales tax rate compared to counties like Adams and Franklin.

What types of goods and services are exempt from sales tax in Pennsylvania?

+Certain items are exempt from sales tax in Pennsylvania, including prescription medications, residential utilities, agricultural equipment, educational materials, and religious publications. Additionally, there are special considerations and reduced tax rates for specific food items.

How often do businesses need to remit sales tax to the state of Pennsylvania?

+The frequency of sales tax remittance can vary depending on the business’s sales volume and tax liability. Businesses may remit taxes monthly, quarterly, or annually, ensuring compliance with the state’s remittance deadlines to avoid penalties and interest charges.

What are the potential future reforms for Pennsylvania’s sales tax system?

+Potential future reforms for Pennsylvania’s sales tax system may include revisions to tax rates, changes to taxable goods and services, or the introduction of new tax incentives. These reforms aim to adapt the tax system to the evolving economic landscape while balancing revenue generation and the tax burden on consumers and businesses.