Head Of Household Taxes

Welcome to a comprehensive guide on the intricacies of the Head of Household (HOH) tax filing status. This article will delve into the various aspects of this tax classification, offering a detailed understanding of its benefits, eligibility criteria, and potential pitfalls. As you navigate the complex world of taxes, the Head of Household status emerges as a beacon of opportunity for certain taxpayers, providing reduced tax rates and a host of other advantages. Let's explore this status in depth and uncover its potential impact on your financial well-being.

Understanding the Head of Household Tax Status

The Head of Household tax filing status is a unique classification designed to provide tax benefits to individuals who maintain a household and meet specific criteria. It is a middle ground between the Single and Married Filing Jointly tax brackets, offering a lower tax rate and a higher standard deduction compared to the Single status, while providing additional tax advantages that resemble those of the Married Filing Jointly status. This status is particularly advantageous for single parents or individuals supporting other qualifying relatives.

The Internal Revenue Service (IRS) has outlined precise guidelines to determine eligibility for the Head of Household status. Understanding these criteria is crucial for taxpayers to maximize their tax benefits accurately.

Eligibility Criteria

To qualify for the Head of Household status, an individual must meet the following conditions:

- Filing Status: The taxpayer must not be married at the end of the tax year and must not have lived with a spouse at any time during the last six months of the year. This criterion is a fundamental prerequisite for HOH status.

- Qualifying Person: The taxpayer must have a qualifying person who lived with them for more than half of the tax year. This individual is typically a dependent, such as a child, parent, or other relative, who meets specific criteria outlined by the IRS. The qualifying person must be a U.S. citizen, U.S. national, U.S. resident, or a resident of Canada or Mexico.

- Financial Support: The taxpayer must provide more than half of the qualifying person’s financial support. This includes basic living expenses like food, shelter, clothing, and utilities. The taxpayer’s support must be greater than the total financial support provided by all other potential contributors combined.

- Residence: The taxpayer must maintain a household as their principal home for more than half of the tax year. This residence can be a house, apartment, mobile home, boat, or even a relative’s home if it’s their primary residence.

Meeting these criteria ensures eligibility for the Head of Household tax status, unlocking a range of benefits and tax savings.

Benefits and Advantages of Head of Household Status

The Head of Household tax filing status offers a multitude of advantages, making it a desirable choice for eligible taxpayers. These benefits are designed to provide financial relief and support to individuals who are primarily responsible for maintaining a household.

Lower Tax Rates

One of the most significant advantages of the Head of Household status is the lower tax rate. The tax brackets for HOH are more favorable compared to the Single status, resulting in a lower overall tax liability. This means that eligible taxpayers can keep more of their income and have more funds available for their household expenses and financial goals.

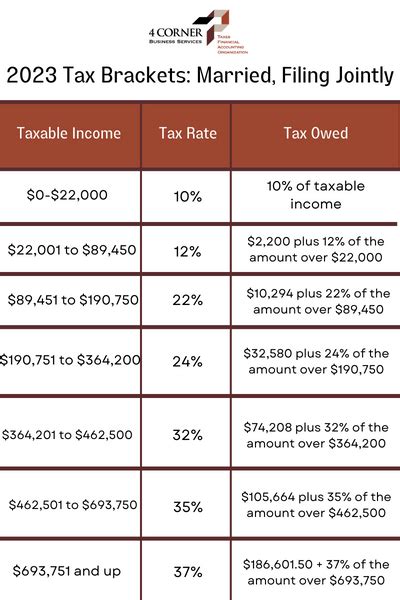

| Tax Status | Tax Rate |

|---|---|

| Head of Household | 10% for the first $19,750, 12% for the next $37,200, 22% for the next $173,350, 24% for the next $268,850, 32% for the next $298,650, 35% for the next $582,500, and 37% for amounts over $630,050 |

| Single | 10% for the first $10,275, 12% for the next $29,575, 22% for the next $91,150, 24% for the next $182,100, 32% for the next $223,050, 35% for the next $418,200, and 37% for amounts over $539,900 |

As illustrated in the table above, the Head of Household tax rates provide a more favorable structure, especially for higher income levels.

Higher Standard Deduction

The Head of Household status also offers a higher standard deduction, which reduces the amount of income subject to tax. For the 2023 tax year, the standard deduction for HOH is 19,750, compared to 14,300 for Single filers. This increased deduction can significantly lower the taxable income, resulting in substantial tax savings.

Additional Tax Credits

Eligible taxpayers can claim various tax credits, such as the Child Tax Credit, the Earned Income Tax Credit, and the Child and Dependent Care Credit. These credits can provide substantial financial relief, especially for families with dependent children or those incurring childcare expenses.

Lower Capital Gains Tax

The Head of Household status offers a lower capital gains tax rate for certain types of assets. Long-term capital gains and qualified dividends are taxed at more favorable rates, providing an opportunity to maximize returns on investments.

Potential Pitfalls and Considerations

While the Head of Household tax status offers numerous benefits, there are certain considerations and potential pitfalls to be aware of. Understanding these aspects is crucial for taxpayers to navigate the complexities of this status effectively.

Eligibility Requirements

Meeting the eligibility criteria for the Head of Household status can be complex, and taxpayers must ensure they meet all the requirements. Failing to meet even one criterion can result in disqualification, leading to potential penalties and tax liabilities. It’s essential to carefully review and understand the IRS guidelines to avoid any missteps.

Documentation and Record-Keeping

To claim the Head of Household status, taxpayers must maintain thorough documentation and records. This includes proof of residence, financial support, and the relationship between the taxpayer and the qualifying person. Proper record-keeping is essential to substantiate the HOH status and avoid any audits or penalties.

Tax Liability and Complexity

While the Head of Household status offers tax benefits, it can also increase the complexity of tax filings. Taxpayers may need to navigate additional forms and calculations, such as the Child Tax Credit or the Earned Income Tax Credit. The increased complexity can make tax preparation more challenging, and it’s advisable to seek professional assistance to ensure accuracy.

Alternative Filing Statuses

Taxpayers should carefully consider whether the Head of Household status is the most beneficial option for their situation. Depending on their personal circumstances, other filing statuses, such as Single or Married Filing Jointly, might offer more favorable tax outcomes. It’s essential to evaluate all options and choose the status that aligns best with an individual’s financial goals and circumstances.

Maximizing Benefits and Planning Strategies

To fully maximize the benefits of the Head of Household status, taxpayers can employ various planning strategies. These strategies can help optimize tax savings and ensure compliance with IRS guidelines.

Maximizing Deductions

Taxpayers can maximize their deductions by claiming eligible expenses, such as medical expenses, state and local taxes, and charitable contributions. By carefully tracking and documenting these expenses, taxpayers can reduce their taxable income and increase their tax savings.

Tax-Efficient Investment Strategies

Implementing tax-efficient investment strategies can help taxpayers optimize their returns. This includes utilizing tax-advantaged accounts, such as IRAs or 401(k)s, to reduce taxable income and maximize savings. Additionally, understanding the tax implications of different investment vehicles can help taxpayers make informed decisions and minimize their tax liability.

Utilizing Tax Credits and Deductions

Eligible taxpayers should take advantage of the various tax credits and deductions available to them. This includes the Child Tax Credit, the Earned Income Tax Credit, and deductions for education expenses, student loan interest, and more. By claiming these credits and deductions, taxpayers can significantly reduce their tax liability and maximize their refunds.

Seeking Professional Guidance

Given the complexities of tax law and the potential pitfalls associated with the Head of Household status, seeking professional guidance is often advisable. Tax professionals can provide personalized advice and assistance, ensuring taxpayers navigate the tax landscape effectively and maximize their benefits. A tax advisor can help taxpayers understand their eligibility, complete their tax returns accurately, and explore all available tax-saving opportunities.

Conclusion: Empowering Taxpayers with Knowledge

The Head of Household tax filing status offers a range of benefits and advantages to eligible taxpayers. By understanding the eligibility criteria, maximizing deductions, and employing tax-efficient strategies, individuals can optimize their tax savings and financial well-being. However, it’s crucial to approach this status with caution and seek professional guidance when needed. With the right knowledge and planning, taxpayers can confidently navigate the complexities of tax law and make informed decisions to maximize their benefits.

What is the Head of Household tax filing status, and who is eligible for it?

+

The Head of Household (HOH) tax filing status is for taxpayers who are unmarried or considered unmarried and provide more than half of the financial support for their household. To be eligible, one must live with a qualifying person for over half the tax year, provide more than half of their financial support, and maintain the household as their principal residence.

What are the tax benefits of filing as Head of Household?

+

Filing as Head of Household provides several tax benefits, including a lower tax rate, a higher standard deduction, and eligibility for certain tax credits like the Child Tax Credit. HOH filers often pay less tax compared to Single filers, especially if they have dependent children or other qualifying relatives.

How does the Head of Household status impact my tax refund or liability?

+

The Head of Household status can increase your tax refund or decrease your tax liability. With a lower tax rate and a higher standard deduction, HOH filers often have a reduced tax burden. Additionally, they may qualify for tax credits that further reduce their tax liability.

What are some common mistakes to avoid when filing as Head of Household?

+

Common mistakes to avoid include not meeting the residency and financial support requirements, failing to claim eligible tax credits and deductions, and not properly documenting your filing status. It’s crucial to understand the criteria for Head of Household status and maintain accurate records to support your filing.