Pa Sales Tax Calculator

The Pennsylvania Sales Tax Calculator is a vital tool for both businesses and consumers in the Keystone State. With a unique sales tax system and various tax rates across counties, understanding and calculating sales tax accurately is crucial for financial compliance and strategic planning. This article delves into the intricacies of the Pa Sales Tax Calculator, providing a comprehensive guide for anyone navigating the state's tax landscape.

Understanding Pennsylvania’s Sales Tax Structure

Pennsylvania operates a unique sales tax system, where the state-level sales tax rate is 6%, but counties have the authority to impose additional local sales taxes. This means that the total sales tax rate can vary significantly depending on the location of the purchase.

The state-level sales tax, also known as the Pennsylvania State Tax, is a flat rate applicable across all counties. However, when it comes to local sales taxes, things get more complex. Each of Pennsylvania's 67 counties has the power to set its own local sales tax rate, which can range from 0% to 2%. This local variation means that the total sales tax rate can differ significantly between counties, even within a relatively small geographical area.

The Role of the Pa Sales Tax Calculator

The Pa Sales Tax Calculator is an essential tool for anyone looking to understand and calculate sales tax in Pennsylvania accurately. It simplifies the complex tax structure by allowing users to input the location of the purchase and the price of the item, and it then calculates the total sales tax and the final price, including tax.

The calculator takes into account both the state-level sales tax and the applicable local sales tax for the specified county. This ensures that users receive an accurate calculation, which is crucial for financial planning, budgeting, and compliance with tax regulations.

| County | Local Sales Tax Rate |

|---|---|

| Allegheny County | 1% |

| Philadelphia County | 2% |

| Dauphin County | 0.5% |

| Erie County | 1% |

| York County | 1% |

| ... (and so on for all 67 counties) | ... |

Note: This table provides a snapshot of local sales tax rates for a few counties in Pennsylvania. The actual rates can change, so it's always advisable to use the Pa Sales Tax Calculator for the most accurate and up-to-date information.

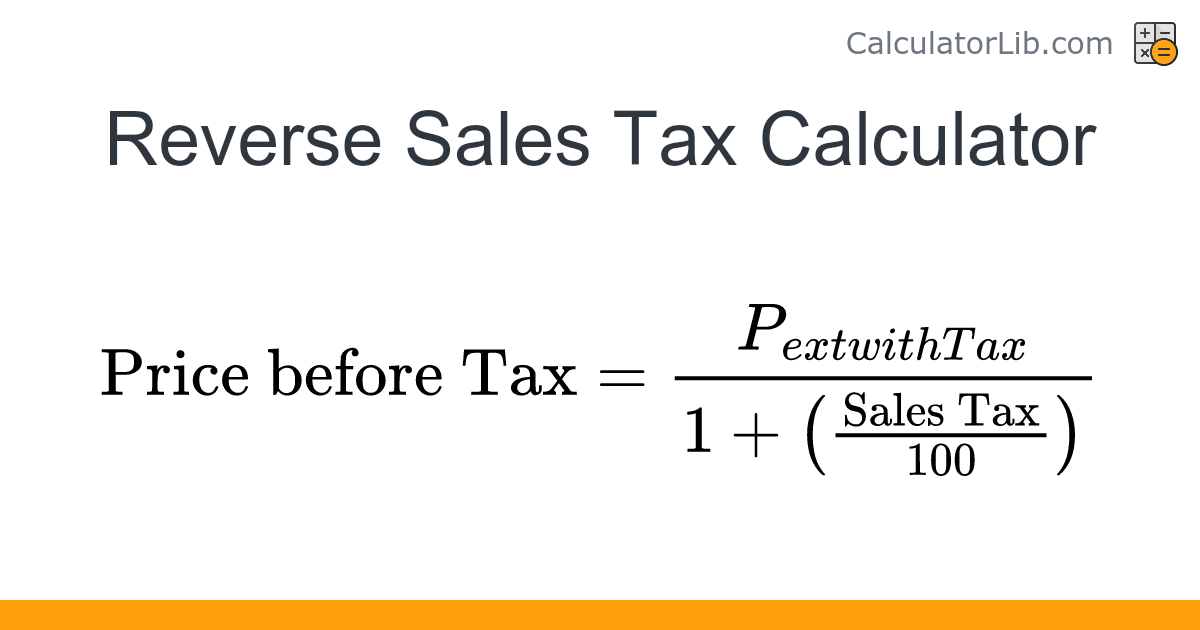

How the Pa Sales Tax Calculator Works

The Pa Sales Tax Calculator is designed with user-friendliness and accuracy in mind. It operates in a straightforward manner, guiding users through a simple process to calculate sales tax.

- Select County: Users begin by choosing the county where the purchase is being made. This is crucial as it determines the applicable local sales tax rate.

- Input Price: After selecting the county, users enter the price of the item they wish to purchase. This can be a single item or the total price of multiple items.

- Calculate: Once the county and price are entered, the calculator does its magic. It applies the state-level sales tax rate of 6% and adds the applicable local sales tax rate for the chosen county. The total sales tax and the final price, including tax, are then displayed.

- Review and Use: Users can review the calculated sales tax and final price. This information is essential for financial planning, budgeting, and ensuring compliance with tax regulations.

Advanced Features and Customization

The Pa Sales Tax Calculator offers several advanced features and customization options to cater to different user needs.

- Multiple Item Calculation: Users can input the prices of multiple items and calculate the total sales tax and final price for all items combined. This is particularly useful for bulk purchases or when creating shopping lists.

- Tax Rate Customization: In cases where the local sales tax rate is not accurately reflected in the calculator (due to recent changes), users can manually adjust the local tax rate. This ensures that the calculator remains a reliable tool even with changing tax rates.

- Export and Save Options: The calculator allows users to export and save their calculations for future reference. This is beneficial for keeping records, especially for businesses or individuals who make frequent purchases in Pennsylvania.

Applications and Benefits of the Pa Sales Tax Calculator

The Pa Sales Tax Calculator offers a range of benefits and applications for different users, including businesses, consumers, and tax professionals.

Benefits for Businesses

- Accurate Pricing: By using the Pa Sales Tax Calculator, businesses can ensure that their prices are accurate and compliant with local tax regulations. This helps to build trust with customers and avoid potential legal issues.

- Strategic Pricing Decisions: The calculator enables businesses to understand how different tax rates impact their pricing. This information can be valuable when making strategic pricing decisions, especially when considering expansion into new counties.

- Efficient Tax Compliance: For businesses with multiple locations, the calculator simplifies tax compliance. It ensures that each location applies the correct tax rate, making it easier to manage and report taxes accurately.

Benefits for Consumers

- Budgeting and Financial Planning: Consumers can use the calculator to understand the total cost of their purchases, including sales tax. This helps with budgeting and financial planning, especially when making significant or frequent purchases.

- Comparison Shopping: The calculator allows consumers to compare prices between different counties or stores. This can be especially useful when shopping for big-ticket items or when looking for the best deals.

- Awareness of Local Tax Rates: By using the calculator, consumers become more aware of the local sales tax rates in their area. This knowledge can be beneficial when discussing tax issues with local authorities or businesses.

Benefits for Tax Professionals

- Quick and Accurate Calculations: Tax professionals can rely on the Pa Sales Tax Calculator for quick and accurate sales tax calculations. This saves time and reduces the risk of errors, especially when dealing with multiple clients or complex tax scenarios.

- Client Education: The calculator can be a valuable tool for educating clients about Pennsylvania’s unique sales tax structure. It helps clients understand the impact of local tax rates on their finances and makes tax planning more transparent.

- Data Analysis: Tax professionals can use the calculator’s data export feature to analyze sales tax trends over time. This data can be insightful for strategic tax planning and forecasting.

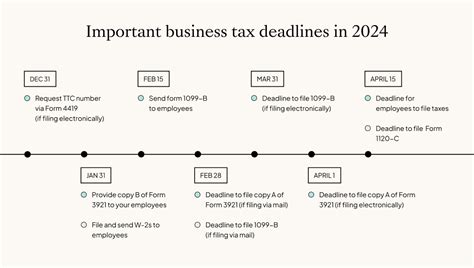

Future Implications and Updates

As Pennsylvania’s sales tax structure is subject to change, the Pa Sales Tax Calculator must remain adaptable and up-to-date. Regular updates are essential to ensure the calculator continues to provide accurate calculations based on the latest tax rates.

In the future, we can expect the calculator to incorporate more advanced features, such as real-time tax rate updates, more detailed reporting options, and perhaps even integration with accounting software for seamless tax management.

Additionally, as e-commerce continues to grow, the calculator may evolve to cater to online sales, ensuring that businesses and consumers can accurately calculate sales tax for online purchases made in Pennsylvania.

Conclusion

The Pa Sales Tax Calculator is an indispensable tool for anyone navigating Pennsylvania’s complex sales tax landscape. By providing accurate and accessible sales tax calculations, it empowers businesses, consumers, and tax professionals to make informed financial decisions and comply with local tax regulations.

As Pennsylvania's sales tax rates continue to evolve, the Pa Sales Tax Calculator will remain a trusted resource, ensuring that users can stay ahead of the curve and make the most of their financial endeavors in the Keystone State.

What is the state-level sales tax rate in Pennsylvania?

+The state-level sales tax rate in Pennsylvania is 6%.

Do all counties in Pennsylvania have the same local sales tax rate?

+No, each county in Pennsylvania has the authority to set its own local sales tax rate, which can range from 0% to 2%. This means that the total sales tax rate can vary significantly between counties.

How often are the local sales tax rates updated in the Pa Sales Tax Calculator?

+The local sales tax rates in the Pa Sales Tax Calculator are updated regularly to ensure accuracy. However, it’s always advisable to double-check with official sources for the most recent tax rates, especially in counties where tax rates may have changed recently.

Can I use the Pa Sales Tax Calculator for online purchases made in Pennsylvania?

+While the current version of the Pa Sales Tax Calculator is primarily designed for in-store purchases, future updates may include features for calculating sales tax for online purchases. It’s always recommended to check with the seller or consult a tax professional for online sales tax calculations.

How can I stay updated on changes to Pennsylvania’s sales tax rates?

+You can stay informed about changes to Pennsylvania’s sales tax rates by regularly checking the official websites of the Pennsylvania Department of Revenue or the specific county’s tax office. Additionally, subscribing to tax-related newsletters or following reputable tax information sources can provide timely updates.