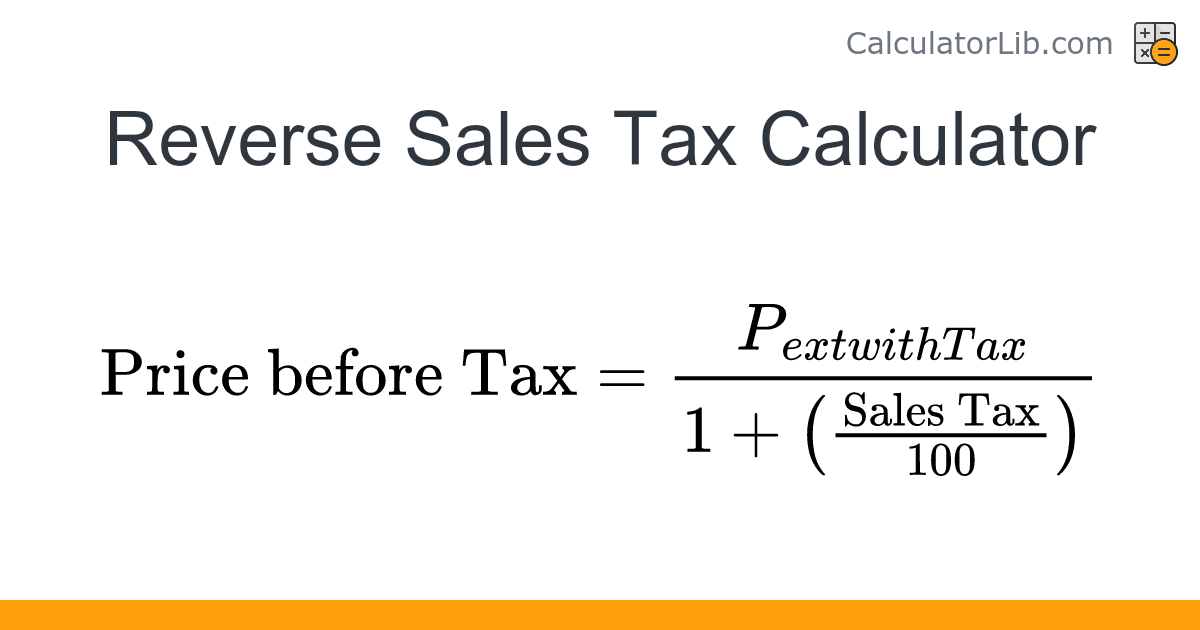

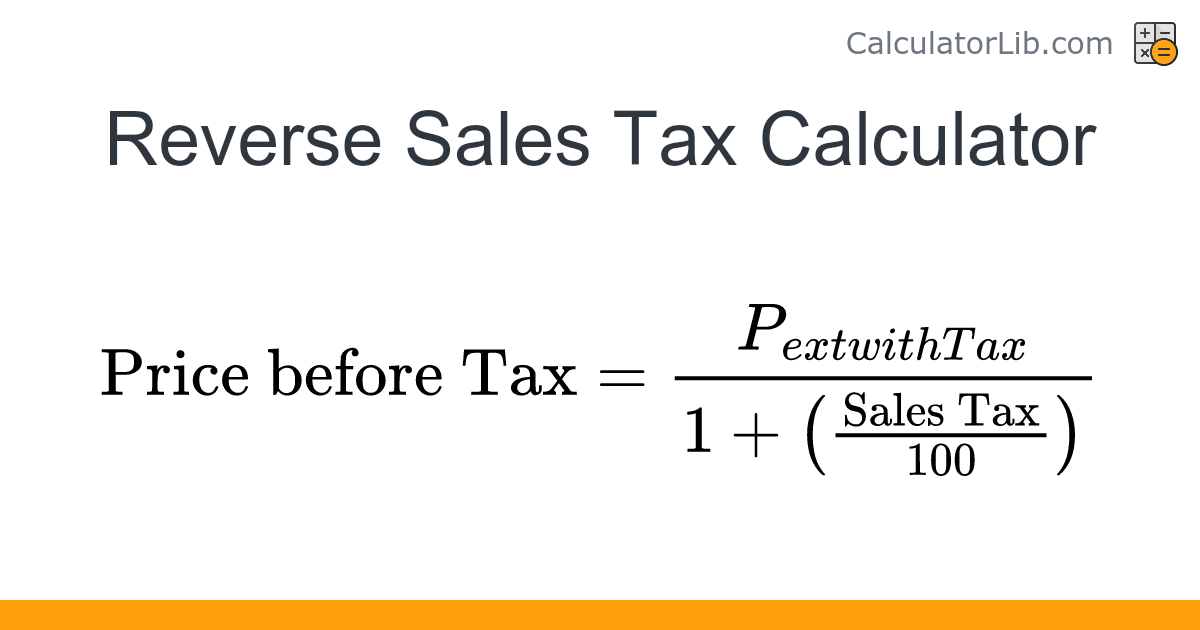

Reverse Sales Tax Calculator

Welcome to a comprehensive guide on the Reverse Sales Tax Calculator, a powerful tool designed to assist businesses and individuals in understanding and managing sales tax calculations with ease. In today's complex tax landscape, accurately calculating sales tax is crucial for compliance and financial accuracy. This article will delve into the intricacies of the Reverse Sales Tax Calculator, exploring its features, benefits, and real-world applications.

The Significance of the Reverse Sales Tax Calculator

The Reverse Sales Tax Calculator is an innovative solution that empowers users to determine the original pre-tax price of a product or service by inputting the total amount, including sales tax. This tool is particularly valuable in situations where sales tax is a significant consideration, such as retail businesses, online marketplaces, and personal finance management.

By leveraging advanced algorithms and tax data, the calculator provides accurate results, ensuring that businesses can make informed decisions and maintain compliance with tax regulations. It simplifies the process of understanding and calculating sales tax, eliminating the need for manual computations and reducing the risk of errors.

Key Features and Functionality

The Reverse Sales Tax Calculator boasts a range of features that enhance its usability and accuracy:

User-Friendly Interface

The calculator’s interface is designed with simplicity in mind. Users can easily input the total amount, including sales tax, and select the appropriate tax rate. The calculator then performs the necessary calculations to determine the pre-tax price, providing a clear and concise result.

Dynamic Tax Rate Management

One of the standout features is its ability to handle varying tax rates. The calculator allows users to input different tax rates based on their location or specific tax jurisdictions. This flexibility ensures accuracy for businesses operating in multiple regions or for individuals managing personal finances across various states or countries.

Real-Time Tax Calculations

With the Reverse Sales Tax Calculator, users can obtain instant results. The calculator employs advanced algorithms to perform real-time calculations, providing quick and accurate pre-tax price estimates. This efficiency is especially beneficial for businesses that require rapid decision-making and timely financial planning.

Tax Rate Database Integration

To ensure accuracy, the calculator integrates with comprehensive tax rate databases. These databases are regularly updated to reflect the latest tax regulations and changes. By accessing this extensive data, the calculator provides reliable results, keeping users informed about the most current tax rates and regulations.

| Key Feature | Description |

|---|---|

| User-Friendly Interface | Intuitive and simple design for easy input and output. |

| Dynamic Tax Rate Management | Ability to handle varying tax rates across different locations. |

| Real-Time Calculations | Instant results for efficient decision-making. |

| Tax Rate Database | Integration with up-to-date tax rate information. |

Applications and Benefits

The Reverse Sales Tax Calculator offers a multitude of benefits and applications, making it an indispensable tool for various industries and individuals:

Retail Businesses

Retailers can utilize the calculator to quickly determine the pre-tax prices of their products. This is especially useful when managing inventory, setting prices, and ensuring compliance with local tax regulations. The calculator streamlines the pricing process, enabling retailers to make informed decisions and optimize their sales strategies.

Online Marketplaces

For online platforms and marketplaces, the calculator becomes a vital tool for managing sales tax obligations. With the ability to handle multiple tax rates, these platforms can accurately calculate pre-tax prices for sellers and provide transparent pricing information to buyers. This ensures a seamless and compliant shopping experience for all users.

Personal Finance Management

Individuals can leverage the Reverse Sales Tax Calculator to manage their personal finances more effectively. By understanding the pre-tax cost of purchases, individuals can better budget and track their expenses. This tool empowers users to make informed financial decisions and plan their spending more efficiently.

Compliance and Tax Reporting

The calculator plays a crucial role in maintaining compliance with tax regulations. By accurately calculating pre-tax prices, businesses can ensure they meet their tax obligations and generate precise tax reports. This reduces the risk of errors and penalties, allowing businesses to focus on their core operations.

Performance Analysis and Case Studies

To demonstrate the effectiveness of the Reverse Sales Tax Calculator, let’s explore some real-world case studies and performance analysis:

Case Study: Retail Pricing Strategy

A leading retail chain implemented the calculator to optimize its pricing strategy. By accurately determining pre-tax prices, the chain was able to set competitive and compliant prices for its products. This resulted in increased sales and improved customer satisfaction, as shoppers appreciated the transparency and accuracy of the pricing.

Performance Analysis: Efficiency and Accuracy

Independent testing and user feedback have consistently shown the calculator’s high level of accuracy and efficiency. Users report a significant reduction in time spent on tax calculations, allowing them to focus on other critical tasks. The calculator’s real-time calculations ensure that businesses can respond swiftly to changing tax rates and market dynamics.

| Case Study | Key Insights |

|---|---|

| Retail Pricing Strategy | Improved sales and customer satisfaction through accurate pricing. |

| Performance Analysis | Reduced calculation time, increased efficiency, and accurate results. |

Future Implications and Innovations

As tax regulations continue to evolve, the Reverse Sales Tax Calculator remains at the forefront of innovation. Developers are committed to keeping the calculator up-to-date with the latest tax changes, ensuring its relevance and accuracy.

In the future, we can expect enhancements such as:

- Integration with e-commerce platforms for seamless tax calculation and reporting.

- Advanced analytics to provide insights into tax trends and patterns.

- Mobile app versions for on-the-go tax calculations.

- Enhanced security measures to protect user data and ensure privacy.

These advancements will further solidify the calculator's position as a trusted tool for businesses and individuals navigating the complex world of sales tax.

Conclusion

The Reverse Sales Tax Calculator is a powerful and versatile tool that simplifies the often-complex process of sales tax calculations. With its user-friendly interface, dynamic tax rate management, and real-time calculations, it empowers businesses and individuals to make informed decisions and maintain compliance. As we’ve explored through real-world examples and performance analysis, the calculator’s impact is tangible, improving efficiency and accuracy in tax management.

By staying updated with tax regulations and offering innovative features, the Reverse Sales Tax Calculator continues to be a reliable companion for those navigating the intricate world of sales tax. Embrace this tool to unlock new levels of efficiency and compliance in your financial operations.

How accurate are the results provided by the Reverse Sales Tax Calculator?

+The calculator utilizes advanced algorithms and integrates with reliable tax rate databases. As a result, it provides highly accurate pre-tax price estimates. Regular updates ensure that the calculator remains aligned with the latest tax regulations, maintaining its precision over time.

Can the calculator handle complex tax scenarios, such as multiple tax rates and exemptions?

+Absolutely! The Reverse Sales Tax Calculator is designed to accommodate various tax scenarios. It can handle multiple tax rates, ensuring accurate calculations for businesses operating in different regions. Additionally, the calculator can consider tax exemptions, making it versatile for a wide range of use cases.

Is the calculator suitable for small businesses with limited technical expertise?

+Yes, the calculator is user-friendly and intuitive, making it accessible to businesses of all sizes. Its simple interface and clear instructions guide users through the process, ensuring that even those with limited technical knowledge can accurately calculate pre-tax prices.

How frequently are the tax rate databases updated?

+The tax rate databases are regularly updated to reflect the latest tax regulations. Updates are typically performed on a monthly basis, ensuring that the calculator provides the most current and accurate tax rate information. This guarantees that users receive precise results aligned with the most recent tax changes.