Arizona Sales Tax

Arizona, the Grand Canyon State, is renowned for its diverse landscapes, from the iconic red rocks of Sedona to the bustling city of Phoenix. While the state offers a myriad of attractions and a vibrant economy, one aspect that businesses and residents must navigate is the Arizona sales tax. Understanding the intricacies of this tax is crucial for effective financial planning and compliance.

Unraveling the Arizona Sales Tax Landscape

The Arizona sales tax is a consumption tax levied on the sale of tangible personal property and certain services within the state. It is an essential revenue stream for the state government, local municipalities, and special taxing districts, funding various public services and infrastructure projects.

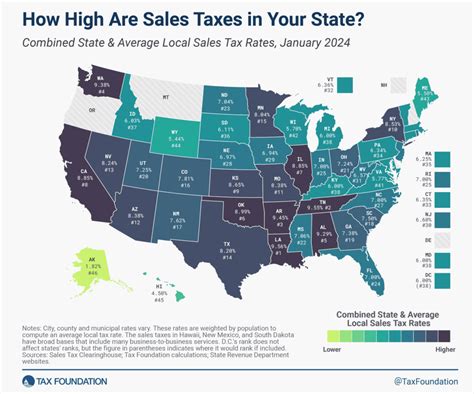

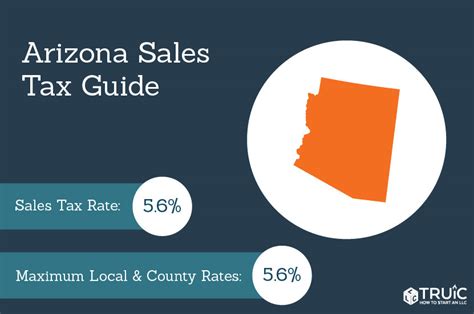

The sales tax rate in Arizona comprises two components: the state sales tax rate and the local sales tax rate. The state sales tax rate is a uniform 5.6%, applicable across the state. However, the local sales tax rate varies depending on the jurisdiction, with rates ranging from 0% to 4.65%.

When a purchase is made within Arizona, the buyer pays the combined state and local sales tax rate, which is known as the total tax rate. This total tax rate is calculated by adding the state sales tax rate to the local sales tax rate applicable to the specific jurisdiction where the sale occurs. For instance, in Phoenix, the total tax rate is 8.6%, comprising the state rate of 5.6% and a local rate of 3%.

The Impact of Arizona Sales Tax on Businesses

For businesses operating within Arizona, understanding and managing sales tax obligations is crucial. Sales tax is typically collected by the seller at the point of sale and then remitted to the appropriate taxing authorities. This process ensures compliance with tax laws and helps businesses maintain a positive relationship with the state and local governments.

The Arizona Department of Revenue (ADOR) is responsible for administering and enforcing sales tax regulations. Businesses are required to register with ADOR, obtain a Transaction Privilege Tax (TPT) license, and remit sales tax returns periodically. Failure to comply with these obligations can result in penalties and interest charges.

To assist businesses in managing their sales tax responsibilities, ADOR provides resources such as online filing and payment systems, tax rate lookup tools, and educational materials. These resources aim to simplify the tax compliance process and ensure businesses have the necessary support to navigate the complexities of sales tax.

Navigating Sales Tax Exemptions and Special Considerations

While the general rule in Arizona is that sales tax applies to most tangible personal property and certain services, there are exemptions and special considerations that businesses and consumers should be aware of. These exemptions can significantly impact the total tax liability and should be carefully understood to avoid overpayment or non-compliance.

Some common exemptions include sales tax exemption for certain food items, prescription drugs, and select manufacturing machinery and equipment. Additionally, there are special considerations for specific industries, such as the aerospace industry, which may be eligible for tax incentives and reduced tax rates.

It is crucial for businesses to stay updated on these exemptions and special considerations to ensure accurate tax calculation and compliance. ADOR provides detailed information and guidelines on its website, offering clarity on which items and transactions are subject to sales tax and which are exempt.

| Category | Exemption Status |

|---|---|

| Food and Groceries | Partially Exempt |

| Prescription Drugs | Exempt |

| Manufacturing Equipment | May be Exempt |

| Aerospace Industry | Special Considerations |

The Future of Arizona Sales Tax: Trends and Projections

The Arizona sales tax landscape is subject to ongoing changes and developments, influenced by economic trends, legislative decisions, and technological advancements. Staying informed about these changes is crucial for businesses and consumers alike to ensure compliance and financial planning.

One notable trend is the increasing focus on online sales tax collection. With the rise of e-commerce, states are adapting their tax laws to ensure fair taxation of online transactions. Arizona, like many other states, has implemented laws requiring out-of-state sellers to collect and remit sales tax on transactions with Arizona consumers. This development ensures a level playing field for in-state and out-of-state businesses and enhances tax revenue for the state.

Additionally, technological advancements are shaping the sales tax collection process. Automated tax calculation and filing software, coupled with real-time tax rate databases, are streamlining the compliance process for businesses. These tools help ensure accurate tax calculations and timely remittances, reducing the risk of errors and penalties.

Looking ahead, the Arizona sales tax landscape is expected to continue evolving. Economic growth, changes in consumer behavior, and advancements in technology will likely drive further modifications to sales tax laws and collection methods. Businesses should stay vigilant and adapt their tax strategies to navigate these changes effectively.

Conclusion: Empowering Businesses and Consumers with Sales Tax Knowledge

Understanding the Arizona sales tax landscape is essential for both businesses and consumers. For businesses, a comprehensive grasp of sales tax obligations, exemptions, and compliance processes ensures smooth operations, effective financial management, and positive relationships with tax authorities. Consumers, on the other hand, benefit from understanding sales tax rates and exemptions to make informed purchasing decisions and budget effectively.

By staying informed and utilizing the resources provided by the Arizona Department of Revenue, businesses and consumers can navigate the complexities of sales tax with confidence. This knowledge empowers stakeholders to contribute to the state's revenue stream, support public services, and ensure compliance with tax laws. As the Arizona sales tax landscape continues to evolve, staying updated and adaptable will be key to success.

How often do businesses need to file sales tax returns in Arizona?

+Businesses in Arizona are required to file sales tax returns on a periodic basis, typically monthly, quarterly, or annually, depending on their annual sales volume. Smaller businesses with lower sales may be eligible for quarterly or annual filing, while larger businesses with higher sales volumes must file monthly.

Are there any penalties for late sales tax payments in Arizona?

+Yes, late payments of sales tax in Arizona can result in penalties and interest charges. The ADOR assesses a penalty of up to 10% of the unpaid tax, and interest is charged at a rate of 0.5% per month or portion thereof on the unpaid balance.

Can businesses register for a sales tax permit online in Arizona?

+Absolutely! The ADOR provides an online registration system for businesses to obtain their Transaction Privilege Tax (TPT) license. This streamlined process allows businesses to register quickly and conveniently, ensuring compliance with tax regulations from the outset.