What Is A Tax Certificate

A tax certificate is an official document issued by a government authority, typically a local municipality or tax department, that serves as proof of the successful completion of a taxpayer's obligations. It confirms that an individual or entity has met their tax liabilities for a specific period, such as a fiscal year. Tax certificates are a crucial component of financial management and compliance, ensuring that individuals, businesses, and organizations adhere to tax laws and regulations.

These certificates carry significant importance as they offer assurance to various stakeholders, including investors, creditors, and regulatory bodies, that the taxpayer is in good standing with regard to their tax obligations. They provide transparency and trustworthiness, particularly in business transactions and financial dealings, where tax compliance is a key consideration.

The Purpose and Functionality of Tax Certificates

Tax certificates serve multiple purposes, each contributing to the smooth functioning of the tax system and the broader financial ecosystem.

Compliance and Record-Keeping

At its core, a tax certificate is a record of compliance. It signifies that the taxpayer has fulfilled their tax responsibilities, including the payment of taxes, filing of returns, and adherence to applicable tax laws. This documentation is vital for maintaining accurate financial records and demonstrating tax compliance to relevant authorities.

For instance, consider a business entity operating across multiple jurisdictions. Tax certificates can be instrumental in verifying that the business has paid its taxes in each jurisdiction, thereby simplifying the process of obtaining licenses or permits for expansion.

Facilitating Financial Transactions

In the world of finance, tax certificates play a pivotal role in securing loans, attracting investments, and finalizing significant financial transactions. Lenders and investors often require evidence of tax compliance as a prerequisite for extending financial support. A tax certificate provides this assurance, mitigating the risk of dealing with entities that may have outstanding tax liabilities.

Furthermore, in the event of a business sale or merger, tax certificates can be instrumental in establishing the financial health and stability of the entities involved. They provide potential buyers with a comprehensive understanding of the tax obligations that come with the acquisition.

Real Estate Transactions

In the realm of real estate, tax certificates are particularly relevant. When purchasing property, buyers often need to ensure that all property taxes have been paid by the seller. A tax certificate verifies that the seller is up-to-date with their tax payments, preventing potential legal complications for the buyer.

Additionally, tax certificates can be crucial in situations where a property is being foreclosed due to non-payment of taxes. The certificate ensures that the new owner takes possession of a property free of any outstanding tax liabilities.

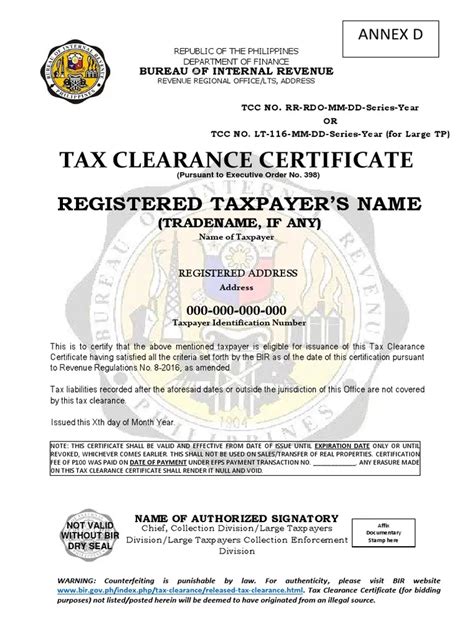

The Process of Obtaining a Tax Certificate

The procedure for acquiring a tax certificate can vary based on jurisdiction and the type of taxpayer. However, there are some general steps that are commonly involved.

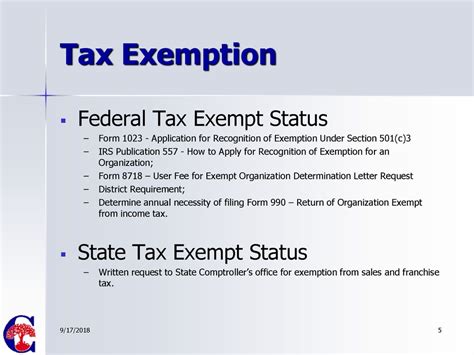

Step 1: Determination of Eligibility

Before applying for a tax certificate, individuals or entities must ensure they meet the eligibility criteria set by the relevant tax authority. This typically involves being up-to-date with tax payments, filing requirements, and any other obligations as mandated by the tax laws.

Step 2: Application Submission

Once eligibility is confirmed, the taxpayer can proceed with the application process. This often involves filling out an official form, which may be available online or at the local tax office. The application typically requires providing basic information about the taxpayer, such as name, address, and tax identification number.

In some cases, additional documentation may be necessary. This could include proof of tax payments, such as copies of tax return receipts or bank statements showing tax payments.

Step 3: Verification and Processing

Upon receiving the application, the tax authority will proceed to verify the information provided. This may involve cross-referencing the taxpayer's records with their internal databases to ensure accuracy and completeness. If any discrepancies are found, the taxpayer may be required to provide additional information or clarify certain details.

Once the verification process is complete and the taxpayer's compliance is confirmed, the tax authority will issue the tax certificate.

Step 4: Issuance and Receipt

The issuance of a tax certificate is typically done in a timely manner, often within a specified timeframe outlined by the tax authority. The certificate can be delivered electronically or physically, depending on the taxpayer's preference and the procedures of the tax authority.

It's important to note that there may be fees associated with obtaining a tax certificate, and these fees can vary based on jurisdiction and the type of taxpayer.

The Information Contained in a Tax Certificate

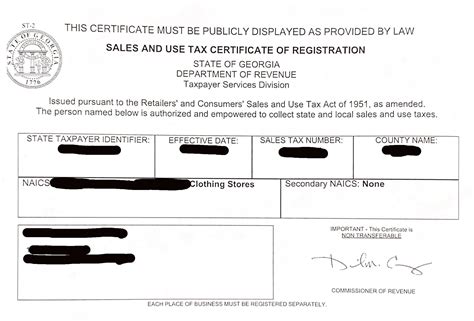

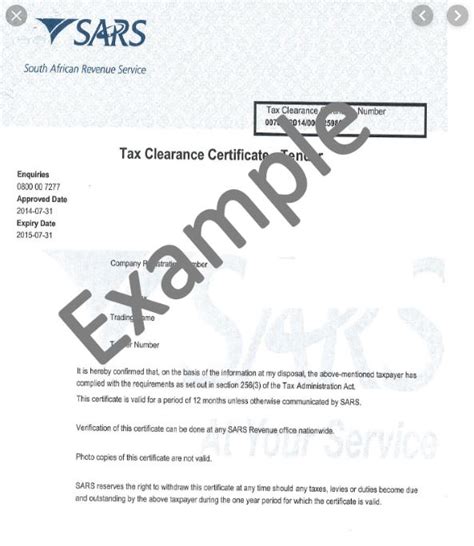

A tax certificate provides a detailed snapshot of the taxpayer's compliance with tax laws. While the specific details can vary, there are some common elements that are typically included.

Taxpayer Identification

The certificate will begin with basic identification information about the taxpayer. This includes the taxpayer's name, address, and tax identification number. For businesses, the legal name and registration details may also be included.

| Taxpayer Information | Details |

|---|---|

| Name | John Doe |

| Address | 123 Main Street, Anytown, CA, 12345 |

| Tax ID | 123-45-6789 |

Tax Obligations and Compliance

The heart of the tax certificate is the record of tax obligations and compliance. This section provides a detailed breakdown of the taxpayer's tax liabilities for a specific period, typically a fiscal year.

| Tax Obligation | Amount | Status |

|---|---|---|

| Income Tax | $10,000 | Paid |

| Property Tax | $5,000 | Paid |

| Sales Tax | $2,500 | Paid |

Certifying Authority and Date

To maintain its integrity, a tax certificate must include the details of the certifying authority, which is typically the tax department or a designated official within the tax authority. This ensures that the certificate is an official document and carries legal weight.

The certificate will also include the date of issuance, which is crucial for understanding the timeframe of the taxpayer's compliance. It provides a clear indication of when the taxpayer was in good standing with their tax obligations.

The Significance of Tax Certificates in Financial Transactions

Tax certificates are a critical component of financial transactions, particularly in the business world. They provide a layer of security and assurance for all parties involved, reducing the risk associated with non-compliance.

Attracting Investors and Securing Loans

Investors and lenders are cautious about the financial health and stability of the entities they support. A tax certificate is a tangible proof of a taxpayer's financial responsibility and compliance with the law. It instills confidence in investors and lenders, encouraging them to extend financial support to the taxpayer.

For instance, a startup seeking venture capital investment can leverage a tax certificate to demonstrate its commitment to financial transparency and compliance. This can be a decisive factor in securing funding, especially in highly regulated industries.

Facilitating Business Partnerships and Mergers

In the corporate world, mergers and acquisitions are common strategies for growth and expansion. Tax certificates play a crucial role in these transactions by providing transparency and reducing potential legal and financial risks.

When two businesses merge, their tax obligations become intertwined. A tax certificate ensures that both parties have a clear understanding of each other's tax liabilities, preventing any unexpected financial burdens post-merger.

Real Estate Transactions and Property Development

In the real estate sector, tax certificates are essential for ensuring smooth transactions. Buyers can use tax certificates to verify that the seller has paid all property taxes, ensuring a clean transfer of ownership. Similarly, developers can use tax certificates to demonstrate their compliance when seeking permits for new projects.

For example, a developer planning to construct a new residential complex may need to provide tax certificates to the local government to demonstrate their financial stability and tax compliance. This can expedite the permitting process and facilitate the project's development.

The Future of Tax Certificates: Digitalization and Blockchain

As technology continues to evolve, the future of tax certificates is increasingly digital. Governments and tax authorities are exploring ways to streamline the process of issuing and verifying tax certificates, leveraging digital technologies and blockchain solutions.

Digital Tax Certificates

Digital tax certificates offer several advantages over their physical counterparts. They are more secure, as they can be encrypted and protected with digital signatures, reducing the risk of fraud and tampering. Additionally, digital certificates can be easily verified online, streamlining the process for both taxpayers and stakeholders.

For instance, a business seeking a loan from a financial institution can provide a digital tax certificate, which can be instantly verified by the lender, reducing the time and effort required for due diligence.

Blockchain Integration

Blockchain technology, with its decentralized and transparent nature, is being explored as a means to revolutionize tax certificate issuance and verification. By utilizing blockchain, tax authorities can create an immutable record of tax compliance, which can be easily accessed and verified by stakeholders.

In a blockchain-based system, each tax payment and filing would be recorded as a transaction on a distributed ledger. This would create an unalterable record of tax compliance, enhancing transparency and reducing the potential for fraud.

Potential Benefits of Blockchain Integration

- Enhanced Security: Blockchain's cryptographic security features can protect tax certificates from tampering and fraud.

- Improved Transparency: A blockchain-based system provides a transparent record of tax compliance, accessible to all stakeholders.

- Streamlined Verification: Digital tax certificates on a blockchain can be instantly verified, reducing the time and effort required for compliance checks.

- Reduced Costs: Blockchain technology can automate many manual processes, potentially reducing administrative costs for tax authorities.

Conclusion: Tax Certificates as a Cornerstone of Financial Compliance

Tax certificates are an indispensable tool in the realm of financial compliance, providing assurance and transparency to taxpayers, investors, lenders, and regulatory bodies. They play a pivotal role in facilitating financial transactions, attracting investments, and ensuring the smooth functioning of businesses and organizations.

As the world of finance continues to evolve, the importance of tax certificates will only grow. With the advent of digital technologies and blockchain solutions, the future of tax compliance and verification looks set to become even more efficient, secure, and transparent.

For taxpayers, understanding the process and significance of tax certificates is crucial for maintaining good financial standing and navigating the complex world of tax obligations. For stakeholders, tax certificates offer a vital glimpse into the financial health and compliance of the entities they engage with, providing a foundation for secure and mutually beneficial financial transactions.

How often should I obtain a tax certificate?

+The frequency of obtaining a tax certificate depends on your specific needs and the requirements of your stakeholders. For most individuals and businesses, obtaining a tax certificate annually, typically at the end of the fiscal year, is sufficient to demonstrate compliance. However, in certain situations, such as when seeking a loan or selling a property, you may need to obtain a tax certificate more frequently to meet the requirements of the transaction.

Can a tax certificate be revoked or invalidated?

+Yes, a tax certificate can be revoked or invalidated if it is discovered that the taxpayer has provided false information or has not met their tax obligations. Tax authorities have the right to investigate and revoke certificates if they find evidence of non-compliance. It is crucial to maintain accurate records and ensure timely tax payments to avoid such situations.

Are there any fees associated with obtaining a tax certificate?

+Yes, many tax authorities charge a fee for issuing tax certificates. The fee structure can vary based on jurisdiction and the type of taxpayer. It’s essential to inquire about these fees when applying for a tax certificate, as they can be a consideration in your financial planning.

Can I obtain a tax certificate online?

+Yes, many tax authorities now offer online platforms for applying for and obtaining tax certificates. These digital services provide convenience and efficiency, allowing taxpayers to complete the process remotely. However, it’s important to ensure that the online platform is secure and authorized by the tax authority to avoid potential scams or fraudulent activities.

What should I do if I have difficulty obtaining a tax certificate due to outstanding tax liabilities?

+If you are facing difficulty obtaining a tax certificate due to outstanding tax liabilities, it’s crucial to address the underlying issue promptly. Contact the tax authority or seek professional advice to explore options for resolving the outstanding liabilities. This may involve payment plans, tax settlements, or other arrangements to bring your tax obligations up to date. Resolving these issues is essential for maintaining your financial standing and obtaining a tax certificate.