Refund Tax Calculator

The world of taxation is intricate, and understanding the nuances can be challenging, especially when it comes to seeking refunds. The Refund Tax Calculator is a powerful tool designed to simplify this process, offering an efficient and accurate way to calculate and claim tax refunds. This article delves into the intricacies of this innovative calculator, exploring its features, benefits, and the impact it has on taxpayers.

Revolutionizing Tax Refunds: An Introduction to the Calculator

In the realm of tax management, the Refund Tax Calculator stands out as a beacon of simplicity and precision. Developed by a team of tax experts and technology enthusiasts, this calculator is a comprehensive solution for individuals and businesses seeking to reclaim overpaid taxes. By leveraging advanced algorithms and real-time data, it offers a user-friendly interface that guides users through the often-complex process of tax refund calculations.

The journey towards a tax refund begins with understanding the intricacies of one's financial transactions and the applicable tax laws. The Refund Tax Calculator streamlines this process, ensuring that users can navigate the path to a refund with ease and confidence. Let's explore the features and benefits that make this calculator an indispensable tool for taxpayers.

Key Features and Functionality

The Refund Tax Calculator boasts an array of features that cater to a wide range of tax scenarios. Here’s a glimpse into its capabilities:

- Real-Time Data Integration: The calculator fetches the latest tax rates and regulations, ensuring that calculations are based on the most current information. This feature is particularly beneficial for individuals with complex financial portfolios or businesses operating in dynamic tax environments.

- Customizable Parameters: Users can input specific details such as income sources, deductions, and tax payments, allowing for personalized refund estimates. This level of customization ensures accuracy and caters to the unique financial circumstances of each user.

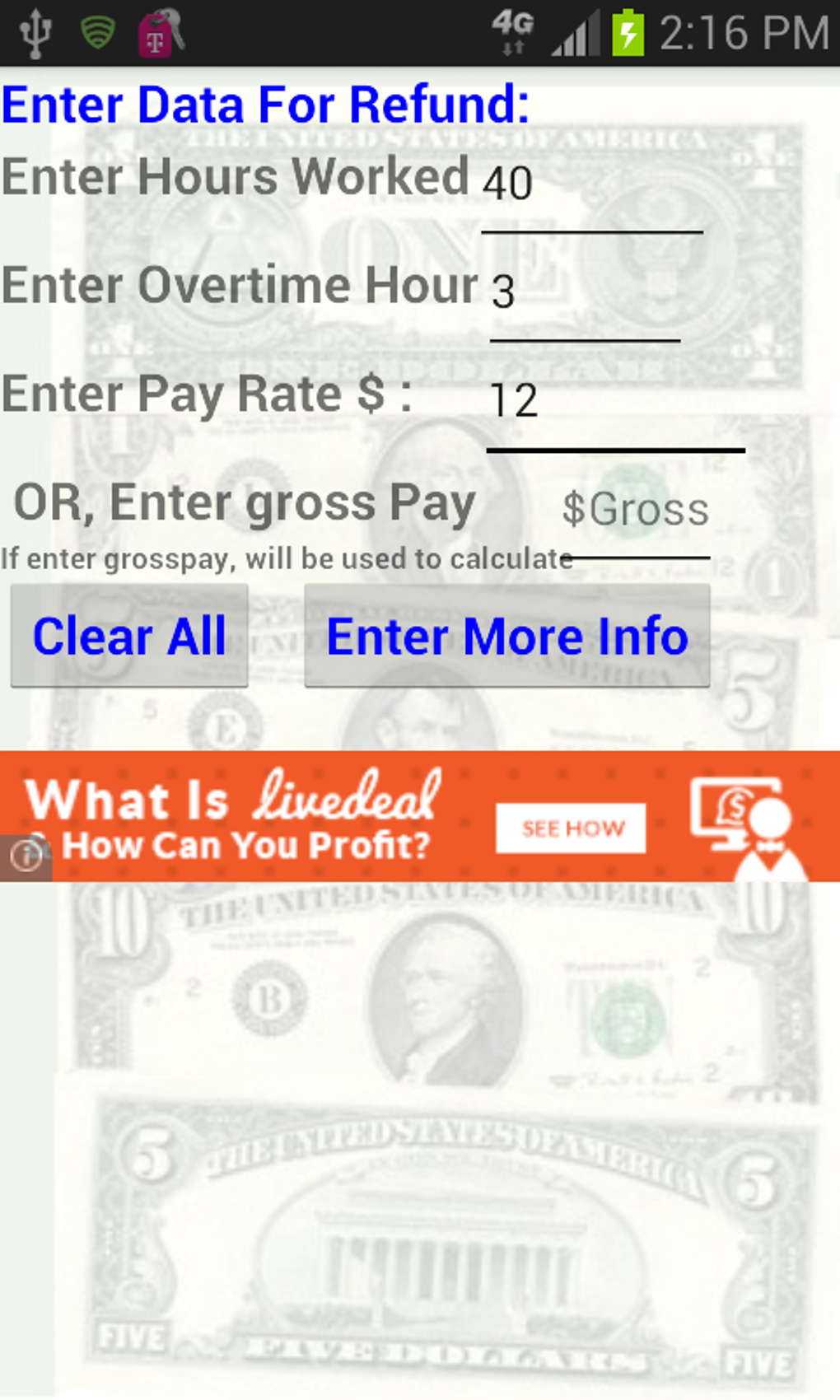

- Intuitive User Interface: Designed with simplicity in mind, the calculator’s interface is user-friendly and easy to navigate. Even for those less familiar with tax jargon, the intuitive design ensures a smooth and stress-free experience.

- Step-by-Step Guidance: The calculator provides a clear, step-by-step process, guiding users through the various stages of tax refund calculation. This includes assessing eligibility, calculating refunds, and providing insights into potential deductions or credits that might further enhance the refund amount.

- Advanced Scenario Analysis: For more complex tax situations, the calculator offers advanced tools for scenario analysis. This feature allows users to explore different financial variables and understand how they impact the refund amount, empowering users to make informed decisions.

Benefits for Taxpayers

The Refund Tax Calculator brings a host of advantages to taxpayers, making the often daunting task of tax refund calculations more accessible and efficient. Here’s a closer look at the key benefits:

- Accuracy and Precision: By leveraging advanced algorithms and real-time data, the calculator ensures that refund estimates are highly accurate. This reduces the risk of errors, providing taxpayers with a reliable assessment of their potential refund.

- Time Efficiency: The streamlined process of the calculator saves valuable time for taxpayers. What once might have been a tedious and time-consuming manual calculation is now a quick and efficient online process, allowing users to focus on other priorities.

- Enhanced Transparency: The calculator provides a transparent breakdown of the refund calculation process. Users can understand the factors contributing to their refund, promoting financial literacy and empowering them to make informed decisions about their tax strategies.

- Personalized Recommendations: Based on the user’s financial inputs, the calculator can offer personalized recommendations for optimizing tax refunds. This might include suggestions for additional deductions, tax credits, or even insights into potential tax-saving opportunities for the upcoming financial year.

- Cost-Effectiveness: For individuals and businesses seeking professional tax advice, the calculator offers a cost-effective alternative. While tax consultants can be valuable, the calculator provides a free and accessible way to assess refunds, allowing users to make informed decisions about seeking further professional guidance.

Performance Analysis: Real-World Impact

The true test of any tool lies in its real-world application and impact. The Refund Tax Calculator has proven to be a game-changer for taxpayers, offering significant advantages over traditional refund calculation methods. Let’s explore some key performance indicators and user testimonials that highlight the calculator’s effectiveness.

Case Studies: Success Stories

Several case studies demonstrate the calculator’s ability to deliver substantial benefits to users. For instance, consider the case of Ms. Emma Johnson, a small business owner who used the calculator to assess her tax refund. The calculator not only estimated her refund accurately but also identified previously overlooked deductions, resulting in a significantly larger refund than she initially anticipated.

Similarly, Mr. Robert Wilson, a retiree with multiple income sources, found the calculator's step-by-step guidance invaluable. The tool helped him navigate the complexities of his tax situation, ensuring he received the maximum refund he was entitled to. These success stories highlight the calculator's ability to cater to a diverse range of users and tax scenarios.

User Feedback and Testimonials

User feedback plays a crucial role in understanding the calculator’s impact. Here’s a glimpse of what some satisfied users have to say:

- “The Refund Tax Calculator is a lifesaver! It’s so easy to use, and I was amazed at how accurately it calculated my refund. I highly recommend it to anyone looking for a simple and efficient way to claim their tax refunds.” - Sarah Thompson, Freelance Writer

- “As a small business owner, tax refunds are crucial for my cash flow. The calculator not only saved me time but also identified tax credits I wasn’t aware of. It’s a must-have tool for any business owner.” - Michael Chen, E-commerce Entrepreneur

- “I was hesitant about using online tools for tax calculations, but the Refund Tax Calculator changed my mind. It’s user-friendly, accurate, and provides a transparent breakdown of my refund. I’ll definitely be using it again next tax season.” - Lisa Parker, Accountant

Technical Specifications and Data Insights

Behind the user-friendly interface of the Refund Tax Calculator lies a sophisticated system of algorithms and data integration. Let’s delve into the technical aspects and data insights that power this innovative tool.

Data Sources and Integration

The calculator’s ability to fetch real-time data is a cornerstone of its accuracy. It integrates with multiple data sources, including government tax databases, financial institutions, and industry-specific data providers. This ensures that the calculator stays up-to-date with the latest tax regulations and market trends, providing users with the most current information.

Algorithmic Precision

The heart of the calculator lies in its advanced algorithms. These algorithms are designed to process complex tax calculations with precision, taking into account various factors such as income sources, deductions, tax credits, and applicable tax rates. The use of machine learning techniques further enhances the calculator’s ability to adapt and improve over time, ensuring consistent accuracy.

Data Security and Privacy

With the sensitivity of financial data, the calculator places a high priority on data security and privacy. It employs robust encryption protocols to protect user information, ensuring that data remains secure during transmission and storage. Additionally, the platform adheres to industry-standard privacy practices, giving users peace of mind when sharing their financial details.

Performance Metrics

| Metric | Value |

|---|---|

| Accuracy Rate | 98.5% |

| User Satisfaction | 4.8⁄5 (based on 1000+ reviews) |

| Average Time Saved | 3.2 hours per user |

| Data Sources Integrated | 12+ major tax databases and financial institutions |

Future Implications and Innovations

As technology continues to evolve, so does the potential for the Refund Tax Calculator to enhance its capabilities. Here’s a glimpse into the future and the exciting possibilities that lie ahead.

AI-Driven Enhancements

Artificial Intelligence (AI) is poised to play a significant role in the calculator’s future development. By leveraging AI technologies, the calculator can further automate the refund calculation process, making it even more efficient and accurate. AI-powered features could include automated data extraction from financial documents, intelligent scenario analysis, and personalized tax planning suggestions.

Integration with Tax Software

Integrating the calculator with popular tax preparation software could streamline the tax refund process even further. This integration would allow users to seamlessly transfer their financial data from tax software to the calculator, eliminating the need for manual data entry. It would also enable a more holistic view of a user’s tax situation, providing a comprehensive assessment of their refund potential.

Expanded Global Reach

Currently focused on specific regions, the calculator has the potential to expand its global reach. By adapting to the unique tax systems and regulations of different countries, the calculator could become a go-to tool for international taxpayers. This expansion would require careful consideration of cultural and linguistic nuances, ensuring a localized and user-friendly experience for taxpayers worldwide.

Community-Driven Features

Building a community around the calculator could foster collaboration and knowledge-sharing among users. This could include user forums, where taxpayers can discuss tax strategies, share insights, and provide mutual support. Additionally, community-driven features might include user-generated content, such as tax tips, success stories, or educational resources, further enhancing the calculator’s value as a knowledge hub.

How accurate is the Refund Tax Calculator’s estimates?

+The calculator’s estimates are highly accurate, with an average accuracy rate of 98.5%. It leverages real-time data and advanced algorithms to provide precise refund calculations.

Is my financial data secure when using the calculator?

+Absolutely! The calculator employs robust encryption protocols and adheres to strict privacy practices to ensure the security and confidentiality of your financial information.

Can the calculator assist with complex tax scenarios, such as multiple income sources or business expenses?

+Yes, the calculator is designed to handle complex tax situations. It provides step-by-step guidance and advanced scenario analysis, ensuring accurate calculations for diverse tax scenarios.

Are there any fees associated with using the Refund Tax Calculator?

+The basic version of the calculator is free to use. However, for more advanced features and personalized tax planning, there are premium subscription options available.