Morgan County Property Tax

Property taxes are a significant aspect of local government funding, and understanding how they work and how they impact homeowners is crucial for anyone living in Morgan County. This article aims to provide a comprehensive guide to Morgan County property taxes, shedding light on the assessment process, tax rates, payment options, and strategies to ensure you're prepared and informed.

Understanding Property Tax Assessments in Morgan County

Property tax assessments form the foundation of the property tax system in Morgan County. These assessments determine the value of your property, which is then used to calculate the amount of tax you owe. The Morgan County Assessor’s Office plays a vital role in this process, ensuring that property values are assessed fairly and accurately.

The assessment process involves a detailed evaluation of your property, taking into account various factors such as location, size, improvements, and market conditions. This process is typically conducted every few years, and property owners have the right to appeal their assessments if they believe the value assigned to their property is inaccurate.

Here's a breakdown of the key steps in the property tax assessment process in Morgan County:

- Data Collection: The Assessor's Office gathers information about properties, including physical characteristics, sales data, and any recent improvements.

- Property Inspection: Assessor staff may conduct physical inspections to verify the data and ensure accuracy.

- Valuation: Using industry-standard valuation methods, the Assessor's Office determines the market value of each property.

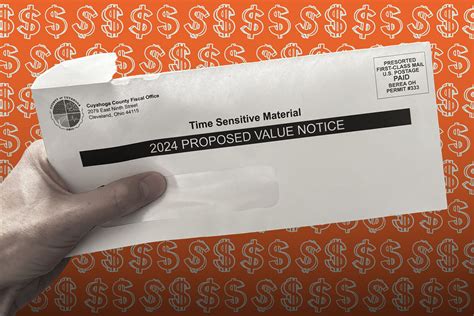

- Notice of Assessment: Property owners receive a notice of their assessed value, which includes information on how to appeal if needed.

- Appeal Process: Property owners have the right to appeal their assessments within a specified timeframe. The appeal process typically involves providing evidence to support a lower valuation.

By understanding this process, homeowners in Morgan County can actively participate in ensuring the accuracy of their property assessments, which directly impacts their tax liability.

Transparency and Appeals

The Morgan County Assessor’s Office strives for transparency in its assessment practices. Property owners can access detailed information about their assessments online, including the factors considered and the methodology used. This transparency allows homeowners to better understand their tax obligations and identify any potential errors.

If you believe your property has been overvalued, you have the right to appeal. The appeal process in Morgan County is designed to be fair and accessible. It typically involves submitting documentation and evidence to support your claim, such as recent sales data for comparable properties or professional appraisals. The Assessor's Office will review your appeal and make a determination, ensuring that property values are fair and consistent across the county.

| Assessment Appeal Timeline | Key Dates |

|---|---|

| Notice of Assessment | Sent by May 1st |

| Appeal Deadline | 30 days after notice |

| Hearing Date | Varies, typically within 60 days |

Property Tax Rates and Calculations in Morgan County

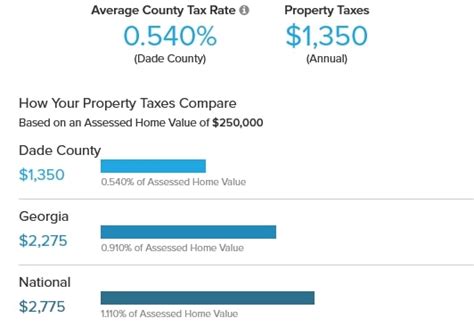

Once your property’s assessed value is determined, the next step is understanding how this value translates into your property tax bill. Morgan County’s property tax system is based on a set tax rate, which is applied to the assessed value of your property. This tax rate is established by local government bodies, including the county government and various taxing districts.

Tax Rate Structure

In Morgan County, the tax rate is typically expressed as a millage rate, which represents the tax per 1,000 of assessed value. For example, a millage rate of 100 mills means that for every 1,000 of assessed value, you would pay $10 in property taxes. This rate can vary from one taxing district to another within the county, as each district has its own tax rate to fund specific services or projects.

Here's a simplified breakdown of the tax rate structure in Morgan County:

- County Tax Rate: This is the rate set by the Morgan County government to fund general county operations.

- School District Tax Rate: Each school district within the county has its own tax rate to support local education.

- Municipal Tax Rate: Cities or towns within the county may have their own tax rates to fund municipal services.

- Special District Tax Rates: Special districts, such as fire protection or water districts, may also have their own tax rates to provide specific services.

The combined tax rates from these various districts make up the total tax rate for your property. It's important to note that tax rates can change from year to year, based on the budgetary needs of the local government and voter-approved initiatives.

Calculating Your Property Taxes

To calculate your property taxes, you’ll need to multiply your property’s assessed value by the applicable tax rate. Here’s a simplified formula:

Property Taxes = Assessed Value x Tax Rate

For example, if your property has an assessed value of $200,000 and the total tax rate is 150 mills, your property taxes would be calculated as follows:

Property Taxes = $200,000 x 0.15 = $3,000

In this example, you would owe $3,000 in property taxes for the year. It's important to note that this calculation is a simplified version, and actual tax rates may be more complex, especially in areas with multiple taxing districts.

Payment Options and Deadlines

Understanding how and when to pay your property taxes is crucial to avoid penalties and maintain a good standing with the local government. Morgan County offers various payment options and deadlines to accommodate different financial situations and preferences.

Payment Methods

The Morgan County Treasurer’s Office provides several convenient payment methods to ensure a smooth and hassle-free experience. These include:

- Online Payment: You can make secure payments through the county's official website. This method is often preferred for its convenience and real-time transaction confirmation.

- Mail-in Payment: Property owners can send their payments via check or money order to the Treasurer's Office. It's important to include the proper paperwork and allow sufficient time for processing.

- In-Person Payment: The Treasurer's Office typically accepts walk-in payments during regular business hours. This option allows for immediate confirmation and provides an opportunity to address any questions or concerns directly.

It's essential to verify the accepted payment methods and any associated fees or requirements before making a payment. The Treasurer's Office website often provides detailed information on these aspects.

Payment Deadlines

Property taxes in Morgan County are typically due in two installments, with specific deadlines set by the local government. Missing these deadlines can result in penalties and interest charges, so it’s crucial to stay informed and plan your payments accordingly.

| Payment Deadline | Due Date |

|---|---|

| First Installment | Varies by taxing district, typically due in June |

| Second Installment | Varies by taxing district, typically due in December |

It's important to note that these deadlines may not be uniform across the county, as different taxing districts may have slightly different schedules. Property owners should refer to their tax bills or the Treasurer's Office website for precise information on their specific payment deadlines.

Strategies for Managing Property Taxes

Property taxes can be a significant financial burden for homeowners, especially in areas with high property values or increasing tax rates. Fortunately, there are strategies you can employ to manage and potentially reduce your property tax obligations. Here are some effective approaches:

Appeal Your Assessment

As mentioned earlier, appealing your property assessment is a crucial step if you believe your property has been overvalued. By providing evidence of recent sales of similar properties or other relevant data, you can potentially reduce your assessed value and, consequently, your property taxes. Stay informed about the appeal process and deadlines to ensure a successful outcome.

Exemptions and Deductions

Morgan County, like many other jurisdictions, offers various exemptions and deductions that can reduce your taxable property value. These may include homestead exemptions for primary residences, veteran’s exemptions, or deductions for certain improvements like solar panels or energy-efficient upgrades. Researching and applying for these exemptions can lead to significant savings on your property taxes.

Tax Relief Programs

The local government in Morgan County may provide tax relief programs to assist certain groups of homeowners. These programs often target senior citizens, low-income individuals, or those with disabilities. By qualifying for such programs, you may be eligible for reduced tax rates or deferred payment plans. Stay updated on these programs and their requirements to determine if you’re eligible.

Stay Informed and Advocate

Being actively involved in your community and staying informed about local government decisions can have a significant impact on your property taxes. Attend town hall meetings, engage with local officials, and voice your concerns or suggestions. By understanding the budgetary needs and priorities of your community, you can advocate for responsible spending and potentially influence tax rates.

Strategic Property Improvements

While improvements to your property can increase its assessed value, certain strategic improvements may lead to tax deductions or incentives. For example, making energy-efficient upgrades or installing renewable energy systems can often qualify for tax credits or deductions. Research and consult with professionals to determine which improvements may provide the best tax benefits for your property.

Conclusion

Navigating property taxes in Morgan County requires a comprehensive understanding of the assessment process, tax rates, payment options, and available strategies. By staying informed, participating in the assessment appeal process when necessary, and taking advantage of exemptions and deductions, you can effectively manage your property tax obligations. Remember, property taxes play a crucial role in funding local services and infrastructure, so staying engaged and contributing to your community is beneficial for all residents.

How often are property assessments conducted in Morgan County?

+Property assessments in Morgan County are typically conducted every 3 to 5 years, ensuring that property values remain up-to-date and accurate.

What happens if I miss the deadline for appealing my assessment?

+Missing the appeal deadline may result in your assessment standing, and you’ll need to wait for the next assessment cycle to challenge it. It’s crucial to stay informed about deadlines to ensure your rights are protected.

Are there any online tools to estimate my property taxes before receiving the bill?

+Yes, the Morgan County Treasurer’s Office website often provides online calculators or estimators that allow you to calculate your estimated property taxes based on your assessed value and the current tax rates.