Irs Layoffs Tax Refunds Audits

The Internal Revenue Service (IRS) is a pivotal government entity tasked with tax collection and administration in the United States. However, amidst recent economic challenges and a shifting political landscape, the IRS has been faced with significant budgetary constraints and a potential workforce reduction. These developments have sparked concerns about the potential impact on tax refunds, audits, and overall tax compliance.

Understanding the IRS Layoffs

In 2023, the IRS faced a critical juncture as it grappled with budget constraints and the need to streamline its operations. The agency proposed a series of layoffs, primarily affecting its enforcement and support divisions. This move was part of a broader effort to adapt to changing economic conditions and align with budgetary restrictions.

The proposed layoffs would reduce the IRS workforce by approximately 5% to 10%, affecting thousands of employees across the country. While the agency emphasized that it would prioritize retaining front-line employees who directly interact with taxpayers, the proposed cuts would significantly impact its enforcement capabilities.

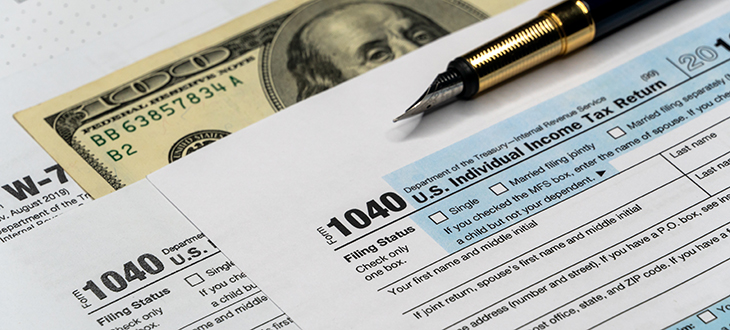

Impact on Tax Refunds

One of the immediate concerns arising from the IRS layoffs is the potential delay in processing tax refunds. The IRS is already facing a backlog of returns from the 2022 tax season, with many taxpayers awaiting their refunds. With a reduced workforce, the agency may struggle to keep up with the volume of returns, leading to extended wait times for refunds.

Additionally, the IRS has been dealing with a surge in fraudulent refund claims, which has further burdened its resources. The agency’s ability to identify and prevent fraudulent activities may be compromised with a reduced staff, potentially leading to more erroneous refunds being issued.

Implications for Tax Audits

The proposed layoffs also have significant implications for tax audits. The IRS’s enforcement division plays a critical role in ensuring tax compliance and addressing potential violations. With a reduced workforce, the agency may need to prioritize certain types of audits, potentially leading to a decrease in the overall number of audits conducted.

Moreover, the IRS may need to shift its focus towards higher-risk cases, such as those involving significant tax evasion or complex tax schemes. This could mean that taxpayers with lower-risk profiles may experience a decrease in audit activity, potentially creating a perception of reduced tax compliance oversight.

Addressing Tax Compliance Challenges

The IRS layoffs come at a time when tax compliance is already facing significant challenges. The COVID-19 pandemic and its economic aftermath have led to an increase in tax non-compliance, with many taxpayers struggling to meet their tax obligations.

To address these challenges, the IRS has been actively pursuing various initiatives to enhance tax compliance. These include expanding taxpayer education programs, improving online tools and resources, and exploring new technologies to streamline tax administration processes.

Modernizing Tax Administration

One key aspect of the IRS’s strategy to improve tax compliance is modernizing its tax administration systems. The agency has been investing in technological advancements to enhance its ability to identify and address tax non-compliance.

For instance, the IRS has been implementing advanced data analytics and machine learning algorithms to identify potential tax evasion cases. These technologies can analyze vast amounts of data, including taxpayer information and third-party sources, to detect anomalies and potential fraud.

Expanding Taxpayer Support

Recognizing the challenges faced by taxpayers, the IRS has also been focusing on expanding its taxpayer support services. This includes improving its customer service operations, such as call centers and online help resources, to provide timely assistance to taxpayers with questions or concerns.

Additionally, the IRS has been actively engaging with tax professionals and industry stakeholders to gather feedback and insights on improving tax administration processes. This collaborative approach aims to enhance taxpayer satisfaction and compliance while ensuring a fair and efficient tax system.

Future Implications and Outlook

The IRS layoffs and the broader tax compliance challenges present a complex landscape for taxpayers and tax professionals alike. While the agency is taking steps to modernize its operations and enhance taxpayer support, the proposed workforce reductions may pose significant challenges in the short term.

Looking ahead, the IRS will need to carefully navigate these challenges to maintain its critical role in tax administration. This includes effectively managing its resources, continuing to prioritize taxpayer education and support, and adapting to the evolving needs of taxpayers in a post-pandemic world.

| Metric | Data |

|---|---|

| Proposed Layoff Percentage | 5% to 10% |

| Estimated Number of Employees Affected | Thousands |

| Impact on Tax Refunds | Potential delays and increased wait times |

| Focus of Audits | Priority on higher-risk cases |

How will the IRS layoffs affect the processing of tax refunds?

+The IRS layoffs may lead to delays in processing tax refunds, especially with the existing backlog of returns. Wait times for refunds could be extended, impacting taxpayers’ financial planning.

Will the IRS prioritize certain types of audits after the layoffs?

+Yes, the IRS may need to prioritize higher-risk cases, such as those involving significant tax evasion or complex tax schemes. This could mean a decrease in audit activity for lower-risk taxpayers.

What steps is the IRS taking to improve tax compliance?

+The IRS is modernizing its systems, expanding taxpayer support services, and collaborating with tax professionals to enhance tax compliance. These initiatives aim to address the challenges posed by the pandemic and economic shifts.