West Virginia Property Tax

West Virginia's property tax system is an essential aspect of the state's fiscal framework, contributing significantly to local government revenue. The property tax is levied on both real and personal property, with unique features and exemptions. Understanding this system is crucial for homeowners, investors, and anyone interested in West Virginia's economic landscape. This comprehensive guide will delve into the intricacies of West Virginia property tax, covering its assessment process, rates, exemptions, and more.

Understanding the West Virginia Property Tax System

The property tax in West Virginia is primarily a local tax, with revenue generated going directly to support local services and infrastructure. This tax is administered by the West Virginia State Tax Department and each county’s Assessor’s Office. The state sets the basic framework and guidelines, while individual counties have some flexibility in implementing and collecting the tax.

Taxable Property and Assessment

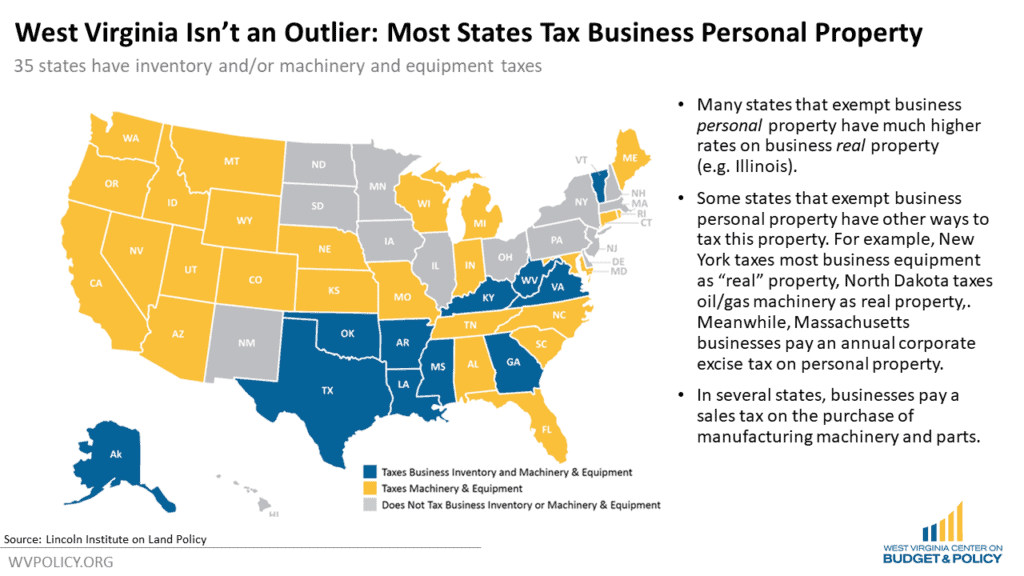

West Virginia defines taxable property broadly. It includes real property, which encompasses land and any structures permanently attached to it, such as buildings, houses, and other improvements. Personal property, on the other hand, refers to tangible property that is not permanently affixed to the land, like vehicles, machinery, and certain business assets. However, personal property is not taxed uniformly across the state; each county has its own regulations regarding what types of personal property are taxable.

The assessment process begins with an appraisal of the property's value. This is typically done by the county Assessor's Office, which uses various methods to determine the property's fair market value. These methods include the cost approach, the income approach, and the sales comparison approach. Once the value is determined, it is then subject to a classification process. Properties are classified based on their use, such as residential, commercial, agricultural, or industrial. Each classification has a different assessment rate, which we will explore in the next section.

Property Tax Rates and Calculations

West Virginia’s property tax rates are established at the county level, with each county setting its own rates. These rates are typically expressed as millage rates, which are calculated in mills per dollar of assessed value. One mill is equal to one-tenth of a cent, or 0.001. For instance, if a county has a millage rate of 80 mills, it means that for every 1,000 of assessed value, the property owner will pay $8 in property taxes.

The calculation of property taxes involves multiplying the assessed value of the property by the applicable millage rate. For example, if a property has an assessed value of $150,000 and the millage rate is 80 mills, the annual property tax would be calculated as follows:

| Assessed Value | $150,000 |

|---|---|

| Millage Rate | 80 mills |

| Annual Property Tax | $1,200 |

It's important to note that millage rates can vary significantly between counties and even within a county based on the property's location. This variation can lead to considerable differences in property tax bills for similar properties in different parts of the state.

Exemptions and Relief Programs

West Virginia offers several property tax exemptions and relief programs to help certain property owners reduce their tax burden. These exemptions are designed to support specific groups, such as senior citizens, veterans, and low-income homeowners.

One notable exemption is the Homestead Exemption, which reduces the assessed value of a primary residence by a certain amount, typically $20,000. This exemption is available to homeowners who are at least 65 years old or have a disability, and it can significantly lower their property tax bill. For example, if a homeowner qualifies for the Homestead Exemption and their property has an assessed value of $150,000, the exemption would reduce the taxable value to $130,000, resulting in potential tax savings.

The state also offers a Disabled Veterans Exemption, which provides a full exemption from property taxes for certain disabled veterans. Additionally, there are Agricultural Use Valuation programs that allow agricultural land to be assessed at its use value rather than its fair market value, benefiting farmers and landowners who use their property for agricultural purposes.

The Impact of Property Taxes on West Virginia’s Economy

Property taxes play a critical role in West Virginia’s economy, funding a wide range of essential services and infrastructure. These taxes support local schools, fire departments, emergency services, road maintenance, and other public services that are vital to the state’s residents and businesses.

Economic Development and Investment

The property tax system also influences economic development and investment in West Virginia. Lower property tax rates can make the state more attractive for businesses looking to expand or relocate, as it reduces their operational costs. Additionally, property taxes can be a significant incentive for developers, as they can offer potential tax benefits for certain types of developments, such as affordable housing or renewable energy projects.

Equity and Fairness Concerns

While property taxes are an essential revenue source, they can also lead to concerns about equity and fairness. As mentioned earlier, millage rates can vary significantly across the state, potentially leading to situations where similar properties pay vastly different tax amounts. This variation can be influenced by factors such as the property’s location, its assessed value, and the specific tax policies of the county.

To address these concerns, West Virginia has implemented various programs and initiatives to ensure a more equitable distribution of the tax burden. For instance, the state provides funding to assist counties with lower tax bases, helping to ensure that all areas can provide essential services to their residents.

Future Outlook and Potential Reforms

Looking ahead, West Virginia’s property tax system is likely to undergo further evolution and reforms to meet the changing needs of the state and its residents. Here are some potential areas of focus for future reforms:

- Streamlining Assessment Processes: Implementing more uniform and standardized assessment methods across counties could reduce potential inconsistencies and disputes.

- Expanding Exemptions and Relief Programs: The state could consider expanding existing programs or introducing new ones to provide greater relief to vulnerable populations, such as low-income earners or those facing economic hardship.

- Addressing Millage Rate Variations: While county-level millage rates allow for local control, they can also lead to disparities. Exploring ways to balance local control with state-level oversight could help ensure a more equitable tax system.

- Digital Transformation: Investing in digital technology for property tax administration could improve efficiency, reduce costs, and enhance transparency.

The future of West Virginia's property tax system will be shaped by a balance between maintaining local control and ensuring statewide equity. These reforms will aim to enhance the system's fairness, transparency, and efficiency while continuing to support local communities and the state's economy.

Frequently Asked Questions

How often are property assessments conducted in West Virginia?

+

Property assessments in West Virginia are conducted every four years. However, counties have the authority to conduct reassessments more frequently if they deem it necessary. The assessments ensure that property values remain up-to-date and that tax revenues are fairly distributed.

Are there any penalties for late property tax payments in West Virginia?

+

Yes, late payments of property taxes in West Virginia can incur penalties. Typically, a penalty of 10% is applied to the unpaid tax amount if the tax is not paid by the due date. Additionally, interest may accrue on the unpaid balance at a rate of 0.75% per month.

How can I appeal my property’s assessed value in West Virginia?

+

If you believe your property’s assessed value is incorrect, you have the right to appeal. The process typically involves filing an appeal with your county’s Board of Equalization and Review within a specified timeframe. It’s advisable to consult with a professional tax advisor or attorney to ensure your appeal is well-prepared and meets all legal requirements.