Are Labor Union Dues Tax Deductible

Labor union dues and fees are an essential part of the cost of employment for many workers across various industries. In the United States, the tax deductibility of these expenses has been a topic of interest and debate for labor union members and tax professionals alike. Understanding the tax implications of union dues is crucial for workers to optimize their financial planning and maximize their tax savings.

The Tax Treatment of Labor Union Dues

The Internal Revenue Service (IRS) in the United States considers labor union dues as a deductible expense for tax purposes. This means that union members can reduce their taxable income by claiming these expenses on their federal tax returns.

However, it's important to note that the deductibility of union dues is subject to certain restrictions and qualifications. The IRS has established guidelines to ensure that only legitimate and necessary expenses are considered for tax deductions.

Deductible Expenses and Qualifications

To be eligible for tax deduction, labor union dues must meet specific criteria:

- Membership Requirement: The union member must be an active and current member of the labor union during the tax year for which they are claiming the deduction. Dues paid for future membership periods are not deductible.

- Employment-Related Expense: The dues must be directly related to the member’s employment and not for any other personal or recreational purposes. This means that social or fraternal membership fees are generally not deductible.

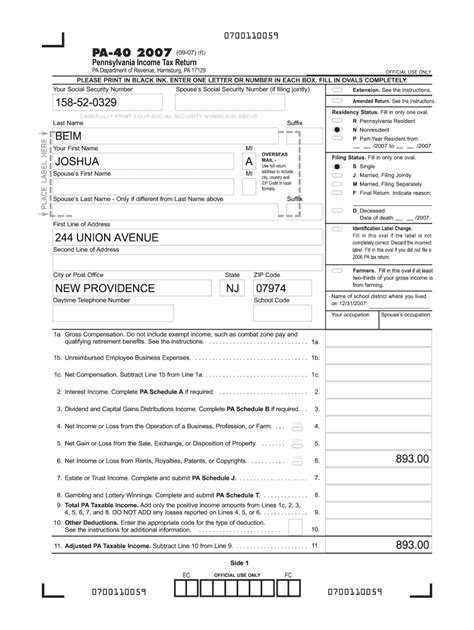

- Itemized Deductions: Union dues are claimed as an itemized deduction on Schedule A of Form 1040. Taxpayers must choose to itemize their deductions instead of taking the standard deduction to claim this benefit.

- Reporting Requirements: Union members must maintain proper records of their dues payments, including receipts or statements from the union. These records are essential for verifying the deduction during tax audits.

Calculating the Deduction

The amount of labor union dues that can be deducted varies depending on the member’s total income and other deductions claimed. Generally, the deduction is calculated as follows:

| Deduction Formula | Deduction Amount |

|---|---|

| Union Dues - 2% of Adjusted Gross Income (AGI) | The lesser of the actual dues paid or the amount exceeding 2% of AGI. |

For example, if a union member's AGI is $50,000 and they paid $2,000 in union dues, they can deduct the amount exceeding $1,000 (2% of $50,000) from their taxable income. In this case, the deductible amount would be $1,000.

💡 It's important to note that the 2% threshold applies to all miscellaneous itemized deductions, not just union dues. This means that if a taxpayer has other itemized deductions, such as unreimbursed employee expenses or tax preparation fees, these deductions are also subject to the 2% AGI limitation.

Impact on Tax Refund

Claiming labor union dues as a deduction can significantly impact a taxpayer’s tax refund or liability. By reducing taxable income, union members may qualify for a larger refund or lower tax bill. The amount of savings will depend on the taxpayer’s income bracket and other deductions claimed.

Comparison with Other Employment-Related Expenses

Labor union dues are one of the many employment-related expenses that taxpayers can deduct on their federal tax returns. Other common deductions include:

- Unreimbursed Employee Expenses: These are expenses that employees incur in the course of their employment but are not reimbursed by their employer. Examples include uniform costs, tool purchases, and business travel expenses.

- Job Search Costs: Expenses related to finding a new job, such as resume preparation, job placement agency fees, and travel costs for interviews, are deductible.

- Education Expenses: If education or training is required to maintain or improve employment skills, related expenses, including tuition, books, and supplies, can be deducted.

While these expenses are similar to union dues in that they are employment-related, it's important to note that each expense category has its own set of rules and limitations. Taxpayers should carefully review the IRS guidelines for each deduction to ensure compliance and maximize their tax benefits.

Future Outlook and Considerations

The tax treatment of labor union dues is subject to change based on legislative and regulatory developments. In recent years, there have been discussions and proposals to limit or eliminate the deductibility of union dues as part of broader tax reform initiatives.

Furthermore, the IRS regularly updates its guidelines and forms to reflect changes in tax laws and policies. Taxpayers should stay informed about these updates to ensure they are claiming their deductions accurately and in compliance with the latest regulations.

For labor union members, staying engaged with their union and local tax professionals is essential to understanding the tax implications of their dues and maximizing their financial benefits.

Can I deduct union dues if I’m not an itemizer on my tax return?

+No, union dues are claimed as itemized deductions on Schedule A of Form 1040. If you choose to take the standard deduction, you cannot deduct union dues.

Are there any limitations on the amount of union dues I can deduct?

+Yes, there is a 2% AGI limitation on miscellaneous itemized deductions, including union dues. This means you can only deduct the amount of dues that exceed 2% of your Adjusted Gross Income.

Can I deduct union initiation fees or one-time fees in addition to regular dues?

+Yes, initiation fees and one-time fees paid to join a union can also be deducted as long as they meet the eligibility criteria for union dues deductions.