State Of Pa Tax Return

The process of filing tax returns is an annual ritual for individuals and businesses alike, and understanding the specific requirements and deadlines for each state is crucial. This article aims to provide a comprehensive guide to filing tax returns in the state of Pennsylvania, offering an in-depth analysis of the process, requirements, and important deadlines.

Navigating the State of Pennsylvania Tax Landscape

Pennsylvania, often referred to as the Keystone State, has a robust tax system that plays a significant role in funding state operations and services. The Pennsylvania Department of Revenue is responsible for administering and enforcing state tax laws, including income tax, sales and use tax, corporate net income tax, and various other taxes.

For individuals, filing tax returns in Pennsylvania involves reporting and paying taxes on various sources of income, including wages, salaries, bonuses, tips, and other compensation. Additionally, income from investments, such as dividends, interest, and capital gains, is also subject to Pennsylvania income tax. Understanding the specific rules and regulations surrounding income reporting is crucial for accurate filing.

Income Tax Rates and Brackets

Pennsylvania employs a progressive tax system, which means that the tax rate increases as income rises. As of the 2023 tax year, the state has three income tax brackets with corresponding tax rates:

| Income Bracket | Tax Rate |

|---|---|

| First $36,450 of taxable income | 3.07% |

| $36,451 to $87,600 of taxable income | 3.70% |

| Taxable income over $87,600 | 3.87% |

It's important to note that these tax rates are subject to change annually, so it's advisable to refer to the official Pennsylvania Department of Revenue website for the most up-to-date information.

Tax Credits and Deductions

Pennsylvania offers a range of tax credits and deductions that can reduce the amount of tax owed or increase the size of a refund. Some common credits and deductions include:

- Property Tax/Rent Rebate: This program provides a rebate for property taxes or rent paid by eligible Pennsylvania residents. The maximum rebate amount varies annually.

- Low-Income Tax Credit: Individuals with low to moderate incomes may qualify for this credit, which can reduce the amount of tax owed.

- Education Tax Credit: Pennsylvania residents who pay tuition for eligible educational institutions may be able to claim this credit.

- Standard Deduction: All Pennsylvania taxpayers are entitled to a standard deduction, which reduces taxable income. The amount of the standard deduction is adjusted annually.

For a comprehensive list of available tax credits and deductions, it is recommended to consult the Pennsylvania Department of Revenue's official guidelines.

Pennsylvania Tax Return Deadlines

Understanding the deadlines for filing tax returns is crucial to avoid penalties and ensure compliance with state regulations. Here are the key deadlines for Pennsylvania tax returns:

Individual Income Tax Returns

The standard deadline for filing individual income tax returns in Pennsylvania is April 15th of the year following the tax year. For instance, the deadline for filing taxes for the 2023 tax year is April 15, 2024. However, it’s important to note that this deadline may be extended due to holidays or special circumstances.

In the event that the deadline falls on a weekend or a state holiday, the deadline is typically extended to the next business day. It's crucial to stay updated on any official announcements regarding deadline extensions, especially in exceptional circumstances such as natural disasters or widespread emergencies.

Extension of Time to File

If a taxpayer is unable to meet the standard deadline, they may request an extension of time to file their tax return. To request an extension, individuals can use Form PA-4868, “Application for Automatic Extension of Time to File Pennsylvania Income Tax Return”. This extension provides an additional six months to file the tax return, but it does not extend the time to pay any taxes owed.

Estimated Tax Payments

Pennsylvania requires individuals with estimated tax liabilities of $1,000 or more to make estimated tax payments throughout the year. These payments are typically due on the 15th day of the 4th, 6th, 9th, and 12th months of the tax year. For instance, for the 2023 tax year, the estimated tax payment deadlines would be June 15, 2023, September 15, 2023, December 15, 2023, and March 15, 2024.

Filing Options for Pennsylvania Tax Returns

Pennsylvania offers several options for filing tax returns, catering to various preferences and technological capabilities. Here are the primary methods:

Online Filing

The Pennsylvania Department of Revenue provides an online filing system known as e-file, which allows taxpayers to file their returns electronically. This system is secure, efficient, and often results in faster refunds. e-file supports both individual and business tax returns.

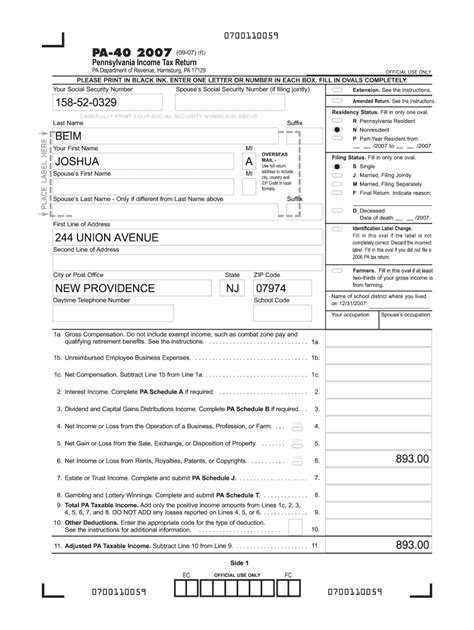

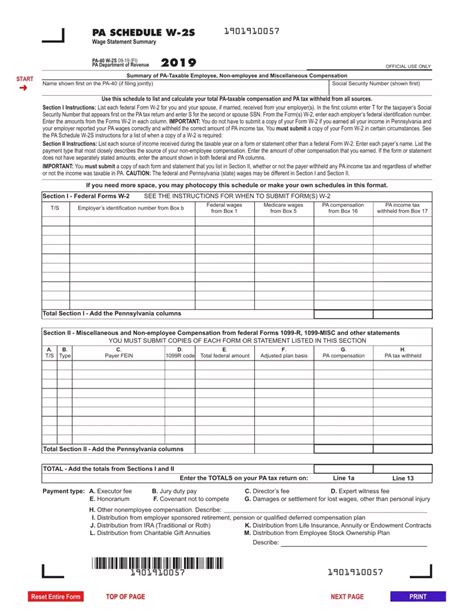

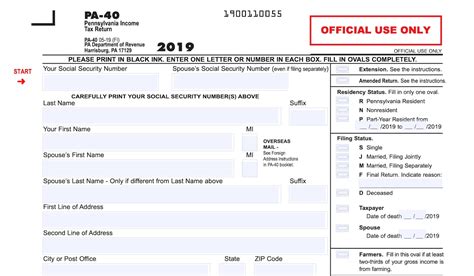

Paper Filing

For those who prefer traditional methods or have unique filing requirements, paper filing is an option. Taxpayers can download and print the necessary forms from the Department of Revenue’s website or request a paper copy to be mailed to them. The completed forms must then be mailed to the address specified on the form.

Electronic Filing through Tax Preparers

Taxpayers may choose to engage the services of a tax preparer or accountant who can electronically file their tax returns on their behalf. This option is particularly beneficial for individuals with complex tax situations or those who prefer professional assistance.

Pennsylvania Tax Refunds and Payment Options

Pennsylvania offers several methods for taxpayers to receive refunds or make payments for any taxes owed.

Receiving Refunds

Taxpayers who overpay their taxes or are eligible for tax credits may receive a refund. The Department of Revenue provides the following options for receiving refunds:

- Direct Deposit: Taxpayers can opt to have their refund directly deposited into their bank account. This method is fast and secure, and it eliminates the risk of lost or stolen refund checks.

- Check by Mail: For those without a bank account or who prefer traditional methods, the Department of Revenue can issue a refund check that is mailed to the taxpayer's address.

Making Tax Payments

If a taxpayer owes taxes, they have several options for making payments:

- Online Payment: The Department of Revenue's website provides a secure online payment system that allows taxpayers to pay their taxes using a credit or debit card, or through an electronic funds transfer from their bank account.

- Check or Money Order: Taxpayers can mail a check or money order, made payable to the Commonwealth of Pennsylvania, to the address specified on the tax return form.

- Pay by Phone: Pennsylvania offers a phone payment system that allows taxpayers to make payments using a credit or debit card. The phone number for this service is typically provided on the tax return form or on the Department of Revenue's website.

Pennsylvania Tax Resources and Assistance

The Pennsylvania Department of Revenue provides a wealth of resources and assistance to help taxpayers navigate the tax filing process. Here are some key resources:

Online Resources

The Department of Revenue’s website offers a comprehensive online portal with detailed information on tax laws, regulations, and filing requirements. It includes guides, forms, and publications, making it a valuable resource for taxpayers.

Taxpayer Service Centers

Pennsylvania operates several Taxpayer Service Centers across the state, providing in-person assistance to taxpayers. These centers offer help with filing tax returns, resolving tax issues, and answering general tax-related questions.

Taxpayer Assistance Program (TAP)

The Taxpayer Assistance Program is a specialized service provided by the Department of Revenue to help taxpayers with limited incomes, disabilities, or those who speak limited English. TAP offers personalized assistance and support to ensure that these taxpayers can navigate the tax system effectively.

Pennsylvania Free File Program

Pennsylvania partners with private-sector tax software companies to offer the Free File program, which provides free tax preparation and e-filing services to eligible taxpayers. This program is designed to assist taxpayers with moderate to low incomes who meet certain criteria.

Conclusion

Filing tax returns in Pennsylvania requires careful consideration of income reporting, tax rates, credits, and deductions. Understanding the deadlines, filing options, and payment methods is crucial for a smooth and compliant tax filing process. With the resources and assistance provided by the Pennsylvania Department of Revenue, taxpayers can navigate the complexities of state taxes with confidence.

Can I file my Pennsylvania tax return electronically if I don’t have a bank account for direct deposit?

+

Yes, you can still file your tax return electronically even if you don’t have a bank account. When filing electronically, you will be given the option to receive your refund by check instead of direct deposit. This means that the Department of Revenue will mail you a paper check for the amount of your refund.

Are there any tax preparation assistance programs available for low-income earners in Pennsylvania?

+

Absolutely! Pennsylvania offers the Free File program, which provides free tax preparation and e-filing services to eligible taxpayers with moderate to low incomes. This program ensures that individuals who may not be able to afford professional tax preparation services can still file their taxes accurately and efficiently.

What happens if I miss the tax return filing deadline in Pennsylvania?

+

Missing the tax return filing deadline can result in penalties and interest charges. However, you can request an extension of time to file your tax return by using Form PA-4868. This extension provides an additional six months to file your return, but it’s important to note that it does not extend the time to pay any taxes owed.