Tax Bandits

In the ever-evolving landscape of the digital world, a new breed of criminals has emerged, leveraging the power of technology to commit tax-related crimes. These individuals, often referred to as "Tax Bandits," have mastered the art of exploiting vulnerabilities in tax systems and using sophisticated techniques to evade taxes, commit fraud, and steal sensitive information.

As the world becomes increasingly digital, the risks and challenges associated with tax-related crimes have grown exponentially. Tax Bandits employ a range of tactics, from phishing scams and malware attacks to more intricate schemes, leaving taxpayers and governments vulnerable. This article aims to shed light on the rise of Tax Bandits, their methods, and the potential solutions to combat this growing menace.

The Evolution of Tax-Related Crimes in the Digital Age

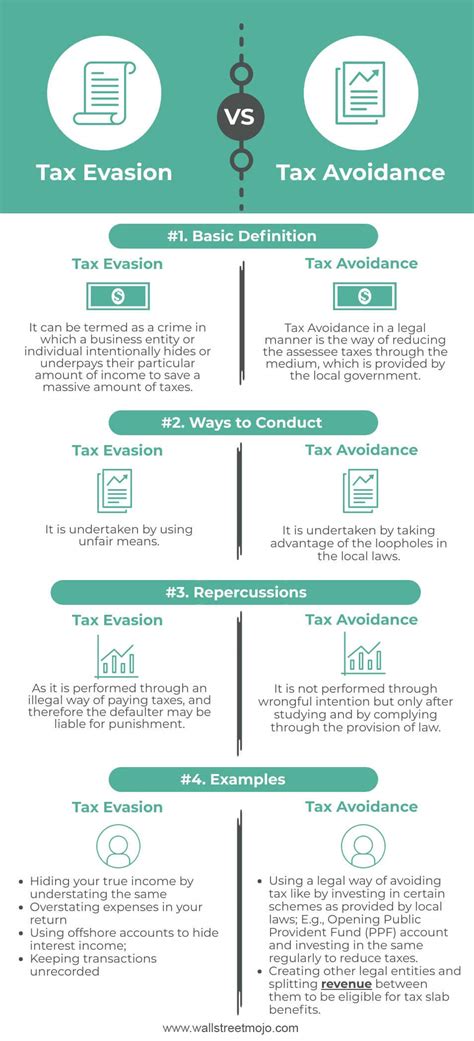

The advent of the internet and the rapid advancement of technology have transformed the way taxes are filed and managed. While these innovations have brought convenience and efficiency, they have also created new avenues for criminal activities. Tax Bandits have seized this opportunity, utilizing their technical expertise to manipulate tax systems and exploit loopholes.

The impact of these crimes is far-reaching. Tax evasion and fraud not only result in significant financial losses for governments and legitimate taxpayers but also erode trust in the tax system. Additionally, the theft of sensitive data, such as social security numbers and financial information, can have devastating consequences for individuals, leading to identity theft and further financial complications.

Unraveling the Methods of Tax Bandits

Tax Bandits employ a variety of tactics to carry out their illicit activities. Here are some of the most common methods used by these cybercriminals:

Phishing Scams

Phishing is a prevalent tactic used by Tax Bandits to deceive taxpayers. They create sophisticated emails or websites that mimic legitimate tax authorities or financial institutions, tricking individuals into revealing sensitive information such as passwords, social security numbers, or credit card details. Once obtained, this information is used for identity theft or unauthorized access to tax records.

Malware and Ransomware Attacks

Tax Bandits often deploy malware, a malicious software designed to disrupt, damage, or gain unauthorized access to computer systems. By infecting computers with malware, they can steal tax-related data, monitor user activities, or even encrypt important files, demanding a ransom for their release.

Identity Theft and Fraud

Identity theft is a critical aspect of Tax Banditry. These criminals steal personal information, such as social security numbers and birthdates, to create fake identities or assume the identities of real individuals. This allows them to file fraudulent tax returns, claim refunds, or even open new credit accounts, causing significant financial harm to the victims.

Tax Return Fraud

Tax Bandits are experts at manipulating tax return processes. They may file false returns on behalf of unsuspecting individuals, claiming excessive refunds or credits. Alternatively, they might intercept legitimate tax returns, alter the information, and redirect refunds to their own accounts.

Fake Tax Preparation Services

In some cases, Tax Bandits set up fake tax preparation businesses, offering their services to unsuspecting taxpayers. These businesses may promise quick refunds or low-cost tax preparation, but in reality, they steal personal information and use it for fraudulent purposes.

The Impact and Consequences of Tax Banditry

The consequences of Tax Banditry are severe and far-reaching. Apart from the financial losses incurred by governments and taxpayers, there are several other significant impacts:

- Erosion of Trust in Tax Systems: As Tax Banditry becomes more prevalent, it erodes the trust individuals have in tax authorities and the tax system as a whole. This can lead to decreased tax compliance and an increase in tax evasion, further complicating revenue collection efforts.

- Financial Instability for Individuals: Victims of Tax Banditry often face significant financial challenges. Identity theft and fraudulent tax returns can result in unexpected tax liabilities, credit score damage, and even legal consequences if the authorities mistake the victim for the perpetrator.

- Damage to Businesses: Businesses can also fall victim to Tax Bandits. Fraudulent tax schemes can lead to financial losses, reputational damage, and even legal repercussions for companies that unknowingly engage in illicit activities.

- Impact on the Economy: The financial losses incurred due to Tax Banditry can have a detrimental effect on the economy. Reduced tax revenues can impact government spending on essential services, infrastructure development, and social welfare programs.

Combating Tax Bandits: Strategies and Solutions

Addressing the threat posed by Tax Bandits requires a multi-faceted approach involving governments, tax authorities, technology companies, and individuals. Here are some strategies and solutions to mitigate the risks:

Enhanced Security Measures

Tax authorities and financial institutions must invest in robust security measures to protect their systems and sensitive data. This includes implementing advanced encryption protocols, multi-factor authentication, and regular security audits to identify and patch vulnerabilities.

Public Awareness and Education

Raising awareness among taxpayers about the risks of Tax Banditry is crucial. Tax authorities should actively educate individuals about common scams, phishing attempts, and best practices for protecting their personal information. This can be achieved through public awareness campaigns, online resources, and collaboration with community organizations.

Advanced Fraud Detection Systems

Developing sophisticated fraud detection systems can help identify suspicious activities and potential tax fraud. These systems can analyze patterns, detect anomalies, and flag suspicious tax returns for further investigation. Machine learning and artificial intelligence can play a crucial role in enhancing the accuracy and efficiency of fraud detection.

Strengthened Legal Frameworks

Governments should continuously review and update their legal frameworks to address the evolving nature of tax-related crimes. This includes enacting laws that specifically target tax fraud, identity theft, and cybercrimes, as well as providing adequate resources for law enforcement agencies to investigate and prosecute these crimes effectively.

International Collaboration

Tax Banditry is a global issue, and international collaboration is essential to combat it effectively. Governments and tax authorities should work together to share intelligence, best practices, and strategies for combating tax-related crimes. This can involve information sharing, joint investigations, and harmonizing legal frameworks to ensure consistent enforcement across borders.

Conclusion

The rise of Tax Bandits in the digital age presents a significant challenge to governments, taxpayers, and businesses alike. However, by adopting a proactive and collaborative approach, it is possible to mitigate the risks and protect the integrity of tax systems. Through enhanced security measures, public awareness campaigns, advanced fraud detection, and strengthened legal frameworks, we can create a safer environment for taxpayers and ensure the efficient collection of revenues for the betterment of society.

How can individuals protect themselves from Tax Bandits?

+Individuals can protect themselves by being vigilant and adopting good cybersecurity practices. This includes regularly updating passwords, enabling two-factor authentication, and being cautious of suspicious emails or websites. Additionally, keeping personal information secure and being aware of common tax-related scams can help prevent becoming a victim of Tax Banditry.

What steps are tax authorities taking to combat Tax Banditry?

+Tax authorities are investing in advanced technology, such as AI-powered fraud detection systems, to identify and prevent tax-related crimes. They are also collaborating with law enforcement agencies and financial institutions to share intelligence and strengthen their response to Tax Banditry. Additionally, they are actively educating taxpayers about the risks and providing resources to report suspicious activities.

How can businesses protect themselves from Tax Banditry?

+Businesses should implement robust cybersecurity measures, including regular security audits and employee training on data protection. They should also stay updated on the latest tax regulations and work closely with tax professionals to ensure compliance. Additionally, businesses can collaborate with industry associations and share best practices to enhance their overall security posture.