San Mateo County Tax Collector

The San Mateo County Tax Collector's Office is a vital government entity responsible for collecting and managing various taxes and fees within San Mateo County, California. From property taxes to vehicle registration fees, this office plays a crucial role in the county's fiscal health and infrastructure development. In this comprehensive guide, we will delve into the operations, services, and impact of the San Mateo County Tax Collector, offering valuable insights for residents, businesses, and anyone interested in understanding the intricacies of local taxation.

Understanding the Role of the Tax Collector

The San Mateo County Tax Collector is entrusted with the responsibility of efficiently collecting and processing tax payments from individuals and businesses across the county. This role is integral to the county’s financial stability, as the collected revenues fund essential public services, infrastructure projects, and community initiatives.

The Tax Collector's Office operates under the guidance of the San Mateo County Board of Supervisors, ensuring transparency and accountability in tax administration. It is headed by the County Tax Collector, who is appointed by the Board of Supervisors and serves as the chief administrator of the office.

Key Responsibilities and Services

The Tax Collector’s Office handles a diverse range of tax-related services, including:

- Property Tax Administration: Collecting property taxes from homeowners and businesses, ensuring accurate assessments, and providing timely tax bills.

- Vehicle Registration: Processing vehicle registration renewals, title transfers, and issuing new registrations for vehicles purchased or relocated within the county.

- Business Taxes: Managing business tax registration, collection, and compliance for various business activities, such as sales taxes, business license fees, and occupational taxes.

- Tax Payment Options: Offering convenient payment methods, including online payments, direct debit, and in-person transactions at designated locations.

- Tax Information and Assistance: Providing resources and support to taxpayers, including tax forms, payment due dates, and guidance on tax-related queries.

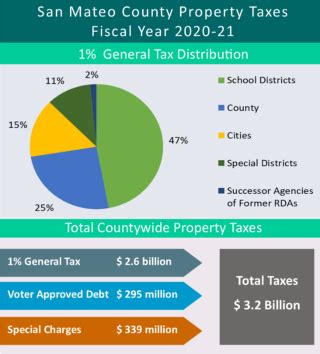

Navigating Property Taxes in San Mateo County

Property taxes are a significant source of revenue for San Mateo County, contributing to the funding of vital public services and infrastructure. The Tax Collector’s Office plays a critical role in ensuring that property owners understand their tax obligations and have access to the necessary resources for timely payment.

Property Tax Assessment Process

Property tax assessments are conducted by the San Mateo County Assessor’s Office, an independent entity responsible for valuing properties within the county. The Assessor’s Office determines the taxable value of each property based on factors such as location, improvements, and market conditions.

Once the taxable value is established, the Tax Collector's Office generates tax bills and sends them to property owners. These bills outline the total tax due, payment due dates, and any applicable penalties for late payments.

Payment Options and Due Dates

The Tax Collector’s Office offers a range of payment options to accommodate different preferences and circumstances. Property owners can choose to pay their taxes online, by mail, or in person at designated locations. Additionally, the office provides the option of paying taxes in installments, easing the financial burden for some taxpayers.

The payment due dates for property taxes are typically in two installments: the first installment is due in November, and the second is due in April. However, these dates may vary slightly depending on the calendar year. It is crucial for property owners to adhere to these deadlines to avoid penalties and potential legal consequences.

Vehicle Registration and Title Transfers

The San Mateo County Tax Collector’s Office is also responsible for vehicle registration and title transfers. This service is essential for ensuring that vehicles operated within the county are properly registered and comply with state regulations.

Registration Renewals

Vehicle registration renewals are a routine process that ensures vehicles remain legally operable on public roads. The Tax Collector’s Office sends renewal notices to vehicle owners, outlining the necessary steps and payment amounts. Renewals can be completed online, by mail, or in person, and typically involve a registration fee and a smog certificate (if applicable) for vehicles older than six years.

New Vehicle Registrations and Title Transfers

When purchasing a new vehicle or relocating to San Mateo County with an existing vehicle, owners must register their vehicles and transfer titles. The Tax Collector’s Office provides the necessary forms and guidance for these processes, ensuring that vehicles are properly documented and registered within the county.

Vehicle Registration Fees

Vehicle registration fees vary depending on the type of vehicle and its usage. These fees are calculated based on factors such as vehicle weight, fuel efficiency, and environmental impact. The Tax Collector’s Office provides a fee calculator on its website, allowing vehicle owners to estimate their registration costs accurately.

| Vehicle Type | Registration Fee Range |

|---|---|

| Passenger Vehicles | $30 - $150 |

| Trucks and Trailers | $30 - $300 |

| Motorcycles | $25 - $150 |

Business Taxes and Compliance

The San Mateo County Tax Collector’s Office oversees business tax registration and compliance, ensuring that businesses operating within the county meet their tax obligations.

Business Tax Registration

All businesses operating within San Mateo County, regardless of size or industry, are required to register with the Tax Collector’s Office. This registration process involves providing business details, including the type of business, location, and estimated annual revenue. The office then issues a business tax certificate, which must be renewed annually.

Sales Tax Collection and Remittance

Businesses that sell tangible goods or certain services are responsible for collecting and remitting sales taxes to the Tax Collector’s Office. The office provides resources and guidance to help businesses understand their sales tax obligations, including tax rates, collection methods, and reporting requirements.

Business License Fees

In addition to sales taxes, businesses may be subject to various license fees, depending on their industry and location. These fees contribute to the funding of specific services or infrastructure projects within the county. The Tax Collector’s Office maintains a comprehensive list of applicable fees and provides guidance on how to obtain the necessary licenses.

Online Services and Taxpayer Assistance

The San Mateo County Tax Collector’s Office recognizes the importance of convenience and accessibility in tax administration. To this end, the office has implemented a range of online services and resources to assist taxpayers in managing their tax obligations efficiently.

Online Payment Portal

The Tax Collector’s Office offers a secure online payment portal, allowing taxpayers to pay their property taxes, vehicle registration fees, and business taxes conveniently. This portal provides real-time updates on payment status and offers a user-friendly interface for managing tax-related transactions.

Tax Forms and Publications

The office maintains a comprehensive library of tax forms and publications on its website. These resources cover a wide range of tax-related topics, providing taxpayers with the necessary information to understand their obligations and rights. From property tax exemptions to business tax guides, these publications offer valuable insights for taxpayers.

Taxpayer Assistance and Support

The Tax Collector’s Office understands that tax-related matters can be complex and sometimes confusing. To assist taxpayers, the office provides a dedicated support team that can be reached via phone, email, or in-person visits. This team offers personalized guidance and support, ensuring that taxpayers receive the information they need to comply with their tax obligations.

Impact and Community Engagement

The San Mateo County Tax Collector’s Office is not just a revenue-generating entity; it is an integral part of the community, playing a vital role in the county’s economic and social development.

Funding Public Services and Infrastructure

The taxes collected by the Tax Collector’s Office directly contribute to the funding of essential public services and infrastructure projects. These revenues support schools, public safety, healthcare, transportation, and environmental initiatives, enhancing the quality of life for residents and businesses alike.

Community Outreach and Education

The Tax Collector’s Office actively engages with the community through various outreach programs and educational initiatives. These efforts aim to increase tax awareness, promote compliance, and provide support to vulnerable populations. By hosting workshops, participating in community events, and offering targeted assistance, the office strengthens its relationship with the community it serves.

Future Trends and Innovations

As technology advances and taxpayer expectations evolve, the San Mateo County Tax Collector’s Office remains committed to innovation and continuous improvement.

Digital Transformation

The office is investing in digital transformation initiatives to enhance its online services and streamline tax administration processes. This includes the development of user-friendly mobile apps, expanded online payment options, and the integration of advanced data analytics for improved decision-making.

Data-Driven Decision Making

By leveraging data analytics and advanced technology, the Tax Collector’s Office aims to optimize its operations and improve taxpayer services. This approach enables the office to identify trends, anticipate taxpayer needs, and implement targeted solutions, ultimately enhancing the overall tax administration experience.

FAQ

How often do I need to renew my vehicle registration in San Mateo County?

+

Vehicle registrations in San Mateo County are typically renewed annually. The Tax Collector’s Office sends renewal notices to vehicle owners, providing details on the renewal process and payment options. Renewals can be completed online, by mail, or in person at designated locations.

What happens if I miss the deadline for my property tax payment?

+

Missing the deadline for your property tax payment can result in penalties and additional fees. It is important to adhere to the payment due dates to avoid these consequences. The Tax Collector’s Office provides resources and assistance to help taxpayers understand their payment options and due dates.

How can I obtain a business tax certificate in San Mateo County?

+

To obtain a business tax certificate in San Mateo County, you must first register your business with the Tax Collector’s Office. This process involves providing business details and paying the applicable registration fees. Once registered, the office will issue a business tax certificate, which must be renewed annually.

Are there any tax exemptions or discounts available for senior citizens or veterans in San Mateo County?

+

Yes, San Mateo County offers various tax exemptions and discounts for senior citizens and veterans. These include property tax exemptions, sales tax exemptions, and business tax discounts. The Tax Collector’s Office provides detailed information on these benefits and the eligibility criteria. It is advisable to contact the office or visit their website for specific details.

Can I make partial payments for my property taxes in San Mateo County?

+

Yes, the San Mateo County Tax Collector’s Office offers the option of making partial payments for property taxes. This can be especially beneficial for taxpayers facing financial challenges. Partial payments can be made online, by mail, or in person, and the office provides guidelines on the acceptable payment plans.