Maine State Income Tax

In the state of Maine, income tax is a vital component of the state's revenue system, contributing significantly to the funding of essential public services and infrastructure. The state's income tax structure is designed to ensure a fair and equitable distribution of tax burdens among its residents. This article delves into the intricacies of Maine's state income tax, exploring its rates, brackets, deductions, and how it impacts the financial landscape of the state.

Understanding Maine’s Income Tax Structure

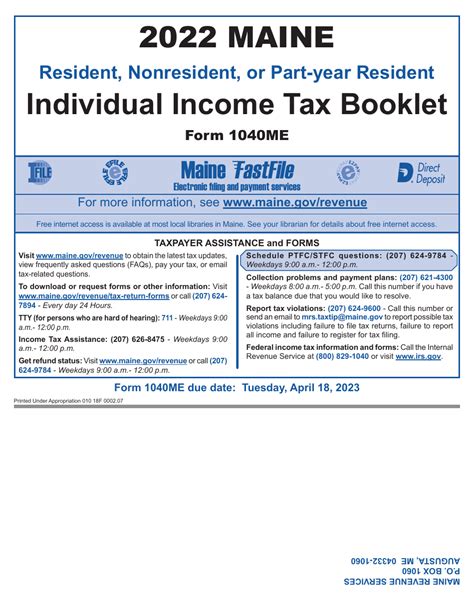

Maine operates a progressive income tax system, which means that taxpayers are categorized into different tax brackets based on their annual income. The state’s income tax rates vary depending on the taxpayer’s filing status and income level, ensuring a fair and proportionate tax burden. As of 2023, Maine has four tax brackets with corresponding tax rates, ranging from 5.8% to 7.15%.

| Tax Bracket | Tax Rate |

|---|---|

| Up to $22,950 | 5.8% |

| $22,951 - $45,900 | 6.55% |

| $45,901 - $81,600 | 6.77% |

| Over $81,600 | 7.15% |

These tax brackets and rates are subject to periodic review and adjustment by the Maine Legislature to ensure they remain competitive and in line with the state's fiscal needs.

Tax Filing Status and Income Brackets

Maine recognizes various filing statuses for tax purposes, including single, married filing jointly, married filing separately, and head of household. Each status has its own set of income brackets, which determine the applicable tax rate for that filing category. For instance, a single taxpayer with an income of $40,000 would fall into the 6.77% tax bracket, while a married couple filing jointly with the same income would still be in the 6.77% bracket.

Deductions and Credits

Maine offers a range of deductions and credits to help alleviate the tax burden on its residents. These include standard deductions, which vary based on filing status, and itemized deductions for certain expenses like medical costs, charitable contributions, and state and local taxes. Additionally, Maine provides various tax credits, such as the Property Tax Fairness Credit and the Homestead Exemption, to assist homeowners and low- to moderate-income individuals.

Impact on Maine’s Economy

Maine’s state income tax plays a crucial role in shaping the state’s economic landscape. The revenue generated from income taxes is a significant source of funding for essential services, including education, healthcare, infrastructure development, and public safety. It allows the state to invest in initiatives that foster economic growth, support small businesses, and enhance the overall quality of life for its residents.

Economic Development and Business Climate

The state’s progressive income tax system, coupled with a competitive tax structure, has been a key factor in attracting and retaining businesses. Maine’s tax environment, which includes a range of incentives and credits for businesses, has contributed to a thriving entrepreneurial ecosystem. This has led to job creation, increased investment, and a robust local economy, all of which benefit from a stable and well-managed tax system.

Impact on Personal Finances

For individuals and families, Maine’s income tax structure can have a significant impact on personal finances. While the progressive nature of the tax system ensures a fair distribution of tax burdens, it also means that higher-income earners contribute a larger proportion of their income in taxes. However, the availability of deductions and credits can help mitigate this burden, especially for those with specific expenses or circumstances.

Comparative Analysis

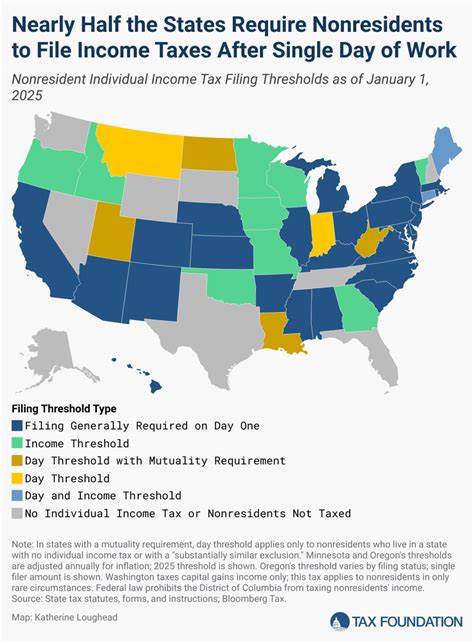

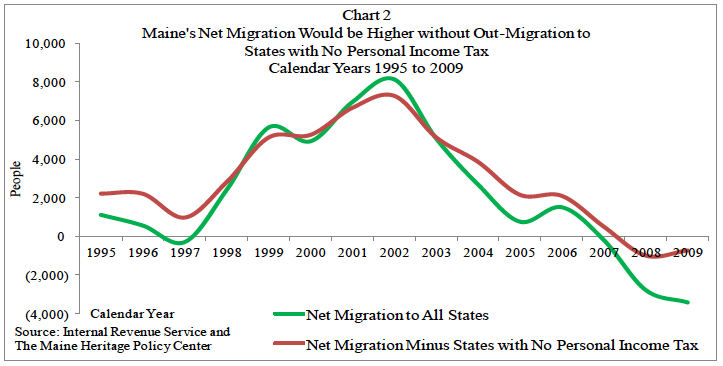

Maine’s state income tax structure can be compared to other states to understand its position in the broader U.S. tax landscape. While Maine’s tax rates are relatively moderate compared to some states, it offers a more progressive system with a wider range of tax brackets. This allows for a more nuanced approach to taxation, ensuring that those with higher incomes contribute proportionally more.

State-to-State Comparison

For instance, when compared to neighboring states like New Hampshire, which has no state income tax, Maine’s tax rates may appear higher. However, when considering the overall tax burden, including property and sales taxes, Maine’s position may be more competitive. Additionally, Maine’s tax system offers more opportunities for deductions and credits, providing a potential tax advantage for certain individuals and businesses.

Future Implications and Considerations

As Maine’s economy continues to evolve, the state’s income tax structure will remain a critical aspect of its fiscal policy. The ongoing debate surrounding tax reform and the potential for changes in tax rates and brackets highlights the importance of understanding the current system and its implications.

Potential Reforms and Changes

There have been discussions about reforming Maine’s tax system to make it more competitive and responsive to the needs of its residents and businesses. This could include adjustments to tax rates, brackets, and deductions to encourage economic growth and provide tax relief to specific groups. Any changes would need to balance the state’s revenue needs with the goal of fostering a thriving and sustainable economy.

Conclusion

Maine’s state income tax is a vital component of the state’s fiscal landscape, contributing significantly to the funding of essential services and infrastructure. The progressive nature of the tax system ensures a fair and equitable distribution of tax burdens, while deductions and credits provide relief for specific circumstances. As Maine continues to evolve, the state’s income tax structure will remain a key focus, shaping the economic future of the state and its residents.

What is the current tax rate for Maine’s highest income bracket?

+The current tax rate for Maine’s highest income bracket, which applies to incomes over $81,600, is 7.15%.

Are there any special tax credits available for Maine residents?

+Yes, Maine offers several tax credits, including the Property Tax Fairness Credit and the Homestead Exemption, to provide relief to homeowners and low- to moderate-income individuals.

How does Maine’s income tax structure compare to other states in the region?

+Maine’s tax rates are generally moderate compared to some neighboring states. While it offers a progressive system with a range of tax brackets, it may have a higher overall tax burden when considering property and sales taxes.