Mn State Tax Refund Status

The Minnesota Department of Revenue offers several options for taxpayers to check the status of their state tax refunds. This article provides an in-depth guide on how to track the progress of your refund, including online methods, telephone inquiries, and important timelines to keep in mind. Whether you filed your taxes electronically or on paper, there are convenient ways to stay informed about the status of your refund.

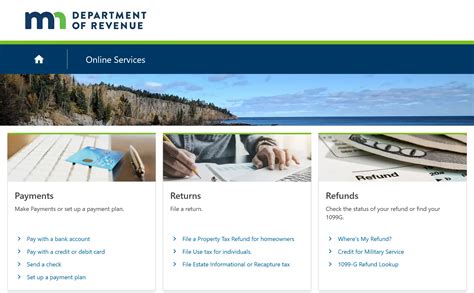

Online Refund Status Check

The most efficient way to check the status of your Minnesota state tax refund is through the Department of Revenue’s online refund status tool. This user-friendly platform provides real-time updates on the processing of your refund. Here’s a step-by-step guide on how to utilize this service:

Step 1: Access the Online Tool

Visit the Minnesota Department of Revenue website at https://www.revenue.state.mn.us. Navigate to the “Taxes” section and select “Individual Income Tax”. Under the “Refunds” heading, you’ll find a link to the “Check your refund status” page.

Step 2: Input Your Information

On the refund status page, you’ll be prompted to enter specific details from your tax return. This typically includes your:

- Social Security Number or Individual Taxpayer Identification Number (ITIN)

- Refund Amount (enter the exact amount as shown on your return)

- Tax Year for which you are checking the refund status

Ensure that you enter the information accurately, as any discrepancies may result in an error message.

Step 3: View Your Refund Status

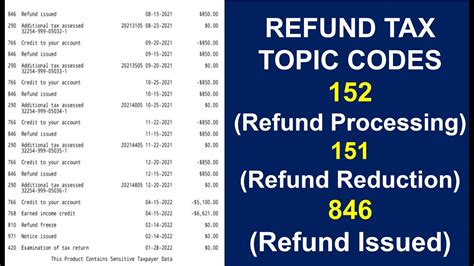

After submitting your details, the online tool will display the current status of your refund. You may see one of the following messages:

- Processing: Your return is being processed, and a refund has not yet been issued.

- Refund Issued: Your refund has been approved and sent out. The tool will provide the date it was issued and the method of payment (direct deposit or check).

- Error: If an error message appears, double-check the information you entered and try again. If the issue persists, contact the Department of Revenue for assistance.

Online Tool Features

The online refund status tool offers additional features to enhance your experience:

- Email Notifications: You can opt to receive email updates when there are changes to your refund status. This ensures that you stay informed without constantly checking the website.

- Mobile Accessibility: The tool is optimized for mobile devices, making it convenient to check your refund status on the go.

- Secure Connection: All interactions with the Department of Revenue’s website are encrypted, ensuring the security and privacy of your information.

Telephone Inquiry

If you prefer a more personal approach or encounter issues with the online tool, you can contact the Minnesota Department of Revenue by phone to inquire about your refund status. Here are the details:

Contact Information

Phone Number: (651) 296-3781 or 1-800-652-9094 (toll-free)

Hours of Operation: Monday to Friday, 8:00 AM to 4:30 PM (Central Time)

What to Have Ready

When calling, have the following information readily available to expedite the process:

- Your Social Security Number or ITIN

- The exact refund amount shown on your tax return

- The tax year for which you are inquiring

Expected Wait Times

Call volumes can vary, but the Department of Revenue aims to answer calls promptly. During peak periods, such as shortly after tax filing deadlines, wait times may be longer. Consider calling earlier in the day or outside of peak hours to minimize hold times.

Refund Processing Timelines

Understanding the typical refund processing timelines can help manage your expectations. The Minnesota Department of Revenue aims to process refunds within a certain timeframe, but individual circumstances may vary.

Electronic Filing (e-File)

If you filed your taxes electronically, you can expect the following timeline:

- Initial Processing: It typically takes 2 to 3 weeks for the Department of Revenue to process electronic returns.

- Direct Deposit: If you opted for direct deposit, your refund will be deposited into your account within 4 to 6 weeks from the date you filed.

- Paper Check: For those who requested a paper check, allow 6 to 8 weeks for the check to arrive in the mail.

Paper Filing

If you filed your taxes on paper, the processing times may be slightly longer:

- Initial Processing: Paper returns generally take 4 to 6 weeks to be processed.

- Direct Deposit: Direct deposit refunds from paper returns are issued within 6 to 8 weeks from the filing date.

- Paper Check: For paper checks, allow 8 to 10 weeks for delivery.

It's important to note that these timelines are estimates and may be affected by factors such as errors on your return, additional reviews, or high volumes of tax returns during peak filing seasons.

Common Refund Issues and Solutions

While most refunds are processed smoothly, some taxpayers may encounter issues. Here are some common refund problems and potential solutions:

Delayed Refund

If your refund is taking longer than expected, consider the following:

- Error Correction: The Department of Revenue may need to contact you to resolve errors or discrepancies on your return. Ensure that your contact information is up-to-date.

- Identity Verification: In some cases, the Department may require additional identity verification, especially if there are suspicious activities or multiple refunds requested from the same account.

- Review Process: Your return may be selected for further review, which can delay the refund process. Stay patient and avoid submitting multiple inquiries, as this may only slow down the process further.

Incorrect Refund Amount

If you believe your refund amount is incorrect, review your tax return carefully. Ensure that all calculations and withholdings are accurate. If you find an error, contact the Department of Revenue for guidance on how to rectify the issue.

Refund Not Received

If your refund status shows that it has been issued but you haven’t received it, take the following steps:

- Check Your Account: If you opted for direct deposit, verify that the refund was deposited into the correct account. Contact your financial institution if there are any discrepancies.

- Mail Delays: For paper checks, allow for potential postal service delays, especially during peak tax seasons or in areas affected by weather events.

- Return to Sender: If your refund check was returned to the Department of Revenue, update your address with the Department to ensure proper delivery.

Future Implications and Tax Planning

Understanding your refund status and processing timelines can also inform your future tax planning strategies. Here are some key takeaways:

e-Filing Advantages

Electronic filing offers several benefits, including faster processing times and reduced errors. Consider e-filing for your next tax return to expedite the refund process.

Tax Withholdings and Adjustments

Review your tax withholdings throughout the year to ensure you’re not overpaying or underpaying your taxes. Adjustments can be made via your employer’s payroll department or by submitting a new W-4 form.

Explore Refund Options

Explore different refund options, such as direct deposit or paper checks. Direct deposit is generally faster and more secure, as it eliminates the risk of lost or stolen checks.

Stay Informed

Stay updated on tax laws and regulations to ensure you’re taking advantage of all available deductions and credits. Consult tax professionals or reliable online resources for guidance.

| Key Takeaways | Actions |

|---|---|

| Utilize Online Tools | Check refund status regularly using the Department of Revenue's online tool. |

| Opt for e-Filing | Consider electronic filing for faster processing and reduced errors. |

| Review Tax Withholdings | Adjust withholdings throughout the year to avoid overpaying or underpaying taxes. |

| Stay Informed | Stay updated on tax laws and explore available deductions and credits. |

Can I check the status of my refund if I e-filed with a tax preparation software or service?

+Yes, you can still check your refund status using the Department of Revenue’s online tool or by calling the designated phone number. The refund status tool is accessible to all taxpayers, regardless of how they filed their taxes.

What if I haven’t received my refund within the estimated timeline?

+If your refund has not arrived within the estimated timeframe, it’s recommended to contact the Department of Revenue. They can investigate potential delays and provide updates on your refund’s status.

How can I ensure my refund is deposited into the correct bank account for direct deposit?

+Double-check the account details you provided on your tax return. If you need to update your banking information, contact the Department of Revenue promptly. They can guide you through the process of updating your direct deposit details.

What should I do if I receive a refund check that is made out to someone else or is incorrect?

+Contact the Department of Revenue immediately if you receive a refund check with errors. They will guide you on the next steps, which may involve returning the incorrect check and requesting a replacement.