Sales Tax Texas Austin

In the bustling city of Austin, Texas, understanding the intricacies of sales tax is crucial for both businesses and consumers alike. This comprehensive guide delves into the specifics of sales tax in Austin, offering an in-depth analysis of the rates, regulations, and practical implications for the vibrant local economy.

Sales Tax Landscape in Austin

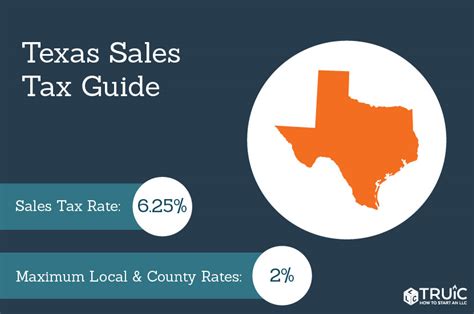

The sales tax structure in Austin, much like the rest of Texas, is a complex interplay of state, county, and city tax rates. As of [current year], the state sales tax rate stands at 6.25%, a figure that forms the foundation of the tax system in the Lone Star State.

City-Specific Sales Tax

Austin, being a bustling urban center, imposes an additional 0.25% sales tax, bringing the total sales tax rate within city limits to 6.5%. This city-specific tax is often used to fund local projects and infrastructure, contributing to the development of the city.

Special Tax Districts

Additionally, Austin is home to various special tax districts, each with its own unique tax rate. These districts, established for specific purposes like transportation or economic development, can add an extra layer of complexity to the sales tax landscape. For instance, the Austin Transportation District levies an additional 0.5% tax, dedicated solely to transportation projects.

| Tax Jurisdiction | Sales Tax Rate |

|---|---|

| State of Texas | 6.25% |

| City of Austin | 0.25% |

| Austin Transportation District | 0.5% |

| Other Special Districts (e.g., Cultural District) | Varies |

The combined sales tax rate in Austin can therefore vary from 6.5% to over 7%, depending on the specific location and the presence of special tax districts.

Impact on Businesses and Consumers

The diverse sales tax landscape in Austin has a profound impact on both local businesses and consumers. For businesses, understanding and managing these taxes is crucial for financial planning and compliance. They must ensure accurate tax collection and remittance to avoid penalties and maintain a positive relationship with the Texas Comptroller’s Office.

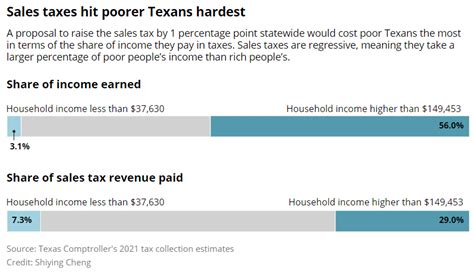

Consumers, on the other hand, face a more direct impact. The sales tax rates influence their purchasing decisions, with higher taxes potentially leading to reduced spending or a shift in preferences towards online or out-of-state retailers, where tax rates might be lower.

Strategies for Businesses

To navigate the complex sales tax environment, businesses in Austin employ various strategies. Many utilize specialized software to automate tax calculations, ensuring accuracy and compliance. Others opt for consulting services to stay updated on the ever-changing tax landscape, especially with the potential for new special tax districts or rate changes.

Consumer Behavior and Online Sales

The sales tax rates in Austin also influence consumer behavior. With the convenience of online shopping, consumers can compare prices across retailers, often opting for lower-priced items or stores, even if they are out-of-state. This shift towards online sales has a direct impact on brick-and-mortar stores in Austin, which must find ways to compete by offering unique experiences or exclusive in-store deals.

Sales Tax Compliance and Challenges

Compliance with sales tax regulations is a significant challenge for businesses in Austin. The complex structure, with its varying rates and special districts, requires meticulous record-keeping and accurate tax calculations. Failure to comply can result in substantial penalties and legal repercussions.

Furthermore, the dynamic nature of the sales tax landscape, with frequent changes in rates and regulations, poses an ongoing challenge for businesses. Staying updated and adapting to these changes is essential to avoid non-compliance.

Tips for Compliance

- Utilize sales tax automation tools to streamline the process and reduce human error.

- Stay informed about local and state tax regulations through official channels and industry associations.

- Conduct regular audits to ensure accurate tax collection and remittance.

- Consider engaging tax professionals for complex tax scenarios or when facing significant tax challenges.

Future Trends and Implications

The sales tax landscape in Austin is expected to continue evolving, with potential changes in tax rates and the establishment of new special tax districts. These changes could impact the local economy, influencing business strategies and consumer spending patterns.

Additionally, the ongoing shift towards e-commerce and online sales is likely to shape the future of sales tax in Austin. As more consumers opt for online shopping, the city may need to adapt its tax strategies to ensure a fair and competitive market for local businesses.

Proactive Strategies for the Future

To stay ahead of these changes, businesses in Austin should adopt a proactive approach. This includes regularly reviewing tax strategies, investing in technology for tax automation, and staying connected with industry peers and tax professionals to share insights and best practices.

How often do sales tax rates change in Austin?

+Sales tax rates in Austin can change annually or even more frequently, depending on local and state government decisions. It’s crucial for businesses and consumers to stay updated through official channels.

Are there any tax-free days in Austin?

+Yes, Texas has designated tax-free weekends for specific items like clothing and school supplies. These weekends typically occur in August, providing a boost to retail sales.

How do online retailers handle sales tax in Austin?

+Online retailers are required to collect and remit sales tax based on the shipping address of the customer. This ensures fairness in the market and compliance with local tax laws.