Denton County Property Tax

In the realm of real estate and financial management, understanding the intricacies of property taxes is essential for homeowners and investors alike. This article aims to provide a comprehensive guide to Denton County property taxes, shedding light on the assessment process, tax rates, payment options, and the impact of these taxes on local residents and businesses. By delving into the specifics, we aim to offer valuable insights for anyone navigating the complex world of property ownership in Denton County.

Understanding Denton County Property Taxes

Property taxes in Denton County, Texas, are a significant aspect of local governance and community funding. These taxes are essential for maintaining public services, infrastructure, and various community initiatives. The process of assessing and collecting property taxes is overseen by the Denton County Appraisal District (DCAD), an independent governmental body responsible for appraising property values within the county.

The Appraisal Process

The DCAD conducts annual appraisals to determine the market value of each property in the county. This value serves as the basis for calculating property taxes. The appraisal process involves considering various factors, including:

- Market Value: The DCAD researches recent sales of similar properties to estimate the market value of each parcel.

- Physical Characteristics: The size, location, age, and condition of the property are taken into account.

- Income Potential: For commercial properties, the potential income generated by the property is a key consideration.

- Exemptions and Special Valuation: Certain properties may be eligible for exemptions or special valuation programs, such as the Homestead Exemption or Agricultural Valuation.

After the initial appraisal, property owners receive a Notice of Appraised Value, which outlines the DCAD's valuation and provides an opportunity for review and protest. This notice is typically mailed out in April, allowing for a period of protest before the final value is set.

Tax Rates and Calculations

Denton County’s property tax rates are determined by the various taxing entities within the county, including the county government, school districts, cities, and special districts. These entities set their tax rates annually, and the combined rate is known as the Effective Tax Rate. For the year 2023, the average Effective Tax Rate in Denton County was approximately 2.27%, although this can vary significantly depending on the specific location within the county.

The property tax calculation is straightforward: the appraised value of the property is multiplied by the Effective Tax Rate. For instance, a property with an appraised value of $200,000 would have an estimated tax liability of $4,540 based on the 2023 average Effective Tax Rate.

| Year | Average Effective Tax Rate (%) |

|---|---|

| 2023 | 2.27 |

| 2022 | 2.25 |

| 2021 | 2.23 |

It's important to note that tax rates can fluctuate from year to year due to changes in the tax base and the needs of the taxing entities. Property owners should stay informed about the tax rates applicable to their specific property.

Payment Options and Deadlines

Property taxes in Denton County are typically due by January 31st of each year. However, taxpayers have the option to pay their taxes in two installments: the first by January 31st and the second by July 1st. Failure to pay by the due date may result in penalties and interest charges.

The county offers several convenient payment methods, including online payments through the DCAD website, by mail, or in person at the DCAD offices. Taxpayers can also set up automatic payments or choose to pay through their mortgage servicer, which often includes property taxes as part of the monthly mortgage payment.

Impact on Local Residents and Businesses

Property taxes in Denton County play a crucial role in supporting the local community and its infrastructure. The revenue generated from these taxes is utilized for various purposes, including:

- Education: A significant portion of property taxes funds the local school districts, ensuring the education of children in the community.

- Public Safety: Property taxes contribute to the funding of law enforcement, fire departments, and emergency services.

- Infrastructure: These taxes support the maintenance and improvement of roads, bridges, parks, and other public facilities.

- Social Services: A portion of the tax revenue goes towards healthcare, social welfare programs, and community development initiatives.

- Economic Development: Property taxes help attract businesses and promote economic growth in the county.

For residents and businesses, property taxes are a tangible investment in the community's well-being and future. However, it's important to manage these taxes effectively to ensure financial stability. Strategies such as budgeting for tax payments, exploring available exemptions, and staying informed about tax rates and deadlines can help property owners navigate this essential aspect of homeownership.

Staying Informed and Engaged

Understanding and actively managing property taxes is a crucial aspect of responsible homeownership and community involvement. By staying informed about the appraisal process, tax rates, and available exemptions, Denton County residents can make informed decisions about their financial obligations and contribute meaningfully to the local community.

For further information and resources, the Denton County Appraisal District website is an invaluable tool, providing detailed explanations, tax calculators, and updates on relevant tax matters. Additionally, attending local government meetings and engaging with community organizations can offer insights into how property taxes are allocated and the impact they have on the community's growth and development.

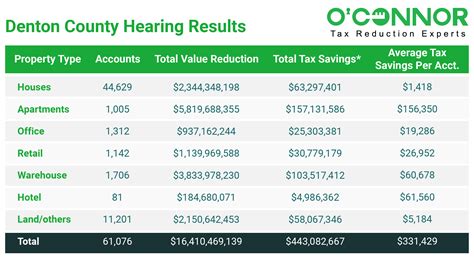

How can I protest my property’s appraised value?

+If you believe your property’s appraised value is incorrect, you have the right to protest. You can do so by submitting a written protest to the DCAD within the designated protest period. The protest should include specific reasons and evidence supporting your claim. The DCAD will review your protest and schedule a hearing if necessary. Be prepared to present your case and provide supporting documentation.

Are there any tax relief programs available for seniors or veterans?

+Yes, Denton County offers several tax relief programs for eligible residents. The Over-65 Exemption allows homeowners aged 65 or older to exempt a portion of their home’s value from taxation. The Disabled Veterans Exemption provides similar benefits to qualifying disabled veterans. It’s important to research and apply for these exemptions to take advantage of the available tax relief.

What happens if I miss the property tax payment deadline?

+If you miss the property tax payment deadline, you may be subject to penalties and interest charges. It’s important to stay organized and plan your payments accordingly. If you encounter financial difficulties, consider reaching out to the tax office or seeking professional advice to explore potential solutions.