Alabama Vehicle Sales Tax

Alabama's vehicle sales tax is an essential component of the state's revenue system, contributing significantly to its economic landscape. Understanding this tax is crucial for both residents and businesses operating in the state, especially when it comes to purchasing vehicles. The tax rate, calculation methods, and various exemptions play a pivotal role in the financial aspect of vehicle ownership. This article aims to delve into the intricacies of Alabama's vehicle sales tax, providing a comprehensive guide for anyone navigating this aspect of the state's taxation system.

The Fundamentals of Alabama Vehicle Sales Tax

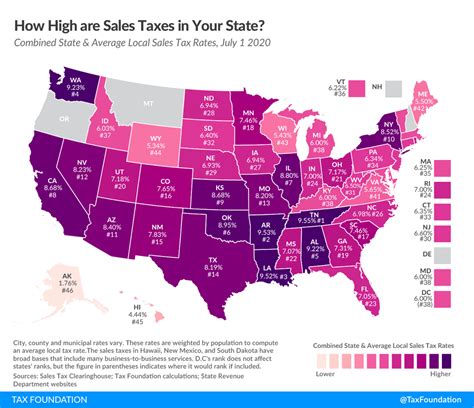

Alabama imposes a sales tax on the purchase of vehicles, which is a percentage of the vehicle’s sales price. This tax is distinct from the state’s general sales tax and is specifically applied to motor vehicles, including cars, trucks, motorcycles, and other similar modes of transportation. The revenue generated from this tax is a vital source of funding for various state initiatives and programs.

Tax Rate and Calculation

The sales tax rate for vehicles in Alabama is currently set at 2%, which is lower than the state’s general sales tax rate. This reduced rate is a strategic move to encourage vehicle sales and ownership while still generating sufficient revenue. The tax is calculated based on the vehicle’s purchase price, which includes the cost of the vehicle, any additional options or accessories, and the applicable sales tax.

| Vehicle Type | Sales Tax Rate |

|---|---|

| New Vehicles | 2% |

| Used Vehicles | 2% |

| Motorcycles | 2% |

| RV's and Trailers | 2% |

For example, if you purchase a new car for $25,000, the sales tax would be calculated as follows: $25,000 x 0.02 = $500. So, the total cost of the vehicle would be $25,500, including the sales tax.

Exemptions and Special Cases

While the vehicle sales tax is generally applicable to most vehicle purchases, there are certain exemptions and special cases to consider. These exemptions are designed to support specific industries, promote economic growth, and provide relief to certain segments of the population.

- Military Exemptions: Active-duty military personnel and their spouses are eligible for a sales tax exemption on the purchase of a vehicle. This exemption is a token of appreciation for their service and can significantly reduce the overall cost of vehicle ownership.

- Trade-Ins: When trading in an old vehicle for a new one, the sales tax is calculated based on the difference between the trade-in value and the purchase price of the new vehicle. This ensures that you're not paying tax on the full purchase price, but rather on the net increase in value.

- Business Vehicles: Vehicles purchased for business use may be eligible for tax deductions or exemptions. These deductions can offset the cost of vehicle ownership, making it more cost-effective for businesses to operate and expand their fleet.

- Specialized Vehicles: Certain specialized vehicles, such as those designed for agricultural use or emergency services, may have different tax rates or be exempt from sales tax altogether. These exemptions recognize the unique nature of these vehicles and their critical role in specific industries.

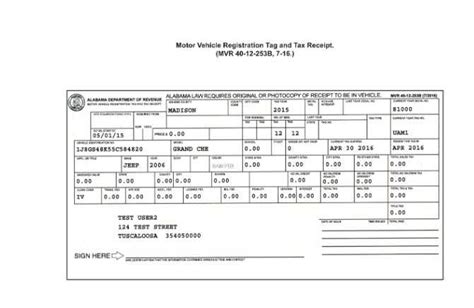

Registration and Title Fees

In addition to the sales tax, vehicle owners in Alabama are also subject to registration and title fees. These fees are separate from the sales tax and are paid to the Alabama Department of Revenue.

Registration Fees

Registration fees in Alabama vary depending on the type of vehicle and its weight. For standard passenger vehicles, the registration fee is $40 per year. However, for heavier vehicles like trucks or SUVs, the fee increases based on the vehicle’s weight.

| Vehicle Weight | Registration Fee |

|---|---|

| Up to 5,000 lbs | $40 |

| 5,001 - 7,500 lbs | $44 |

| 7,501 - 10,000 lbs | $48 |

| Over 10,000 lbs | $52 |

Title Fees

Title fees in Alabama are a one-time cost when registering a vehicle for the first time. The fee is 30 for most vehicles, including cars, trucks, and motorcycles. For trailers and mobile homes, the title fee is 20.

Impact on Vehicle Sales and Ownership

The vehicle sales tax in Alabama plays a crucial role in shaping the state’s vehicle sales landscape. While the reduced tax rate encourages vehicle purchases, it also presents challenges for dealerships and vehicle owners.

Dealer Perspectives

For dealerships, the sales tax is a significant consideration when pricing vehicles. They must factor in the tax rate to ensure competitive pricing while still maintaining profitability. Many dealerships offer tax-inclusive pricing to simplify the buying process and make it more transparent for customers.

Additionally, dealerships often provide financing options to make vehicle purchases more accessible. These financing options can help spread out the cost of the vehicle, including the sales tax, over a period of time.

Vehicle Ownership and Maintenance

For vehicle owners, the sales tax is just one component of the overall cost of ownership. Regular maintenance, insurance, and fuel costs also contribute to the ongoing expenses associated with owning a vehicle. However, the reduced sales tax rate in Alabama can make purchasing a vehicle more affordable, especially for those who plan to keep their vehicle for an extended period.

Long-Term Implications

The vehicle sales tax in Alabama has long-term implications for both the state’s economy and its residents. By encouraging vehicle sales, the state promotes economic growth and supports local businesses. Additionally, the revenue generated from the sales tax funds various state initiatives, including infrastructure development and maintenance, which indirectly benefit vehicle owners through improved roads and transportation systems.

FAQs

What happens if I buy a vehicle from out of state?

+If you purchase a vehicle from out of state, you are still required to pay Alabama’s vehicle sales tax when registering the vehicle in the state. This ensures that all vehicle owners contribute to the state’s revenue system, regardless of where the vehicle was purchased.

Are there any discounts or incentives for purchasing electric vehicles (EVs) in Alabama?

+Currently, Alabama does not offer specific discounts or incentives for purchasing electric vehicles. However, EV owners may be eligible for federal tax credits, which can significantly reduce the overall cost of ownership. It’s always recommended to consult with a tax professional to understand the latest incentives and credits available.

Can I deduct vehicle sales tax from my federal or state taxes?

+The deductibility of vehicle sales tax depends on various factors, including your tax filing status and the nature of the vehicle purchase. Generally, if the vehicle is used for business purposes, you may be able to deduct a portion of the sales tax as a business expense. It’s advisable to consult with a tax professional or refer to the IRS guidelines for specific details.