Racine County Property Tax Records

Welcome to an in-depth exploration of Racine County's property tax records. This article aims to provide a comprehensive understanding of the property tax system within Racine County, offering insights into the processes, assessments, and implications for both homeowners and investors. By delving into the intricacies of property taxes, we aim to empower residents and stakeholders with the knowledge they need to navigate this essential aspect of county finances.

Understanding Property Taxes in Racine County

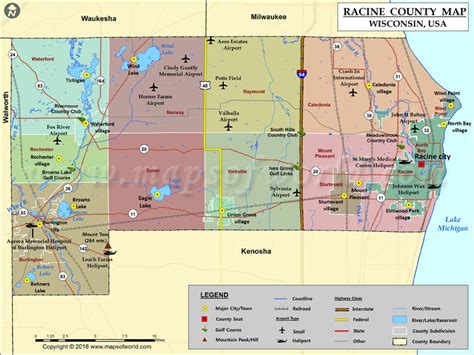

Property taxes are a crucial component of local government funding in Racine County, Wisconsin. These taxes are levied on real estate properties, including residential homes, commercial buildings, and even vacant land. The revenue generated from property taxes contributes significantly to the county’s budget, funding essential services like schools, infrastructure, and public safety.

The property tax system in Racine County is governed by state laws and local regulations. The assessment process, tax rates, and collection methods are carefully designed to ensure fairness and efficiency. Here's a breakdown of the key aspects of property taxes in Racine County:

Property Assessment

The foundation of the property tax system lies in the assessment process. Racine County employs a professional team of assessors who are responsible for evaluating the value of each property within the county. This valuation is based on various factors, including the property’s size, location, condition, and recent sales data.

Assessors use standardized methods and guidelines to ensure consistency across all assessments. They take into account market trends, comparable property sales, and other relevant data to determine the fair market value of each property. This value serves as the basis for calculating the property taxes owed by the owner.

| Assessment Year | Average Property Value |

|---|---|

| 2023 | $250,000 |

| 2022 | $235,000 |

| 2021 | $220,000 |

Tax Rates and Levies

Once the assessed value of a property is determined, the tax rate comes into play. The tax rate is established by the local government bodies, including the county board, school districts, and other taxing authorities. These rates are typically expressed as a percentage of the property’s assessed value.

The tax rate is applied to the assessed value to calculate the property tax levy. This levy represents the total amount of property tax that the owner is required to pay for the year. The tax rate can vary across different taxing districts within Racine County, reflecting the unique funding needs of each jurisdiction.

| Taxing Authority | Tax Rate (per $1,000 assessed value) |

|---|---|

| Racine County | $7.50 |

| School District | $12.00 |

| City/Town | $4.25 |

Tax Bills and Payment Options

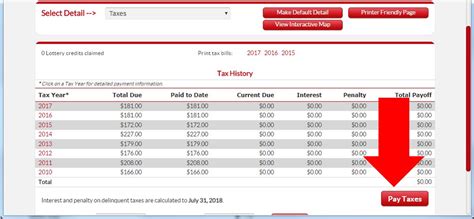

Property owners in Racine County receive a tax bill detailing the assessed value of their property, the applicable tax rates, and the resulting tax levy. This bill provides a clear breakdown of the taxes owed and the payment options available.

Racine County offers convenient payment methods, including online payments, direct debit, and traditional mail-in payments. Property owners can choose the option that best suits their preferences and financial situation. The county also provides resources and assistance for those facing difficulties in paying their property taxes.

Tax Exemptions and Credits

To promote fairness and support certain segments of the community, Racine County offers various tax exemptions and credits. These incentives reduce the property tax burden for eligible homeowners and businesses.

- Homestead Credit: This credit provides a reduction in property taxes for owner-occupied homes. It aims to make homeownership more affordable and encourage long-term residency.

- Veteran Exemption: Racine County recognizes the service of veterans by offering property tax exemptions based on their military service. This exemption reduces the assessed value of the property, resulting in lower taxes.

- Senior Citizen Exemption: Senior citizens may be eligible for a property tax exemption based on their age and income. This exemption helps alleviate the financial burden on older residents.

Navigating the Property Tax Process

Understanding the property tax process is crucial for homeowners and investors in Racine County. Here’s a step-by-step guide to help you navigate this essential aspect of property ownership:

Step 1: Property Assessment Review

Upon receiving your property assessment notice, it’s important to review the details carefully. Ensure that the assessed value aligns with your expectations and market trends. If you believe the assessment is inaccurate, you have the right to appeal the decision.

The assessment appeal process involves submitting a formal request to the county assessor's office, providing evidence and arguments to support your case. The assessor's office will review your appeal and make a determination. If necessary, you can seek further assistance from legal professionals or tax consultants.

Step 2: Understanding Tax Bills

When your tax bill arrives, take the time to understand the breakdown of charges. The bill should provide a clear overview of the assessed value, tax rates, and any applicable exemptions or credits. If you have any questions or concerns, reach out to the Racine County Treasurer’s office for clarification.

Step 3: Payment Options and Deadlines

Choose a payment method that suits your needs and ensure you meet the payment deadlines. Late payments may incur penalties and interest, so it’s important to stay organized and plan your finances accordingly. The county provides flexible payment plans for those facing temporary financial challenges.

Step 4: Tax Exemptions and Credits

Familiarize yourself with the tax exemptions and credits available in Racine County. If you believe you qualify for any of these incentives, take the necessary steps to apply. The county’s website and local government offices provide detailed information and application forms for these programs.

The Impact of Property Taxes on the Community

Property taxes play a vital role in shaping the economic landscape and community development in Racine County. The revenue generated from these taxes directly impacts the quality of life for residents and the overall growth of the county.

Funding Essential Services

Property taxes are a primary source of funding for critical public services. These taxes contribute to the maintenance and improvement of schools, ensuring a high-quality education for students. They also support public safety initiatives, such as police and fire departments, keeping the community safe and secure.

Additionally, property taxes fund infrastructure development, including roads, bridges, and public transportation systems. Well-maintained infrastructure enhances connectivity and accessibility within the county, benefiting both residents and businesses.

Economic Development and Investment

A stable and predictable property tax system attracts businesses and investors to Racine County. The revenue generated from property taxes can be leveraged to support economic development initiatives, creating jobs and stimulating the local economy.

For homeowners, property taxes are a key factor in building equity and wealth. Paying property taxes contributes to the overall value of the property, making it a valuable asset over time. This encourages long-term residency and investment in the community.

Community Engagement and Transparency

Racine County recognizes the importance of transparency and community engagement in the property tax process. The county strives to provide clear and accessible information to residents, ensuring they understand their rights and responsibilities.

Regular town hall meetings, public forums, and online resources allow residents to voice their concerns and stay informed about tax-related matters. This fosters a sense of trust and collaboration between the government and the community, leading to a more effective and responsive tax system.

Future Outlook and Potential Reforms

As Racine County continues to evolve and adapt to changing economic and social dynamics, the property tax system may undergo reforms to ensure its sustainability and fairness.

Potential Reforms and Considerations

One area of focus could be reassessing the tax rates and exemptions to ensure they align with the county’s current needs and demographics. Regular reviews of the tax system can help identify areas where adjustments are necessary to maintain a balanced and equitable tax structure.

Additionally, the county may explore alternative revenue streams to supplement property taxes. This could involve diversifying the tax base or implementing new taxes on specific industries or activities. Such reforms would require careful planning and community engagement to ensure a smooth transition.

Technological Advancements and Data Analysis

The integration of technology and data analysis can enhance the efficiency and accuracy of the property tax system. Racine County can leverage advanced assessment tools and software to streamline the valuation process and reduce human error.

Furthermore, data-driven insights can inform policy decisions and ensure that tax rates are set appropriately. By analyzing market trends, economic indicators, and demographic data, the county can make informed choices about tax policies, leading to a more responsive and dynamic tax system.

Community Engagement and Education

Continuing to prioritize community engagement and education is vital for the long-term success of the property tax system. Racine County can invest in initiatives that promote financial literacy and tax awareness among residents.

Educational programs, workshops, and online resources can empower homeowners and investors to make informed decisions about their property taxes. By understanding the system and their rights, residents can actively participate in shaping the tax policies that affect their community.

Conclusion

Racine County’s property tax records reflect the vital role that property taxes play in funding essential services and driving community development. The system, though complex, is designed to be fair and transparent, with avenues for appeal and support for eligible residents.

By understanding the assessment process, tax rates, and payment options, homeowners and investors can navigate the property tax landscape with confidence. The impact of these taxes extends beyond individual properties, contributing to the overall growth and well-being of the community.

As Racine County moves forward, ongoing dialogue and engagement between the government and residents will be crucial in shaping a sustainable and equitable property tax system that benefits all stakeholders.

How often are property assessments conducted in Racine County?

+Property assessments in Racine County are conducted every two years. This allows for regular updates to property values, ensuring that the tax system remains fair and reflective of market trends.

Can I appeal my property assessment if I disagree with the valuation?

+Yes, you have the right to appeal your property assessment if you believe it is inaccurate. The appeal process involves submitting a formal request and providing evidence to support your case. The assessor’s office will review your appeal and make a determination.

What happens if I miss the property tax payment deadline?

+Missing the property tax payment deadline may result in penalties and interest charges. It’s important to stay organized and plan your finances accordingly to avoid late payments. Racine County offers flexible payment plans for those facing temporary financial difficulties.

Are there any property tax exemptions or credits available for senior citizens in Racine County?

+Yes, Racine County offers a Senior Citizen Exemption for eligible senior citizens. This exemption reduces the assessed value of the property, resulting in lower property taxes. The county’s website provides detailed information on eligibility criteria and the application process.